A Comparative Ecosystem Analysis of Arbitrum's Positioning in DeFi

The Arbitrum Ecosystem has experienced rapid growth, as evidenced by increases in users, total value locked (TVL), and underlying technological advancements.

Recent developments include:

Ethena’s Partnership with Arbitrum to launch Converge.

Robinhood's Partnership with Arbitrum.

Timeboost, designed to capture MEV and enhance protocol revenue.

This list of innovations continues to expand, highlighting a clear growth trajectory; however, to move forward, it's essential to understand Arbitrum's position within the broader crypto ecosystem and identify areas for improvement.

This analysis aims to illuminate those aspects.

Arbitrum's Current State

This section will explore Arbitrum's current positioning in TVL, growth of the Arbitrum Stack, incentive programs, and recent developments.

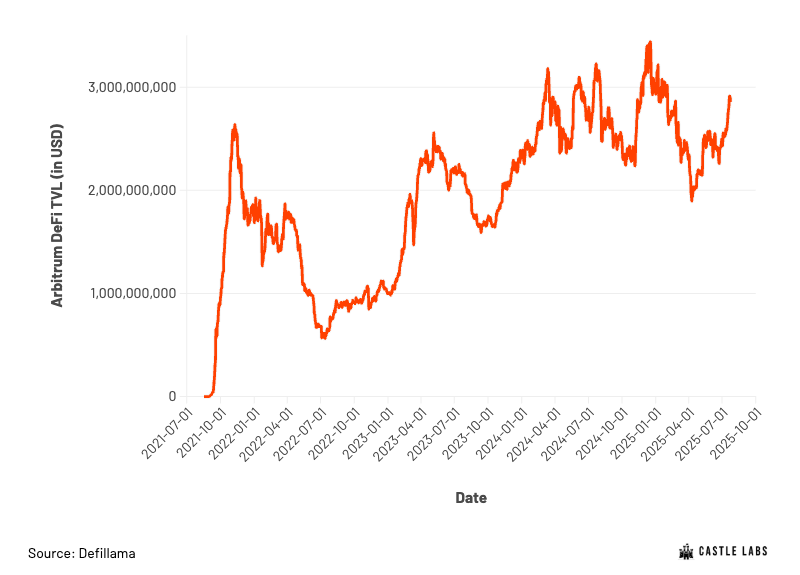

Liquidity: Arbitrum's DeFi TVL is currently approximately $2.9 billion, with the majority of value locked in Aave, GMX, and Uniswap, representing 64% of the total TVL.

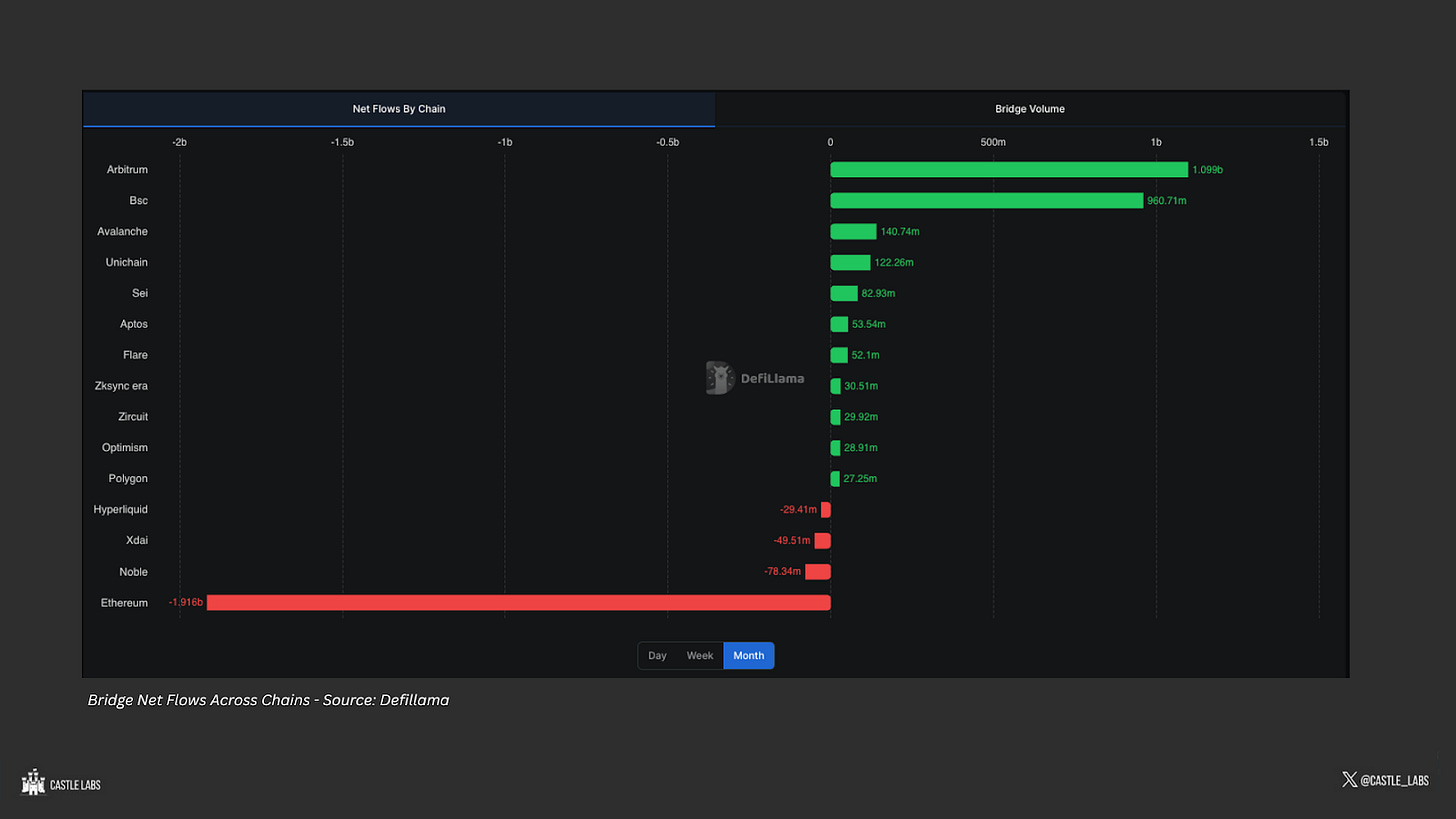

Over the last month, Arbitrum has experienced net inflows of over $1 billion, ranking it first among networks in terms of inflows.

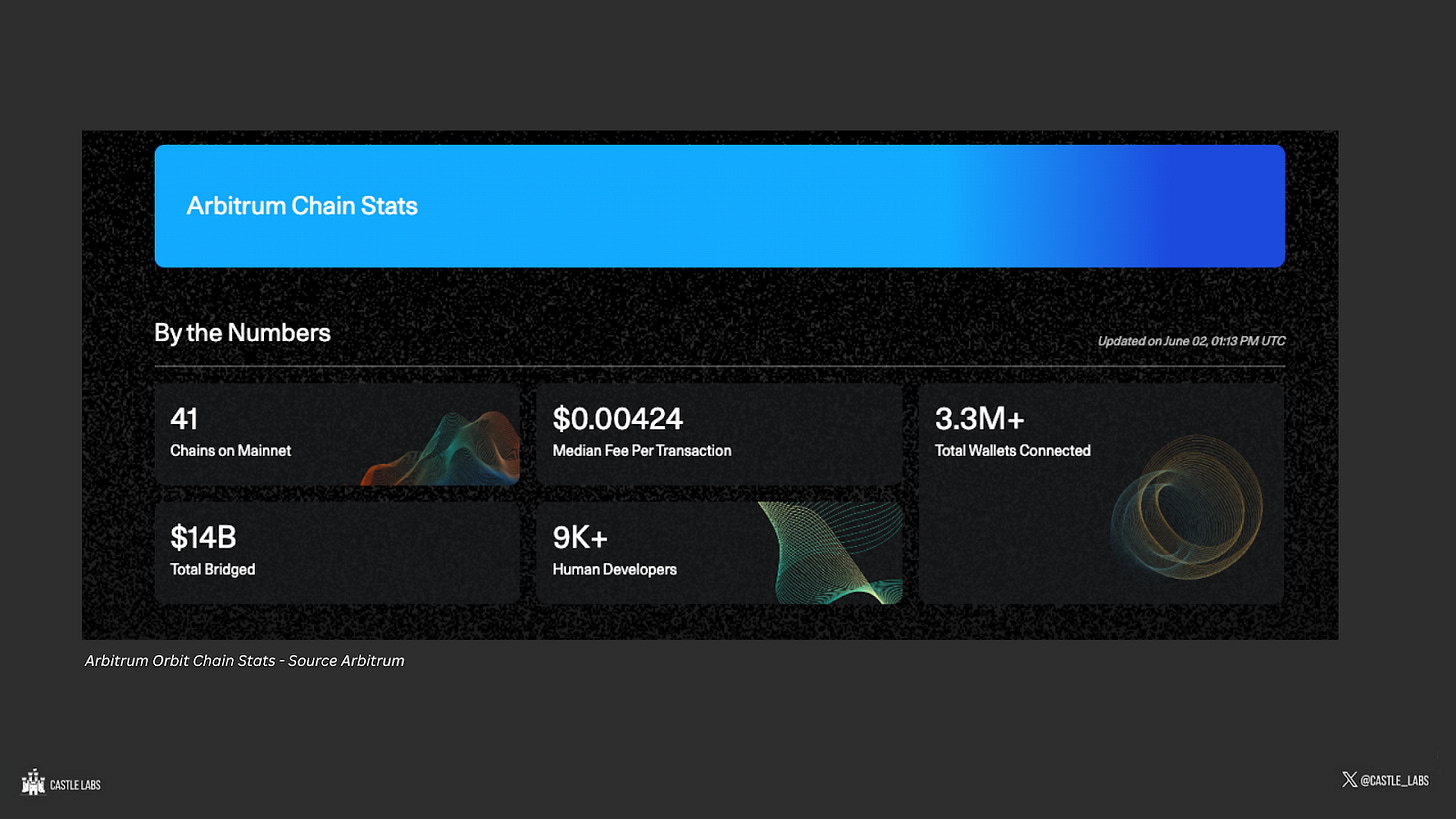

Arbitrum Orbit: Arbitrum Orbit is experiencing rapid growth following recent announcements of deployments from Ethena and Robinhood. The Arbitrum Stack is developer-centric, easing the process of deploying an L2 or L3. There are currently 41 chains live on the mainnet, with over 100 in the pipeline across DeFi, RWAs, Gaming, NFTs, AI, DePIN & more.

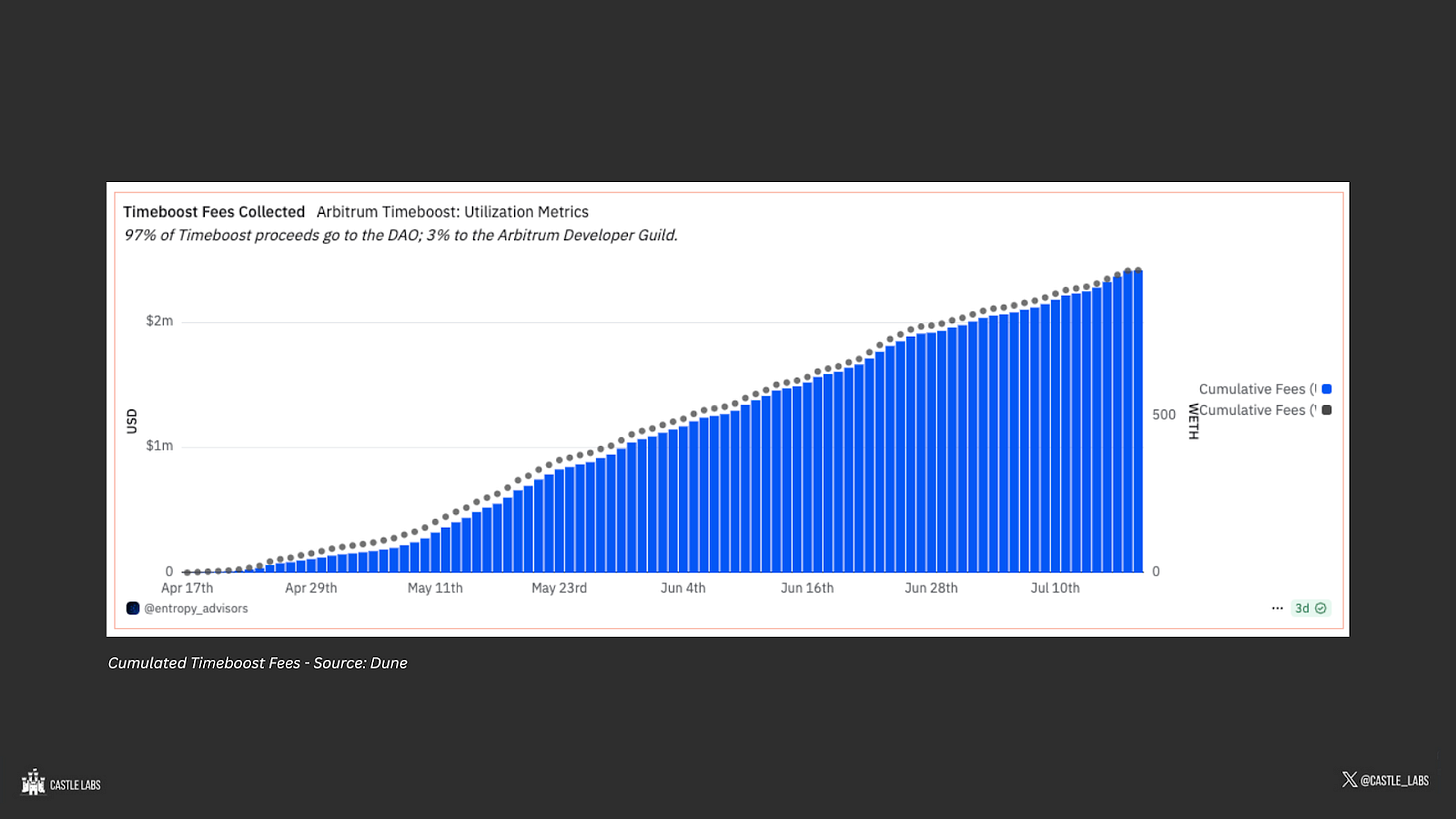

Timeboost: Arbitrum Timeboost is a transaction ordering policy that enables the chain to capture MEV and reduce spam across the network. Timeboost has cumulatively generated fees of approximately $2.4 million since its inception in April 2025, representing an increasing share of revenues for the Arbitrum DAO.

Developer Ecosystem and Tooling: Arbitrum, being an EVM chain, has access to extensive tooling, similar to that of the Ethereum Mainnet. Moreover, the introduction of Stylus enables developers to build in WASM-compatible languages, such as Rust, C, and C++, thereby expanding the potential use cases and the ease of development on Arbitrum.

Incentive Programs: Arbitrum has run early experimental incentive programs, such as STIP, LTIPP, and STIP.b, which were unable to drive sustained long-term growth after the program ended. The introduction of DRIP marked a shift towards more strategic incentive allocation to attract products that have already achieved levels of PMF.

Read in more detail about the Arbitrum DRIP and other programs here:

https://x.com/castle_labs/status/1946213821586034705

Competitive Landscape

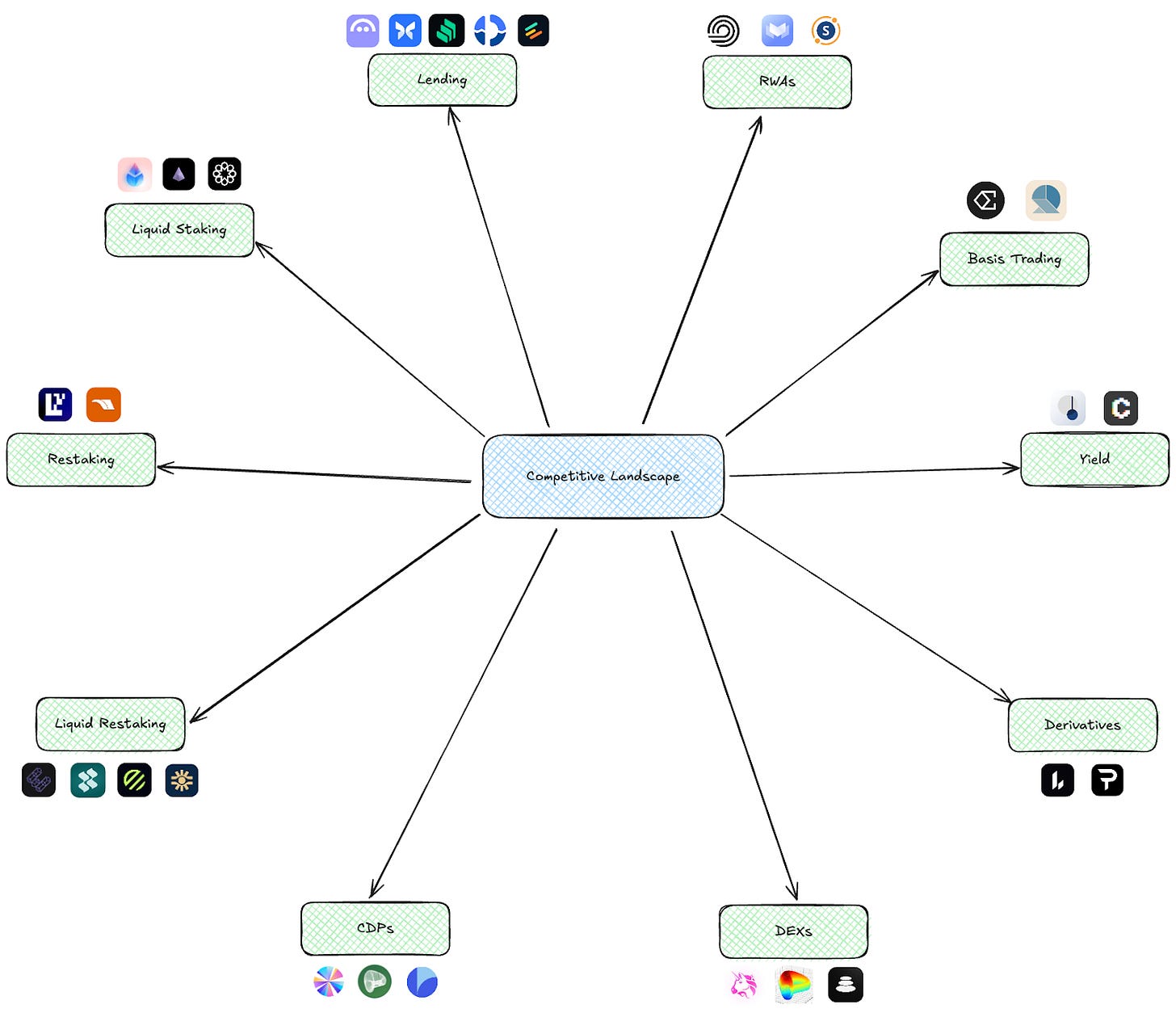

There are multiple verticals to focus on. For the scope of this research, we selected the ones that are growing and attracting the most TVL, which narrowed our list down to the 10 verticals closely related to DeFi and presenting an excellent opportunity for expansion or focus. In each of the verticals, we focused on key protocols, not necessarily based on the TVL, but also on their recent growth pattern.

This section examines the comparative landscape in each of the selected verticals and how Arbitrum compares with other chains in terms of key metrics, such as TVL, features, and the Go-to-Market (GTM) strategies employed by these protocols.

DEXs

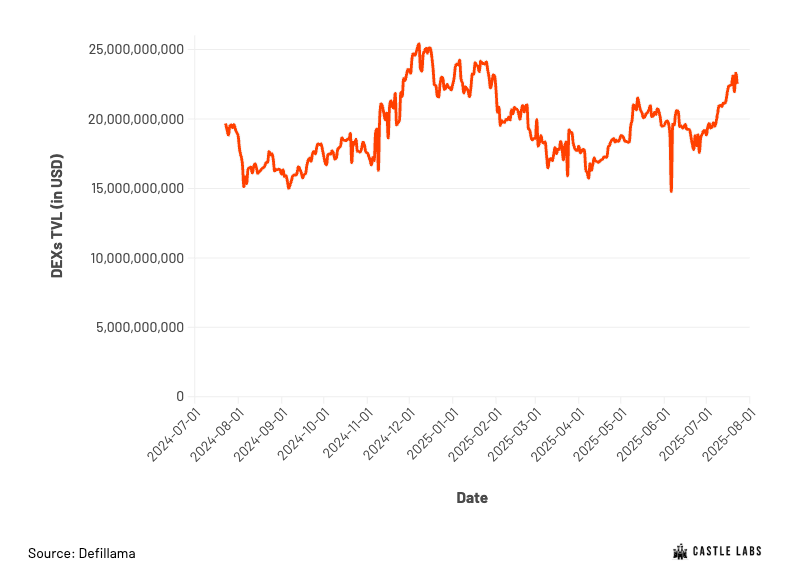

DEX's TVL across all chains is approximately $23 billion, with TVL on Arbitrum at $565.5 million, representing 2.4% of the total value locked. The major protocols include Uniswap, Camelot, Curve, and Balancer.

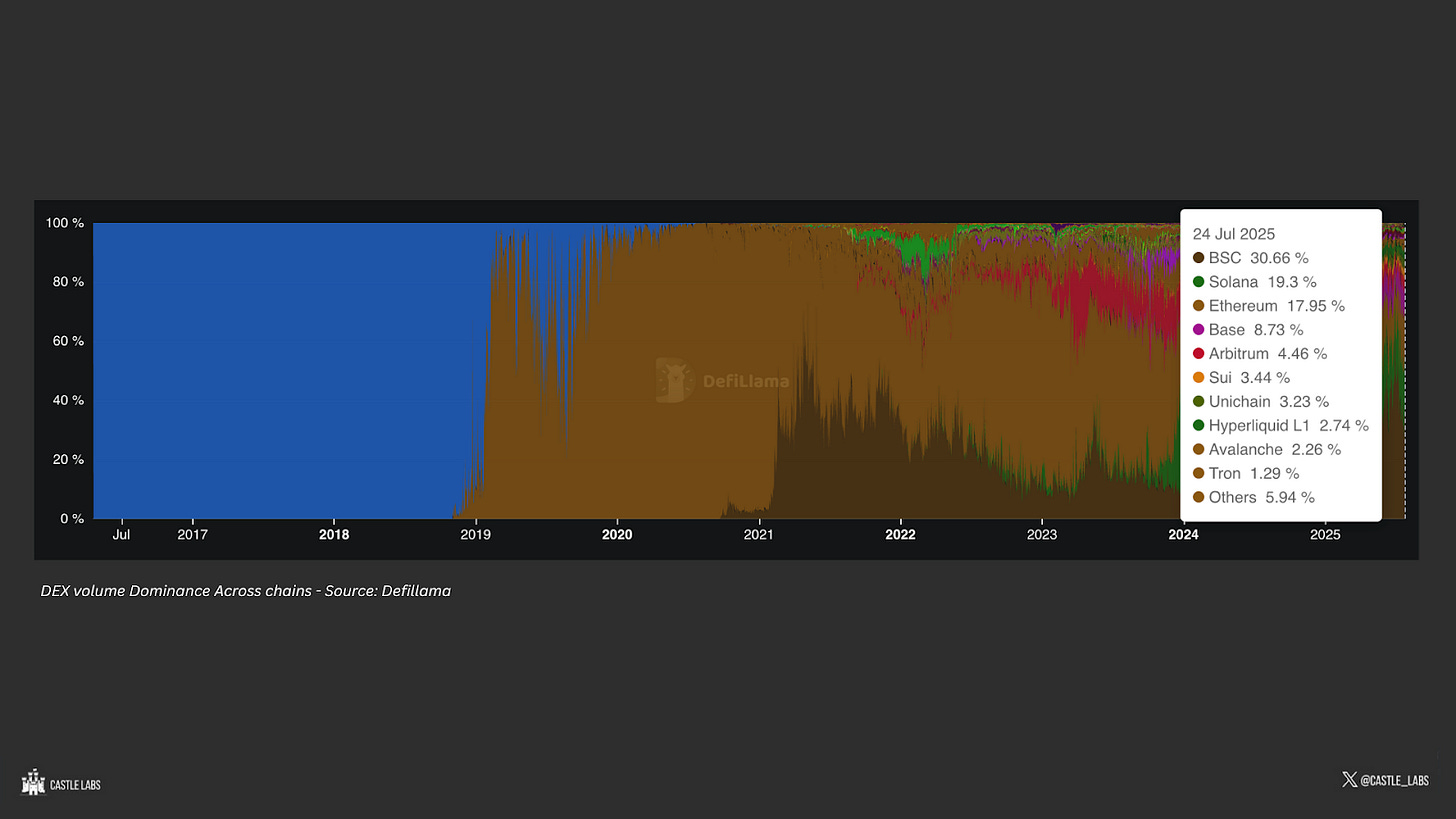

The majority of the DEX volume is concentrated on three chains: BSC, Solana, and Ethereum Mainnet, which collectively represent over 65% of the total volume. DEX activity on Arbitrum is stable, primarily driven by Uniswap, but the lack of growth could become an issue as the market becomes increasingly competitive. For example, Arbitrum has seen less volume than its major competitor, Base, over the past three months.

Curve: Curve's current TVL is $2.24 billion, with 95% of it being on Ethereum. Curve is still the leading venue for stablecoin exchange and yield. In Q1 2025, Curve did $35 billion in volume. Curve composability with yield products, such as Convex, increases its user flow. More recently, it has increased focus on crvUSD (Curve’s CDP stablecoin) integrations across various partner protocols.

Uniswap: Uniswap is one of the major DEX protocols on Ethereum, with continuous development, most recently highlighted by Uniswap v4 hooks. Uniswap’s TVL is currently $5.82 billion, and in Q1 2025, it has processed over $150 billion in volume across Ethereum and L2s. Uniswap is presently directing its incentives to Unichain to expand its ecosystem.

Balancer: Balancer has $945 million in TVL, with the majority being on Ethereum. It supports multi-asset pools that help users diversify both exposure and yield within the same pool. Balancer utilises the same token model as Curve’s veCRV for directing incentives and governance power to users. It has integrated with Aura, a yield protocol designed to boost yields and increase user flow, similar to Curve's integration with Convex.

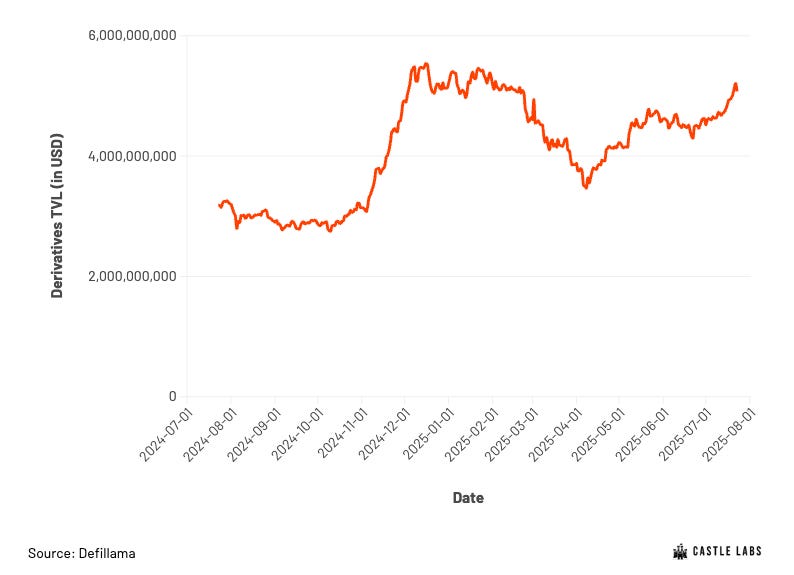

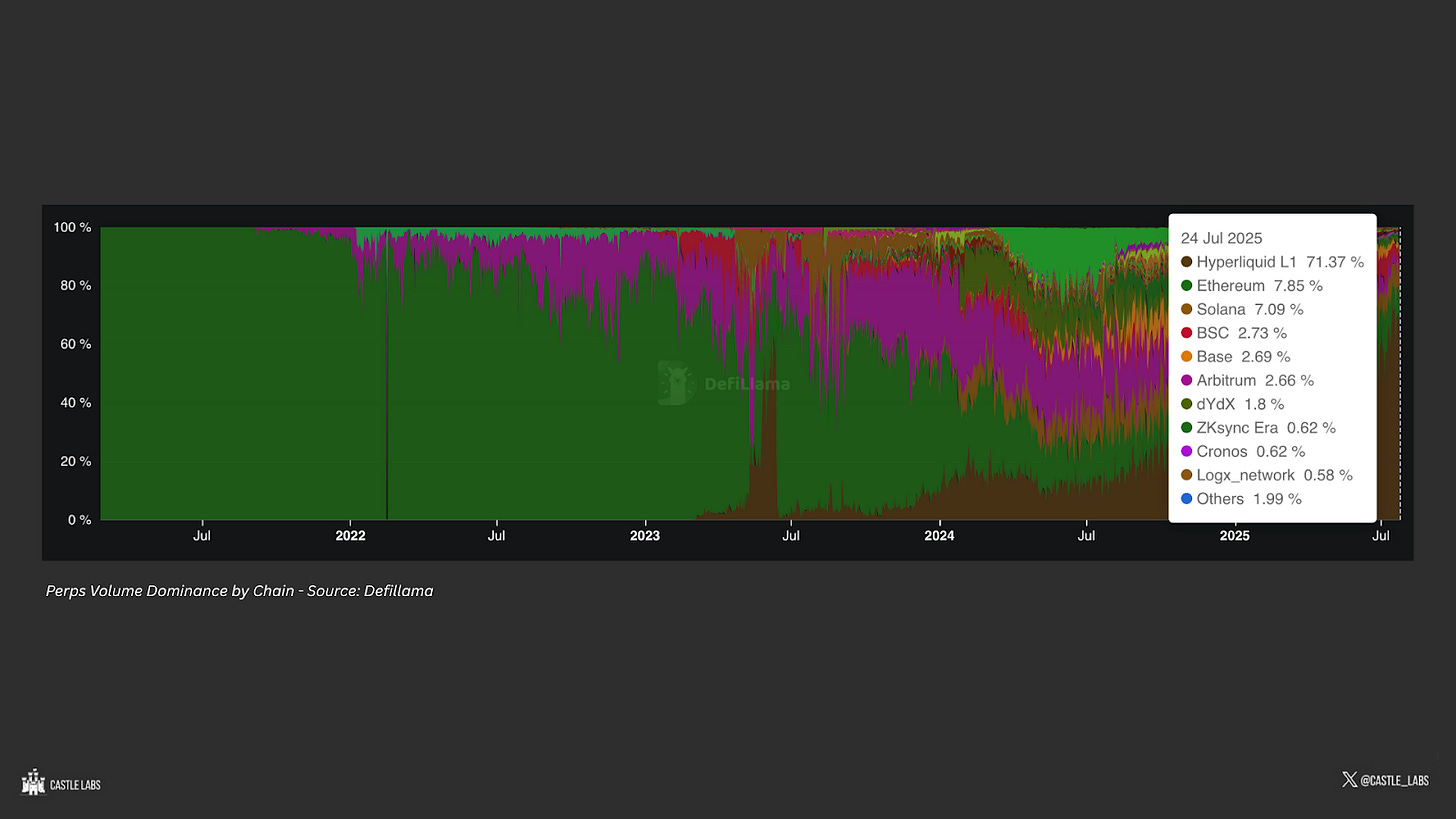

Derivatives

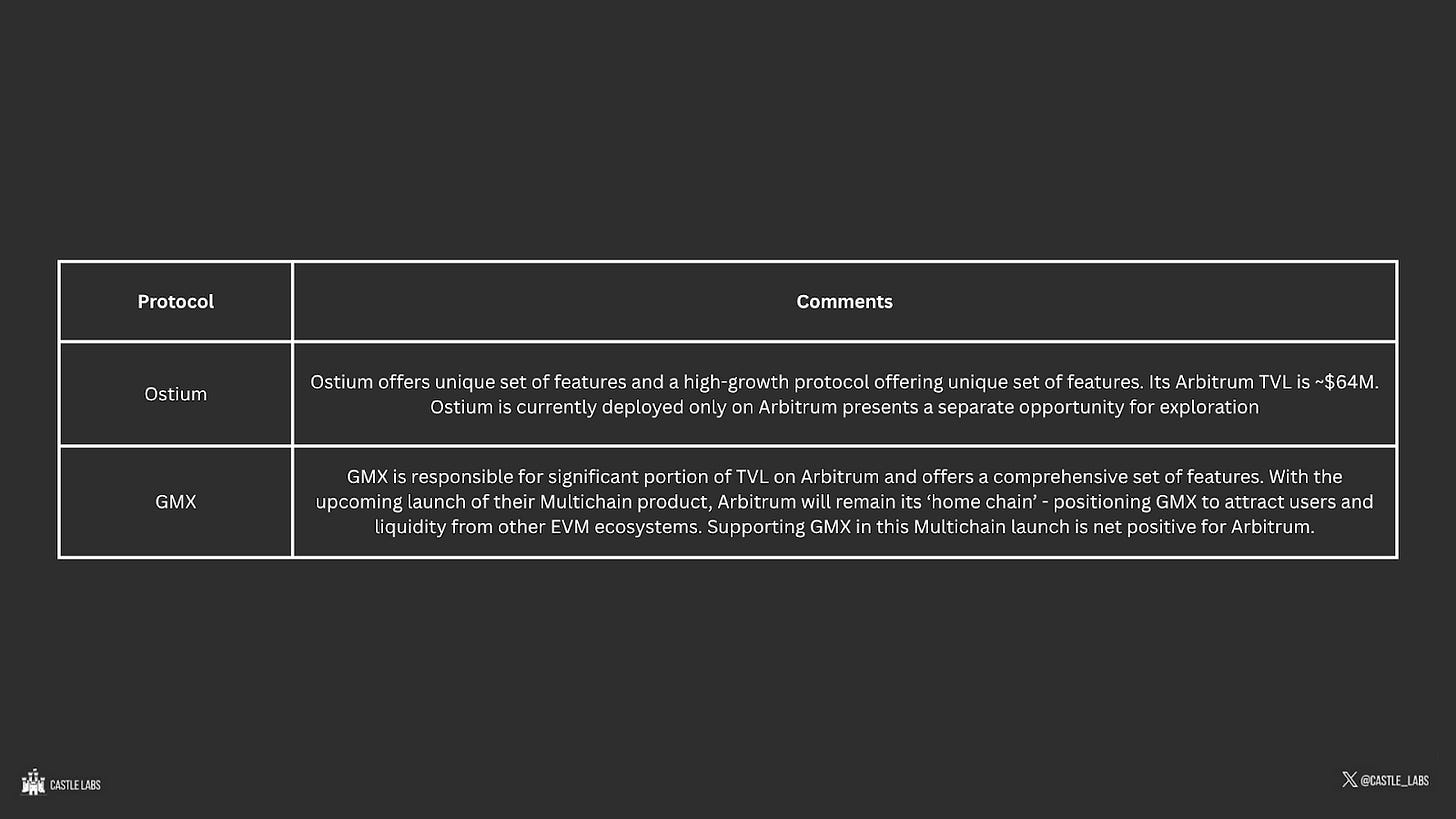

The Perpetual Futures market is constantly growing, with volumes having tripled since the 2021 cycle. This is due to improved onchain UX, driven by products like Hyperliquid. Hyperliquid currently dominates ~70% of the volume in perps onchain, followed by Solana and Ethereum. On Arbitrum, the most prominent product in derivatives is GMX, contributing significantly to the chain’s TVL, followed by Ostium.

Arbitrum's perpetual trading activity has seen a 50% decline over the past year, mainly due to Hyperliquid attracting volume from other ecosystems. The launch of Ostium has been positive for Arbitrum due to its unique offering, including leveraged trading of indices, commodities, and FX pairs on-chain.

Lighter: Lighter is a specialised zk-rollup on Ethereum, providing CEX-level performance. The protocol TVL is $213 million and has been experiencing a positive growth trend. It offers a gasless and fast trading experience with features like zk-based order matching, sub-5ms latency for high-frequency trading (HFT), sub-account management, and more, catering to both retail and professional traders.

The lighter incentive program is currently point-based, and the DEX doesn’t charge any trading fees, making it a great place to trade since there is a future incentive aligned with no cost to traders.

Paradex: Paradex is an appchain-native orderbook-based trading venue. It is built using the Starknet Stack and CairoVM, enabling CEX-level performance, and also provides perpetual and options products. Paradex TVL is $55.2 million and has been witnessing constant growth.

Paradex’s native token, $DIME, is designed for community ownership, with 57.6% of the allocation reserved for users via airdrops and rewards. It also serves as a gas token on the Paradex chain. As with Lighter, Paradex also leverages points and referral programs to incentivise trading.

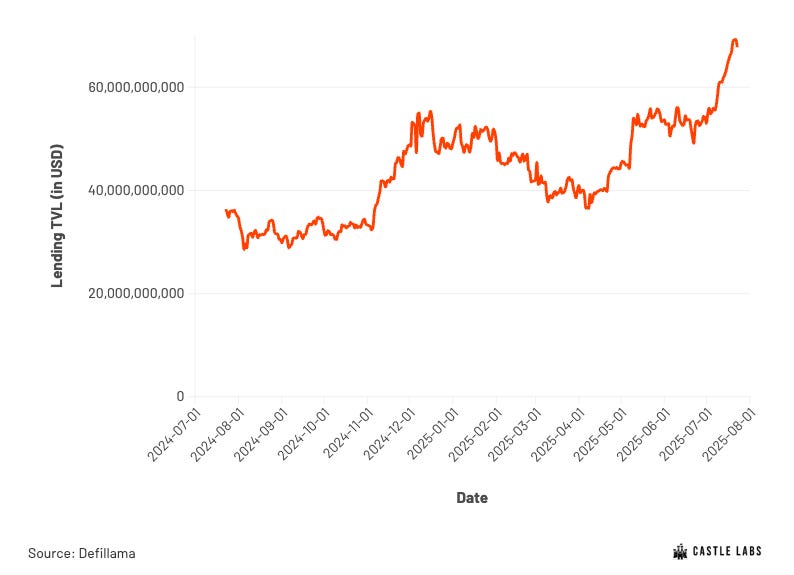

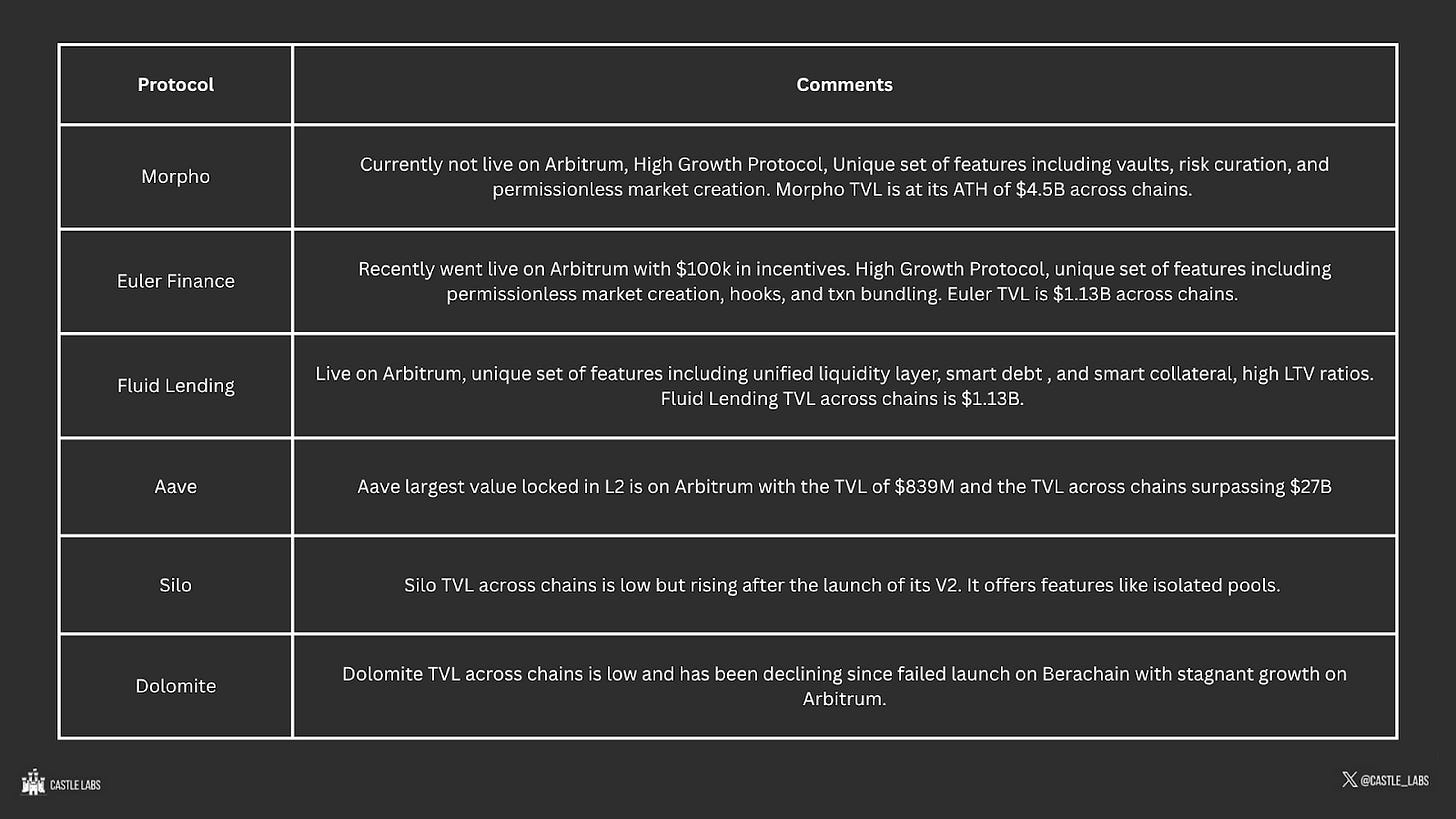

Lending

Lending is one of the largest categories, with a current TVL of $69.53 billion, with Aave representing 48.2% of the total TVL. Beyond Aave, there is a very healthy competition in terms of TVL among protocols like Morpho, Sparklend, Euler, and others, with a great opportunity for growth.

On Arbitrum, most of the lending TVL is held by Aave, surpassing $1.1 billion, with other competitors, including Compound and Fluid, representing a smaller share of the value locked. Arbitrum represents 2.2% of the total lending TVL across chains.

Aave: Aave TVL is $33.54 billion, representing 48% of the TVL in lending. Aave offers its own set of features, including Efficiency mode, which increases LTV value under certain conditions, and Isolation Mode for new or high-risk assets, as well as a Portal for cross-chain lending. Aave, more recently, also introduced Aave Umbrella, which is a staking system that helps users earn yield while protecting the Aave Ecosystem with the added risk of slashing in case of any bad debt to the protocol.

Pendle asset deposits on Aave have surpassed $2 billion in value, unlocking additional utility for Pendle Assets and increasing the flow of users. Aave has also been pushing incentives on chains like Base and Sonic to gain market share. Aave's market share on Arbitrum is already established, with Arbitrum being the largest L2 in terms of TVL for Aave.

Morpho: Morpho TVL is $5.52 billion, representing ~8% of the total value locked in lending. Morpho offers a comprehensive set of features, including Permissionless Market Creation, Vaults, and batching complex transactions. Its V2 is expected to introduce additional features such as peer-to-peer and cross-chain lending.

Morpho incentivises its users through its token and partner tokens, which can be viewed on a dedicated rewards page. Morpho also utilises Merkl for reward distribution. Moreover, Morpho has a partnership with Coinbase to provide bitcoin-backed loans directly to Coinbase users.

Sparklend: Sparklend TVL is $4.95 billion and is the third-largest protocol in terms of value locked, primarily due to SLL (Stablecoin Liquidity Layer) from Spark DAO, which provides liquidity into the protocol. In terms of features, Sparklend is quite similar to Aave v3, as it is a fork of it.

Like Morpho, Sparklend also has a dedicated rewards page that provides incentives across different chains and for various actions. Spark DAO TGE also occurred recently in June, with rewards being distributed to Sparklend users.

Compound: Compound's current TVL is $3.13 billion, making it the fifth-largest protocol in terms of TVL, which represents 5% of the value locked in lending. It offers a dynamic interest rate and a unified market for assets, reducing risks for users.

Compound recently launched Compound Blue in collaboration with Morpho and Polygon, with a dedicated frontend and the provision of rewards in COMP and POL tokens. Apart from this, in the core protocol, most of the markets are incentivised through COMP tokens.

Fluid: The current TVL for Fluid is $1.16 billion and has witnessed a positive growth trend. Fluid offers a unique set of features within its lending architecture, including “Smart Debt” and “Smart Collateral”, which enable users to deploy loan collateral as LP positions, thereby enhancing capital efficiency and reducing borrowing rates. Fluid liquidations are also efficient, as they only liquidate a portion of the position to bring it back to a healthy state.

Fluid is currently expanding across multiple chains, offering incentives through its governance token, FLUID, as well as chain-specific incentives.

Euler: Euler's current TVL is $1.16 billion, representing 1.8% of the total value locked in lending. It provides a unique set of features, including Permissionless Vault Creation, Hooks to trigger during specific conditions, and the ability to Multiply to create leveraged positions, among others. Euler also recently launched on Arbitrum.

Euler pools are incentivised through rEUL (reward EUL) and partner tokens and points. Moreover, Pendle PT assets can also be deposited in the protocol as Aave, reflecting increased utility for PT holders.

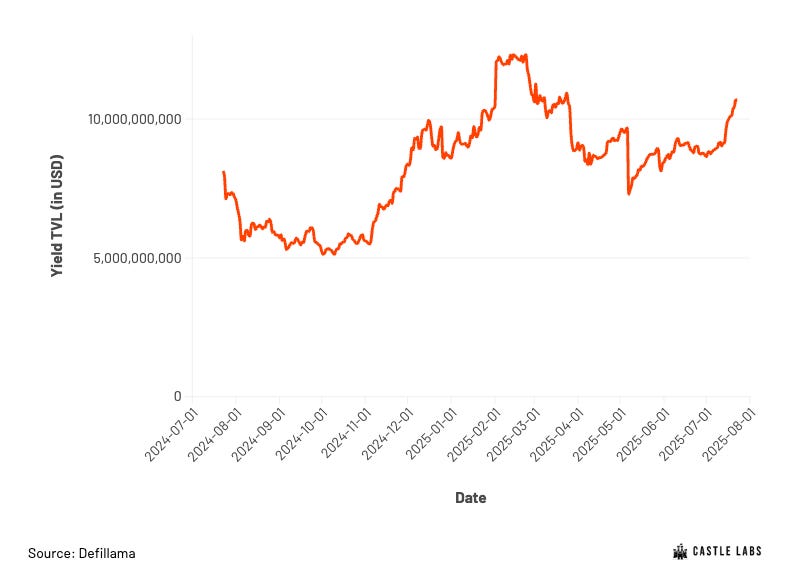

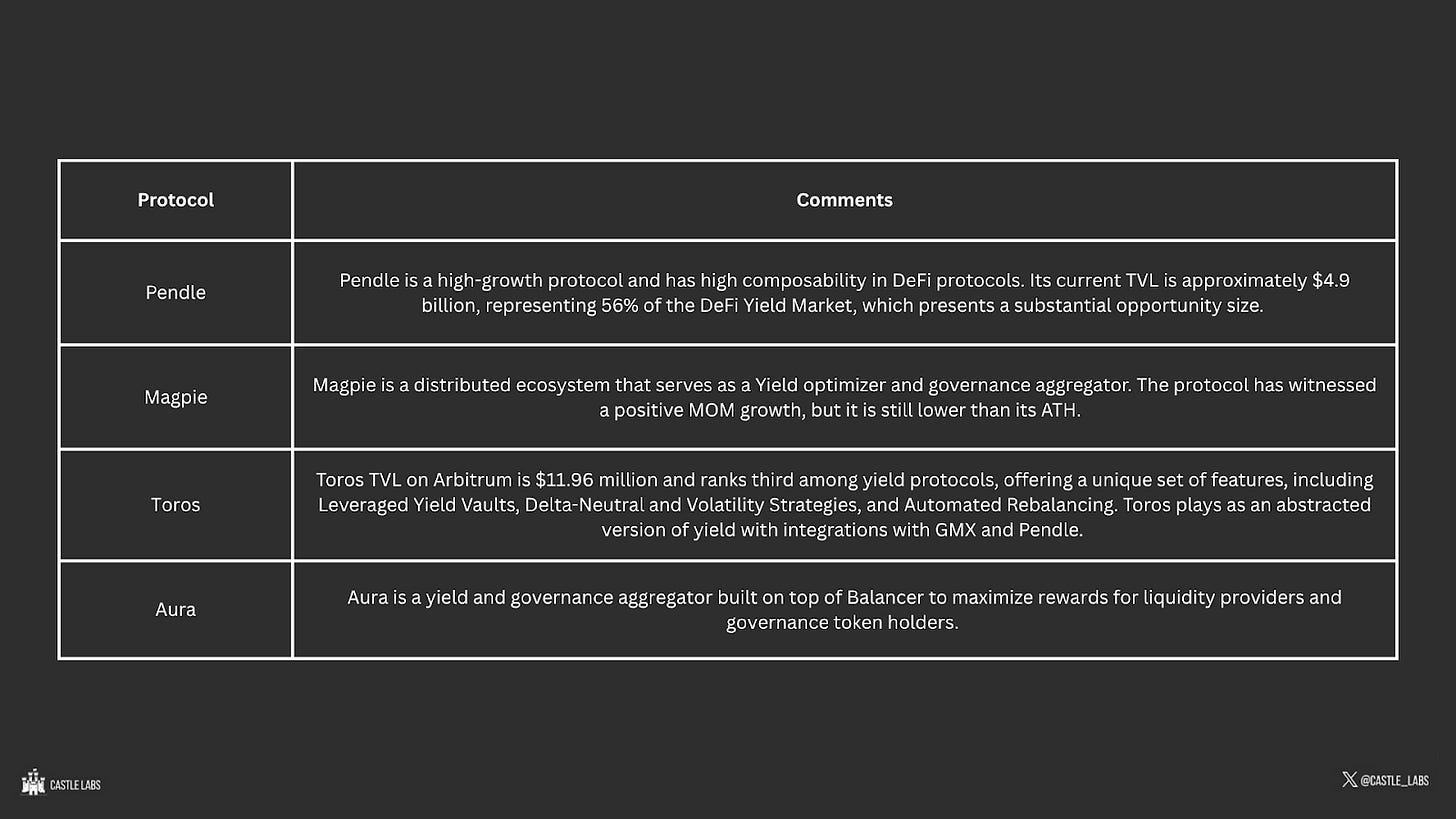

Yield

Yield as a category is growing, with the current TVL standing at $10.5 billion, contributed mainly by Pendle and Convex, which collectively represent ~68% of lending TVL. Most of the TVL is locked in Ethereum, followed by Solana and Arbitrum. The Arbitrum yield sector is currently growing with positive MOM growth, with protocols like Pendle, Magpie, Toros, and Aura.

Pendle: Pendle TVL across chains is $5.64 billion, representing ~54% of the yield market. Pendle provides users with a feature to tokenise their Yield through PT and YT assets. Pendle allows for permissionless market creation and provides a custom AMM.

Pendle GTM strategy can be correlated to its token, which is used for incentives and governance. Pendle assets are integrated into the DeFi ecosystem through collaborations with Morpho, Euler, Aave, and other partners.

Convex: Convex TVL across chains is $1.45 billion, representing 13.8% of the yield market. Convex is built to optimise and maximise yield for LPs and token holders by aggregating and boosting rewards from Curve, Frax, and f(x) protocol. Their liquid staking tokens, such as cvxCRV, cvxFXS, and cvxFXN, are integrated into the DeFi ecosystem through partnerships with other protocols.

The Convex incentive model is driven by the CVX token, which serves as a governance token and a reward mechanism for users. The protocol's integration with different protocols helps create a flywheel effect.

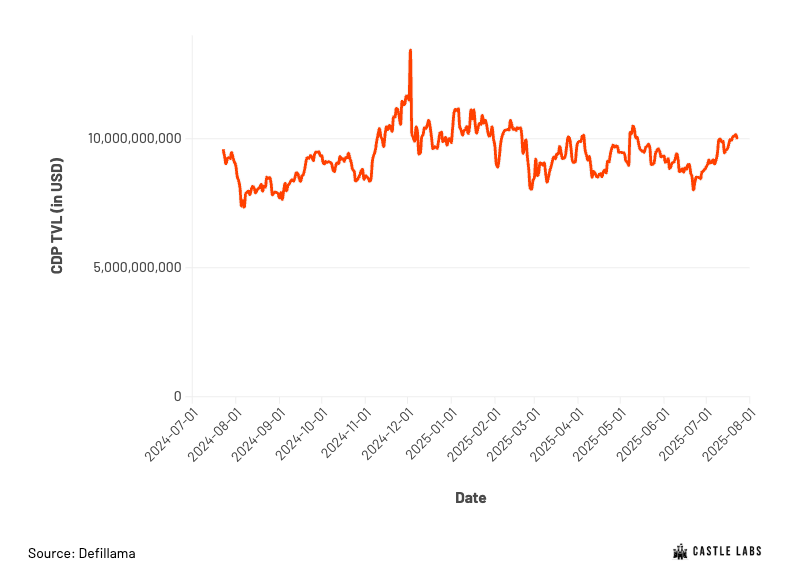

CDP

CDP TVL is $10 billion, with major protocols including Sky Lending and Lista, which together represent 68% of the market share. CDP TVL experienced a surge during the previous cycle but has stabilised around its current value since late 2022. Most CDP protocols are concentrated on Ethereum, followed by BSC. On Arbitrum, there is no major CDP protocol, and the sector as a whole has a current TVL of $26 million. The new launch of Nerite (Liquity multi-chain deployment) has increased the chances of growth of CDPs within the Arbitrum ecosystem.

Sky Lending: Sky Lending is a lending protocol that utilises the CDP model, allowing users to deposit collateral and mint its stablecoin, USDS, in return. Sky Lending TVL is $5.77 billion, representing ~57% of the market. The asset, sUSDS (staked USDS), is going multichain and used in liquidity across different protocols. Moreover, their launch of Spark is aimed at increasing the DeFi composability of the native tokens.

Sky Lending utilises its governance tokens (SKY and SPK) to incentivise users and liquidity providers, with 3.25B SPK allocated over two years.

crvUSD: crvUSD is a stablecoin protocol developed by Curve, and its TVL is ~$250 million. Curve utilises a unique LLAMMA (Lending-Liquidating AMM) mechanism, which gradually swaps out the collateral during price declines, reducing liquidation shocks and improving capital efficiency. Users can mint crvUSD using ETH, stETH, and other volatile assets.

crvUSD is deeply integrated into Curve pools, allowing LP tokens to be used as collateral, which increases liquidity across the platform. Staking CRV from Curve would also give governance rights to direct liquidity incentives for crvUSD. Moreover, crvUSD is also integrated across DeFi through Convex, Yearn, and Frax.

Liquity: Liquity TVL is $526 million. Its stablecoin, BOLD, is fully backed by ETH and staked ETH assets such as wstETH and rETH.The protocol enables higher LTV ratios for ETH and the LSTs, which are 90.91% and 83.3% respectively. Moreover, all protocol revenue, including interest from borrowers and liquidation gains, flows directly to the Stability Pool's depositors and liquidity providers, thereby sustaining the yield.

Liquity encourages community-operated frontends and their deployment on multiple chains through partner protocols or products, such as Nerite on Arbitrum.

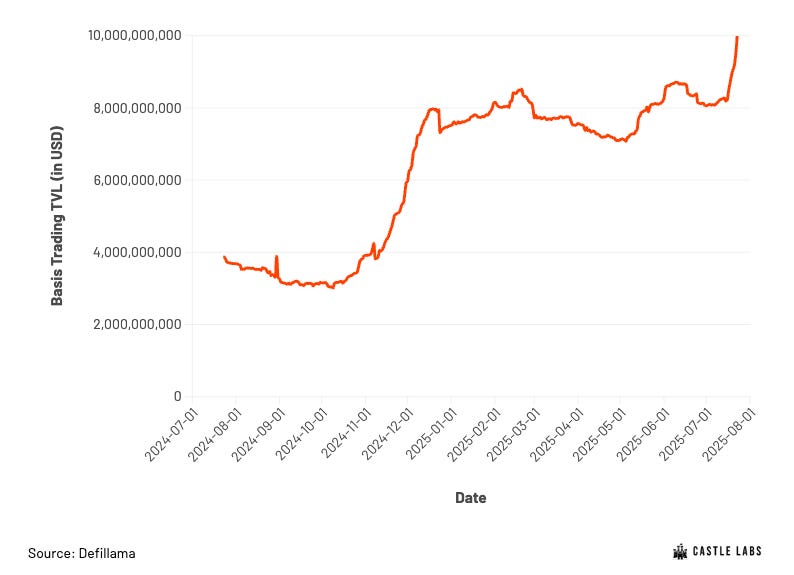

Basis Trading

Basis Trading's current TVL is approximately $9 billion, with Ethena being the major contributor, representing more than 80% of the market. Most of the Basis Trading TVL is tied to Ethereum, and Arbitrum shares a low market share with the major protocol deployed being Stable Labs, which is currently at a TVL of $118 million, experiencing stagnant growth.

Ethena: Ethena TVL is $7.54 billion, with the major market share representation. Its token, USDe, is the third-largest stablecoin, surpassing Sky Lending's USDS recently. Following the recent announcement of $260 million buyback of ENA, the protocol governance token led to a price surge.

Ethena, USDe is embedded into the DeFi ecosystem with active points and incentives campaigns across different protocols. They are also launching the Converge chain using Arbitrum’s stack in collaboration with Securitize to improve its infrastructure.

Resolv: Resolv's current TVL is $500 million with the deployment of USR on Ethereum. USR follows a similar design to USDe of Ethena, but uses only crypto-native assets as backing.. The main difference lies in RLP, Resolv’s backing and insurance pool designed to absorb losses, represented by the token RLP, which users can mint and earn premiums on.

They are DeFi-composable, with a presence across multiple protocols, utilising the protocol’s native token, RESOLV, for fee distribution and incentivising liquidity and insurance pool participation.

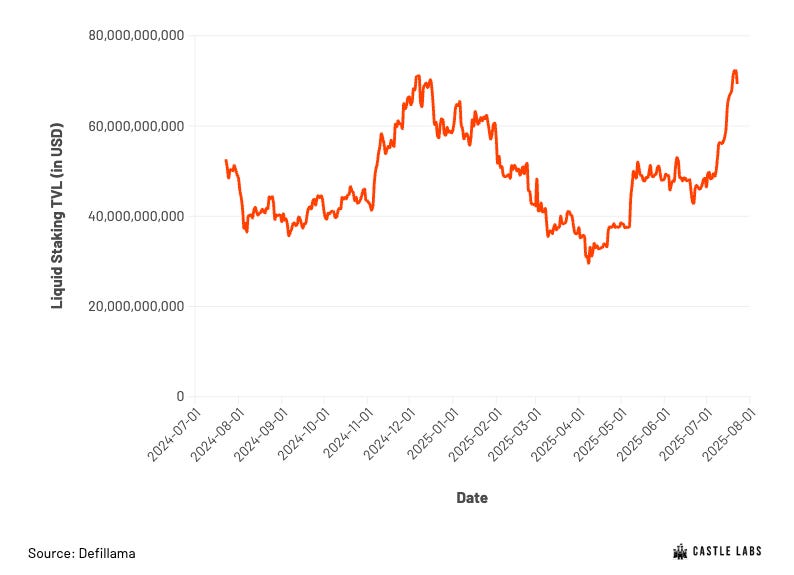

Liquid Staking

Liquid staking is one of the largest categories in DeFi, with Lido being the major contributor, and its TVL stands at $66.8 billion. On a chain basis, it is led by Ethereum, followed by Solana, which together account for ~90% of the market share. These assets are present across different chains, with the majority of them being on the L1, Ethereum, with other chains representing a smaller share of the liquid staking tokens bridged.

Lido: Lido’s TVL is $34 billion and represents ~50% of the market share. Lido’s token, stETH, is DeFi-composable and available across various protocols. Its composability and timing in the market have been the most significant contributors to the asset growth.

Lido v3 introduced stVaults, a system of customisable staking vaults that enable institutions and advanced users to configure personalised staking setups. This allows users to choose specific node operators, customise the fee structure, and change other parameters.

StakeWise: StakeWise TVL is $1.4 billion, making it the eighth-largest liquid staking protocol, and its LST asset is osETH. StakeWise's defining features include its vault-based staking system, which enables any user to create or join isolated staking pools with customizable parameters, such as fee structures, node operator selection, MEV strategies, and more.

StakeWise GTM focuses on delivering advanced staking options through its modular infrastructure, while maintaining composability with DeFi via osETH. StakeWise's strength lies in its vault system, which enables DAOs, institutions, and individual users to deploy staking strategies under tailored terms. Additionally, StakeWise's ability to support solo validator liquid staking expands its addressable market.

Liquid Collective: The Liquid Collective TVL is $1.35 billion, with its token being LsETH. The defining feature of Liquid Collective is its enterprise-grade node operator set, comprising Coinbase Cloud, Figment, Blockdaemon, and Staked, which ensures reliable validator performance.

Liquid Collective's GTM strategy is built around institutional alignment, regulatory compliance, and deep composability, which differentiates it from retail-centric liquid staking protocols. LsETH is integrated into protocols like EigenLayer, Morpho, Aerodrome, and others.

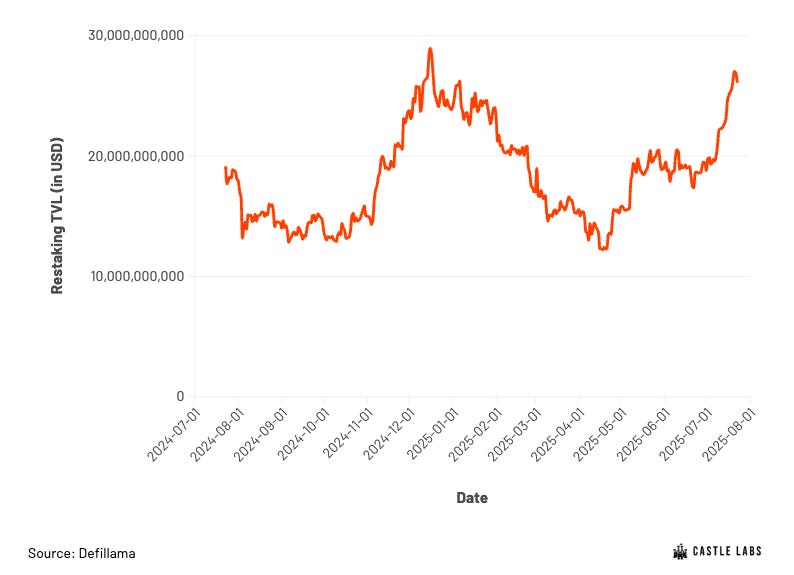

Restaking

Restaking has a lower number of protocols, with a value locked of $25.63 billion across different chains. EigenLayer is the major contributor, representing 70% of the market. On Arbitrum, the only major restaking protocol is Karak, which is deployed as a restaking layer enabling stakers to delegate to AVSs while maintaining composability with the Arbitrum environment.

EigenLayer: EigenLayer’s TVL is $18.4 billion, representing a flagship restaking product that holds a significant market share. EigenLayer enables users to restake their staked assets to secure additional networks and services, referred to as AVSs (Actively Validated Services).

EigenLayer’s LSTs compatibility enables deposits of established assets, such as stETH, rETH, cbETH, and others. EigenLayer’s user acquisition flywheel is initially powered by its points program.

It enables direct ETH stakers and LST holders to restake seamlessly, which has attracted large staking providers and DeFi-native users seeking to optimise yield while supporting the Ethereum ecosystem.

Karak: Karak is a relatively smaller protocol, live on Arbitrum and with a total TVL of $270 million. It focuses on providing modular security to AVSs by allowing users to re-stake ETH and LSTs for layered yields. Karak’s cross-chain deployments allow AVSs on other ecosystems to access Karak’s pooled staking security while preserving Ethereum-aligned trust assumptions.

Karak is pivoting to its L1, which will enable onchain tokenisation of financial instruments such as equities and bonds while leveraging its security infrastructure, positioning Karak to move beyond staking into a settlement layer.

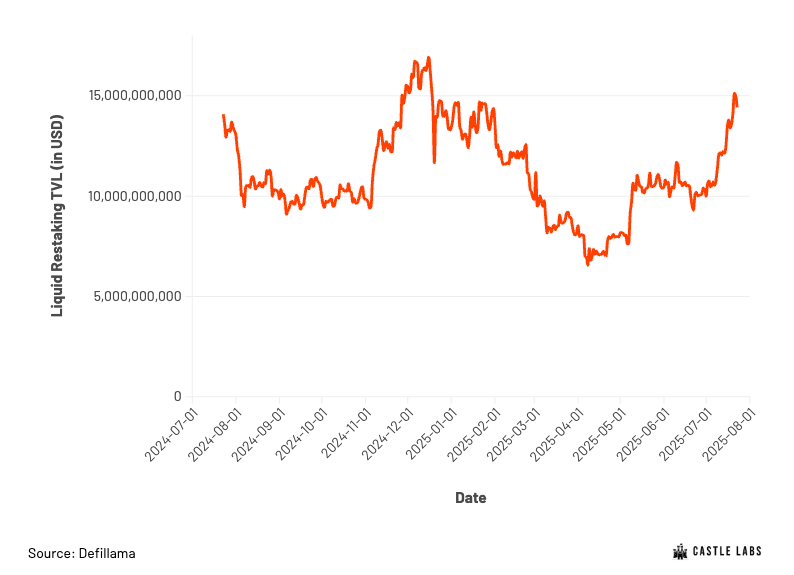

Liquid Restaking

Liquid Restaking is another significant category, with a TVL of $14.1 billion, featuring major protocols such as Etherfi, Kelp, and Renzo. These protocols have begun establishing liquidity pools on Arbitrum, indicating significant potential for the ecosystem to capture liquid restaking flows as LSDfi expands.

Ether.fi: Ether.fi enables users to earn Ethereum Staking rewards, EigenLayer restaking rewards, and additional DeFi yields through liquidity provisioning. Ether.fi TVL is approximately $10 billion, representing 70% of the market. Moreover, eETH DeFi integrations help increase its utility; for example, its Morpho integration has embedded the token within lending markets.

Kelp: Kelp is the second-largest liquid restaking protocol with a similar set of features to Ether.fi, with the differentiator being the user-directed AVS selection. Kelp TVL is $1.78 billion, representing 12.5% of the market. Through participation, users earn Kernel and EigenLayer points.

Renzo: Renzo's current TVL is $1.26 billion, with the primary feature being automated vault architecture, which manages validator delegation and AVS selection on behalf of the user, allocating staked ETH across different AVS opportunities. To drive growth for ezETH (Renzo LRT), the protocol initially utilised the ezPoints programme. It later transitioned to the Renzo Rewards programme, directly incentivising integrations and user activity across DeFi protocols to increase the token's utility.

YieldNest: YieldNest is a liquid staking and staking protocol with the current TVL of ~$110 million. The primary innovation is Yieldnest’s MAX LRTs, which consolidate staking, restaking, and DeFi yield strategies into a single yield token. YieldNest's moat is centred on offering a unified, liquid vehicle for layered yield generation while maintaining composability and settlement assurances. Additionally, its modular architecture for strategy management enables the efficient integration of new opportunities, thereby improving yield.

RWA

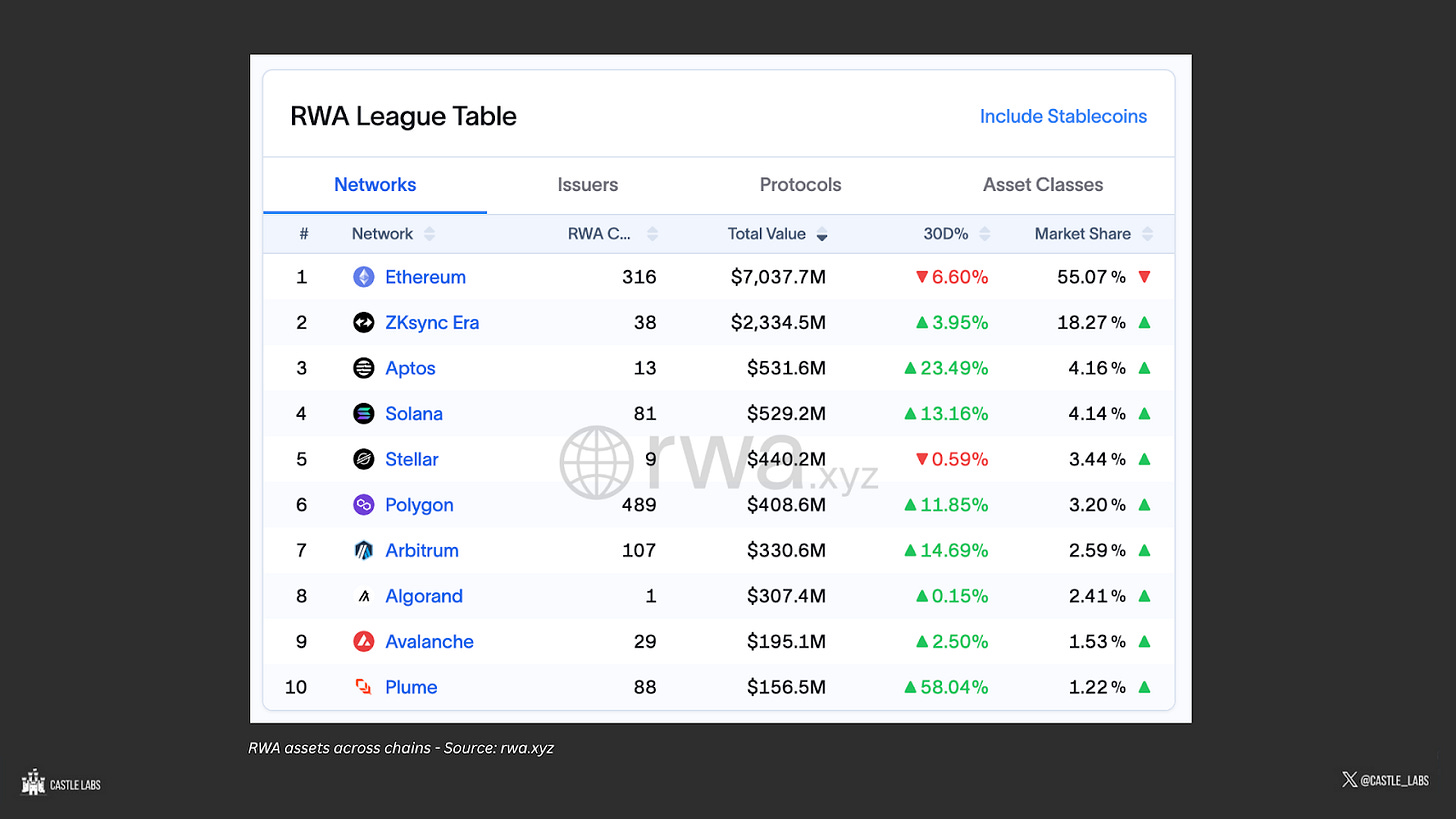

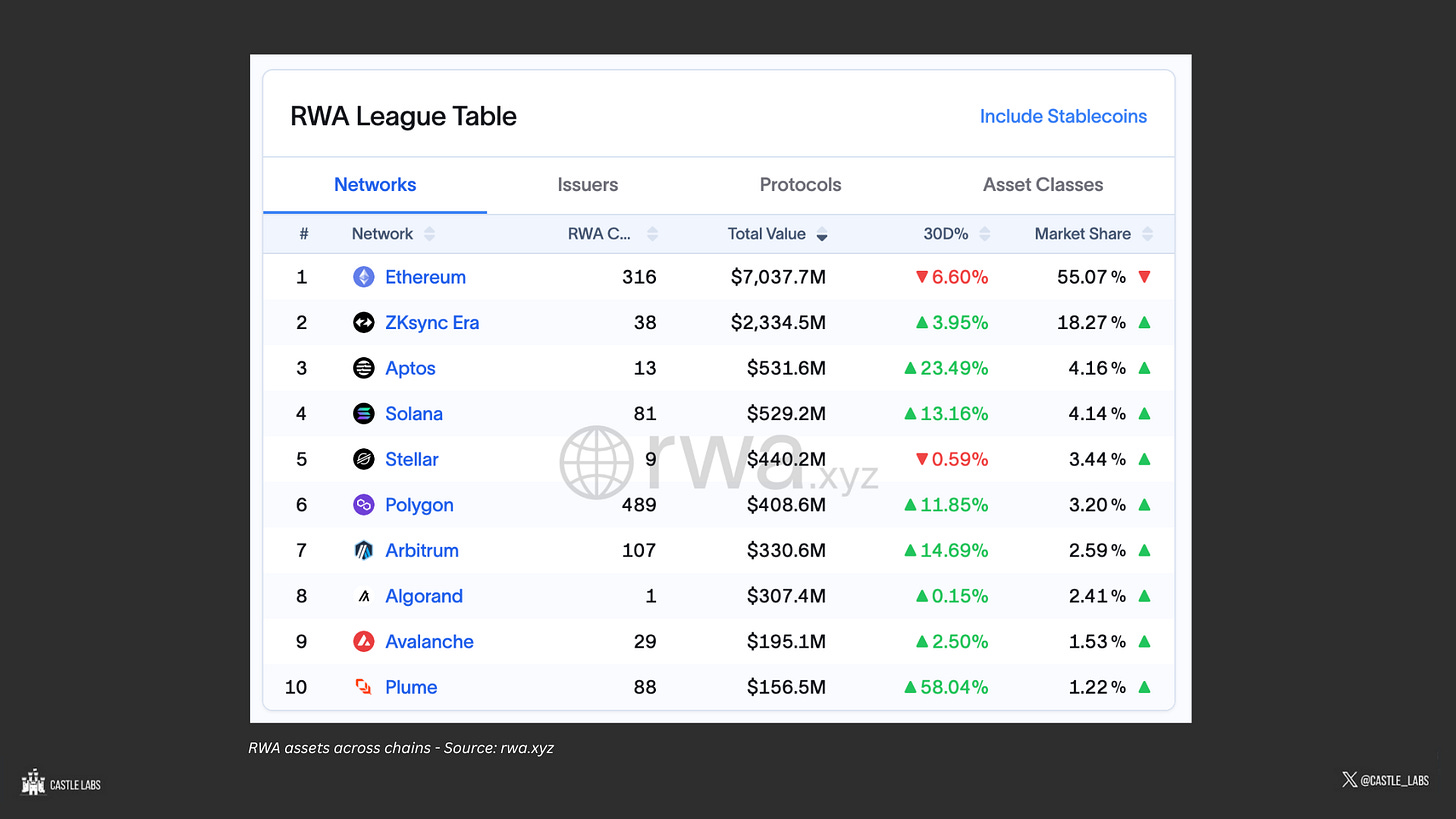

The RWA sector has witnessed constant growth, with a current onchain value of $25.49 billion. This value is distributed among Private Credit, US Treasury Debt, Commodities, and others. At the network level, Ethereum has maintained the largest share.

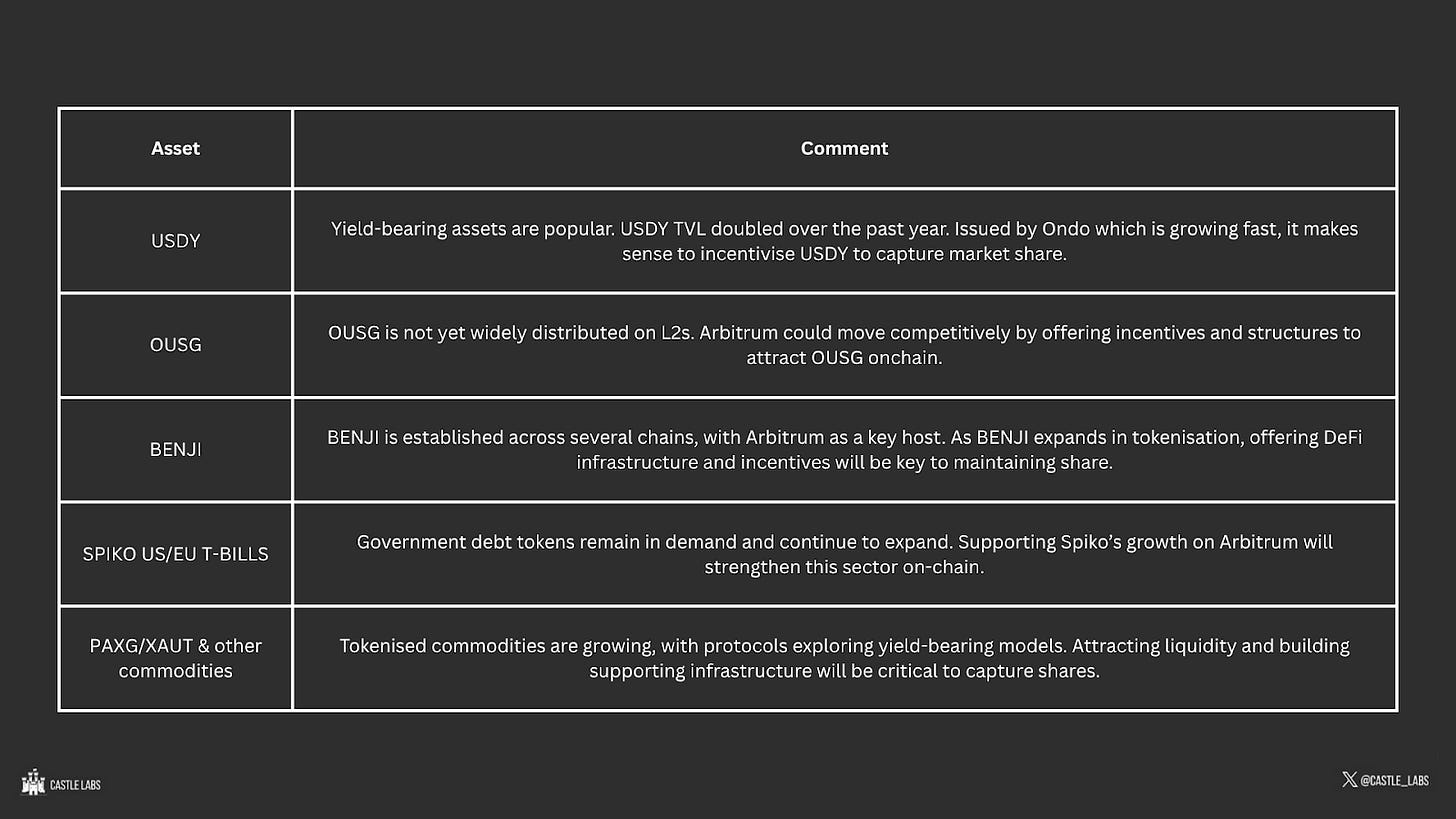

Arbitrum represents a smaller market share in RWA, accounting for only 1.3% of the market, with a TVL of $342 million. Spiko and Franklin Templeton represent 70% of the Arbitrum RWA market, with Securitise and Ondo showing relatively less growth.

Ondo: Ondo is a high-growth protocol with a TVL of $1.39 billion, experiencing constant growth. Ondo's core value proposition is the ability to tokenise secure, yield-bearing financial instruments traditionally inaccessible to DeFi users. Through USDY, Ondo offers a yield backed by highly liquid, short-term US Treasury bills.

Securitize: Securitize is a leading regulated RWA tokenisation platform enabling institutions to issue, manage, and trade tokenised financial instruments onchain while maintaining full compliance with regulatory frameworks. Securitize support for diverse asset classes, enabling tokenisation of private credit markets, US treasuries, corporate bonds, and other debt instruments. For growth, Securitize relies on building institutional trust and securing strategic partnerships like BlackRock, Franklin Templeton, and Hamilton Lane.

Midas: Midas is an emerging RWA protocol specialising in the tokenisation of private credit and alternative yield products, providing DeFi users with access to high-yield and risk-adjusted returns. Midas TVL is $189 million, boasting a significant presence on Ethereum and a consistent growth trajectory.

A key component of the Midas moat is its partnership with specialised risk curators, such as MEV Capital and Edge Capital, which enables the protocol to design and deploy structured credit products.

Recommendations and Area of Focus

While the above section focused on highlighting differences across features and strategies employed by protocols on various chains, as well as key metric differences, this section will concentrate on identifying areas where Arbitrum can focus.

Our recommendations will focus on the assets, protocols, features, and GTM strategy to target or take inspiration from. The protocol recommendations are based on the analysis presented in the section above; most of these protocols already exist on Arbitrum.

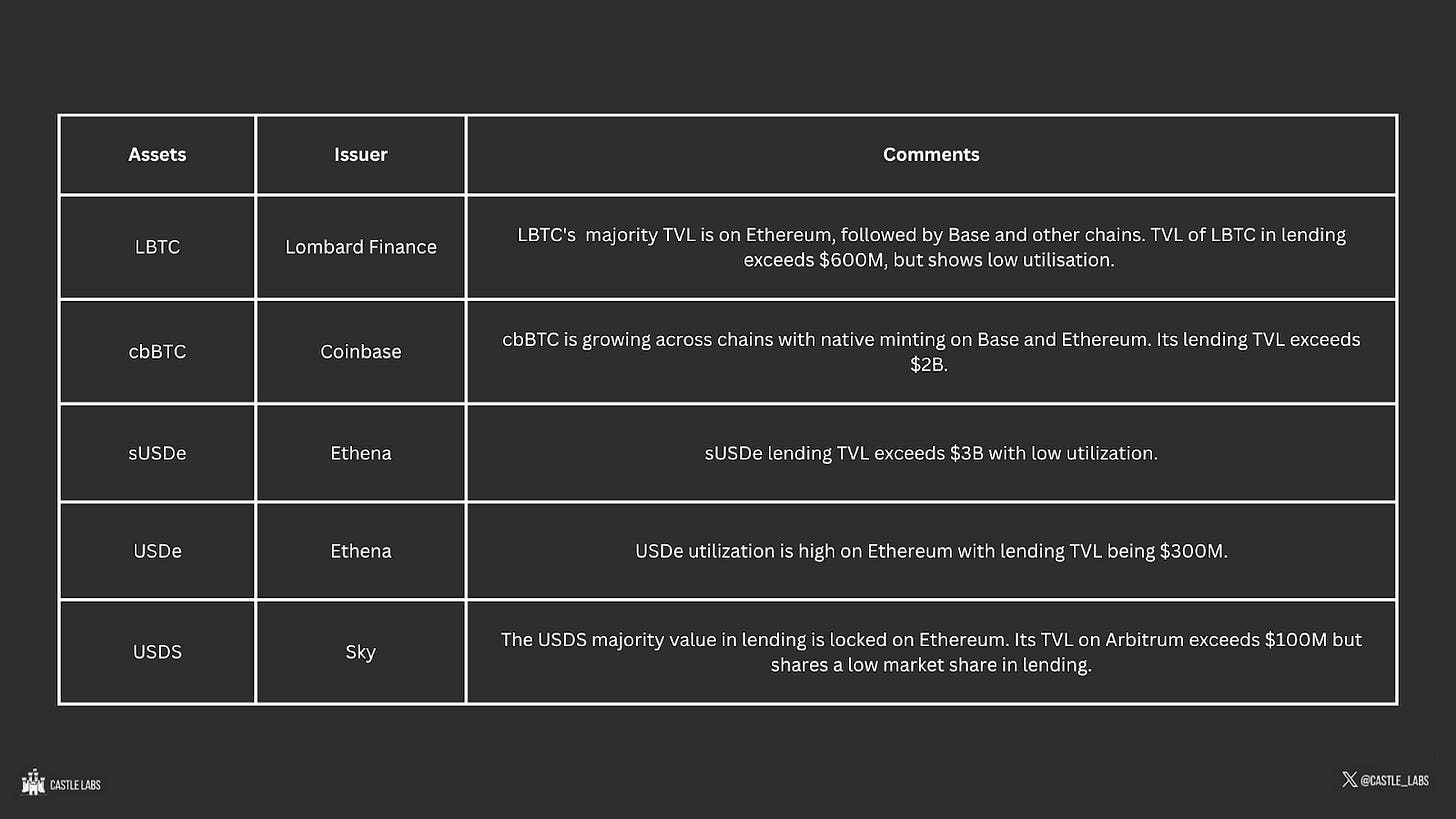

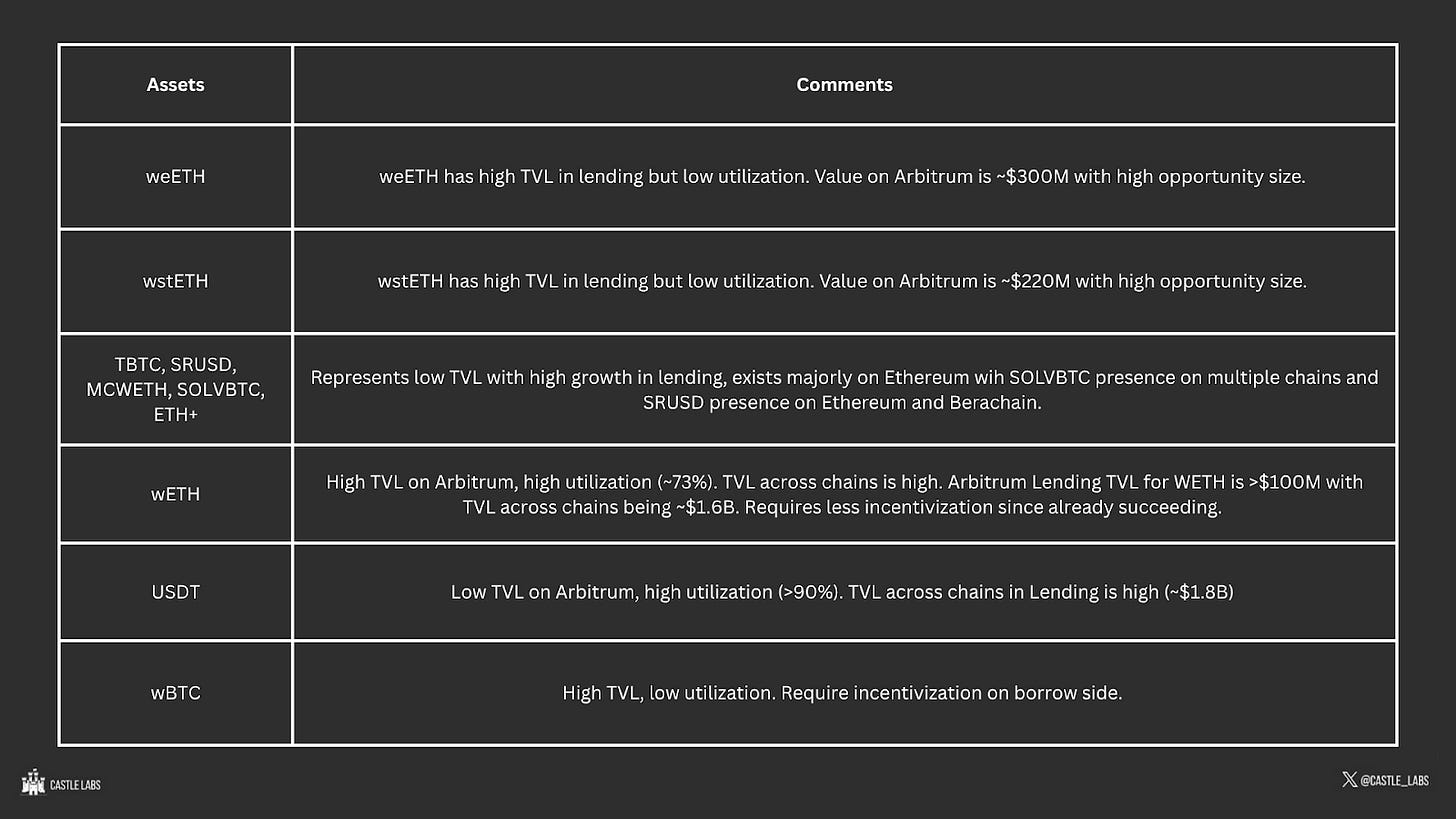

At the asset level, certain assets are growing on other chains but either don’t exist on Arbitrum or have low liquidity, and could be a potential opportunity to leverage, are also mentioned in a separate section named Asset Level Gaps.

DEXs

On Ethereum, Curve has created a strong flywheel with protocols like Convex and LlamaLend, gaining meaningful traction. On the other side, Uniswap is making its ecosystem with Unichain. It is essential to incentivise the Ecosystem as a whole to have meaningful, continuous activity, as liquidity is attracted where it can be utilised most efficiently. So if Curve is incentivised, there would be a need to incentivise Convex as well.

There are no recommendations in this section because Arbitrum wouldn’t reap many benefits by just incentivising activities on DEXs. As already mentioned above, incentivising or pushing the whole ecosystem would be more beneficial.

Derivatives

While Arbitrum has a set of protocols that offer different designs for perpetuals, including the use of orderbooks, the chain still lacks a high-performance perpetual trading platform like Lighter and Paradex. Arbitrum’s stack can support this kind of deployment if someone were to create a strong competitor to these rising protocols, which provides a great UX through a gasless and fast trading experience.

Apart from this, the current products, such as Ostium and GMX, can still be incentivised, as the former offers excellent features like FX and commodities leveraged trading. At the same time, the latter is a well-established brand and has been a major contributor to Arbitrum TVL.

Protocol Recommendations

Lending

Arbitrum currently has no feature-level differences from other chains in lending, thanks to the recent deployments of Fluid and Euler. These protocols feature several notable benefits, including Permissionless Vault Creation, Batch Transactions, Looping through a single transaction, efficient liquidation, and more, which have demonstrated success on other chains. Since these deployments are currently active on Arbitrum, it is best to leverage them and help them gain more traction on the chain through incentives.

On the GTM side, there are fewer rewards and incentives on Arbitrum, which are provided through platforms like Merkl. Merkel is being actively used by lending protocols across different chains. Additionally, on chains like Ethereum and Base, protocols like Superform have deployed their stablecoin, SuperUSDC, which accrues yield by deploying capital across lending markets. A potential partnership with them can unlock new yield opportunities and enhance user retention.

Protocol Recommendations

Asset Level Gaps

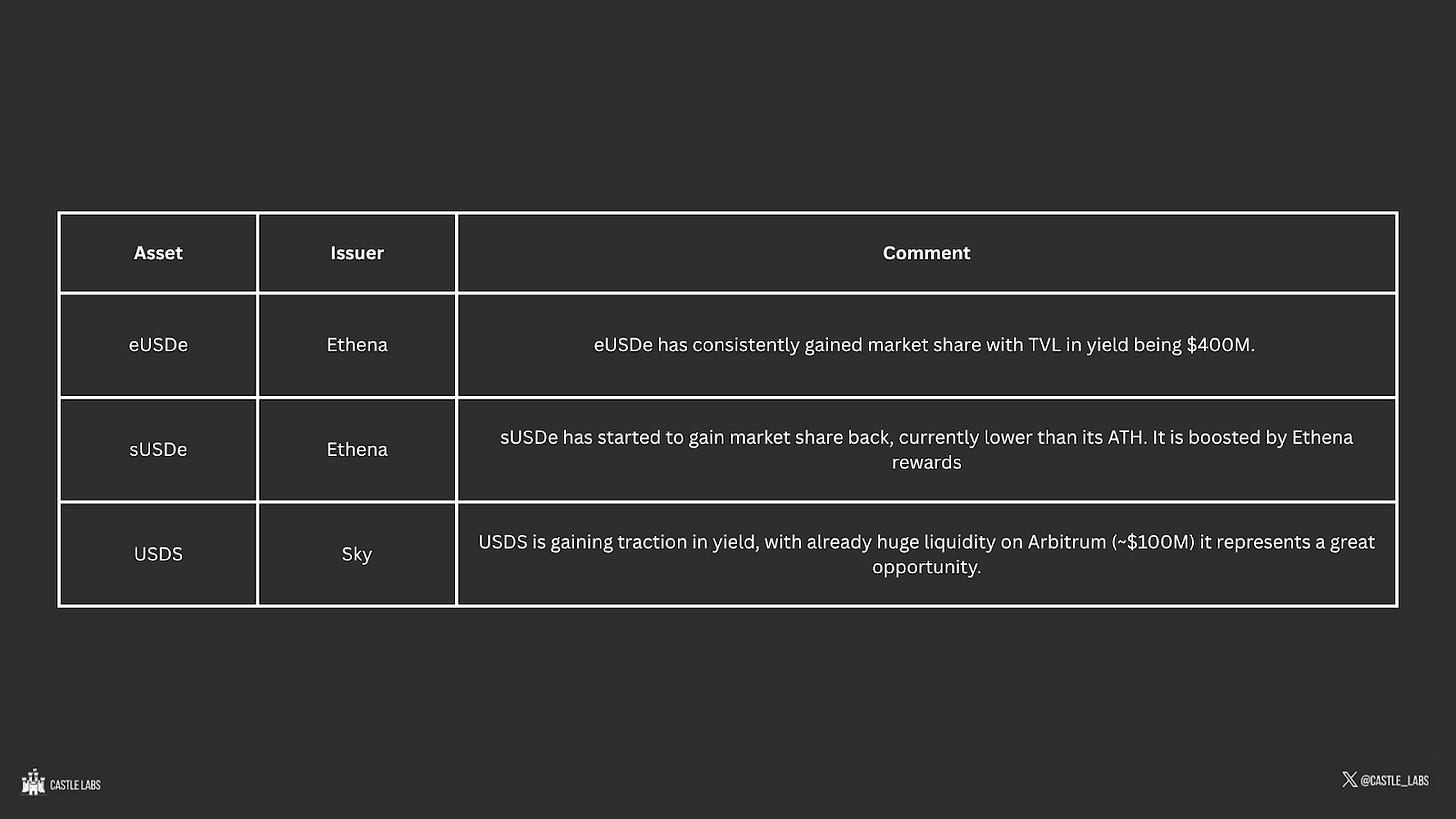

Asset Recommendations

Yield

Convex on Ethereum offers a suite of LSTs, including cvxCRV, cvxFXS, and cvxFXN, upon staking on the supported protocols such as Curve, Frax, and f(x). These tokens offer greater composability in DeFi through Convex’s already established collaborations. It will be challenging to replicate this on Arbitrum, as Convex runs as an ecosystem with Curve, Frax, and f(x), whose majority of value is locked on Ethereum.

On the other hand, Pendle is currently live on Arbitrum and incentivising it is more inclined towards Arbitrum’s growth, given that its TVL has already surpassed $50 million. Moreover, Arbitrum’s usage for yield-related assets is currently low (for example, Pendle’s PT tokens). The utilisation of these assets in various DeFi protocols enables users to leverage additional utility for their assets, thereby improving user retention.

Protocol Recommendations

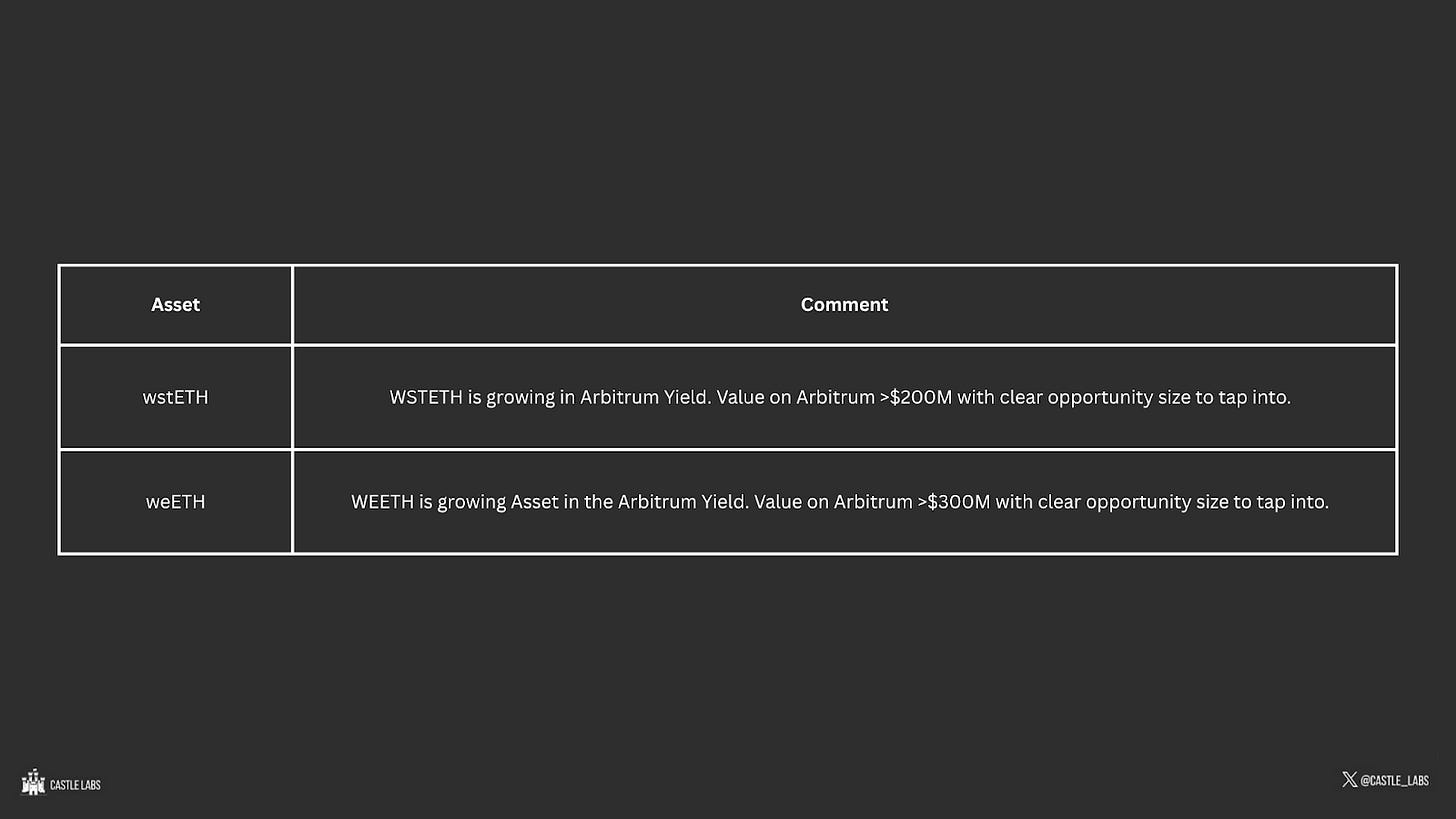

Asset Level Gaps

Asset Recommendations

CDP

The Arbitrum CDP sector is currently small but growing, with native deployments like Nerite, a friendly fork of Liquity V2. The TVL on these protocols are currently low and can be incentivised. Furthermore, these assets are presently limited in scale for DeFi usage given their low TVL.

As soon as incentives catch up, there will be a need to push these assets more into primary DeFi protocols on Arbitrum and improve the token’s utility.

In the asset recommendations below, we discuss two types of assets, which are:

Collateral Assets: These assets are used as collateral for minting the CDP stablecoin.

Stablecoin Assets: These are the assets minted by a CDP protocol against the provided collateral.

While incentivising new-gen CDPs like Nerite at a protocol-level would be beneficial, we recommend an asset-level incentivization, tailored to increase the broader sector’s usage on Arbitrum, as these assets are already highly liquid on Ethereum and represent a good opportunity to explore. These asset-level incentivizations should focus on enhancing the token’s utility within the chain through improving its composability in DeFi protocols and improving yield opportunities, thereby retaining capital.

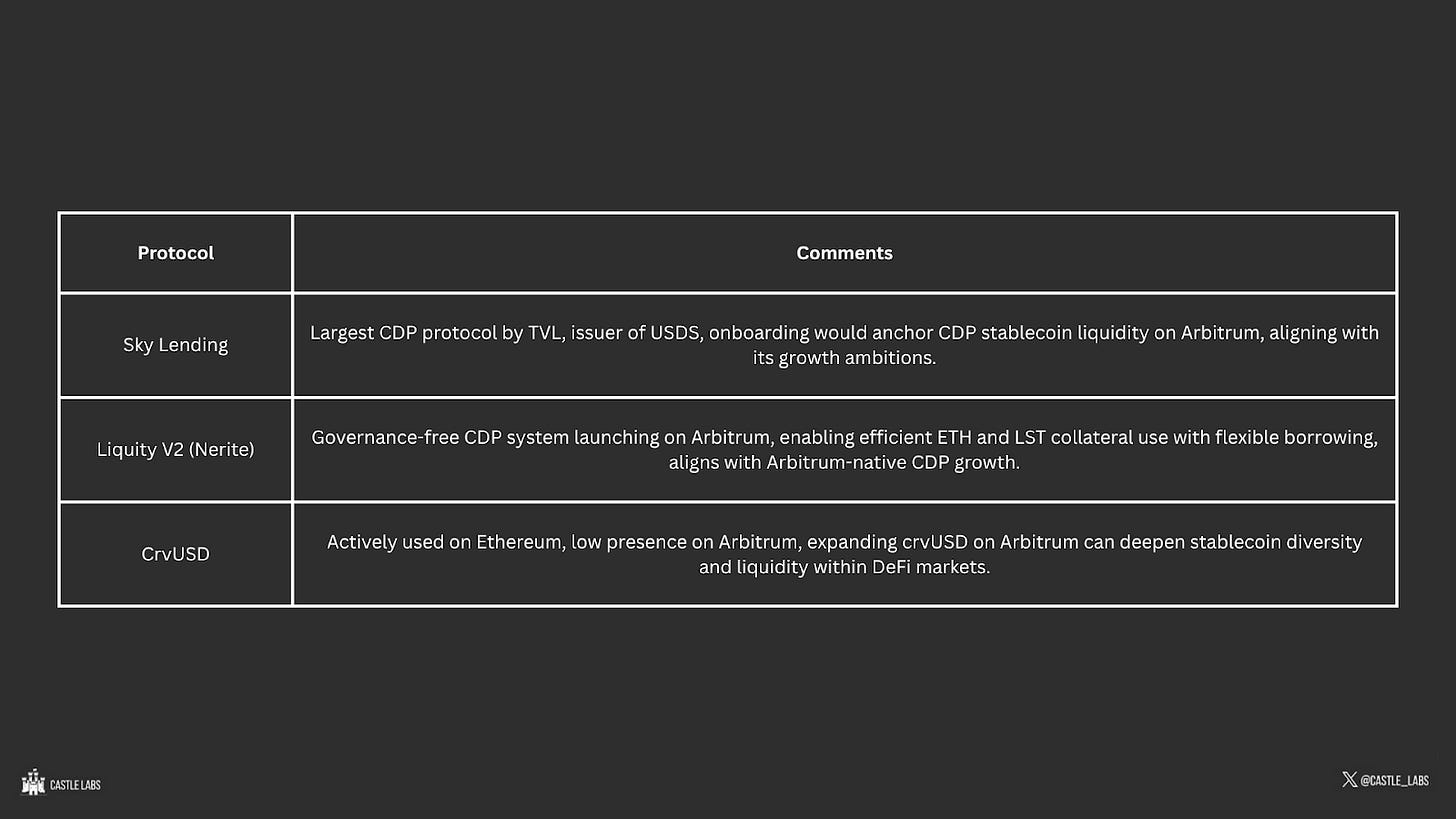

Protocol Recommendations

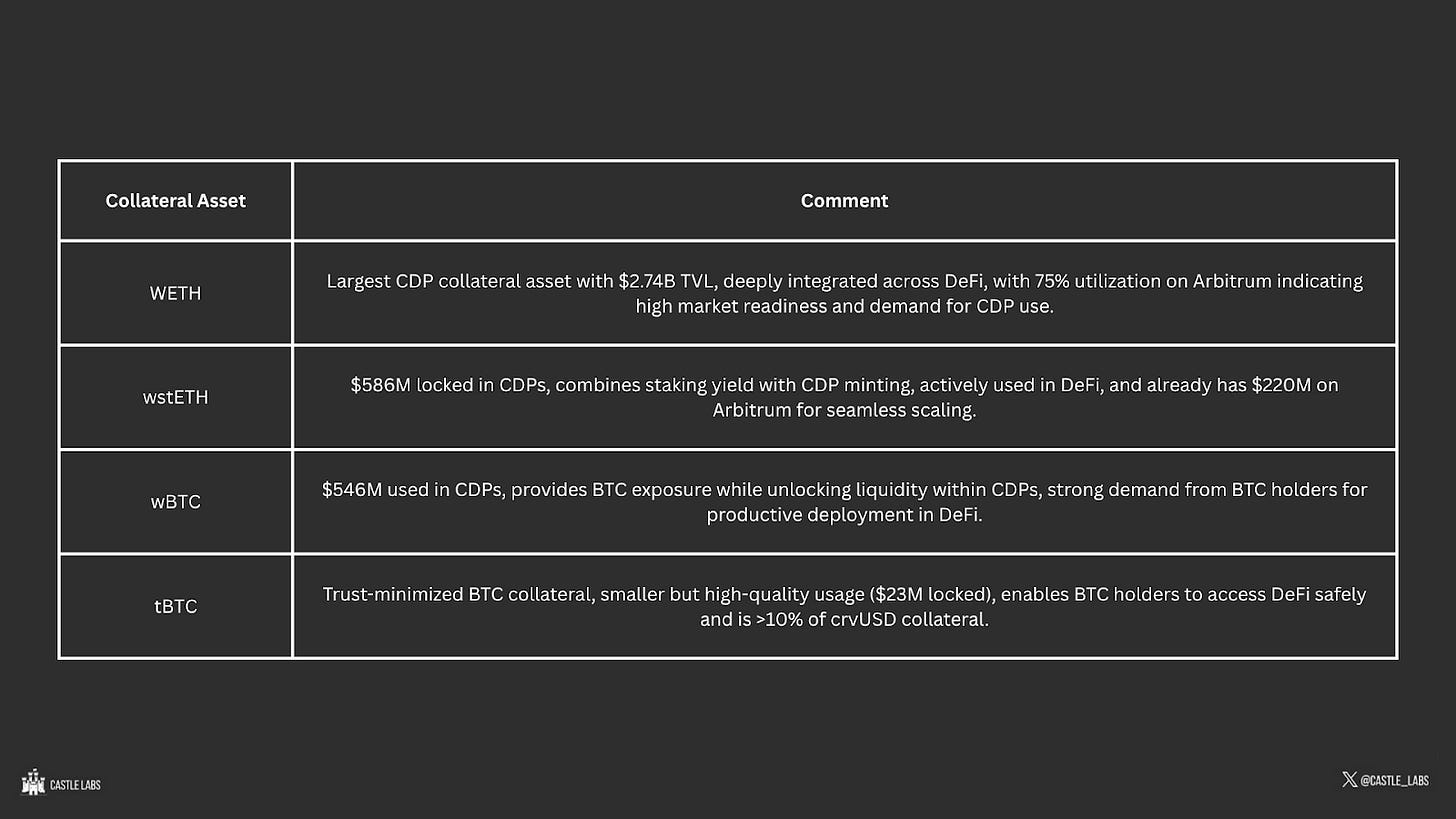

Collateral Asset Recommendations

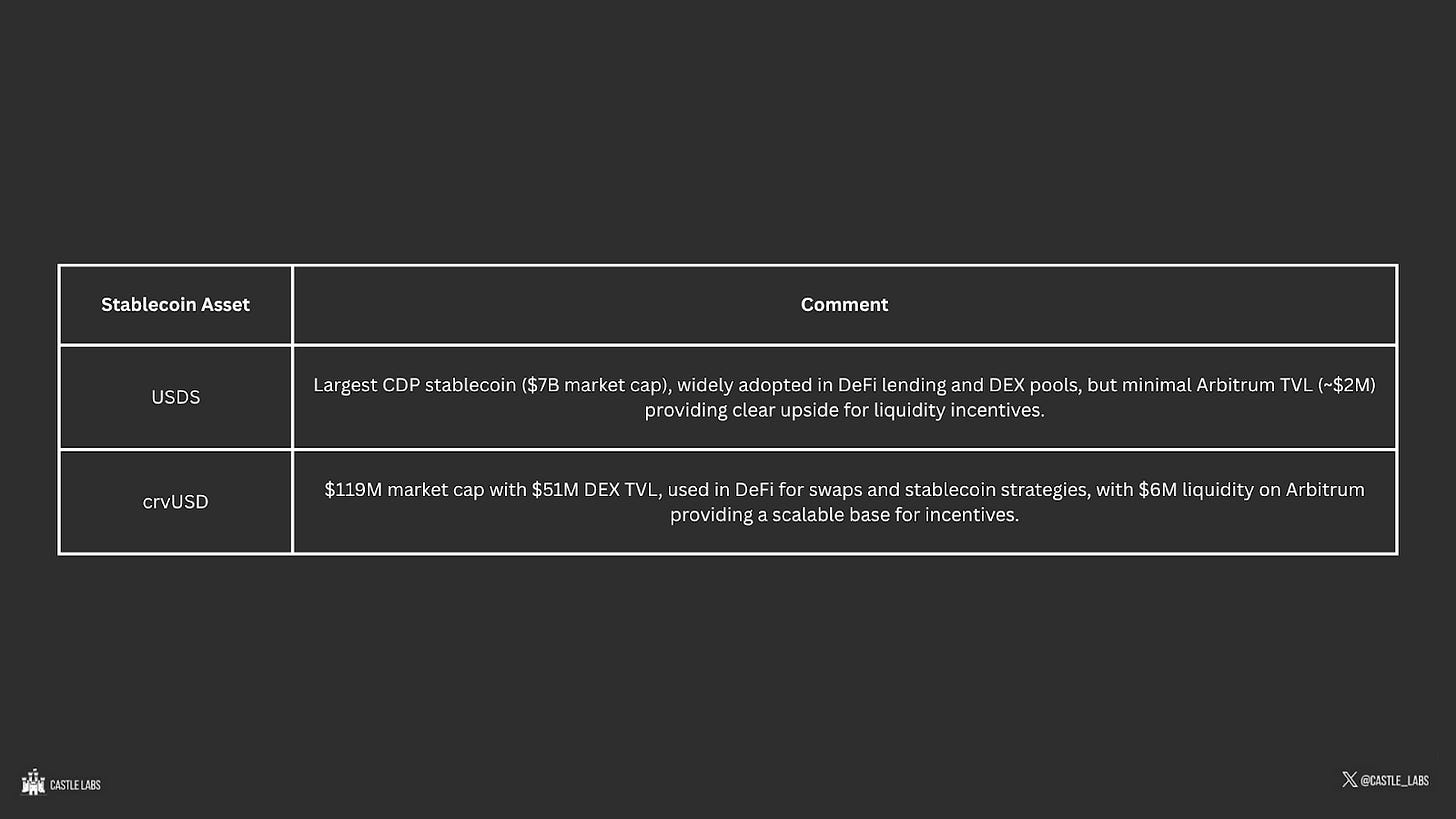

Stablecoin Asset Recommendations

Basis Trading

Arbitrum currently lacks a unique selling proposition or protocol regarding Basis Trading, as the design of this primitive is relatively similar across chains. Protocols like Stable Labs have a decent market share in basis trading on Arbitrum, but their growth has been stagnant for the past few months. Incentivising it could help it grow and increase its share.

We can also examine prominent developments in protocols like Ethena, which is building its ecosystem through Ethereal and Derive, where Ethena serves as the primary liquidity provider through its assets, such as USDe and ENA. In particular, they are focused on creating their network to create better infrastructure for their products through the Converge chain, which is in collaboration with Arbitrum. Given the already established relationship with Ethena, incentivising and onboarding its assets on Arbitrum will be beneficial, improving liquidity and yield opportunities.

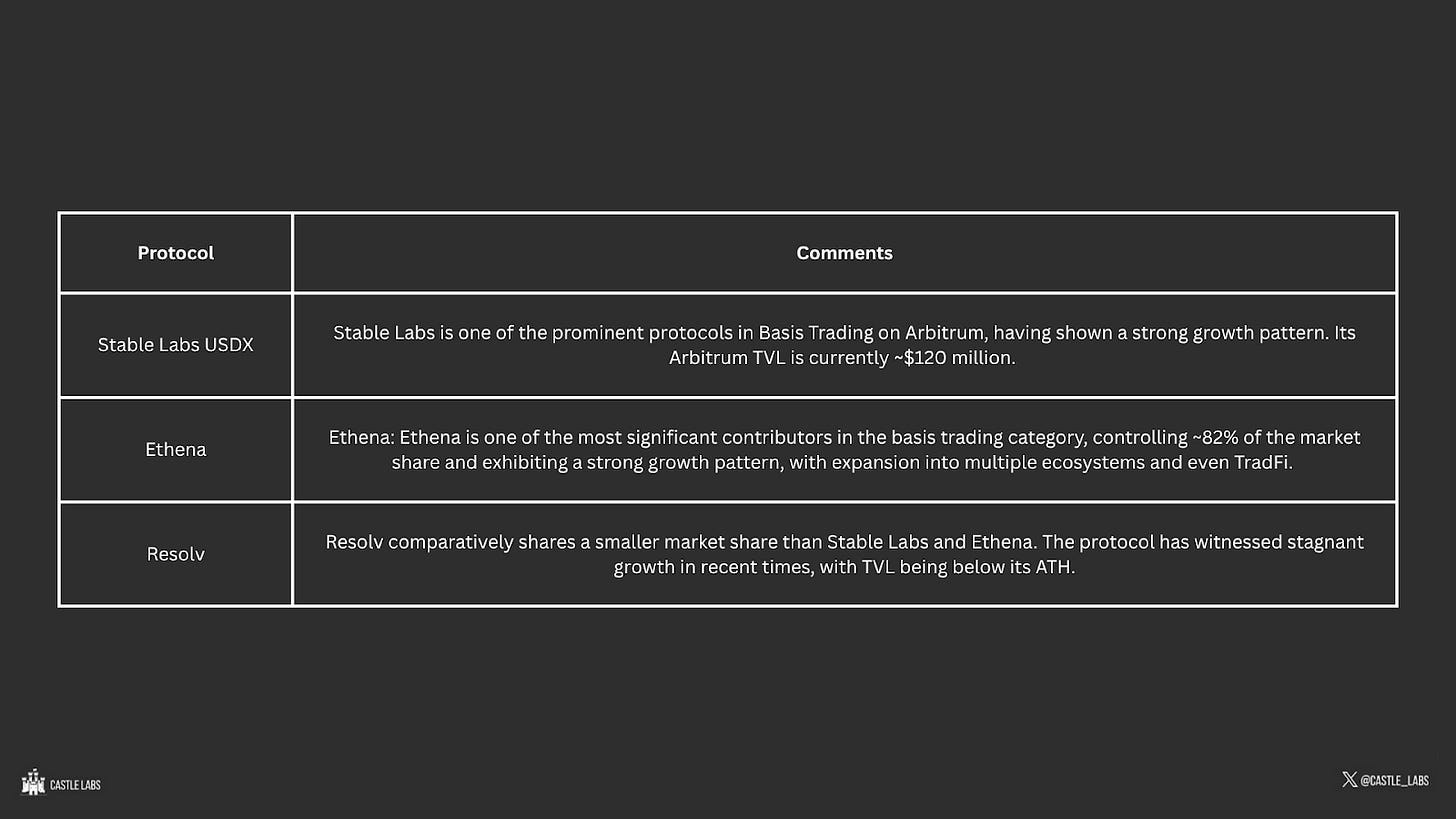

Protocol Recommendations

Asset Level Gaps

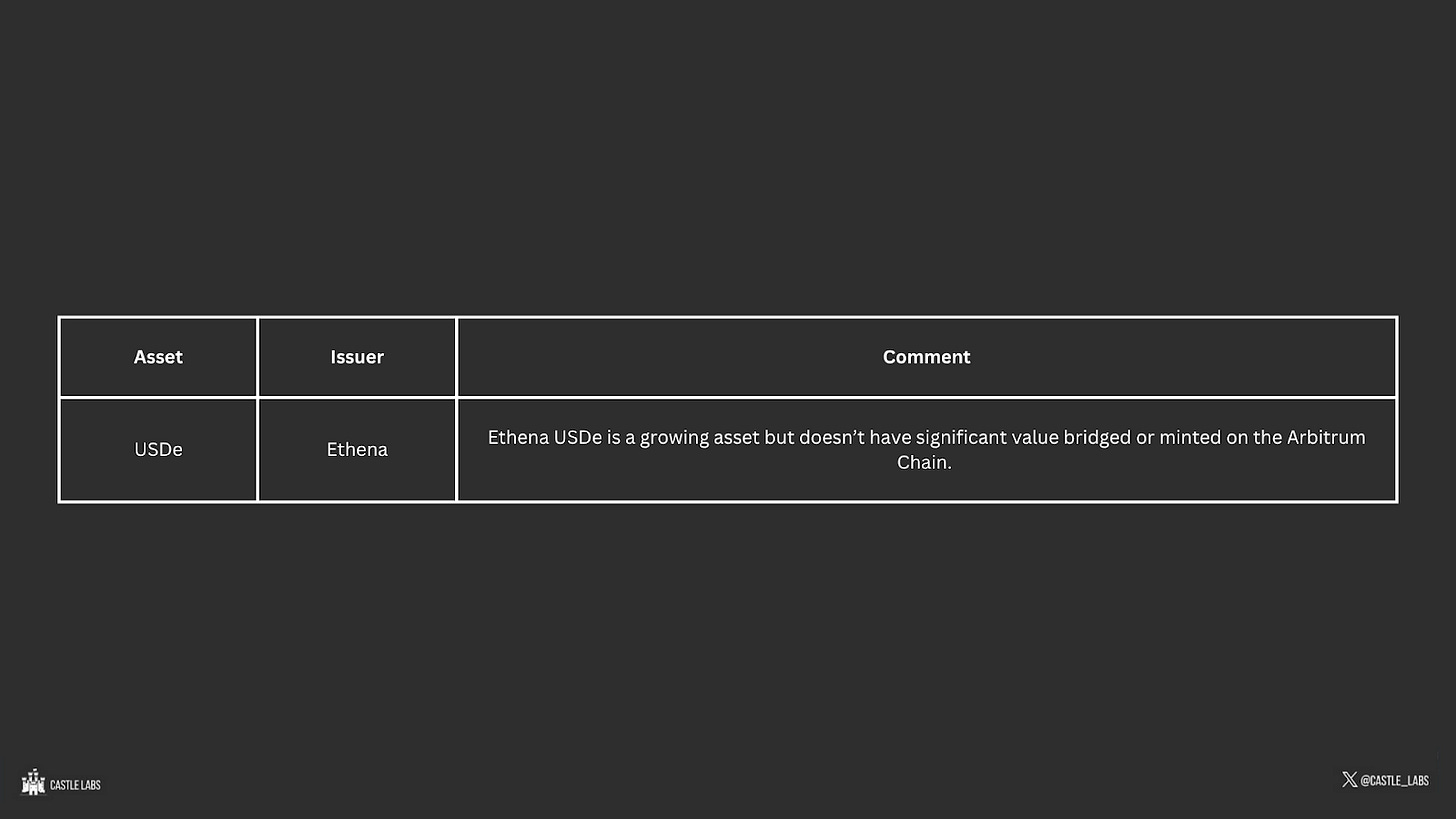

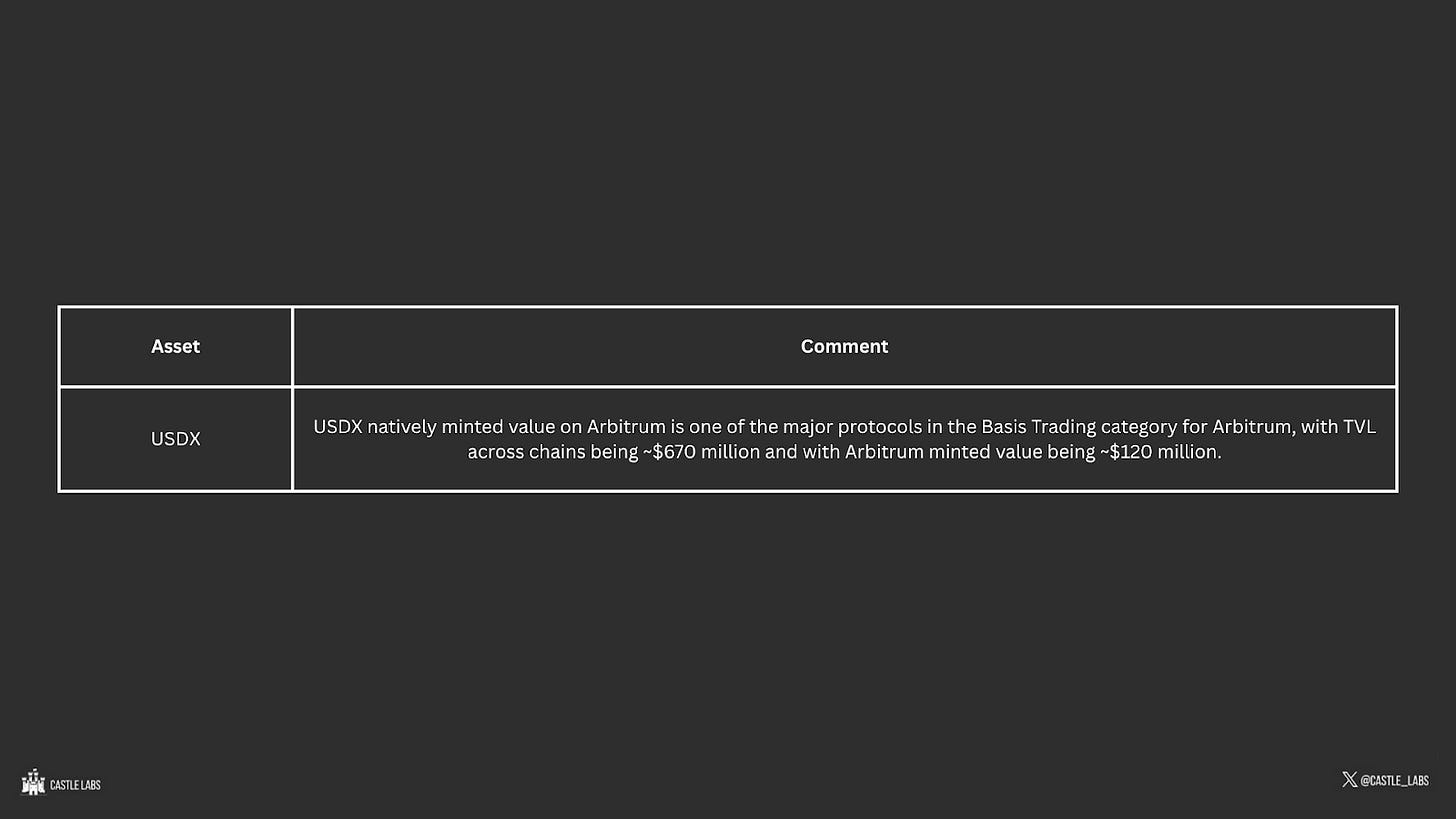

Asset Recommendations

Liquid Staking

Liquid Staking assets are expanding across chains, and these assets are composable in the DeFi ecosystem. Leveraging the growth of these assets and incentivising them would be beneficial for Arbitrum, as it would contribute to chain liquidity and open newer streams for yield generation.

As lending, there is a lack of structured rewards targeting for LSTs, which can be done through platforms like Merkl. Protocols like Superlend and Superform, which aggregate yield opportunities, have limited deployment on Arbitrum. Collaborating with these protocols to support liquid staking tokens within their strategies on Arbitrum can drive incremental liquidity and usage.

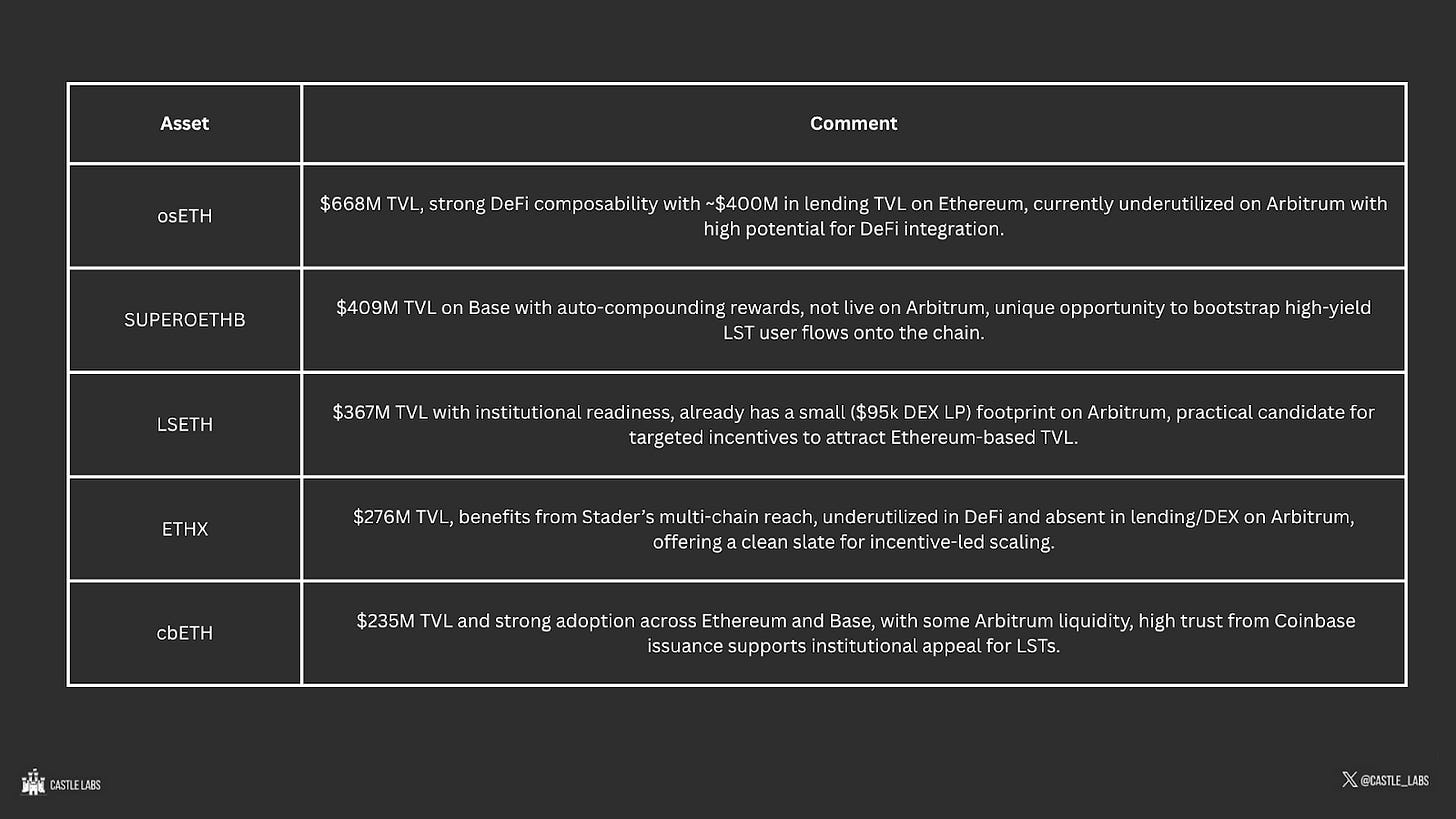

Asset Recommendations

Restaking

The majority of the restaking market is controlled by EigenLayer and Babylon, both of which account for more than 85% of the market share. As the restaking activity must occur on the settlement layer, incentivising or onboarding these protocols wouldn’t make sense for Arbitrum; instead, incentivising LSTs and LRTs' activity would help the chain capture staking-aligned liquidity and activity. Hence, this section doesn’t have any protocol or asset-level recommendations.

Liquid Restaking

On the feature side, protocols like Yieldnest provide auto-compounding vaults that automate the aggregation of staking rewards, restaking rewards, and DeFi yields into a single, easy-to-use asset. These types of structured products are currently not live on Arbitrum, representing a clear gap in user-friendly LRT yield products on the network.

Liquid Restaking assets are also growing, with assets like eETH having the greater market share. Nonetheless, Arbitrum lacks structured incentives specifically targeting these assets. Additionally, yield platforms and liquidity routers, such as Pendle and Superform, can integrate liquid restaking tokens to expand their utility on Arbitrum, which would require incentivisation.

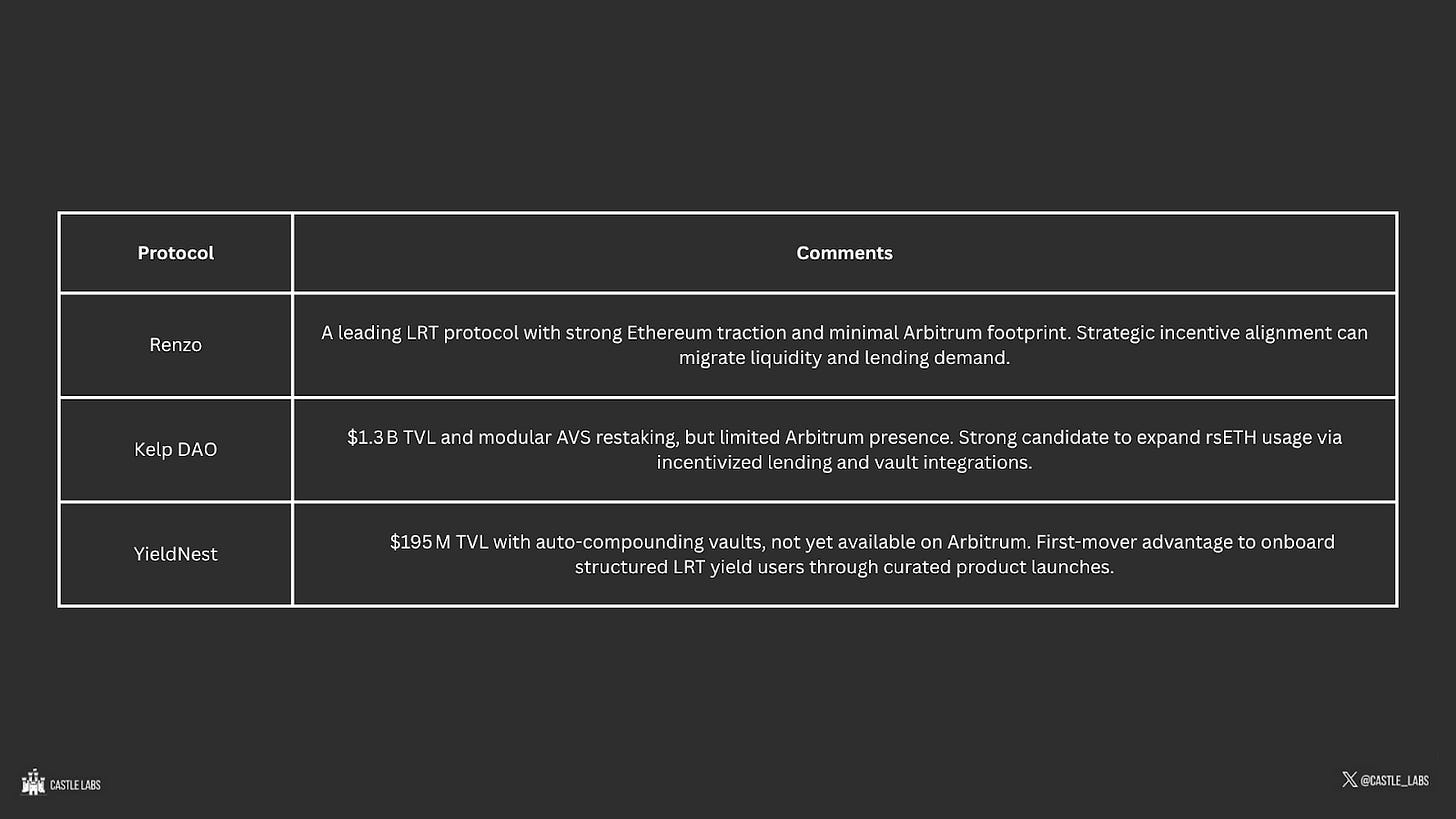

Protocol Recommendations

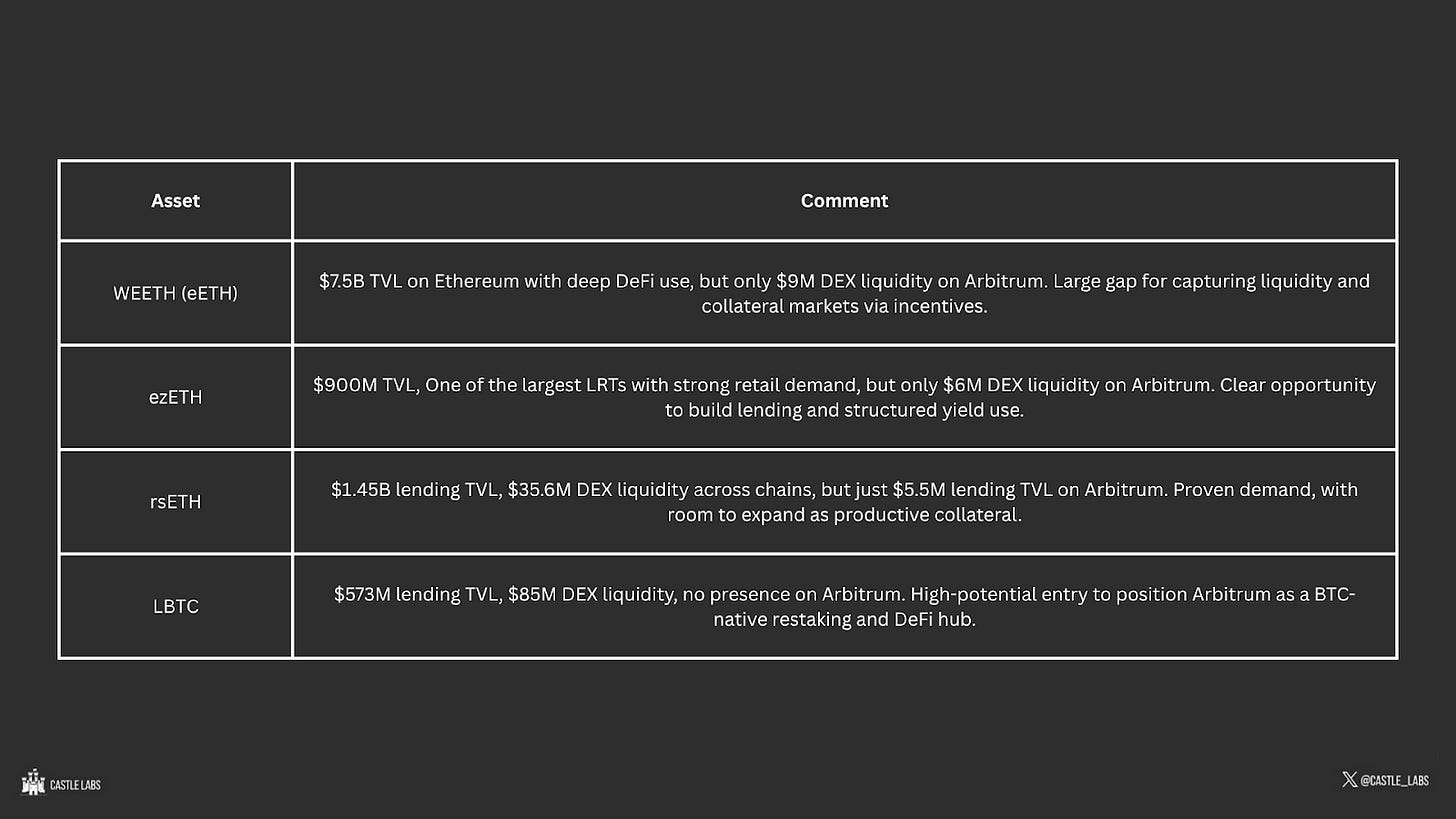

Asset Recommendations

RWA

For RWAs, the strategies to be followed are unique and don’t come under regular incentivization. Robinhood's recent collaboration with Arbitrum already positions the chain as an excellent venue for tokenisation. Additionally, the chain can attract more capital deployments by drawing in TradFi partners.

ZKsync is growing and attracting institutional flows primarily due to its privacy layer that supports strict compliance without compromising user identity. Arbitrum can incentivise or create a privacy-focused chain through its Orbit Stack and expand on this approach.

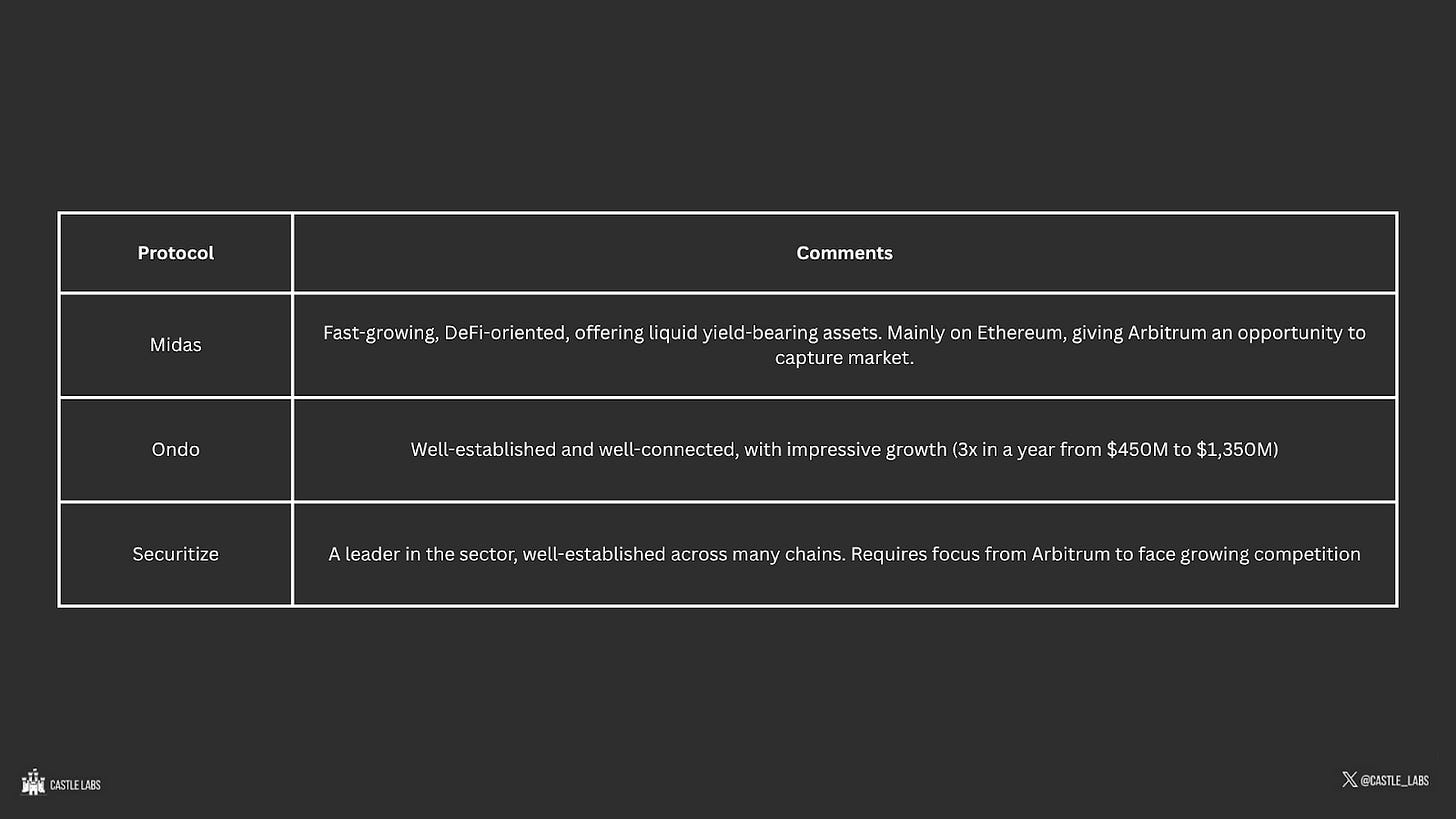

Protocol Recommendations

Asset Recommendations

Conclusion

EVM chains currently control over 60% of the DeFi liquidity. Arbitrum holds ~2% of the DeFi value, presenting a significant opportunity for growth and expansion into various verticals. Our report has shed some light on each of these growing verticals, with a focus on the features they provide and the adopted GTM strategy by various protocols.

The recommendations following the analysis of each vertical are based on the identified gaps and where Arbitrum can start acting upon and expand its market share.

These recommendations involve incentivising already established protocols under various categories, such as GMX, Ostium, Stable Labs, Euler, Fluid, Pendle, and more. They also include streamlining rewards and incentives for users through platforms like Merkl and improving the utility of yield assets (such as Pendle’s PT assets) through collaboration between Pendle and lending markets on Arbitrum.

While some of these recommendations can be solved through a potential incentivization, some require a BD approach to get new protocols onboarded or facilitate collaborations if needed.

The above report is part of our detailed ecosystem mapping, conducted in collaboration with DL Research for Arbitrum DAO, and is available for viewing here.