Avantis: The onchain Leverage Layer for Every Asset

1. Introduction

Onchain perps trading has come a long way, but the economics are still broken. From the clunky UX of early DEXs to today’s high-speed perp platforms, the perp infrastructure has matured. Leverage, composability, and asset depth have improved dramatically.

However, while execution got faster and markets became more sophisticated, the underlying economics remained unchanged.

Most protocols still operate on extractive, zero-sum models, where:

Traders pay hefty fees regardless of whether they win or lose.

Liquidity Providers (LPs) often come out net negative.

Protocols take a cut irrespective of user outcomes.

Fixed fees, funding bleed, and borrowing costs chip away at every position, and there is no structural incentive for traders to win.

Against this backdrop of extractive design, Avantis emerges with a fundamentally different approach. Avantis is creating a cross-asset leverage layer for DeFi, combining CEX-like performance with incentive structures that DeFi was meant to enable. Launched on Base chain in early 2024, Avantis lets anyone trade crypto, forex, and commodities with high leverage, zero slippage, and zero fees, all in one place.

Backed by major investors such as Pantera and Coinbase Ventures, Avantis is pioneering a cross-asset perpetual DEX that blends CEX-like performance with DeFi’s openness.

This deep dive examines how Avantis addresses the most significant challenges in onchain perpetual trading, including fees, slippage, and limited markets, and how its architecture promotes sustainable incentives for both traders and liquidity providers (LPs).

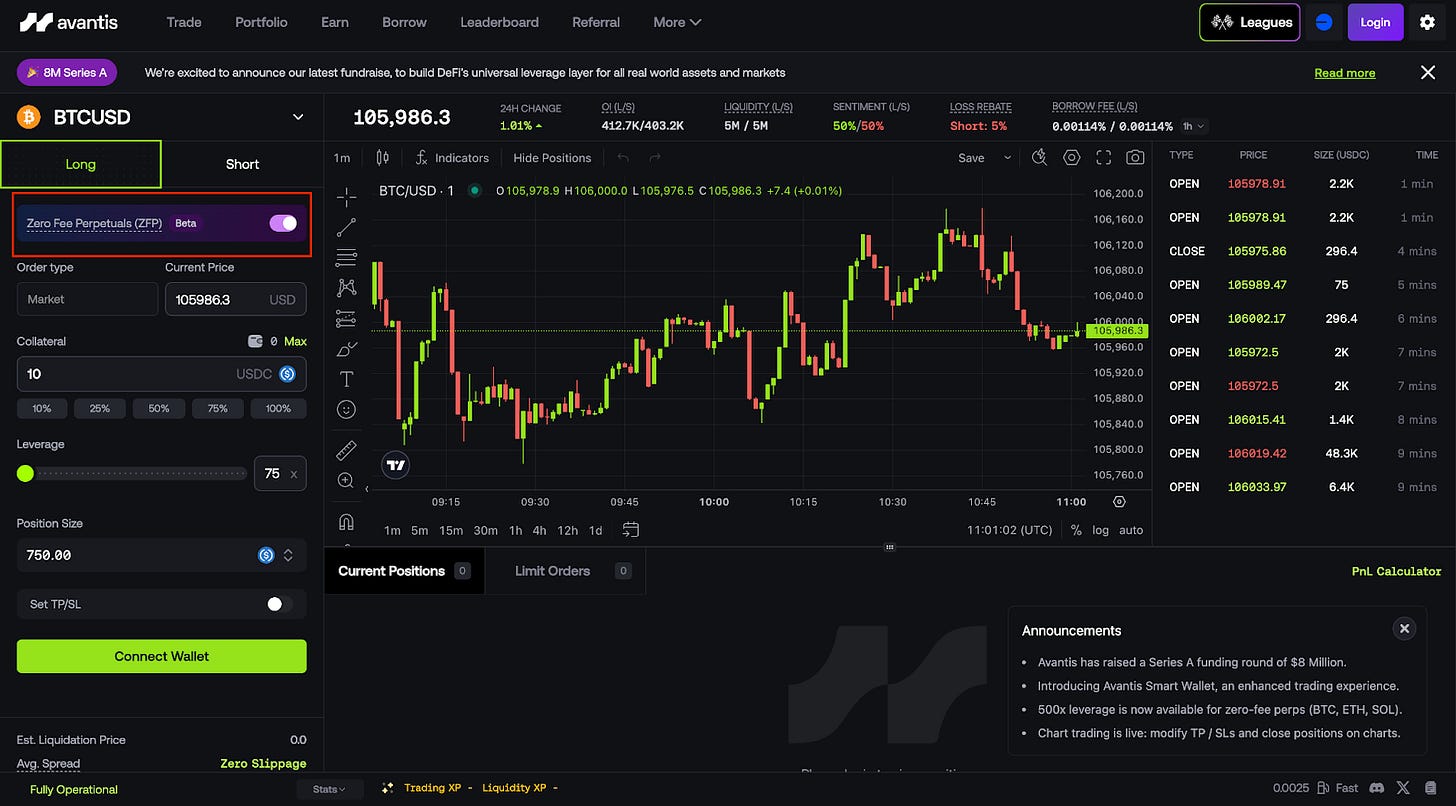

2. Zero-Fee Perpetuals (ZFP): A New Perp Paradigm

Avantis’ Zero-Fee Perpetuals (ZFP) introduces a different approach to the design of perpetual fees. On Avantis, traders pay nothing to open or close a position and incur no ongoing funding or borrowing costs. Instead, the protocol charges a percentage of profits only when a trade closes in profit. If the trade is unprofitable, there are no fees at all.

This flips the standard fee exchange model of perpetual exchanges, which typically extracts value regardless of outcome. By charging only on realized gains, Avantis directly ties protocol revenue to trader success, which aligns incentives at the most fundamental level.

2.1 How ZFPs Work and Who They’re Built For

ZFPs are designed for active, high-leverage traders who are particularly sensitive to trading costs. Structurally, a ZFP is a perpetual futures contract that operates on a binary fee model: no fees are incurred if the trade is at a loss, and a percentage fee is only applied if the trade is profitable.

For scalpers, HFT firms, and directional traders, Avantis' ZFP eliminates the fee on both entry and holding, allowing for profitable execution on tighter spreads and smaller price movements.

This model directly addresses two persistent issues with standard perpetual contracts:

Fixed entry and exit fees reduce the edge: On traditional perp exchanges, traders typically pay a fee on both entry and exit (often 0.1% each way), which means a trade must move significantly just to break even. For high-frequency or small-margin traders, these costs can convert marginal wins into net losses.

Funding and borrowing costs erode positions: Perp contracts often include ongoing costs that penalize traders for holding positions over time. These fees steadily reduce margin, shift liquidation thresholds, and eat into any unrealized gains, which is particularly harmful for directional traders or swing positions.

ZFPs remove both fee layers. There are no charges to open or close a position, and no funding or borrowing fees over time. This means traders can enter tight trades without needing significant price movement to justify them, and hold positions longer without suffering passive profit and loss (P&L) decay.

As long as a trader avoids liquidation, they can theoretically hold a position indefinitely without fees. This makes ZFPs especially compelling for loss-averse traders, scalpers, or anyone operating with high leverage on small price moves.

2.2 Incentive Design

Avantis charges a fee only on profitable trades. This “win fee” is a fixed percentage of the gross P&L realized in a successful position. If a trader loses, they pay no additional fee, only the market loss they incur. This structure ensures that both the protocol and its liquidity providers benefit only when traders do. It is one of the few models in DeFi where trader profitability is directly tied to protocol revenue, creating a non-adversarial exchange dynamic.

2.3 Win Fees: Pay Only If You Profit, Scaled by ROI

Avantis uses a dynamic profit-sharing fee model for ZFPs, where traders pay a percentage of their profits only when a position closes in the green. The fee is not fixed, as it gradually decreases with increasing Return on Investment (ROI), effectively rewarding outsized performance and allowing traders to retain a greater portion of their gains. For significant wins, the fee can be as low as 2.5% of profits.

For smaller profits, the fee is higher. This ensures that LPs are still compensated for providing risk capital on trades that incur no upfront cost.

For example, a modest gain might result in a 15 percent fee on profits, while a 10x return could bring that fee into the single-digit range. On average, traders keep more than 85% of their realized gains. The sliding scale acts as a built-in incentive to let winners run, offering a volume discount on success.

This structure also makes ZFPs economically competitive with traditional fee models across most outcomes. Small wins that would be wiped out by standard entry and exit fees remain viable on Avantis. Only in edge cases, such as extremely large trades with massive ROI, might a conventional 0.1 percent fee structure perform better in net terms.

2.4 ZFP vs Fixed-Fee Perps: Breaking Even & P&L Breakpoints

To illustrate these advantages in practice, let’s walk through a hypothetical 100× long on BTC with ZFP versus a typical perp exchange (with ~0.06% fee each side and ~10% APR funding)

Let’s assume our trader posts a $100 margin and holds for a week.

On Avantis ZFP:

Opening the $10,000 position incurs no additional costs ($0 cost).

If BTC’s price moves up by 1%, the position is now approximately $10,100, representing a $100 gross profit (100% ROI).

Closing incurs a profit fee (let’s assume ~15% at that ROI).

The trader nets about $85 profit after the fee.

If the trade had gone against them (price –1%), they’d lose ~$100, but pay $0 in fees beyond that loss.

On a regular perp DEX:

Opening the same position incurs an entry fee (~$6) and closing another ~$6, plus ~$19 in funding over 7 days, totalling roughly $31 in costs (regardless of profit or loss).

A 1% move ($100 gross profit) would net only approximately $69 after fees.

In fact, the price would need to move by ~0.3% or more just to cover the round-trip fees in this scenario. A tiny +0.1% move (which would be a $10 gain) actually turns into a net loss once fees are paid (you’d pay ~$31 to make $10!).

On Avantis, by contrast, even a +0.1% move yields a small net profit since no upfront costs are taken.

The table above highlights how small gains that are net negative under traditional fees become net positive with ZFP, allowing skilled high-frequency traders to compound wins. Only at very high returns (rightmost column) does the fixed-fee model slightly edge out, once its flat fees are trivial compared to P&L. In most cases, ZFP lets traders keep more of their money

In short, ZFPs considerably lower the breakeven threshold and P&L friction for traders. It’s a game-changer for anyone who’s been “fed to death by ducks” on perp fees, think scalpers, high-leverage speculators, or even algo traders. By paying only from profits, ZFP offers performance-based pricing: if you don’t make money, Avantis doesn’t either.

This model aligns the interests of traders and platforms in a way that few exchanges (if any) have attempted before.

3. Avantis Beyond ZFPs

Avantis does not stop at ZFPs, as they are complemented by a series of additional features.

3.1 Synthetic Real-World Assets (RWAs): Leverage Beyond Crypto

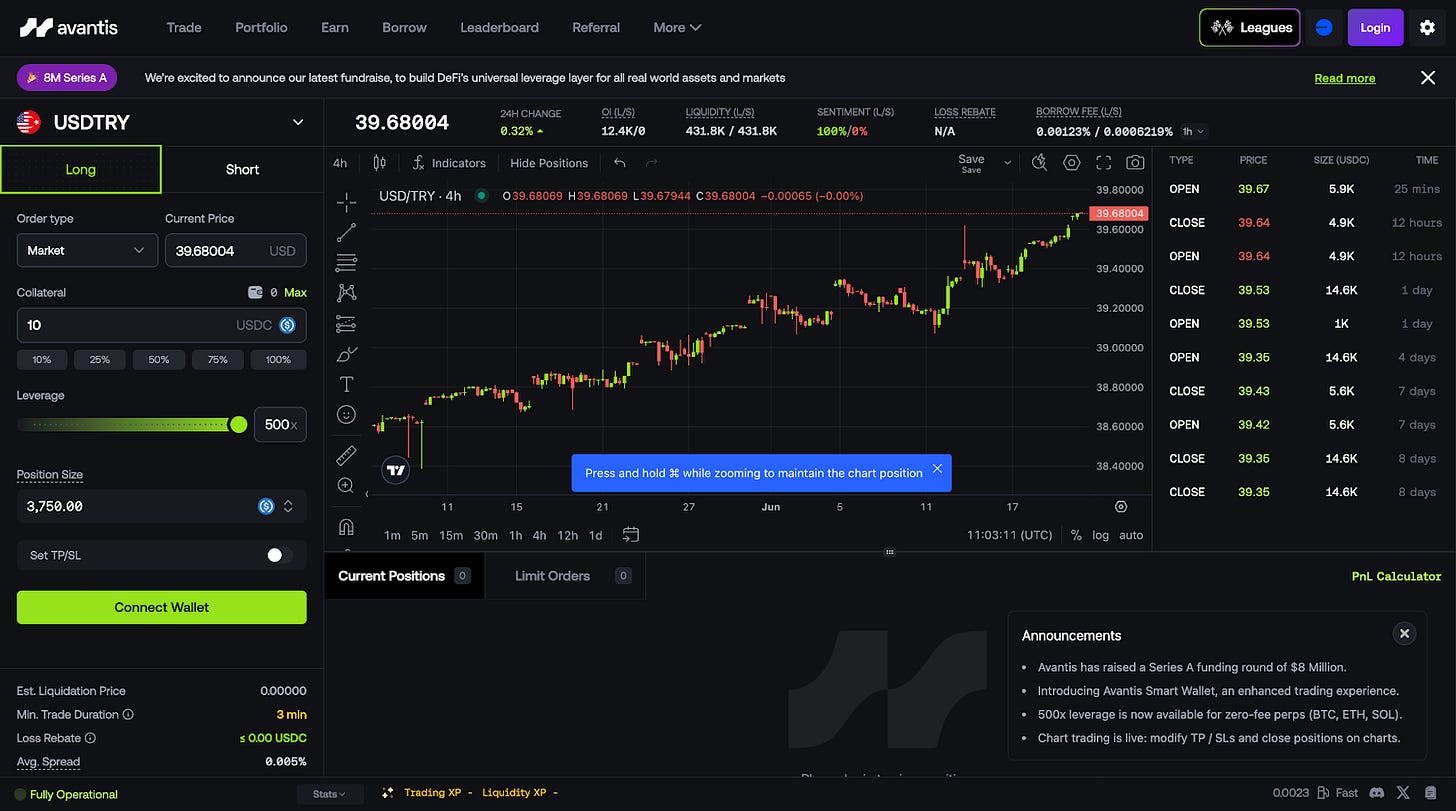

One of the most ambitious extensions of the Avantis platform is its synthetic real-world asset (RWA) trading. Rather than focusing on tokenized treasuries or passive yield products, Avantis enables directional trading on macro markets directly from a DeFi interface. Traders can take leveraged positions on gold, short fiat currencies like the Japanese yen, or speculate on the volatility of emerging market pairs such as the Turkish lira.

This represents a notable departure from the prevailing RWA trend in DeFi, where over 90% of total value locked is concentrated in tokenized U.S. Treasuries and private credit. These instruments offer yield but do not support speculative or directional exposure. Avantis fills that gap by building synthetic markets that behave like perpetuals for non-crypto assets.

3.1.2 Asset Coverage: From FX to Commodities

Since launch, Avantis has rolled out over 15 RWA trading pairs, covering major currencies, exotic FX, and key commodities. This range surpasses that of most decentralized venues and many centralized exchanges in terms of cross-asset exposure. Examples include:

Fiat Currencies: Pairs like USD/JPY, EUR/USD, and USD/TRY offer access to both major and emerging markets. For example, during periods of volatility for the Turkish Lira (TRY), Avantis users could actively trade USD/TRY onchain. This type of real-time macro access has been virtually absent from DeFi until now.

Metals and Energy: Gold (XAU/USD) and crude oil contracts are live. These are traditionally high-volume, multi-trillion-dollar markets in traditional finance (TradFi). On Avantis, users can express views on these assets directly using USDC without relying on intermediaries or brokerage accounts.

Equities (Upcoming): By late 2025, Avantis aims to expand to 100 or more RWA markets, including stock indices and major equities. This could include synthetic versions of instruments like the S&P 500 or large-cap stocks such as Tesla. These additions would mark a significant step toward a fully composable, cross-asset trading layer within DeFi.

3.1.3 A Unified Trading Platform

With this breadth of synthetic exposure, Avantis evolves from a crypto-focused perp DEX into a broader, more universal trading protocol. It allows users to trade across cryptocurrencies, FX, commodities, and eventually equities, all from a single wallet. The ability to express macro views on a DeFi-native platform removes the need for banks, CFD brokers, or custodians, opening up global markets to permissionless access.

Avantis takes a synthetic approach to RWAs. Instead of tokenizing real-world assets one-to-one with the underlying, it utilizes trusted oracles and a USDC vault to settle P&L onchain.

This means that users are not trading real gold or yen, but rather trading price exposure via perpetual swaps, with USDC serving as both collateral and the settlement layer.

This differs from tokenized RWAs, which wrap offchain assets, such as T-bills, into ERC-20 Tokens. Those are often illiquid, constrained by market hours, and mainly used passively. This tradeoff is necessary as Avantis enables active trading on macro assets, 24/7, with leverage and instant settlement.

3.1.4 The Edge

24/7 Markets: Trade FX and gold even when traditional markets are closed.

Instant Settlement: No brokers, no delays. Everything resolves onchain.

High Leverage: Up to 500× on FX and high leverage on commodities. These levels are rarely available to the retail market.

Massive Market Access: FX alone sees $7 trillion per day, compared to crypto’s approximately $ 100 billion. Avantis opens the door to that volume.

Global Permissionless Trading: Anyone with a wallet can express macro views. Go long on crude oil, short the yen, or hedge inflation with minimal capital.

Unique features: Zero-slippage BTC trading and Zero-fee perps, exotic pairs as a hedge.

Avantis is building the foundation for onchain macro trading. Synthetic RWAs are more than just assets, as they are composable building blocks that can eventually be integrated into lending, structured products, and yield strategies.

The result is a permissionless global derivatives engine for RWA assets.

3.2 Zero-Slippage BTC: CEX-Grade Execution onchain

One of Avantis’ core features is zero-slippage execution, especially on its most liquid pair, BTC/USD. For leveraged traders, slippage acts as a hidden cost. A 0.1 percent price impact at 100x leverage effectively reduces the margin on entry by 10 percent. Even small slippage can materially distort P&L.

Avantis addresses this by utilizing a synthetic virtual AMM (vAMM) architecture for select markets, such as BTC. This design enables execution at the oracle price, with no spread or price impact, regardless of order size. Whether trading $100 or $1 million, the user receives the same price. Unlike traditional AMMs or order books, where larger trades consume liquidity and create slippage, the vAMM model bypasses this by referencing oracle prices and routing exposure through its vault infrastructure.

The protocol dynamically adjusts its pricing curve for assets like BTC, allowing it to offer flat pricing for supported pairs. This is possible due to robust liquidity backing, effective risk controls, and a selective application to high-quality, oracle-fed markets. The vault absorbs exposure without market movement, relying on LP capital and internal mechanisms to manage risk.

3.2.1 Why Zero Slippage Matters

Zero-slippage execution is particularly valuable in two cases:

Large trades: On typical DEXs, multi-million dollar orders significantly move the market, resulting in thousands of dollars in hidden costs. On Avantis, a $2.5 million BTC long incurs no price impact. The full notional enters the position at the expected price, which is uncommon in onchain markets.

High leverage: With 50x or 100x leverage, even minor adverse execution can instantly put the trader at a loss. Avantis’ model eliminates this disadvantage by matching at the oracle price, ensuring P&L begins at or near zero, which is critical for tight strategies.

Benchmark tests have shown that Avantis delivers 0 basis points of slippage on BTC trades, compared to several basis points on leading DEXs. Even on mid-cap assets like DOGE, the protocol achieved roughly 4.5 bps of slippage on a $100,000 order, which is comparable to the execution quality of CEXs.

3.2.2 Implications for Volume and Trader Behavior

For serious traders, execution quality is not optional. If Avantis consistently delivers fee-free and slippage-free trading on core assets, it becomes a viable venue for professional flow. This is especially relevant when compared to CEXs, where even modest spreads and fees can erode performance at scale.

In removing both fees and slippage, Avantis positions itself to compete for large volumes from traders who optimize for net execution efficiency. For firms running tight strategies, saving 5 to 10 basis points per trade translates directly into higher returns.

4. The Road Ahead: Global, Composable, and Event-Driven Leverage

To conclude, Avantis has outlined an ambitious roadmap aimed at becoming DeFi’s leading liquidity hub for cross-asset leverage. The protocol is positioning itself as a unified onchain layer for leveraged trading across cryptocurrencies, forex, commodities, equities, and even non-financial markets, such as sports and real-world events.

If the first year was about validating the core model through cryptocurrency and a limited set of RWAs, the next phase focuses on scaling both asset breadth and market depth.

4.1 Expansion of RWA Markets

Avantis aims to have 24/7 markets where users can trade FX and gold, even when traditional markets are closed.

Avantis plans to significantly broaden its asset offering, with 25 or more additional RWA pairs expected in the near term and a target of over 100 RWA markets by the end of 2025. This expansion is likely to include additional fiat currencies (e.g., GBP, CHF, AUD), broader commodity exposure (e.g., silver, oil, major indices), and eventually tokenized equities and ETFs. By mirroring the structure of traditional derivatives markets, Avantis aims to increase its relevance to a wider range of traders and significantly grow its addressable market.

4.2 Extending Zero-Fee Perpetuals Across All Markets

The zero-fee perpetuals model, currently available in beta for BTC, ETH, and SOL, offers high leverage and profit-share-only pricing. Avantis intends to extend this model to all supported asset pairs. Doing so would provide traders with consistent cost advantages across both crypto and macro markets. Implementation will depend on asset-specific risk controls, but the long-term goal is to make ZFP the default fee structure across the platform.

4.3 AMM Upgrades and Capital Efficiency Improvements

A major protocol upgrade is in development to enhance the capital efficiency of the Avantis AMM by an order of magnitude. Future iterations may include a dedicated appchain with cross-margining capabilities and potentially hybrid mechanisms that combine AMMs with order book logic. This could enable higher leverage, better risk management, and greater throughput without requiring proportionate increases in TVL.

4.3 New Product Lines: Options and Event Markets

Avantis has indicated plans to expand beyond linear perpetuals into binary options, exotic derivatives, and event-driven markets. These may include leveraged trading on real-world outcomes such as sports results, election forecasts, and macroeconomic events. The introduction of leveraged event markets would differentiate Avantis from traditional DEXs and bring a new class of financial primitives to DeFi.

4.4 Composability Within the DeFi Ecosystem

Interoperability is a core part of the roadmap. Avantis vault tokens, such as avUSDC, are expected to become compatible with other DeFi protocols, including Pendle, Spectra, and decentralized lending markets. These integrations would enable new use cases such as collateralized borrowing against LP positions, forward yield sales, and composable trading strategies via smart wallets and automation tools.

Taken together, the roadmap suggests Avantis is building toward a multi-asset, onchain trading platform that merges elements of a global derivatives exchange, prediction market, and DeFi-native yield infrastructure. While there are clear challenges ahead, including liquidity constraints, regulatory considerations, and technical scaling, the protocol has demonstrated meaningful traction to date, including live deployments of zero-fee perps, growing volume, and a broadening asset base.

From our perspective at Castle, Avantis represents one of the more structurally ambitious plays in the onchain derivatives space.