Introduction

What are DAOs and brief history

The concept of Decentralized Autonomous Organizations (DAOs) emerged with The DAO in 2016, an investor-directed fund on Ethereum. The DAO raised ~$150 million in ETH as a crowdsourced venture fund, but was infamously hacked due to a smart contract vulnerability. This incident led to Ethereum’s hard fork (creating Ethereum Classic) to restore stolen funds, shaking early trust in DAOs. In response, developers created safer DAO frameworks (e.g. Aragon, MolochDAO in 2019) emphasizing security and simpler governance. By 2020-21, DAOs proliferated: DeFi protocols (Compound, Uniswap) launched governance tokens, grant DAOs like Moloch and MetaCartel funded public goods, social DAOs (e.g. Friends With Benefits) formed online communities, and collector DAOs (Flamingo DAO) grew in scope and membership.

As DAO ecosystems evolved to accommodate greater complexity, the limitations of monolithic governance structures became increasingly apparent, especially in large protocols managing diverse operations, treasuries, and contributor bases. This gave rise to a more modular approach: the MetaDAO.

MetaDAO: a modular governance model that decentralizes execution through spinouts and subDAOs, while retaining strategic alignment through shared capital and incentives.

Building on early DAO principles of community coordination and shared ownership, MetaDAOs introduce a layered, scalable structure that allows organizations to divide responsibilities across specialized subDAOs or spinouts. This next sections explores what MetaDAOs are in practice, how they function as incubators, capital allocators, and decentralized networks of purpose-driven entities.

Clarifying DAO models

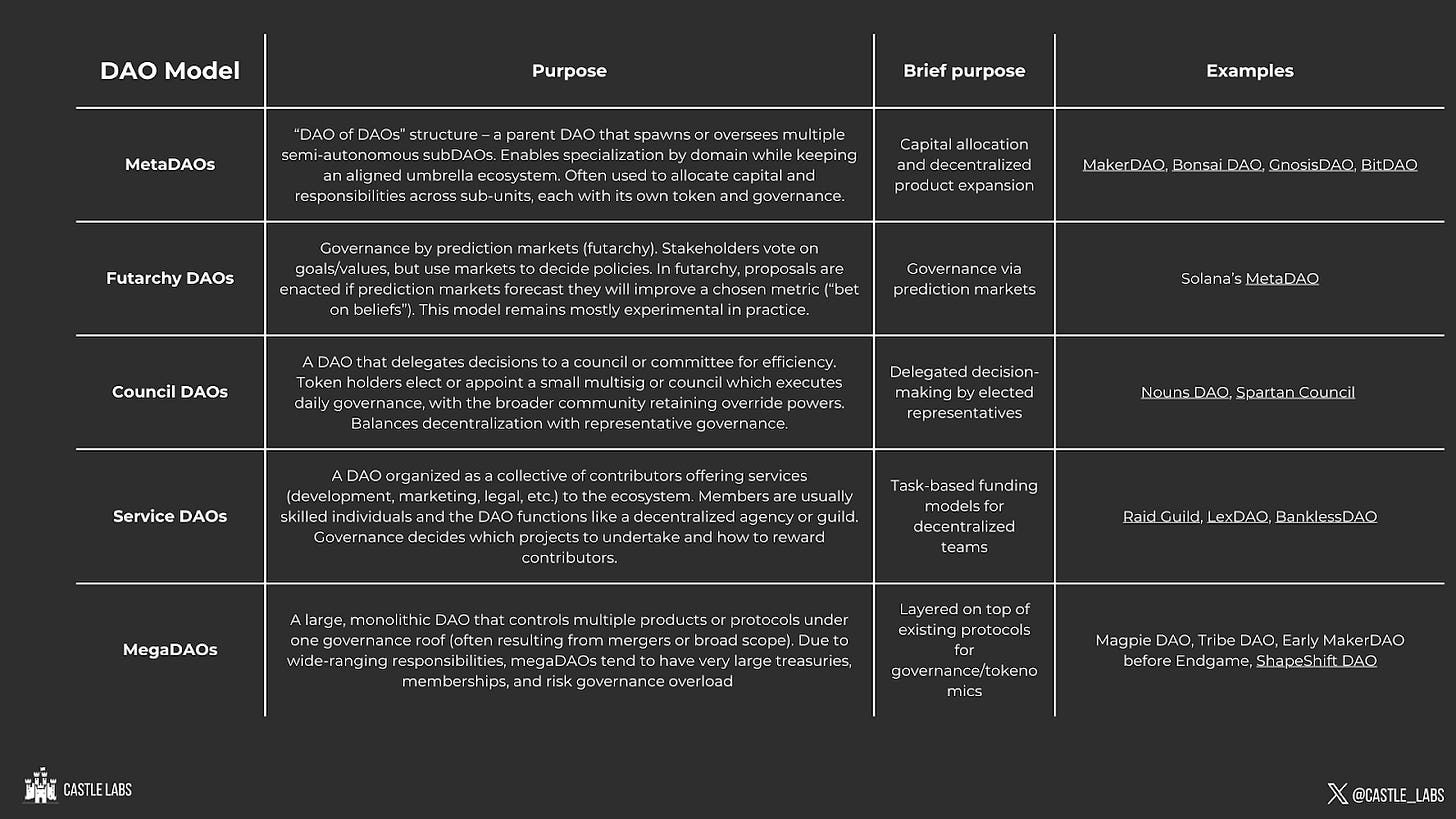

As DAOs have evolved, so too have their governance structures. While many began as flat, community-governed treasuries, different models have emerged to address specific coordination challenges, whether optimizing for speed, specialization, or scale.

This section outlines key DAO archetypes, from monolithic councils to modular MetaDAOs, highlighting how each model structures governance, allocates capital, and balances decentralization with operational effectiveness.

What are MetaDAOs

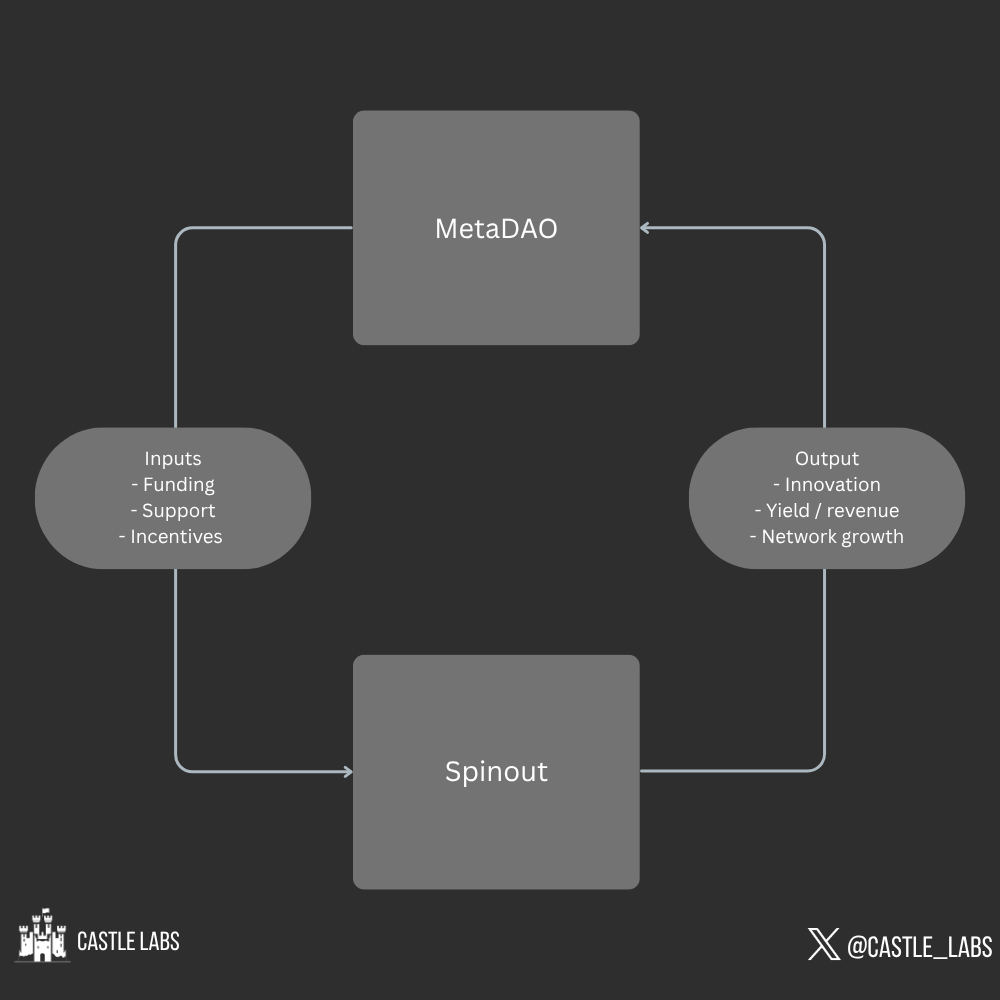

MetaDAOs act as parent DAOs coordinating a network of specialized spinouts. These spinouts may issue their own tokens or remain internal teams, but all operate under a shared umbrella to accelerate experimentation and resource-efficient growth. This structure allows a unified treasury to scale execution through independent subDAOs, each focused on a distinct function or vertical. What defines a MetaDAO is not just its technical or operational segmentation, but the economic and incentive alignment across its constituent entities, creating a dynamic network of interdependent value creators.

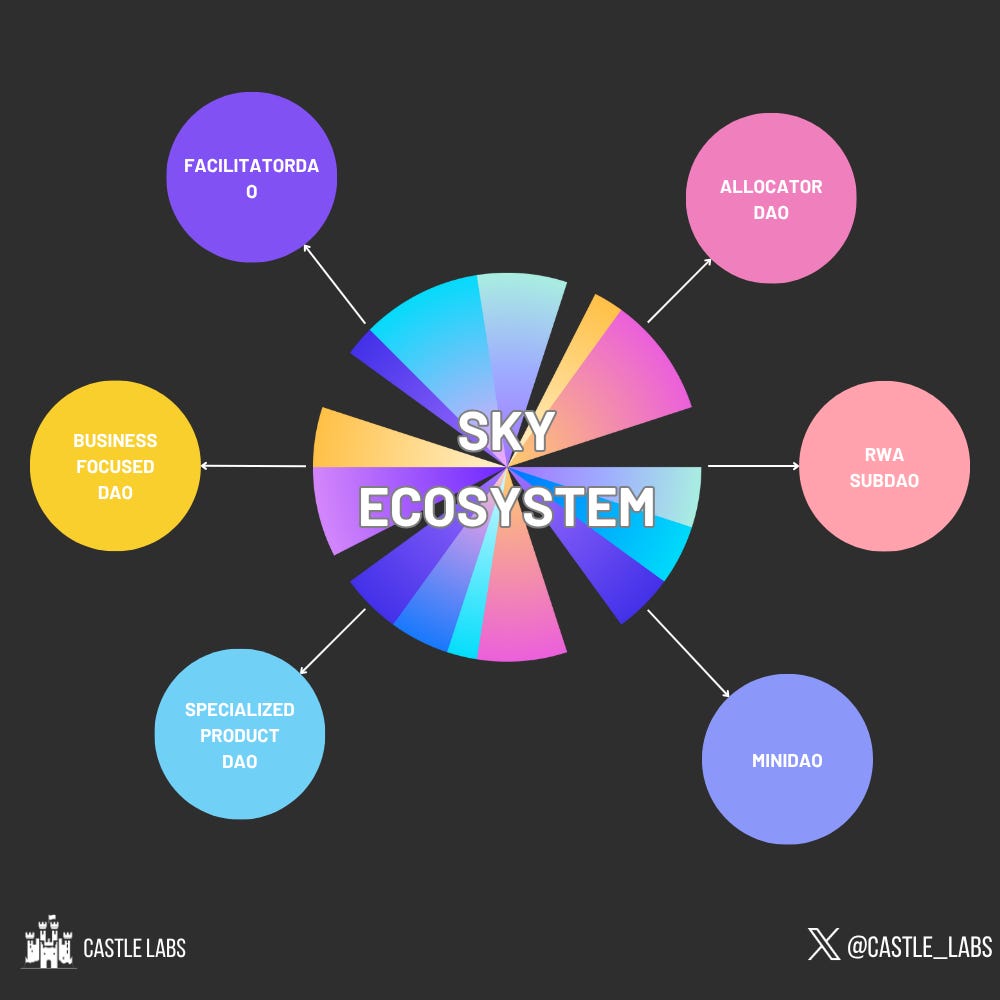

For example, under Sky’s (Previously MakerDAO) Endgame plan, several subDAOs will be spun out from Sky, each is effectively a subset of the Sky ecosystem with its own mandate, the idea is that Sky becomes a MetaDAO ecosystem, and the new units are subDAOs specializing in distinct roles.

Key characteristics of MetaDAOs

1. Capital allocation

One of the primary functions of a MetaDAO is to deploy its treasury across specialized subDAOs that focus on solving targeted problems. Instead of funding proposals piecemeal through base-layer governance, the MetaDAO allocates capital in bulk to domain-specific spinouts that act as internal investment funds or product teams.

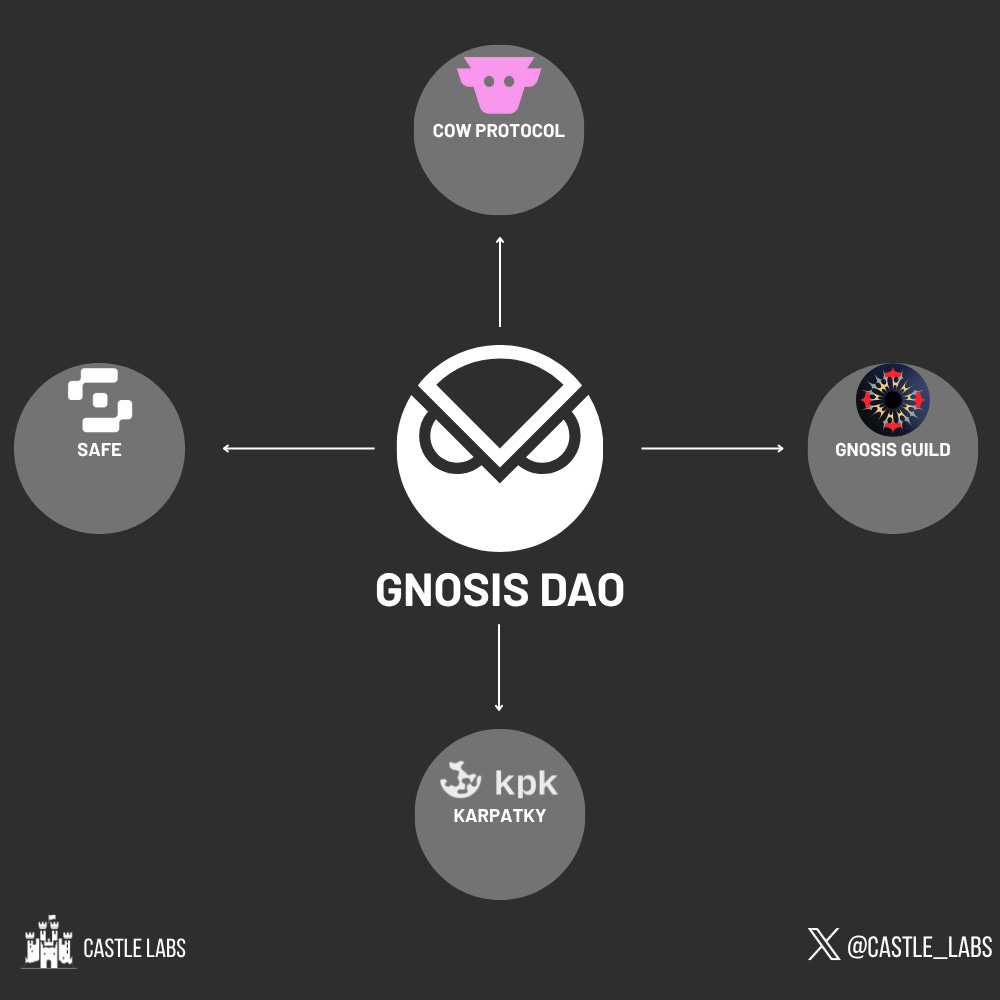

GnosisDAO, for example, takes an ecosystem-style approach, allocating capital and resources to projects such as Safe (a multisig wallet), CowSwap (a DEX aggregator), and Karpatkey (treasury management). While these began as internal initiatives, Gnosis supported their spinouts with early funding, talent, and governance, enabling them to become fully autonomous DAOs, all while maintaining economic links through treasury holdings and token distributions.

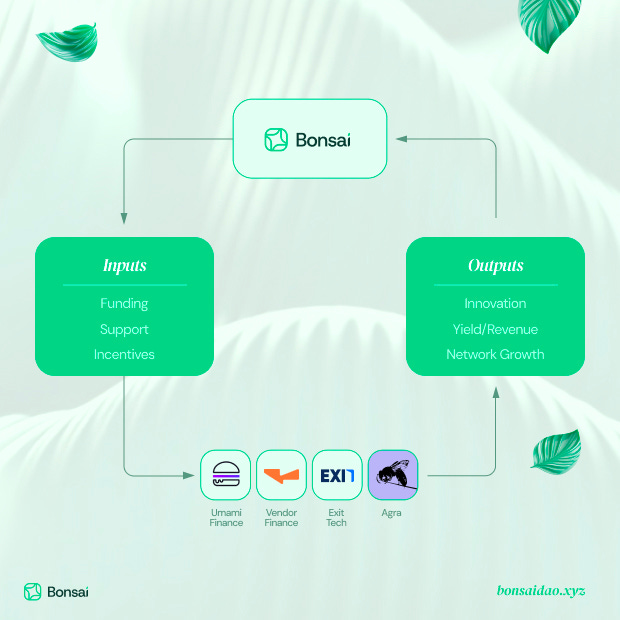

BonsaiDAO positions itself as a venture studio-style MetaDAO that incubates new DeFi products, or “leaves,” using its treasury. When a new project is approved, Bonsai allocates development resources and funding to the team behind it, often covering initial expenses such as liquidity and marketing costs. Once the product reaches maturity, it may launch its own token, with a portion possibly airdropped back to BONSAI holders. This structure allows Bonsai to continuously recycle capital into new experiments, while retaining shared upside and ecosystem alignment across its growing portfolio of spinouts.

BitDAO/Mantle exemplifies a treasury-centric MetaDAO, having deployed billions in funding to spinouts like Game7 (blockchain gaming), zkDAO (zkSync development), and EduDAO (academic research), each with its own mandate and governance. These initiatives operate independently but were bootstrapped by BitDAO’s capital and strategic vision. Rather than micromanaging grants, BitDAO allocated large capital tranches to domain-specific DAOs and allowed them to execute autonomously.

2. Decentralized expansion

Spinouts within a MetaDAO structure often evolve into full-fledged protocols, applications, or service entities. While they may begin as internal teams, they can develop their own branding, roadmaps, and governance models. This modular expansion approach allows the ecosystem to scale horizontally while isolating technical, financial, and regulatory risks. By modularizing its ecosystem through decentralized expansion, a MetaDAO creates an economic environment where contributors can launch and scale new ideas without fragmenting the original community.

3. Tokenomics and incentives

MetaDAOs often rely on token-based incentive systems to align stakeholders across layers. Their purpose is to maintain cohesion between the MetaDAO’s goals and the incentives of its contributors, users, and spinout teams.

In Sky’s Endgame architecture, Sky holders can stake their tokens to earn new subDAO tokens, essentially giving them ownership in the ecosystem’s growth. Each subDAO also distributes a portion of its governance token to Sky’s treasury or to SKY stakers, creating a direct economic linkage between the parent DAO and its sub-entities. This model encourages Sky holders to support subDAOs and provides subDAOs with a built-in base of aligned participants.

As seen in the structures and operations of Sky, BonsaiDAO, GnosisDAO, and BitDAO/Mantle, MetaDAOs are not merely theoretical constructs; they are functional, evolving governance architectures that power real-world decentralized ecosystems. By allocating capital through specialized spinouts, coordinating loosely coupled initiatives, and designing tailored incentive structures, MetaDAOs create the foundation for scalable, modular ecosystems.

The following section explores the practical advantages of this model: how MetaDAOs improve governance agility, enable domain-specific innovation, and reduce systemic risk through decentralization of both capital and decision-making.

MetaDAO Essentials – In Brief

MetaDAOs allocate capital to spinouts (subDAOs) that pursue focused mandates, from product development to treasury strategy. These subDAOs operate semi-independently but stay aligned through shared incentives, token flows, and governance links, creating a scalable, modular ecosystem.

Advantages of MetaDAOs

MetaDAOs offer distinct advantages across scalability, specialization, governance efficiency, experimentation, and overall alignment. By distributing responsibilities across subDAOs, MetaDAOs create modular, adaptable ecosystems more resilient than monolithic governance structures.

Scalability and specialization

MetaDAOs enable horizontal scaling by adding new spinouts without overburdening central governance. This modularity allows the broader organization to manage diverse functions in parallel, such as protocol maintenance, new product development, or ecosystem expansion, without overloading base-layer governance, assuming mandates are clear and aligned.

Sky, for instance, adopted a MetaDAO structure to handle growing complexity by assigning specific mandates to subDAOs. Each unit acts independently, like a franchise of the core mission, improving throughput while preventing contributor burnout. This degree of parallelism is difficult in monolithic DAOs, where an influx of proposals often leads to decision gridlock.

GnosisDAO illustrates this principle by incubating focused spinouts like Safe (wallet infrastructure) and CowSwap (DEX), which scale Gnosis's mission without entangling core governance.

Improved decision making

By narrowing the scope of governance to specialized domains, MetaDAOs create an environment where contributors are more engaged and better informed. SubDAO participants typically have a direct stake in the subDAO’s success and are more likely to possess subject matter expertise, leading to faster and more accurate decisions.

MetaDAOs also mitigate governance fatigue by offloading routine or low-stakes decisions from the main DAO. Only cross-cutting or strategic proposals need to be escalated to the upper layer. This layered approach not only streamlines decision-making but also preserves contributor attention and focus.

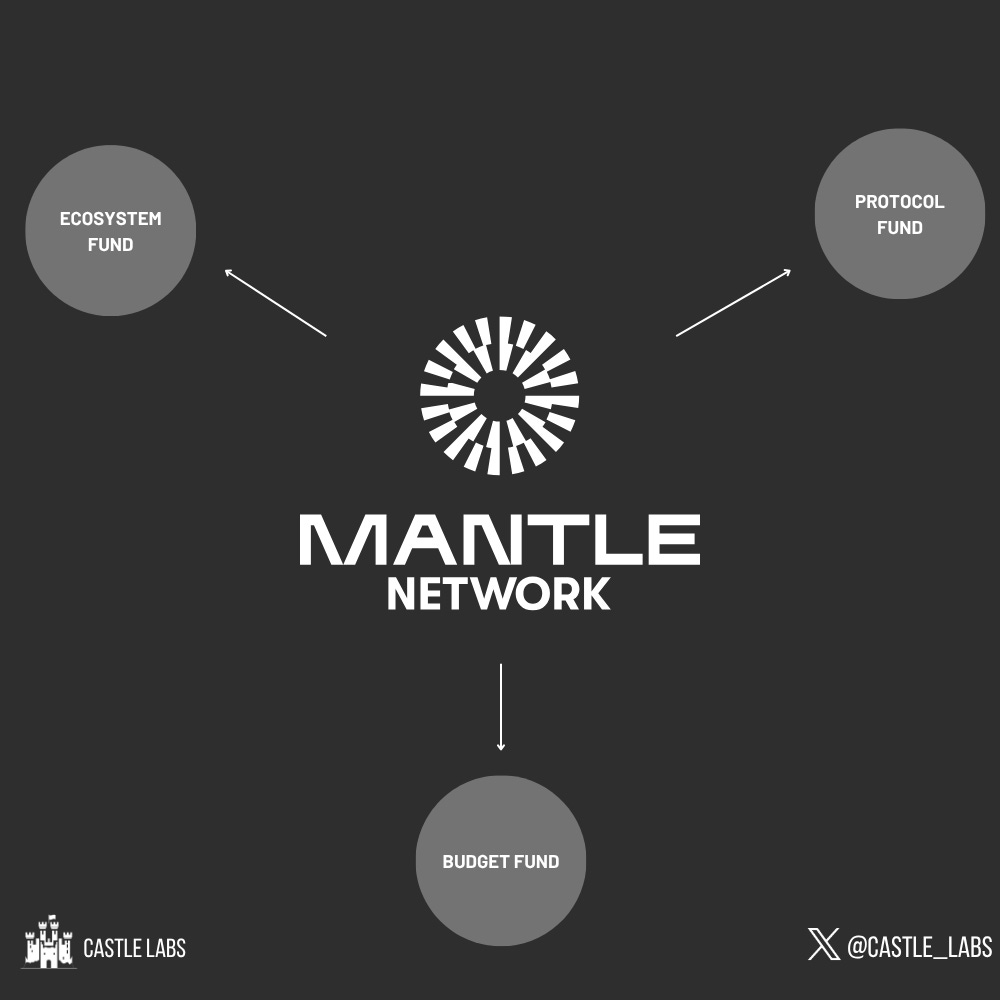

Mantle exemplifies this by assigning operational responsibility for its Layer-2 network, staking infrastructure, and treasury deployment to different domain-specific working groups, each governed by token holders under unified oversight.

Flexibility and experimentation

SubDAOs act as autonomous sandboxes, enabling rapid experimentation with contained risk. They can explore novel tokenomics, growth strategies, or governance models without exposing the core DAO or treasury to systemic danger.

Sky’s Endgame plan supports this flexibility by allowing subDAOs to launch, merge, or dissolve based on performance. BonsaiDAO deploys its "leaves" to test high-risk DeFi strategies in isolation from its main treasury.

Optimism’s RetroPGF rounds (while not subDAOs per se) demonstrate another model of flexible, parallelized value distribution, where community-selected badgeholders allocate funds semi-independently. This approach mirrors the spirit of MetaDAO modularity: rapid iteration, diverse input, and minimized governance bloat.

This architecture also allows for tailored incentive structures. A subDAO focused on growth may opt for aggressive token emissions and liquidity mining, while another focused on protocol security may implement conservative, long-term rewards. This compartmentalization enables diverse economic strategies to coexist under one umbrella.

General alignment

While subDAOs enjoy autonomy, they typically remain economically and strategically aligned with the parent MetaDAO through treasury links, token distributions, and shared governance incentives.

BonsaiDAO spinouts bring back economic value to the Bonsai treasury, maintaining economic linkage and shared upside.

Mantle retains centralized token governance and treasury authority through $MNT, while distributing operational execution to ecosystem participants. Its staking incentives and grant programs ensure participants are aligned with long-term growth.

In addition to financial ties, alignment is reinforced through overlapping contributors, shared branding, and ecosystem-wide roadmaps. A well-structured MetaDAO becomes more than a sum of its parts, it functions as a self-reinforcing network of interdependent economic agents.

Why MetaDAOs Scale

By delegating execution to subDAOs, MetaDAOs reduce governance overhead, speed up innovation, and enable domain-specific specialization, while retaining cohesion through tokenomics and treasury alignment. This modular architecture creates ecosystems that scale like networks, not monoliths.

Challenges of MetaDAOs

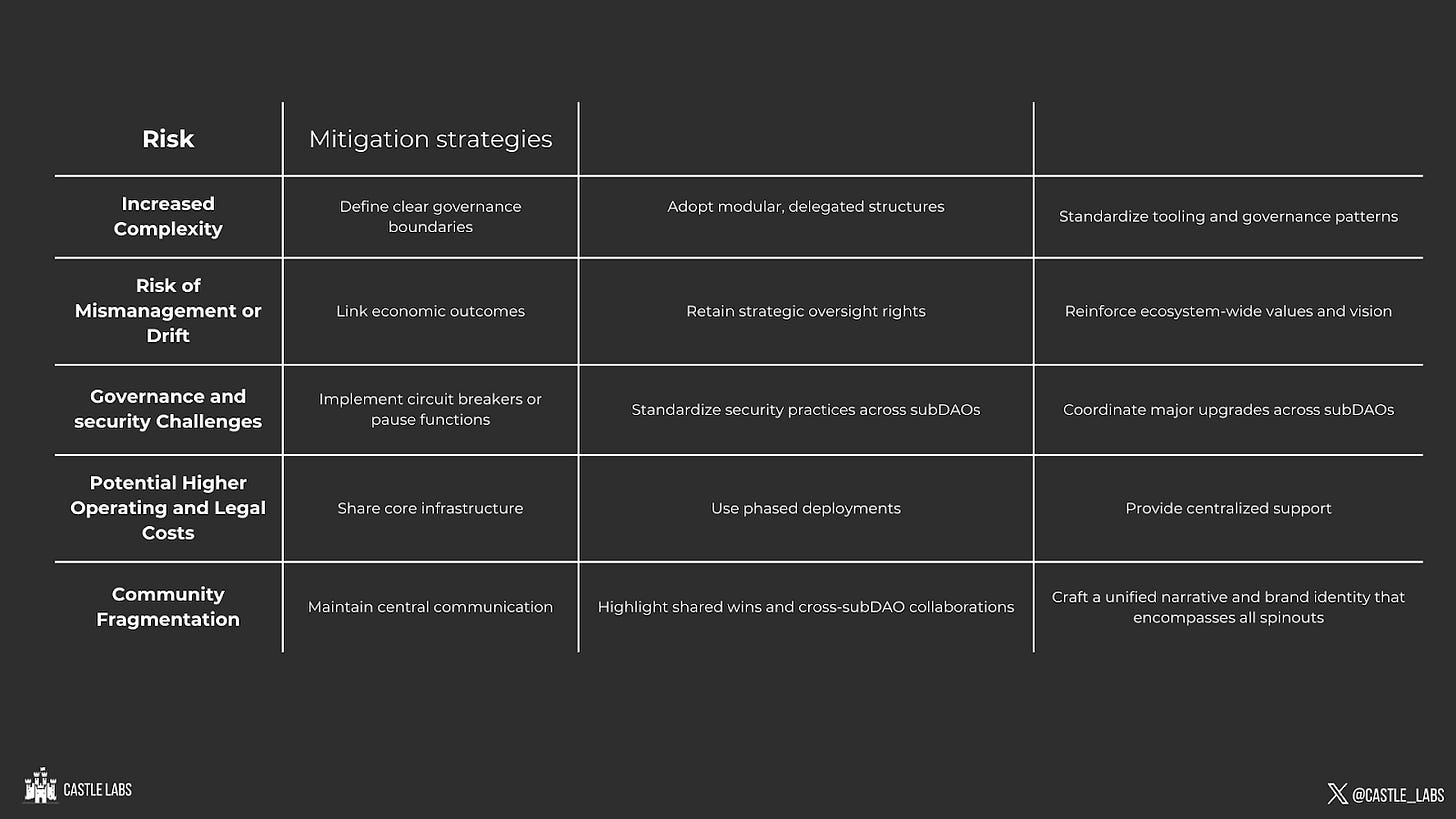

Despite their advantages, MetaDAOs introduce meaningful complexities in coordination, governance, and operations. These challenges must be addressed intentionally through thoughtful design, robust processes, and proactive oversight.

Increased Complexity and Coordination Overhead

Spinning out multiple subDAOs inevitably adds structural complexity. Each unit may develop its own treasury, governance system, and token, which increases the cognitive and operational burden across the ecosystem. Without clear roles and communication pathways, teams risk overlapping efforts or diverging strategies. This can overwhelm new contributors and strain coordination between units.

Mitigation:

To manage this complexity:

Define clear governance boundaries between the parent DAO and its subDAOs, including scope, reporting lines, and escalation paths.

Adopt modular, delegated structures (e.g., treasury./delegation councils) to handle routine tasks while preserving decentralization.

Standardize tooling and governance patterns across subDAOs to reduce fragmentation and learning curves.

Risk of Misalignment or Mission Drift

Autonomy is powerful, but without strategic guardrails, subDAOs may prioritize local goals over ecosystem health. Diverging cultures, token incentives, or short-termism can cause a breakdown in alignment between the parent DAO and its spinouts.

Mitigation:

To maintain alignment:

Link economic outcomes spinouts bring economic value back to the Bonsai DAO in whatever capacity it fits.

Retain strategic oversight rights at the parent level, such as treasury vetoes or the ability to deprecate failing subDAOs — a safeguard Sky intentionally preserves.

Reinforce ecosystem-wide values and vision to guide subDAOs, even when brands or tokens diverge.

Governance and Security Challenges

Expanding to multiple subDAOs increases the surface area for governance attacks or smart contract vulnerabilities. A poorly governed or compromised subDAO can have reputational or financial knock-on effects for the broader network.

Mitigation:

To reduce these risks:

Implement circuit breakers or pause functions that allow the parent DAO to intervene during crises.

Standardize security practices across subDAOs, such as shared auditing resources or code libraries.

Coordinate major upgrades across subDAOs to prevent version mismatches or dependency failures.

Potentially Higher Operational and Legal Costs

Each subDAO requires initial setup and ongoing maintenance — legal structuring, documentation, governance ops, and community engagement. These costs can balloon quickly, especially for smaller or under-resourced DAOs.

Mitigation:

To minimize waste:

Share core infrastructure like Discord servers, bots, and governance tooling across subDAOs.

Use phased deployments, pilot new subDAOs with minimal scope, and scale only those that prove viable.

Provide centralized support (e.g. legal guidance, HR) via the parent DAO to reduce duplication.

Community Fragmentation

As DAOs decentralize into sub-communities, shared culture can erode. Contributors may lose the sense of a unified mission, and cross-subDAO collaboration may decline. In worst cases, rivalry can emerge over treasury resources or influence.

Mitigation:

To foster cohesion:

Maintain central communication channels like shared forums and newsletters to keep the full community engaged.

Highlight shared wins and cross-subDAO collaborations, for example, Gnosis’s spinouts Safe and CowSwap share infrastructure and users.

Craft a unified narrative and brand identity that encompasses all spinouts, even if they develop their own sub-brands.

While MetaDAOs introduce more moving parts than traditional DAOs, most of the complexity is addressable through strong governance architecture, economic alignment, and clear cultural signals. With the right foundations, MetaDAOs can turn these challenges into strategic advantages, building decentralized ecosystems that are both scalable and sustainable.

Comparative case studies

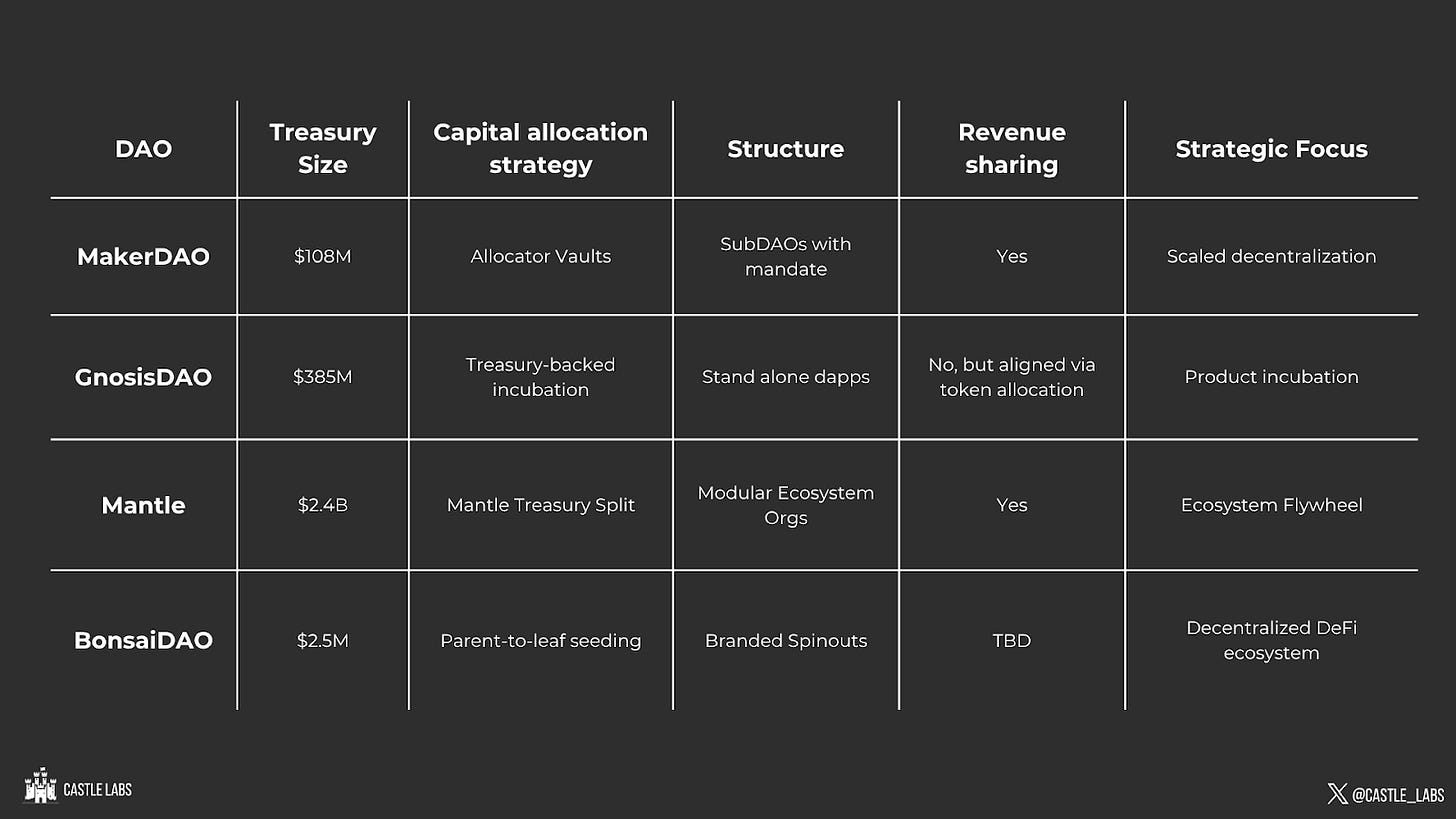

While the concept of MetaDAOs offers a clear architectural blueprint, modular governance, delegated capital, and economic alignment, the way this model manifests in practice varies widely. From Sky’s structured subDAO strategy to GnosisDAO’s ecosystem spinouts, different DAOs are experimenting with MetaDAO-like structures to suit their missions, community structures, and capital strategies.

This section compares four prominent DAOs, Sky, BitDAO/Mantle, GnosisDAO, and BonsaiDAO, not as identical implementations, but as variations on a theme: how to scale governance, decentralize execution, and build sustainable ecosystems.

Sky: A Blueprint for Structured MetaGovernance

Among the DAOs transitioning most intentionally into a MetaDAO model, Sky’s Endgame Plan stands out as a deeply structured approach. Sky is creating a formalized set of subDAOs, each with its own domain, mandate, and token, to offload specialized responsibilities like risk management, RWA integration, and ecosystem expansion.

Capital allocation within Sky’s ecosystem is becoming increasingly modular. Each subDAO will manage a portion of Sky’s treasury, governed by domain experts and token holders aligned to that specific vertical. To incentivize participation and maintain cohesion, Sky holders can stake their tokens to receive rewards in subDAO tokens, creating a multi-token structure that links all activity back to the core DAO.

SubDAOs will operate with significant independence, but Sky retains systemic oversight, including treasury control, mission alignment, and the ability to intervene if a subDAO drifts too far. This architecture reflects a highly integrated MetaDAO: autonomous, but tightly synchronized.

BitDAO → Mantle: From Investment DAO to Ecosystem Orchestrator

BitDAO began not as a MetaDAO, but as an investment DAO, allocating capital to promising external DAOs and initiatives. Over time, however, it evolved into something much closer to a MetaDAO.

Unlike Sky’s internal subDAOs, BitDAO’s original strategy focused on seeding independent DAOs: Game7 for gaming, zkDAO for scaling, EduDAO for education. These were highly autonomous, often with their own tokens, teams, and governance systems. BitDAO provided capital and directional support, but did not retain operational control.

The 2023 rebrand into Mantle marked a shift. Now, BitDAO’s governance and identity are unified under the MNT token, which governs both the treasury and the Mantle Layer-2 network. This brings previously disconnected initiatives into a more cohesive ecosystem, one where Mantle serves as the technical and economic backbone. Compared to Sky, Mantle’s MetaDAO architecture is looser, more ecosystem-led, and grounded in strategic investment rather than internal structure. But its trajectory shows how an investment DAO can evolve into a full-fledged MetaDAO platform.

GnosisDAO: Ecosystem-Driven

GnosisDAO offers another take entirely, one that leans into ecosystem spinouts rather than internal delegation. Rather than forming formal subDAOs under its umbrella, Gnosis has acted as an early-stage investor and incubator for projects that later gained full independence. Notable examples include Safe (formerly Gnosis Safe), CowSwap, and Karpatkey.

Each of these projects began with funding, guidance, and technical infrastructure from GnosisDAO, but eventually developed their own roadmaps, tokens, and DAOs. Gnosis, as the parent, often retains treasury exposure or governance influence, but operational control is decentralized.

GnosisDAO doesn’t define itself as a MetaDAO — yet functionally, it exhibits many of the same properties: modular development, capital allocation to purpose-built entities, and aligned incentives through shared goals and resource flows. Compared to Sky or Mantle, Gnosis takes a hands-off, federated approach — emphasizing independence while loosely aligning projects through Gnosis Chain and GNO token governance.

BonsaiDAO: Incubation as a MetaDAO Core Function

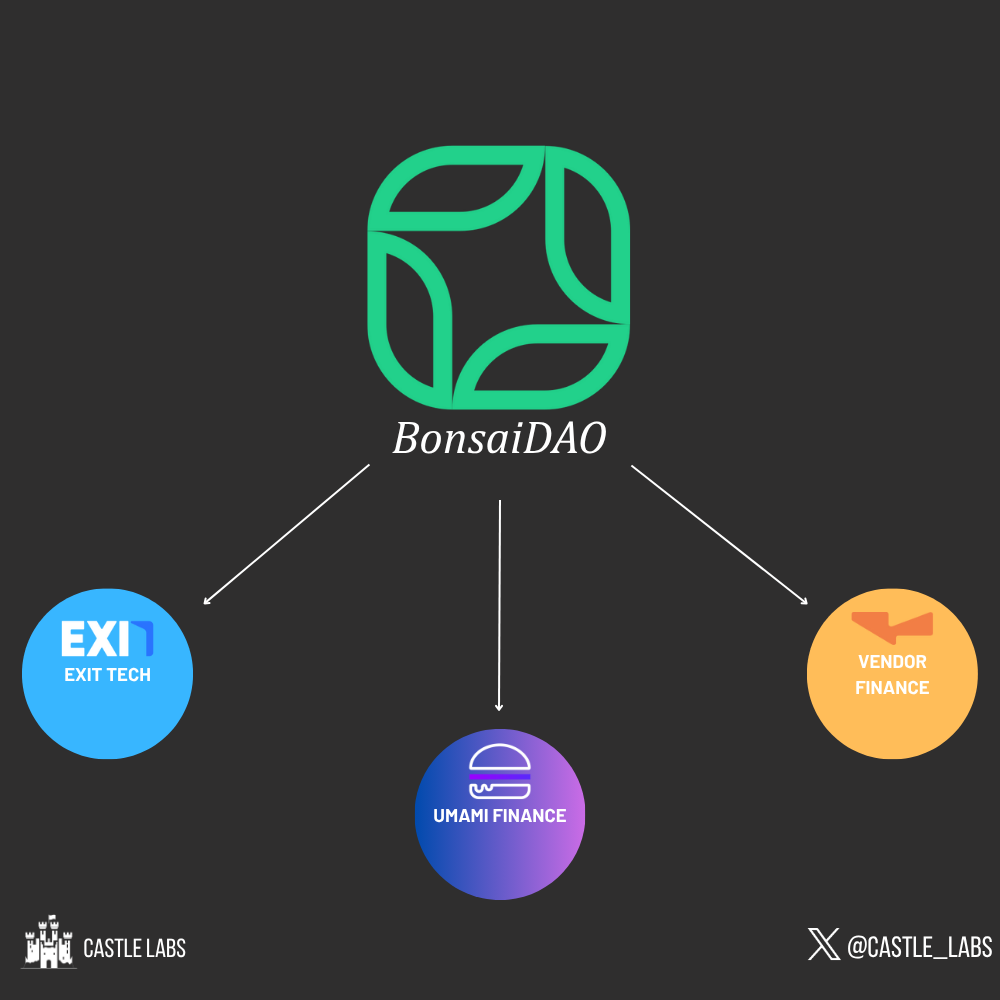

If Sky is structured and Gnosis is federated, BonsaiDAO is something else entirely: a venture studio-style MetaDAO, purpose-built to launch and grow new DeFi products under one economic umbrella.

At the core of BonsaiDAO’s model is the concept of the “leaf”: a spinout protocol or product that originates within the DAO, receives treasury support, and may evolve into its own subDAO or tokenized entity. Each leaf is designed to enrich the broader ecosystem, with mechanisms to share success back to BonsaiDAO. Additionally, BONSAI token holders are granted enhanced governance power over these subDAOs through governance-centric tokenomics, ensuring aligned incentives across the network.

What sets Bonsai apart is its explicit economic integration. While spinouts gain operational autonomy, their success is structurally tied to the parent DAO. The result is an ecosystem of modular DeFi products that reinforce each other, and the BONSAI token becomes an index-like asset that captures value from the broader network.

BonsaiDAO is perhaps the purest current implementation of a MetaDAO-as-incubator, combining coordinated funding, incentive alignment, and phased spinout autonomy.

BonsaiDAO: The Next Evolution of MetaDAOs

While several DAOs have adopted modular governance structures or ecosystem grant programs, BonsaiDAO stands out for its explicit focus on capital allocation as the primary mechanism for coordination. It operates as a decentralized venture studio, launching and supporting DeFi protocols that begin as internal projects (“leaves”) and may evolve into autonomous subDAOs over time.

Bonsai’s framework reflects a clear implementation of the MetaDAO thesis: a shared treasury allocates strategic capital, spinouts are incentivized to remain economically linked through token distributions and infrastructure, and execution is delegated to smaller, product-specific teams.

From Protocol to Ecosystem

BonsaiDAO originated from Umami Finance, a DeFi protocol specializing in yield strategies. As Umami expanded beyond a single product, the team initiated a transition to a MetaDAO model, migrating from the $UMAMI token to $Bonsai and reframing itself as an incubator for interconnected products.

This transition marked the beginning of a new ecosystem:

Umami vaults became the first Leaf, continuing to provide yield strategies across BTC, ETH, and stablecoins.

New Leaves, such as Vendor Finance (fixed-term lending) and Exit Tech (liquidity for locked token positions), were either onboarded or developed within Bonsai.

Each Leaf receives upfront support from Bonsai’s treasury, liquidity, infrastructure, marketing, and has their own ways of sharing their success economically back to $Bonsai holders and the DAO treasury. This design encourages spinouts to pursue autonomy while maintaining economic alignment with the core ecosystem.

Tokenomics as Governance

The $Bonsai token serves as the governance and incentive layer across the MetaDAO. It gives holders influence over strategic decisions such as spinout approvals, treasury management, and roadmap updates. In return, holders are eligible for:

Possible airdrops from new Leaves

Revenue-linked buybacks

And participation in seasonal engagement programs like Garden Seasons, which tie community participation to airdrop eligibility.

Compared to more passive governance models, Bonsai’s tokenomics are structured to create clear, recurring value flows tied to product development. While some of these mechanisms (e.g., the Buyback Program or seasonal airdrop weighting) are still early in execution, the framework reflects a shift from yield-bearing governance tokens to ecosystem-wide exposure via spinout participation.

Modular Autonomy with Shared Infrastructure

Each Leaf within BonsaiDAO operates with its own product roadmap and, potentially, its own token and governance structure. However, they all rely on shared infrastructure, smart contract libraries, audit resources, design templates, and contributor networks. This structure lowers the marginal cost of launching new initiatives and allows Bonsai to recycle technical and organizational resources across products.

Spinouts transition to autonomous subDAOs only after reaching sustainability. These transitions are formalized via Token Generation Events (TGEs), at which point the subDAO gains control over its operations. The model is designed to balance agility at the edge with strategic coherence at the core.

Toward a Multi-Chain MetaDAO Network

Bonsai’s MetaDAO structure is also intended to be multi-chain. Its spinouts are designed to launch natively on L1s and L2s like Arbitrum, Base, Berachain, and Superposition. In some cases, the DAO coordinates with these ecosystems to secure grants or co-funding, enabling new Leaves to establish early traction. This positions Bonsai as both an incubator and deployment coordinator across multiple networks, offering a template for how MetaDAOs can function as chain-agnostic allocators of capital and contributors.

A Living Model for Ecosystem-Scale Capital Allocation

BonsaiDAO offers one of the most explicit examples of a MetaDAO functioning primarily as a capital allocator. It maintains a clear structure:

Products start as Leaves with shared infrastructure and centralized funding,

Transition to spinouts with their own roadmaps and tokenomics,

Its model differs from more passive grant DAOs by incorporating incubation into its operating structure. Whether this approach can scale across market cycles remains an open question, but Bonsai provides a detailed reference point for how MetaDAOs might evolve into capital-first ecosystems with modular governance and multi-chain reach.

Future of MetaDAOs

The emergence of MetaDAOs marks a shift in how decentralized ecosystems organize and scale. As this report has shown, MetaDAOs are not just governance structures, they are capital coordination systems. Their defining characteristic is the ability to strategically allocate funding and resources to a network of semi-autonomous spinouts, while preserving overall alignment through incentive design, shared infrastructure, and ecosystem-wide feedback loops.

Looking ahead, several trends are likely to shape the continued evolution of the MetaDAO model.

Multi-Chain Capital Allocation

As DeFi expands across L1s, L2s, and appchains, MetaDAOs are well-positioned to become multi-chain deployment vehicles. Rather than tying governance and treasury activity to a single network, MetaDAOs can direct capital to wherever innovation is occurring, whether that’s on Ethereum mainnet, emerging rollups, or purpose-built ecosystems. This flexibility enables them to seed projects where the opportunity is greatest, while retaining cross-ecosystem alignment through shared upside and reputation.

In this model, MetaDAOs act less like static protocols and more like dynamic investment DAOs, able to allocate liquidity, incubate teams, and expand influence across a modular, multi-chain terrain.

MetaDAOs as Economic Networks

The long-term significance of MetaDAOs lies in their potential to form interconnected economic systems. When spinouts are structured to return value via, fee sharing, or liquidity pipelines, they form recursive loops of reinforcement. Instead of siloed protocols, the MetaDAO coordinates a set of interoperable entities with aligned incentives.

This can lead to an emergent economic network, where activity in one subDAO benefits the others, and where the ecosystem's treasury and token holders collectively benefit from ongoing innovation. Whether this results in a new kind of "on-chain conglomerate" or simply more efficient public goods funding will depend on how the model is adopted and adapted.

Evolving Governance models

Finally, MetaDAOs push forward the ongoing evolution of DAO governance. By separating capital strategy (at the MetaDAO level) from execution and specialization (at the subDAO level), they offer a more modular and scalable governance architecture. This structure minimizes governance bloat, reduces voter fatigue, and enables contributors to focus on areas where they have the most context and impact.

It also opens the door to experimentation: subDAOs can trial alternative governance methods, tokenomics, and incentive models, without exposing the parent DAO to systemic risk. Over time, this layered approach may become the default organizational form for DAOs seeking both decentralization and operational effectiveness.

Concluding Thoughts

MetaDAOs represent a meaningful advance in decentralized coordination. By treating capital allocation as their core function, not a byproduct of governance, they unlock a more agile, sustainable way to grow decentralized ecosystems.

Whether through structured subDAOs (Sky), independent spinouts (GnosisDAO), or venture studio-style incubation (BonsaiDAO), the model offers a flexible blueprint for funding innovation at scale.

As DeFi and Web3 continue to evolve, MetaDAOs may emerge not only as governance primitives, but as economic infrastructure, modular systems for launching, funding, and sustaining decentralized networks across the multi-chain world.