Bybit Hack: BTC is down, But Here's Why You Shouldn't Be Worried

PLUS: A Critical Look at Arbitrum DAO, Key News and Macro Forces Driving The Market

GM, and welcome to another edition of The Castle Chronicle.

ETHDenver is still ongoing and we hope you’re having a great time! Our founder Atomist is roaming the area, so if you see him don’t be shy and come say hi!

Besides that, we’re having a bit of a bearish week, as one would expect, after crypto suffered its biggest hack: over $1.5b hacked by Bybit. There are huge sell-offs across the board, and altcoins are taking an absolute beating. Is it all over though? Not quite.

We should all be dealing with it like Ben from Bybit is dealing with the hack: with a good laugh!

Here’s what’s happening today:

📈 Price Action – What is the current BTC price action telling us?

🗳️ Arbitrum Corner – A mix of Ecosystem, governance, and tech updates

📖 Recommended Reads - The best reads for the week you might have missed

📈 PRICE ACTION

Gm frens!

Looks like we have some bearish price action this week. While the HTF (weekly) still looks bullish, the lower timeframes are showing weakness. Let’s talk a little bit about what’s going on and what we can expect going forward.

Healthy uptrend

Possibly lost momentum cycle

Re-accumulation

While this is still a very bullish looking chart, we do have a possible failure of the current momentum cycle - meaning we can see price breaking below the 10/20 EMA. What are the possible scenarios here?

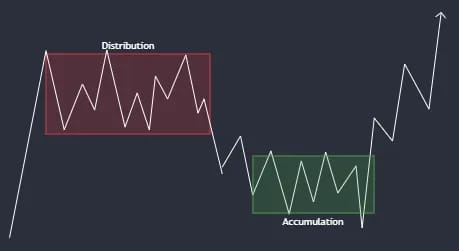

Whatever happens here, our instant assumption should be re-accumulation - a temporary move against the bigger trend to re-fuel for continuation.

The most bullish scenario is that this weekly candle ends up just wicking lows, re-accumulating by liquidating some late longs, and resuming the uptrend. This way the momentum cycle won’t even be lost yet and we remain completely bullish.

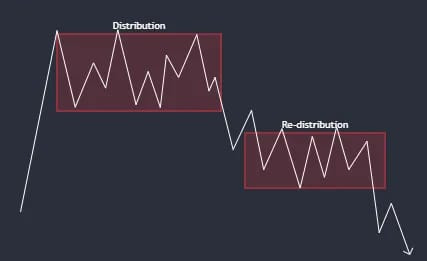

If this candle continues lower, however, that will mean that the most recent sideways price action was a local distribution. The expectation here would be for price to break down and find some equilibrium again - an area of equal supply and demand, resulting in price going sideways. Here, for overall re-accumulation, we’d expect demand to overpower supply and price to break out higher, confirming an accumulation and trend continuation.

If however, supply overpowers demand and price breaks down, that would confirm a re-distribution and a new direction of trend (bearish).

Whatever ends up being the case, one thing is for certain - this is currently not a good market to trade. There is a lot of indecision and mixed signals. One of my most important conditions in determining a tradable market is overall top-down alignment. A clear trending condition in the same direction for each timeframe. That is currently NOT the case.

I hope this analysis can aid you in your trading decisions. Remember, you can outperform the majority of the market by simply staying out during bad times.

Trade responsibly and I’ll see y’all next time!

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

Courtesy of 0x_Vlad - trend-based trader and MentFX student

💙 A MIX OF ECOSYSTEM, GOVERNANCE, AND TECH UPDATES

Welcome to another edition of our weekly Arbitrum Corner!

With many delegates in ETHDenver, this week feels more tranquil than usual.

For this reason, this week we bring you a mix of Ecosystem, governance, and tech updates.

The Funding Stylus Sprint funded over 17 projects, which are then spotlighted:

More details on the projects: https://blog.arbitrum.io/stylus-sprint-recipients/

The first version of this program has successfully bootstrapped diversification within the DAO treasury, incentivizing participation from over 35 providers including Blackrock, Securitize Franklin Templeton, Ondo Finance, MountainUSD and more.

Read the complete proposal on the forum: https://forum.arbitrum.foundation/t/request-for-proposals-arbitrum-treasury-diversification-step-2/28500

Dolomite launching GMX strategies.

An analysis of GLV performance on GMX.

What did $GMX do in February? An update.

New incentive programs are regularly proposed to the DAO, the last one by Jumper and Merkl. Are incentives coming back to Arbitrum soon after the detox?

https://forum.arbitrum.foundation/t/jumper-x-merkl-maga-2025-make-arbitrum-great-again/28463

These are the main updates for the week! If you are in Denver as well make sure to join the Arbitrum Crosschain Collider Event.

Courtesy of Francesco - Co-founder at Castle

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.