ICOs are officially back

Introduction

Does reincarnation exist?

Can something be dead and return in a different form?

At a deeper level, the cyclical nature of markets is widely recognised: what goes around comes around, though in a modified form.

This is the case for Initial Coin Offerings (ICOs).

After reaching peak visibility in 2017, ICOs have a lengthy obituary, being declared dead multiple times.

Moreover, their spectacular failure made the term “ICO” associated with some of the least credible episodes in crypto fundraising.

So much so that, for several years, the term itself became largely taboo.

Only recently did something change.

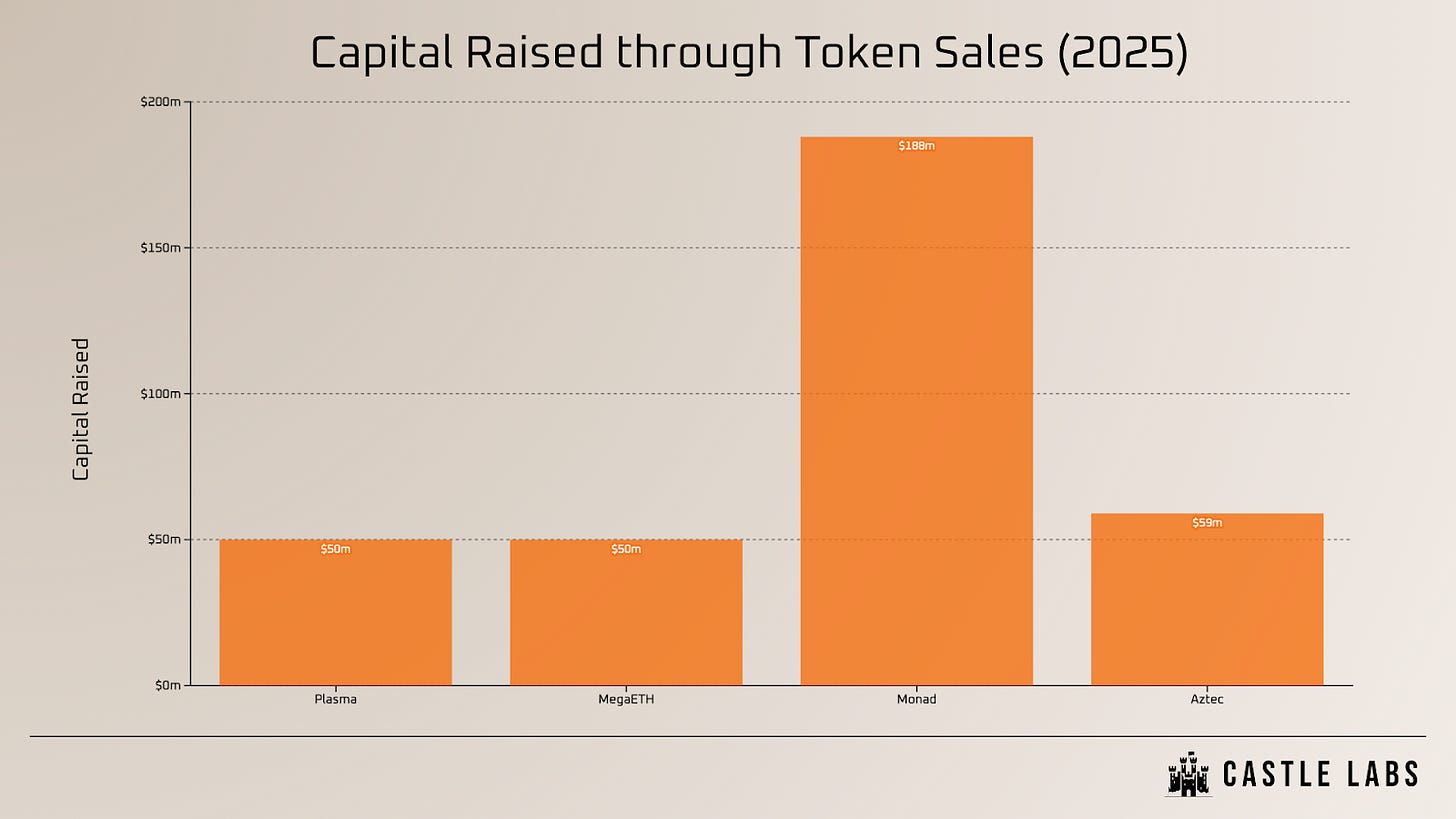

A resurgence of token-sale-style fundraising has been observed, with several large community raises in 2025, including Plasma, MegaETH, Monad, and Aztec, collectively raising over $2 billion in commitments from 100k+ participants.

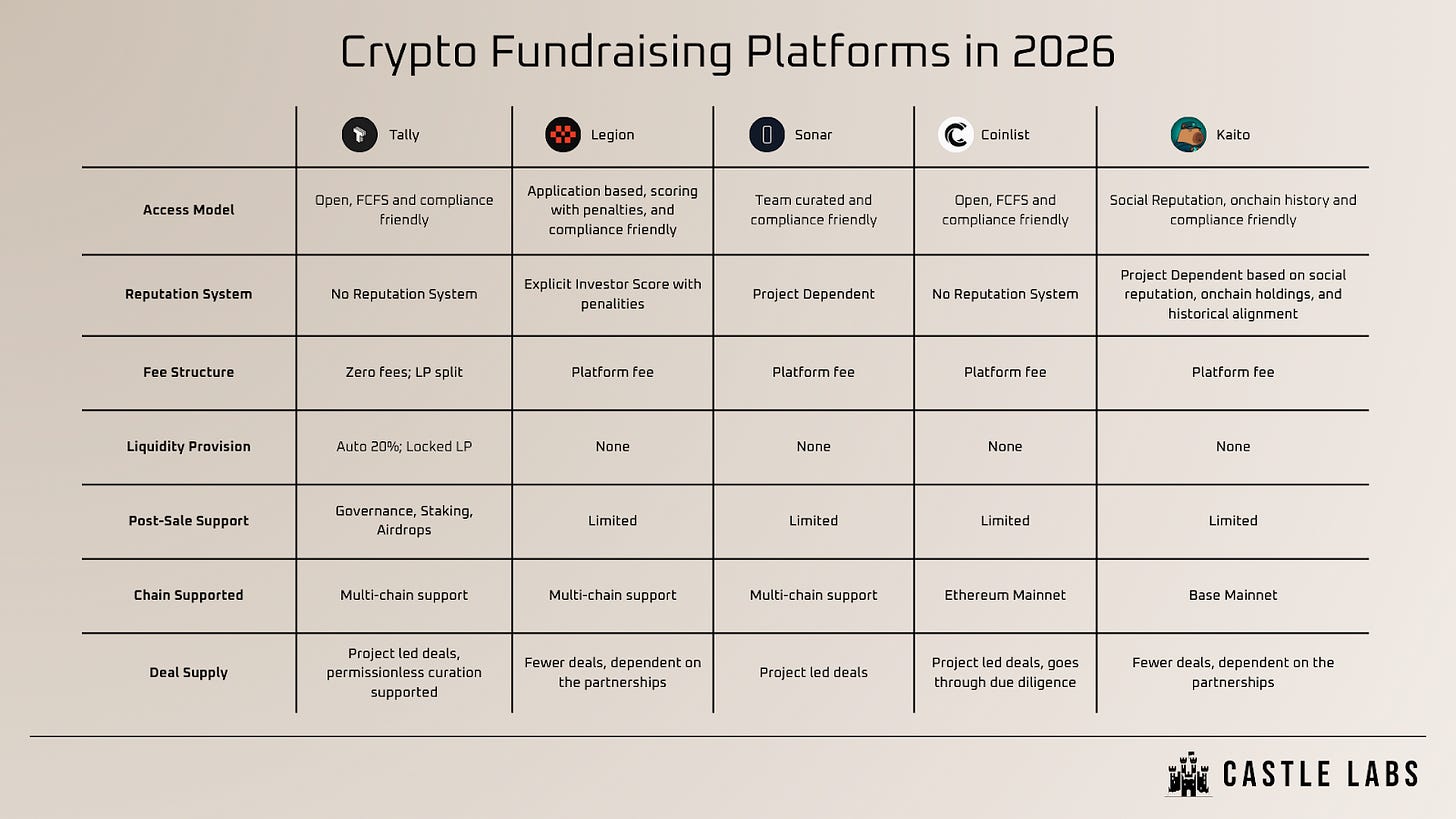

At the same time, the challenges of Venture Capital (VC) led fundraising, alongside the emergence of fundraising and distribution routes such as Legion, Sonar by Echo, Kaito, Coinlist, and Tally, increasingly prompt protocols to adopt community-aligned alternatives.

At the same time, the regulatory environment differs substantially from 2017, when ICOs were prevalent. With greater acceptance and clearer frameworks, token sales may move from unregulated disorder to a viable fundraising model that is more open than the prevailing status quo. Relevant developments include the 2023 MiCA regulations in the EU, the discussion of the CLARITY Act in 2025 (awaiting a committee vote in the U.S. Senate), and the growing prevalence of KYC-enabled sales.

This report examines the underlying issue, reviewing the drivers of ICO-era failures and the conditions now prompting a re-evaluation of community token sales as a fundraising mechanism.

Finally, the analysis outlines the forms that token sales could take under contemporary constraints and uses Tally as a case study of a platform that offers an aggregated framework for launching regulated token sales.

The ICO Mania

The primary value of ICOs is that they enable protocols to raise funds by selling their tokens through an open mechanism that allows broad participation, rather than restricting access to qualified investors.

ICOs became the dominant early-stage crypto fundraising route, as much of the crypto participant base at the time consisted of globally distributed retail investors seeking asymmetric exposure similar to earlier opportunities in Bitcoin and Ethereum.

ICOs also diverged from conventional equity-based capital-raising mechanisms, such as Initial Public Offerings (IPOs) or venture capital.

In those models, investors receive equity, and protocols give up a percentage of their company’s ownership. Under ICOs, projects sold tokens rather than equity, giving sale participants a stake in the ecosystem and control over governance and decision-making. This frequently occurred in a regulatory grey zone, creating uncertainty regarding classification and compliance.

At the end of these ICOs, secondary-market trading typically begins shortly after token distribution.

The first ICO is commonly considered to be Mastercoin, which raised over 5,000 BTC in July 2013. Even Ethereum, now worth over $380 billion, initially launched ETH via an ICO in 2014, raising over 31k BTC, which equated to $18.3 million at the time.

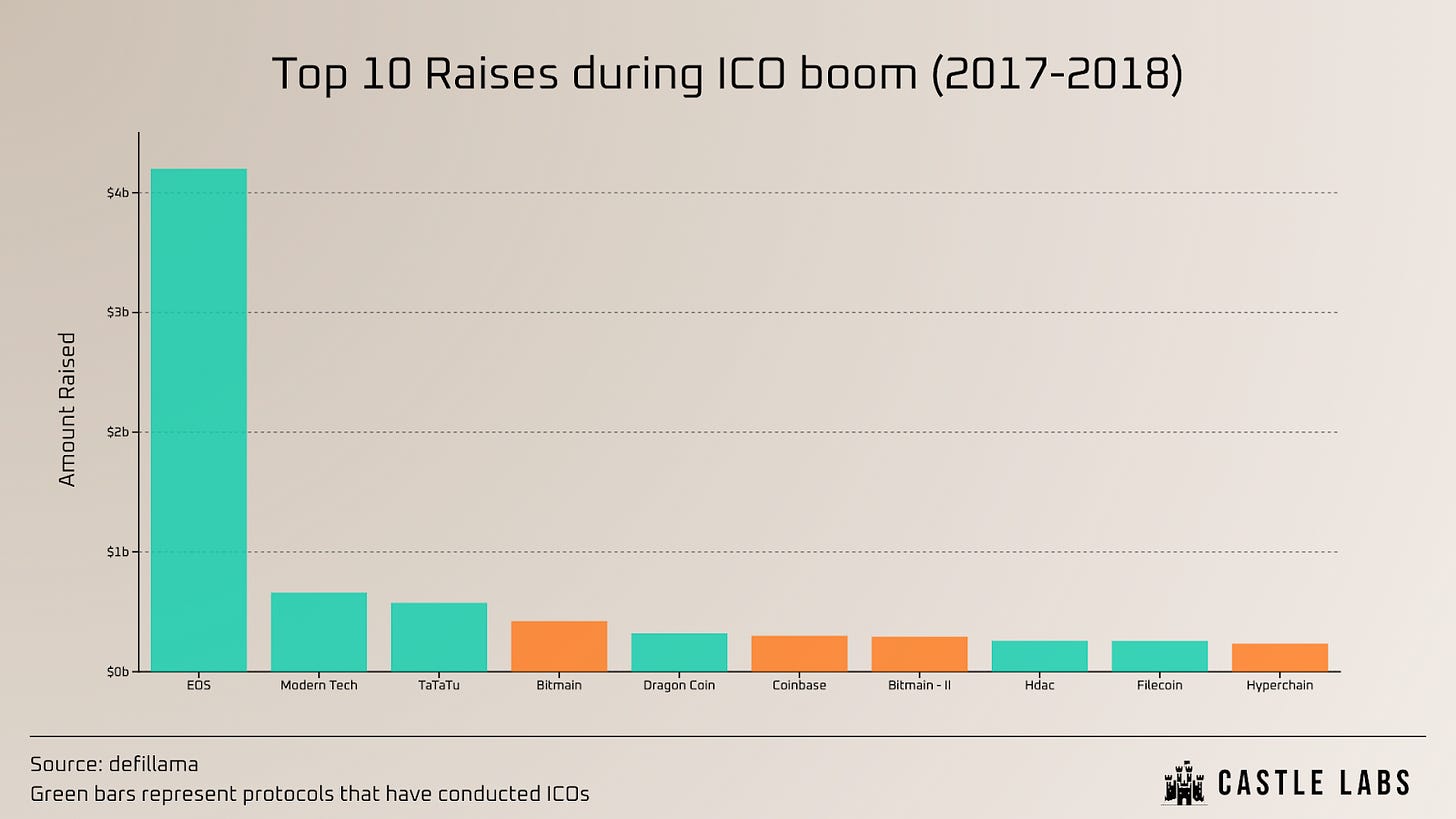

Many known protocols, like Aave, raised funds this way back in 2017: during the ICO gold rush, over $12 billion was raised across more than 4,000 ICOs.

As capital inflows accelerated, structural weaknesses became more visible.

The most significant raise at the time was from EOS, which raised $4.2 billion through a year-long ICO. EOS positioned itself as an “Ethereum Killer” and a Layer 1 (L1) with no fees. While the narrative achieved widespread traction and the token briefly entered the top five by market capitalisation, subsequent delivery challenges undermined momentum, and community attention declined over time.

A second major case was Modern Tech, which disappeared with ~$660 million in investor funds and is widely cited as one of the largest ICO scams. Two products, Pincoin and iFan, were marketed, with Pincoin promising high returns (paid in tokens) and iFan framing itself as a social media engagement product.

Their entire structure proved to be a Ponzi scheme, and it collapsed when cash flows could not support redemptions, resulting in losses for tens of thousands of participants.

Another name on the list is Centra Tech, which raised $25 million in its ICO and promised to deliver a crypto debit card but ultimately did not. The case was later popularised through the Netflix documentary Bitconned, which covers the scheme and its aftermath.

The list of scams goes on and on: ICOs became the most efficient mechanism for capital raising in an environment where overpromising, weak accountability, and non-delivery could persist with limited consequences.

Public ICOs were initially framed as a mechanism to align capital formation with product users and community participants.

Although malicious actors exploited the format, there were examples of projects with real products which executed token sales more responsibly, such as AAVE.

Accordingly, describing “ICOs” as having failed in absolute terms can be misleading. The mechanism itself was not necessarily the root cause. Indeed, token sales enabled developers such as Vitalik Buterin to raise early capital and bootstrap infrastructure that later became foundational to the sector. Instead, the dominant failure behind ICOs was the regulatory and enforcement vacuum. Paradoxically, although crypto communities often express scepticism toward regulation, the absence of clear guardrails contributed substantially to the collapse of the ICO market. In the absence of standardised oversight, a basic fundraising contract could be deployed rapidly and raise significant sums without robust disclosure, controls, or accountability.

ICOs did not fail on their own, but rather became associated with the malicious behaviour of those who took advantage of this model. As a result, token sales were stigmatised and largely avoided until recent developments prompted new experimentation.

Before assessing the current resurgence, it is necessary to examine what followed the ICO cycle.

ICOs left a vacuum that was progressively filled by VCs, which became the dominant funding route for many projects, though often at great cost, as explored in the next section.

Is a VC check a good or bad check?

Following the ICO era in the early days of crypto fundraising, VCs increasingly became the primary source of early-stage funding.

This catalysed a structural shift: retail participation was partially displaced by VC firms.

VC involvement also served as an implicit quality signal. Retail participants frequently interpreted the presence of reputable seed investors as third-party validation, reflecting an underlying preference for delegated risk assessment.

Over time, VC investing suffered a reputational decline due to an embedded misalignment of incentives in the model. Relative to ICOs, where token allocations are often skewed toward community distribution, VC allocations often confer greater influence over roadmap, product priorities, and governance outcomes. This influence is typically mandate-driven: VCs seek to preserve and maximise returns rather than act as neutral stewards.

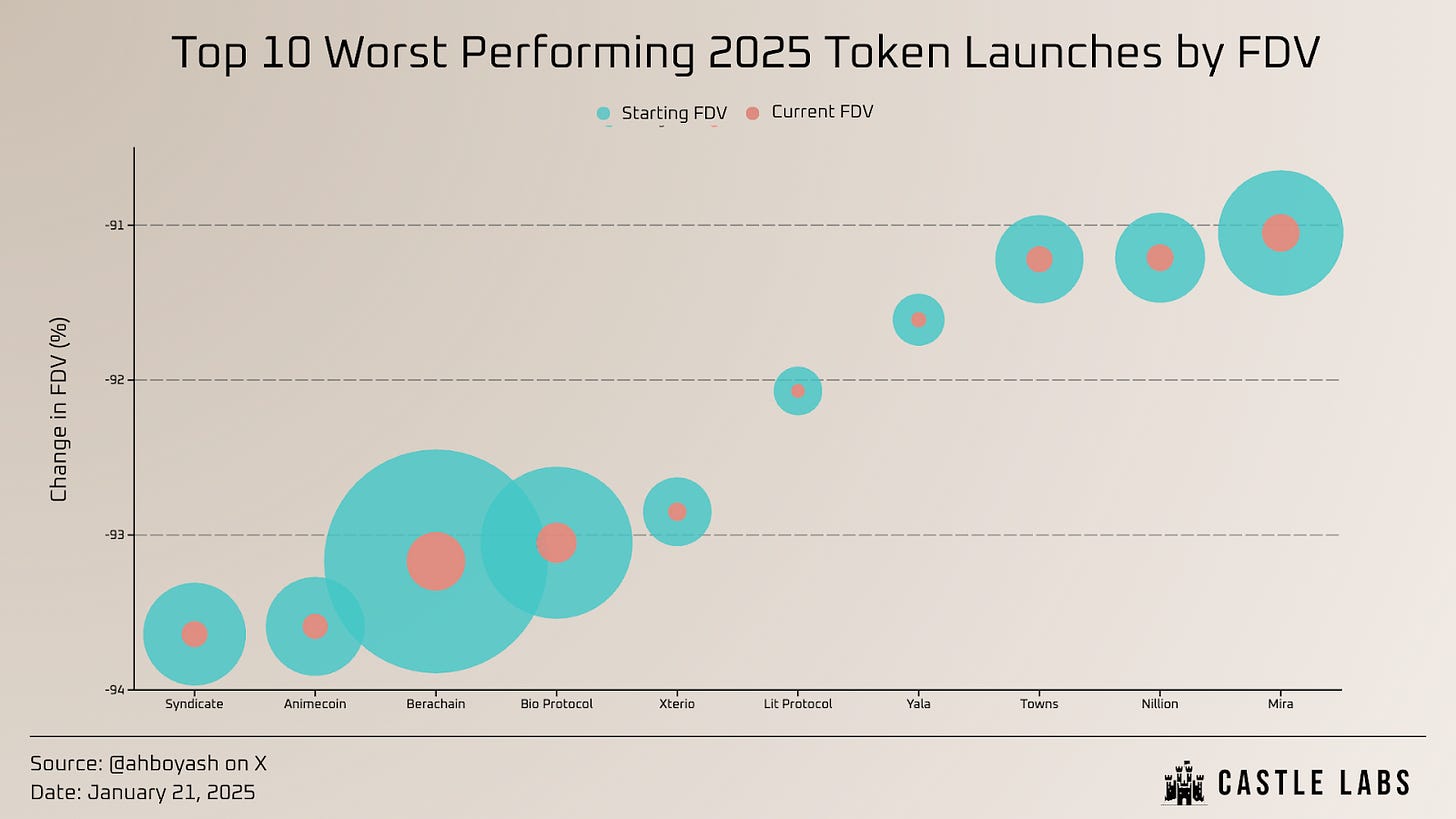

A visible consequence has been the pattern of high launch valuations with limited organic demand. Among the worst-performing tokens of 2025, many launched at elevated valuations. A central driver was the willingness of projects to accept high private-round valuations to raise larger sums, and of VCs to underwrite those valuations on the expectation that listing valuations would be materially higher.

Berachain offers a representative illustration: the final private raise reportedly occurred at a $1.5 billion valuation, the token listed above $4 billion, but currently trades at a sub-$400 million valuation.

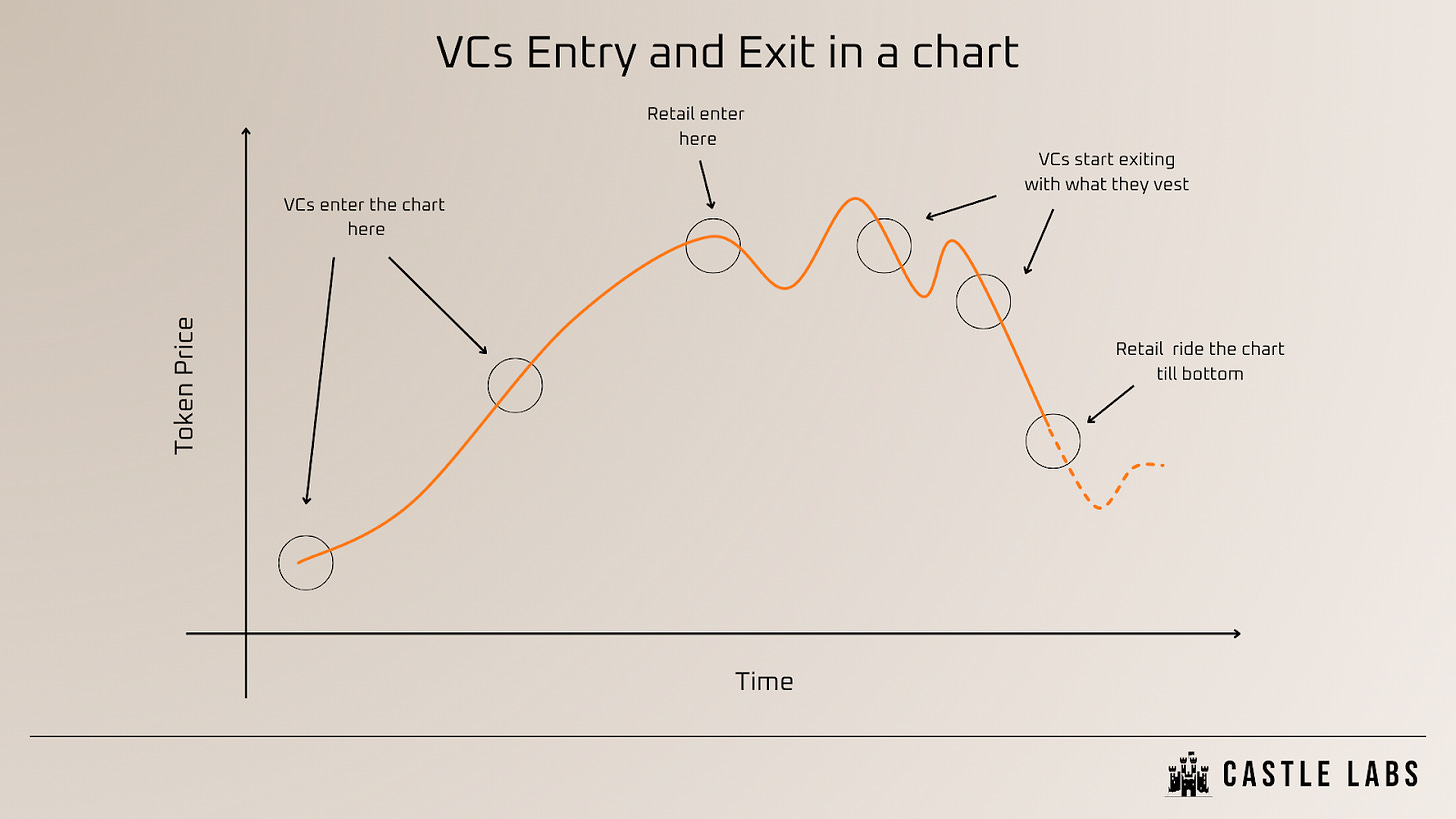

As the primary fundraising route, VCs often enjoyed favourable terms, not accessible to most individual investors.

The resulting market structure has been commonly referred to as the “low float and high FDV” token trend.

During this time, projects frequently raised early capital from investors on favourable terms and, in some cases, even allowed them to stake their locked tokens to earn yield.

Moreover, when and if the project conducts a public round, it would be at a much higher valuation than VC investments (often 5-10x or more) and would often come with vesting, a cliff, and sometimes both, unlike ICOs, which are often unlocked immediately.

When public rounds occurred, they were typically priced at significantly higher valuations than VC entry and included vesting schedules, cliffs, or both for participants, unlike many historical ICOs, which distributed tokens with immediate unlocks.

From an investor’s perspective, this behaviour is not inherently irrational. VC funds are compensated for early-stage risk through preferential entry.

However, this often puts retail users at a disadvantage: Venture Funds often acquire tokens at remarkably low prices, while retail investors enter the price discovery process late.

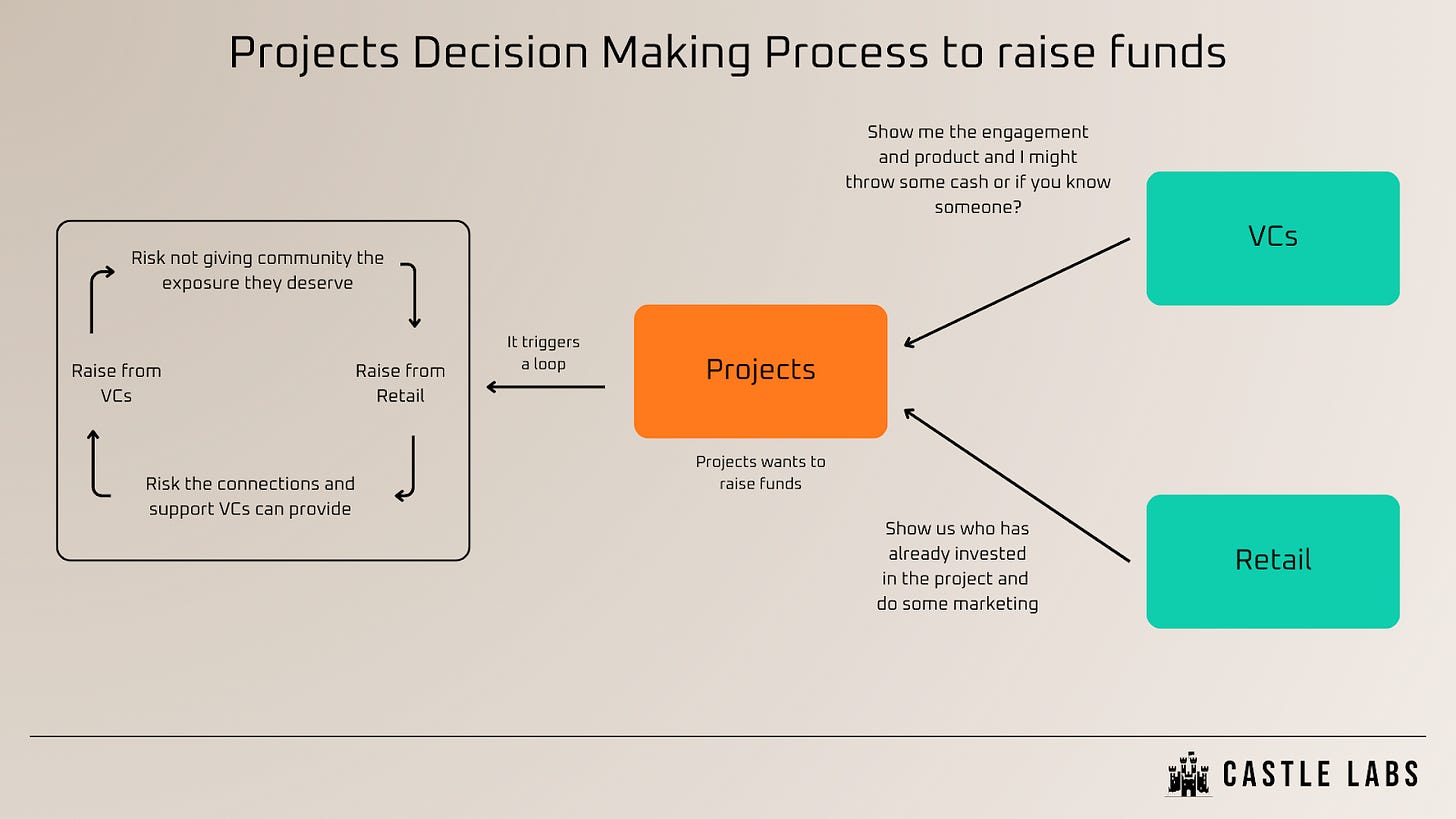

Raising from VCs can be effective when teams have the networks required to access venture introductions. Finding alternatives may be constrained to community rounds, grants, or accelerator programmes.

Projects that avoid the VC route can still raise from retail, but doing so often requires sustained marketing and visibility, investments many teams are not positioned to make early on.

Overall, each route entails trade-offs, and a hybrid approach appears optimal: venture capital may provide networks, recruitment leverage, and strategic support, while community funding can strengthen legitimacy and long-term alignment.

Neither route alone guarantees these outcomes.

In response to the section’s core question, not all VC checks are “bad”, as they may provide resources and capabilities that retail capital typically cannot.

Nevertheless, the VC-dominant phase illustrated persistent misalignment risks. Early VC entry frequently implied late retail entry, leading to distribution dynamics that often made retail the exit liquidity for VCs.

A more credible alternative appears necessary.

What if it was already here?

What Goes Around Comes Around

Although the ICO cycle damaged the credibility of token sales, it did not eliminate the underlying concept. As VC-led fundraising became dominant, a larger share of participants reassessed what ICOs aimed to accomplish: enabling users and token holders to access upside from a project’s growth.

Given that limited early access for retail became a salient issue in the VC-led stage, multiple platforms emerged to address this gap by enabling earlier community participation, such as Echo, Kaito, and Legion.

Each of these platforms serves distinct audiences. Echo (a private fundraising platform launched in 2024) facilitated over $160 million in fundraising, and its acquisition by Coinbase in 2025 for $375 million underscores the demand for token sale infrastructure. Another example was the Yield Basis sale on Legion, which was oversubscribed by 98x, targeting a raise of just $2 million while attracting over $195 million in commitments.

Beyond learning from past mistakes from the ICO era, the contemporary resurgence of token sales has been enabled by an unlikely ally: regulatory clarity.

In the United States, a stronger regulatory posture has been associated with a more favourable political stance toward the sector, creating a more conducive environment for regulated token launches.

Regulations for the European region became clear in 2023 with the launch of Markets in Crypto-Assets (MiCA), which set out rules for token issuance and distribution in the EU. In the United States, the CLARITY Act was introduced in 2025 to potentially further clarify the regulatory landscape for token launches and is awaiting a U.S. Senate vote in January after passing the House of Representatives in July 2025.

Additionally, Token Launches now involve KYC/KYB/KYI. KYI (Know-your-Issuer) is particularly consequential because it links the minting authority of a token to a verifiable identity, enabling exchanges, funds, and custodians to assess issuance standards and supporting broader adoption.

Token Sales in 2025

Following the regulatory and fundraising developments in the sector described above, 2025 saw a revival of high-profile token sales.

Four major examples are Plasma, MegaETH, Monad, and Aztec.

Plasma

In July, Plasma, a stablecoin-focused L1 blockchain, conducted a sale that was filled within minutes. The team initially set a deposit cap of $250 million, which was subsequently increased to $1 billion. Both caps were filled rapidly. Plasma used Sonar for its fundraising event. These deposits qualified buyers to purchase the token; the sale itself raised $50 million at a $500 million FDV. The event reportedly involved 1,110 participants with a median deposit of $35k, though 38% of the funds raised came from the top 10 wallets.

MegaETH

In October last year, MegaETH, an Ethereum Layer-2 (L2), launched a public sale on Echo’s Sonar platform and got $1.4 billion in bids for a raise capped at $50 million (28x oversubscribed). Demand reached $150 million in bids in under 30 minutes, reflecting phenomenal demand for their token. The sale was conducted as an English Auction, involved 5% of the supply and reached a final clearing price of $0.1 or an FDV of $1 billion.

Participants could also receive an additional allocation if they choose to lock their tokens for up to a year. For the U.S. accredited investors, the lockup was mandatory.

The sale was also MiCA-regulated, illustrating the broader shift toward regulatory thinking in token sale design.

Monad

In late 2025, Monad, a hyper-performant L1, launched the first major U.S.-regulated token sale in collaboration with Coinbase, raising $188 million at a $2.5 billion valuation. The sale excluded certain regions, such as New York, but also highlighted regulatory easing towards crypto and token launches.

It is important to note that the Monad sale saw low oversubscription (1.43x) and ended with commitments totalling $269 million. One contributing factor may have been the requirement to create a Coinbase account, an additional friction that reflects the trade-offs involved in combining community participation with regulated distribution.

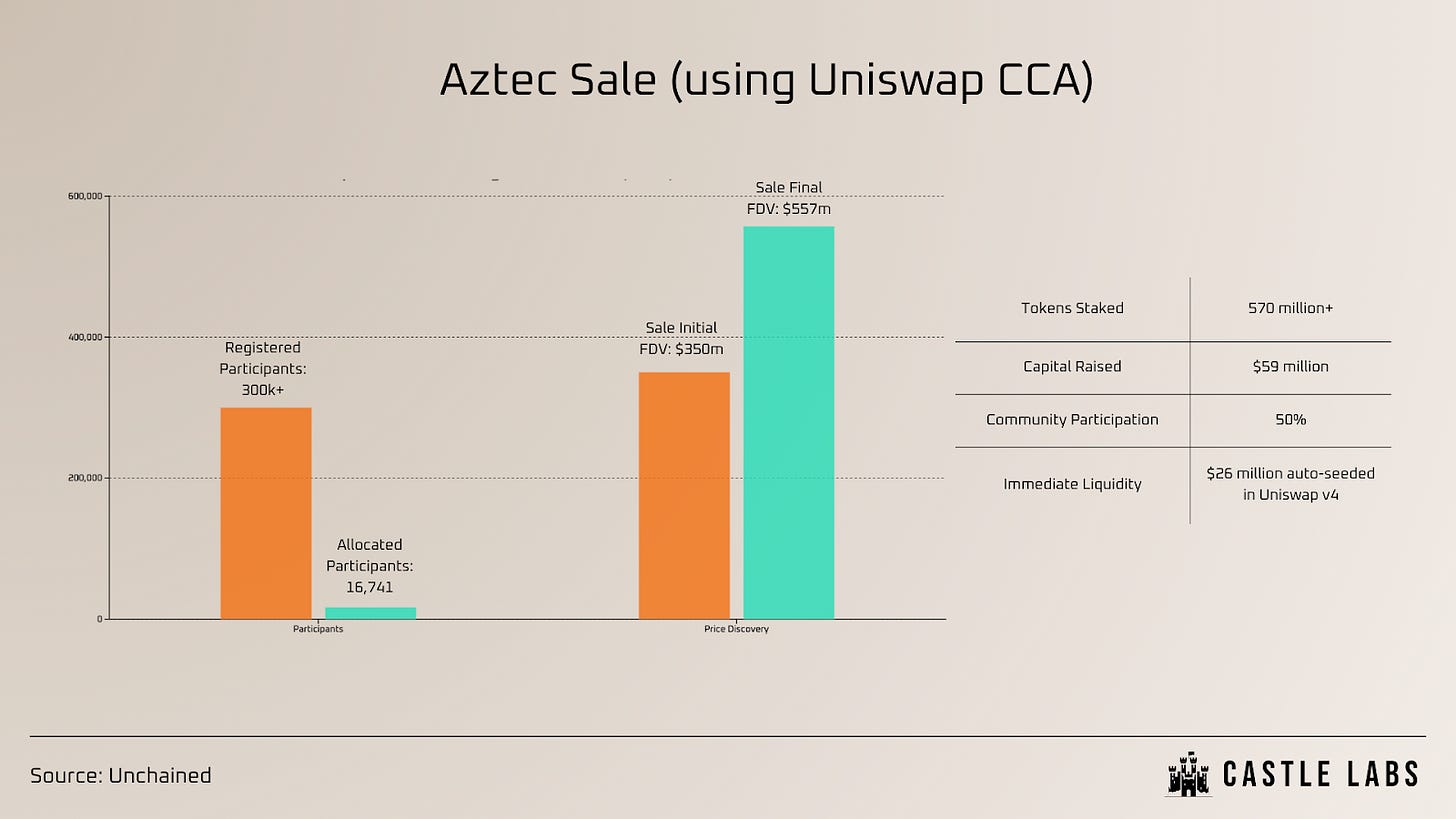

Aztec

Aztec, a privacy-focused chain, raised $59 million in December 2025 using the Uniswap Continuous Clearing Auction (CCA) model. This model enabled the sale to proceed through a slow price-discovery process and to eliminate any snipers or attempts at price manipulation. Participants in the sale were required to complete KYC via ZKPassport to remain regulatory-compliant, with certain regions excluded from participating to maintain compliance.

Given these outcomes, we can wonder whether we can safely say that “ICOs are officially back”.

Although the sales differed in mechanism and results, they resemble ICOs in core function, reinforcing the model’s persistent relevance.

As regulation becomes clearer and token sales can be offered to broader audiences, the next phase raises key questions: can ICOs return as a mainstream instrument, and what forms will they take?

While platforms such as Echo, Kaito, and Legion provide distribution to established audiences, some projects are experimenting with running their own sales to reduce the value leaked to third parties.

Within this context, aggregated platforms have emerged offering end-to-end infrastructure for regulated token sales.

The next section explores Tally, known in the space for its DAO governance tooling, as a case study in how projects can internalise and execute regulated token sales within a broader distribution and governance framework.

Tally: A Capital Formation and Distribution Home

Tally has operated in the cryptocurrency space for over 5 years and has developed a token distribution stack that integrates airdrops, vesting, staking, and governance into a single platform.

Since its inception, it has distributed over $1 billion in value, provided tooling to manage $40 billion in assets under governance, and served over 1 million users, working with protocols like Arbitrum, Uniswap, ENS DAO, ZKsync, Wormhole, and many others.

While distribution and governance tooling had reached maturity, supporting projects with capital formation remained a complementary frontier to explore, a goal Tally has pursued for some time and is now prepared to address through its ICO platform.

Each major ICO platform faces trade-offs.

Sonar by Echo and Legion are among the most prominent providers and have supported multiple high-profile sales.

Older platforms, such as Coinlist, enabled projects such as Solana to raise funds in 2020 and to maintain a solid reputation associated with the quality of project selection. Kaito, launched in mid 2025, has been used to allocate fundraising access based on social and onchain metrics.

Several of these platforms do not provide universal access and often set barriers that determine who gets the token allocation. This is often a feature rather than a flaw, reflecting a preference for more targeted distribution to known or demonstrably aligned participants.

On Sonar, selection can be team-driven; on Legion, through applications and scores; on Kaito, it can be tied to social reputation and perceived alignment.

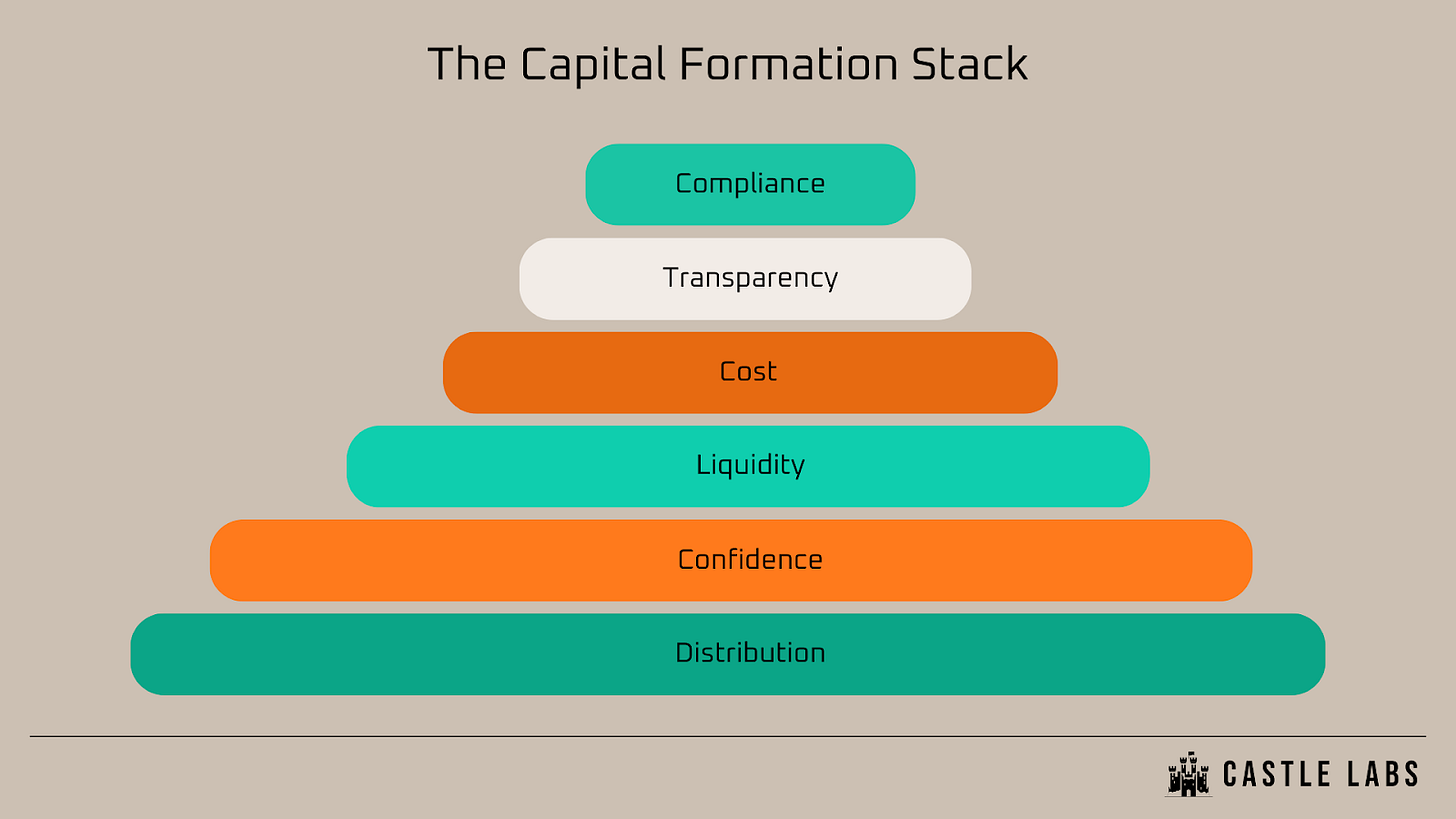

Tally differs by emphasising broad participation through the Capital Formation Stack while employing mechanisms to reduce adversarial behaviour. On Tally, participants can more easily evaluate sales (transparency) and the project’s fundamentals.

This design expands teams’ flexibility to choose sales dynamics. Additionally, Tally positions itself as an integrated solution: it extends beyond sales mechanics to encompass distribution and post-sale usage infrastructure, creating a self-reinforcing culture of long-term-oriented engagement.

Tally’s impact on the capital formation stack can be broken down into 6 important elements:

Distribution: Sales should reach as many qualified participants as possible. On Tally, this includes its own user base – Tally has served 1M+ users since its launch – as well as its partners (the largest organisations in crypto and roadshows targeting institutional investors).

Confidence: Participants should be able to trust any sale and be assured that no malicious behaviour will be tolerated. Tally supports fundraising mechanisms such as Uniswap CCA and Balancer’s LBP (detailed later in the section) to reduce incentives for front-running.

Liquidity: Another important consideration for participants is the token’s liquidity post-sale. Tally removes any assumptions and includes an integrated feature that automatically locks 20% of the raised funds as DEX liquidity for 1 year.

Cost: For projects and sale participants, there are zero platform fees. Tally charges an LP fee only on locked liquidity.

Transparency: Transparency in any sale ensures that participants are not subject to surprise allocations. In any sale, all previous allocations, along with their unlock and vesting schedules, are clearly disclosed.

Regulatory tooling: Regulatory thinking comes at the top of the stack and is important for every sale, given the evolving environment. Tally is designed with regulatory readiness in mind and stays up to date with the latest SEC and CFTC guidance (more on this later in this section).

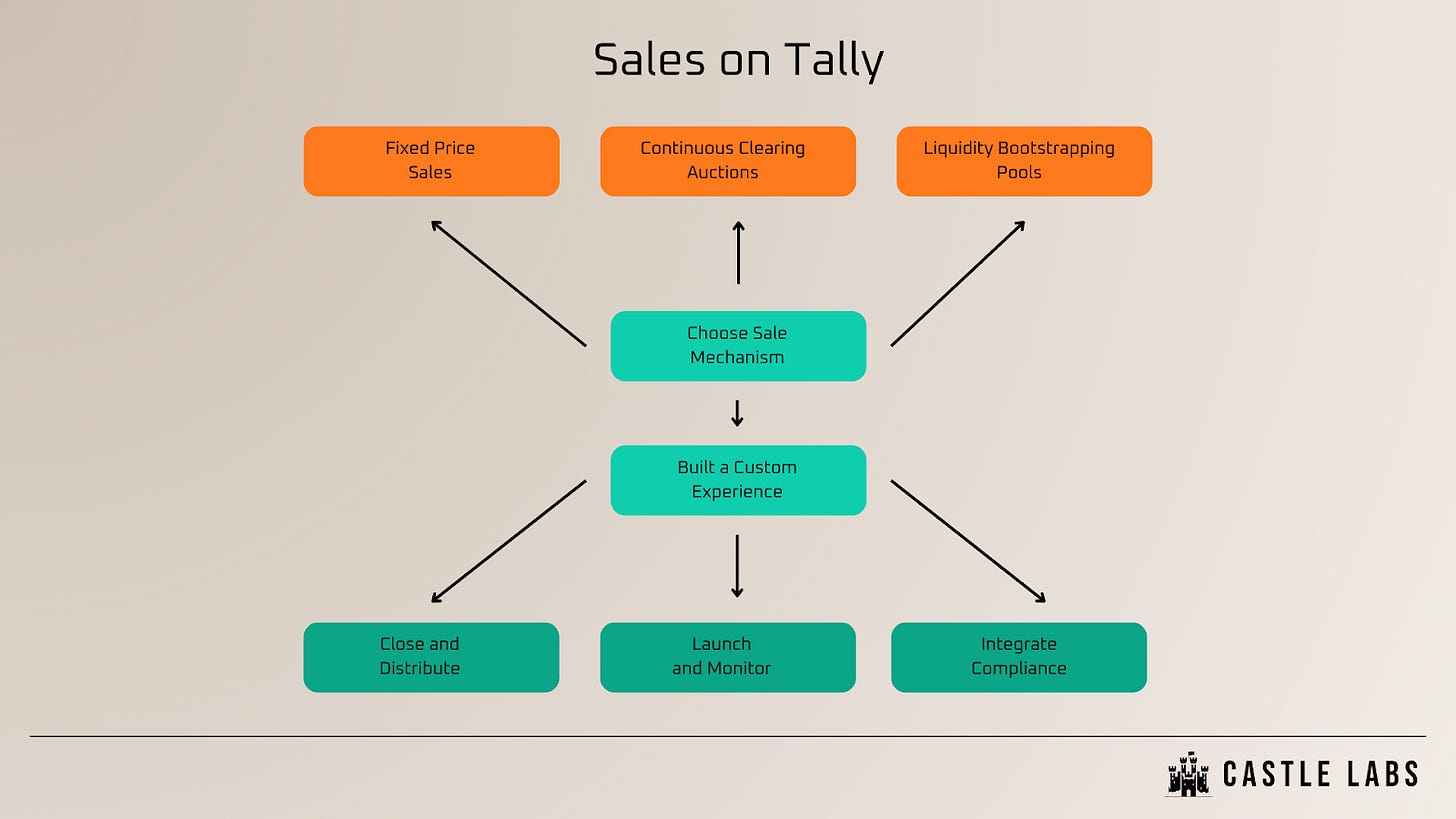

Each sale on Tally follows multiple steps. Teams can create sales permissionlessly and determine:

Sale mechanism: This is the most important component of a sale, as it determines how tokens are allocated.

Building a custom user experience: Projects can create fully branded interfaces and experiences for their users.

Integrating compliance: Token sales have rules about who can participate. Projects can implement the right controls for their jurisdiction and risk tolerance and embed Know-Your-Customer (KYC) into their sales so that every participant is verified.

Post-Launch Support and Monitoring: The work is not done after the sale. Tally supports and helps teams with post-launch support and monitoring, distribution, and user behaviour.

Post-Sale Token Distribution: The post-sale period determines how tokens are distributed and whether a vesting cliff is included.

Choosing the Sale Mechanism

Mechanism design is the most critical determinant of distribution quality. Effective mechanisms allocate capital to genuine users while reducing incentives for manipulation.

To conduct these sales, projects can choose from the following mechanisms.

Liquidity Bootstrapping Pools (LBPs)

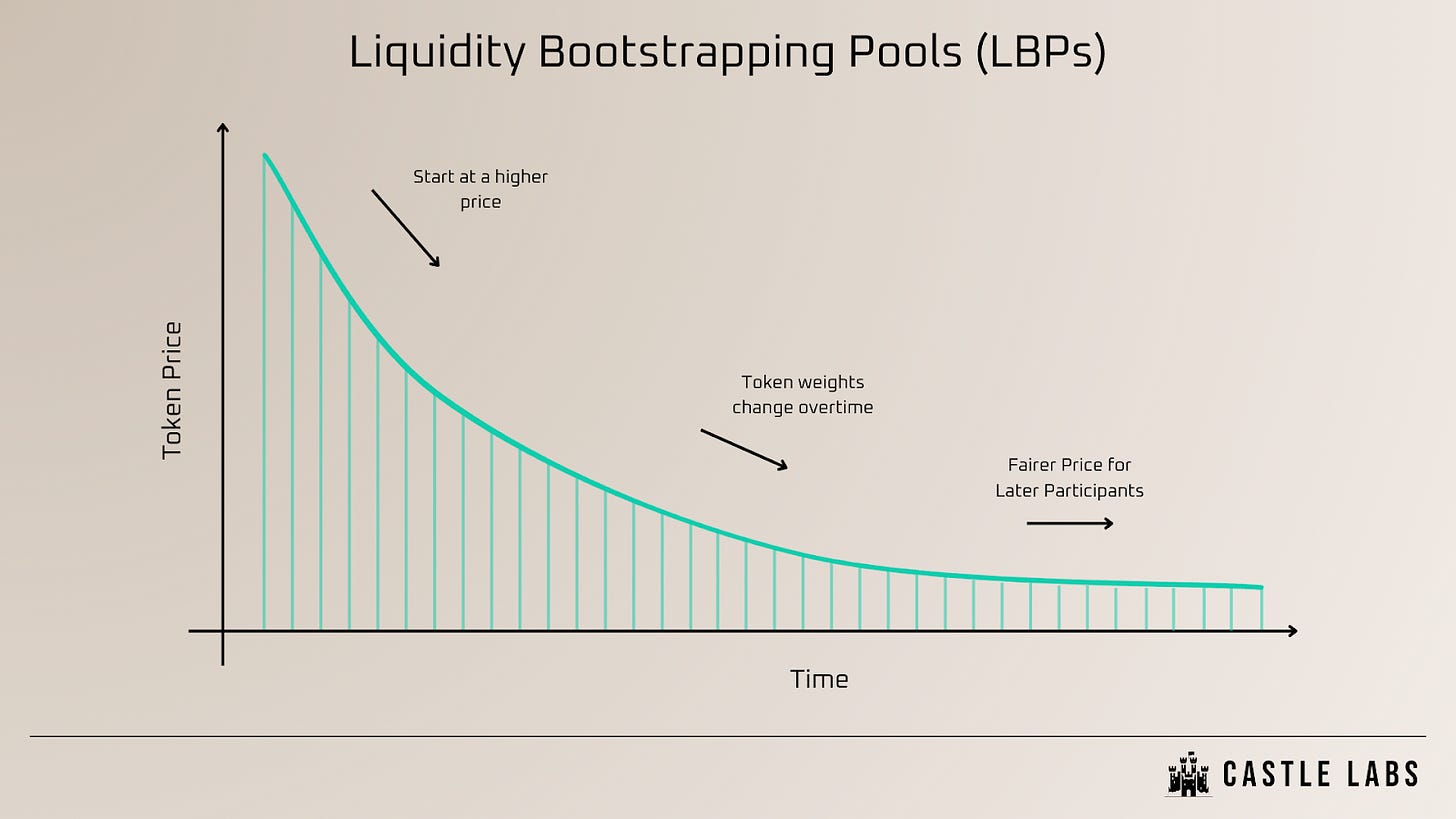

LBPs enable dynamically changing token weights for a sale (TokenA/TokenB). The team can select the starting and ending weights.

Introduced by Balancer in 2020, LBPs typically begin with a high implied price, discouraging early participants (in some cases, malicious, often referred to as “snipers”) from acquiring large numbers of tokens at lower prices.

Over time, the token’s weights are adjusted according to the predefined schedule, causing its price to decrease. This allows gradual price discovery, with later participants typically accessing lower prices.

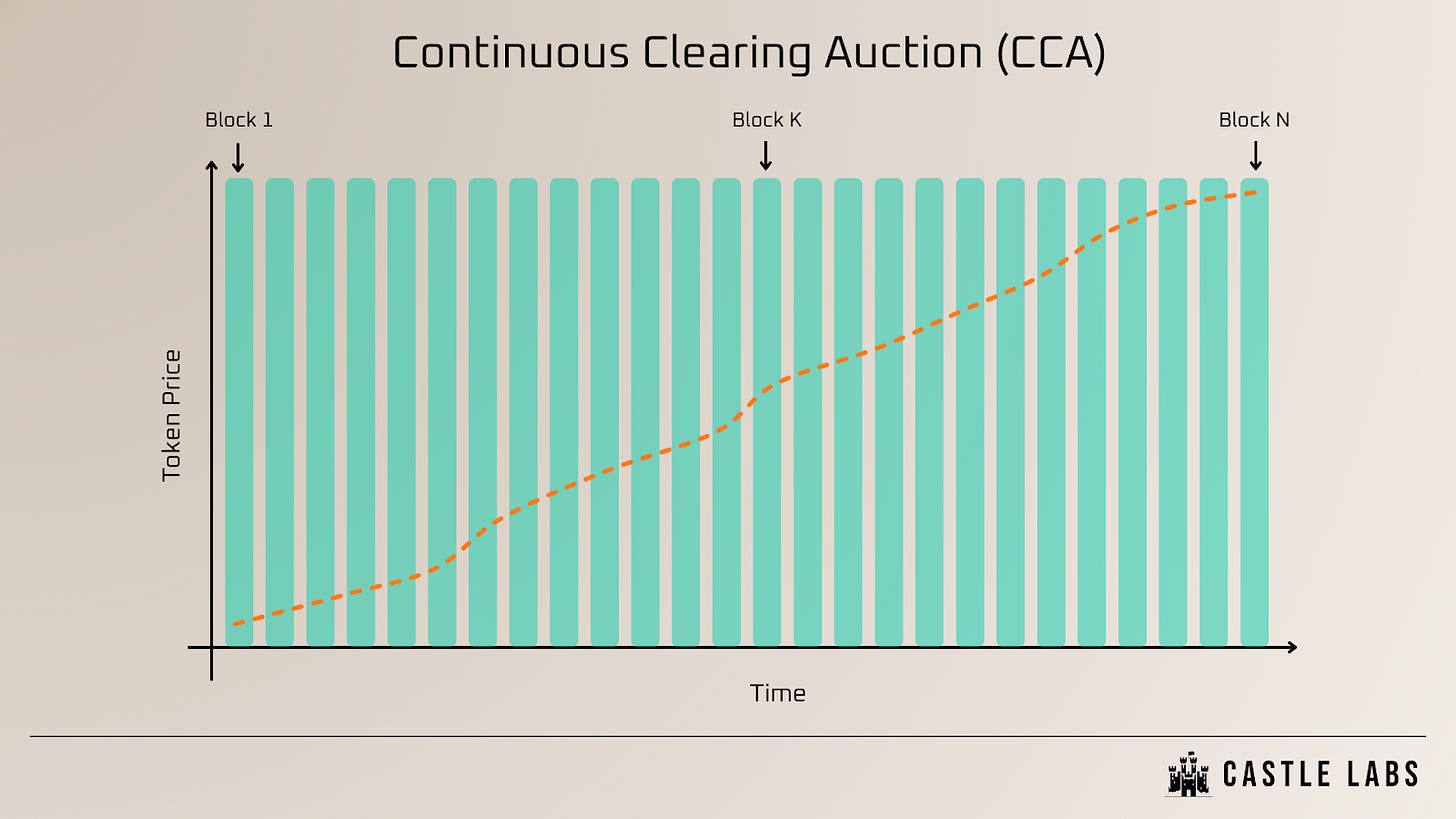

Continuous Clearing Auction (CCAs)

Uniswap introduced the CCA mechanism for liquidity bootstrapping in late 2025, and the first project to use it was Aztec, which used it for its token sale in December 2025.

Since Tally provides CCA as a sales mechanism on the platform, it is positioned to become one of the largest third-party providers of such sales, as Tally automatically seeds 20% of raised funds into Uniswap v4 LP positions.

The team is also working to ensure that sales conducted in Tally are reflected on Uniswap’s frontend.

In a CCA, token supply is released progressively over time. Participants submit bids, indicating a budget and the maximum price they are willing to pay. These bids are then distributed across multiple blocks, preventing demand from concentrating in a single block.

At the end of each block, the available supply is cleared at a single market-clearing price (determined by accumulated bids) and paid for by all participants.

By distributing supply over time and using uniform clearing prices, CCA reduces incentives for gas wars, sniping, and other forms of manipulation, while enabling fair and efficient price discovery.

You can check out Tally’s CCA token sale simulator here.

Fixed-Price Sales

Fixed-price sales specify a set token price, impose per-wallet limits, and allocate according to predefined rules that can reward long-term contributors in accordance with the rules set at the beginning of the sale. This format gives the sale originator greater control over who can participate in their token sale and what their allocation will look like.

The Regulatory Factor

Running regulatory forward token sales is increasingly important, and Tally enables additional features, including:

Identity Verification via KYC/KYI/KYB (Blueprynt integration).

Geo-blocking to block certain regions from the sale to help meet jurisdictional laws and regulations.

Chainlink ACE (Automated Compliance Engine) integration to embed regulatory checks, such as KYC/AML, investor accreditation, and geographic whitelisting. This allows transactions to be automatically approved or blocked onchain without centralised intermediaries.

Tally is designed to evolve with the U.S. market, comply with the latest SEC/CFTC guidance, and be forward-compatible with market-structure bill drafts. Moreover, sales on Tally can be conducted within the U.S. or other major onshore jurisdictions, rather than relying on any offshore entities in a regulatory grey zone.

The regulatory process for launching a token in the U.S. can be overwhelming; therefore, Tally will showcase each step required to launch successfully over the next two months. If you are about to launch a token or are considering it, their documented process can significantly help ensure a successful launch.

Post-Sale Operation

Support continues after the sale and can include seeding DEX liquidity on Balancer or Uniswap, configuring token vesting and lockups, deploying a governance system, setting up staking, adding multichain support, delegate compensation systems, managing security council elections and more.

By combining the established infrastructure with this new capital-formation layer, Tally aggregates all aspects of a token sale, from launch and airdrop to a fully functional governance and staking system.

Closing Thoughts

Fundraising is a crucial part of a project’s journey, providing the fuel needed to drive growth and product development.

Crypto fundraising has evolved in distinct phases. ICOs dominated early capital formation and were once the primary means of raising capital. As adversarial behaviour increased and regulatory pressure intensified, token sales lost legitimacy and declined in prominence.

Over the past 1–2 years, however, token sales have re-emerged, with more projects raising funds from communities and providing users with exposure to the project’s upside. This is partially enabled by improved regulatory conditions, particularly in the United States, including developments such as the proposed CLARITY Act. Last year, regulated token sales such as Plasma, MegaETH, and Monad attracted billions of dollars in expressed demand.

Current platforms, including Sonar by Echo, Kaito, and Legion, capture meaningful flow.

Yet a shift is underway: token sales are increasingly treated not as standalone events, but as components of broader distribution and launch strategies.

Within this landscape, Tally is developing an integrated model that integrates capital formation with distribution and governance infrastructure, offering an aggregated framework that enables the creation of a strong foundation for tokens designed for long-term value accrual.

The direction appears clear. Community inclusion is increasingly favoured because it strengthens alignment and broadens access. At the same time, VCs are unlikely to disappear and will remain relevant as a funding and support channel.

Nevertheless, alternative fundraising paths are expanding.

Rather than novelty, these paths may represent a return to older forms, under new constraints.

Disclaimer: This article was produced in collaboration with Tally. Tally provides token launch infrastructure and tooling. Use of the platform does not constitute legal, financial, or regulatory advice, nor does it guarantee compliance with the laws of any jurisdiction. Projects should consult independent legal counsel before conducting a token sale. Castle Labs applies the same standard to sponsored content as in our independent research. We strive to be accurate, unbiased and educational. Commissioned partnerships provide resourcing and distribution, not editorial control.

written by Noveleader and Francesco ✍️

Every week for the last 3 years, we have shared our research for free, directly in your email. Not a subscriber yet? Let’s fix it:

If you are more of a Telegram guy, you can read all of our research without the noise on our TG channel:

Fantastic breakdown of the ICO resurrgence and regulatory shifts. Your analysis of the VC misalignment problem really resonates, I've watched several promising projects get squeezed by high private valuations. The Tally platform sounds like a smart aproach to balancing community access with compliance requirements, this could genuinely help level the playing feild for retail participants.