Making All Markets Hyperliquid

Predictions Entering the House of All Finance

Initially introduced by Bedlam Research in September 2025, HIP-4 is now being tested on the testnet.

This HIP allows Hyperliquid (HL) to extend its support for instruments beyond perps, supporting binary market outcomes. This is increasingly important, as it allows HL to tap into one of the most active areas of crypto: Prediction Markets (PMs).

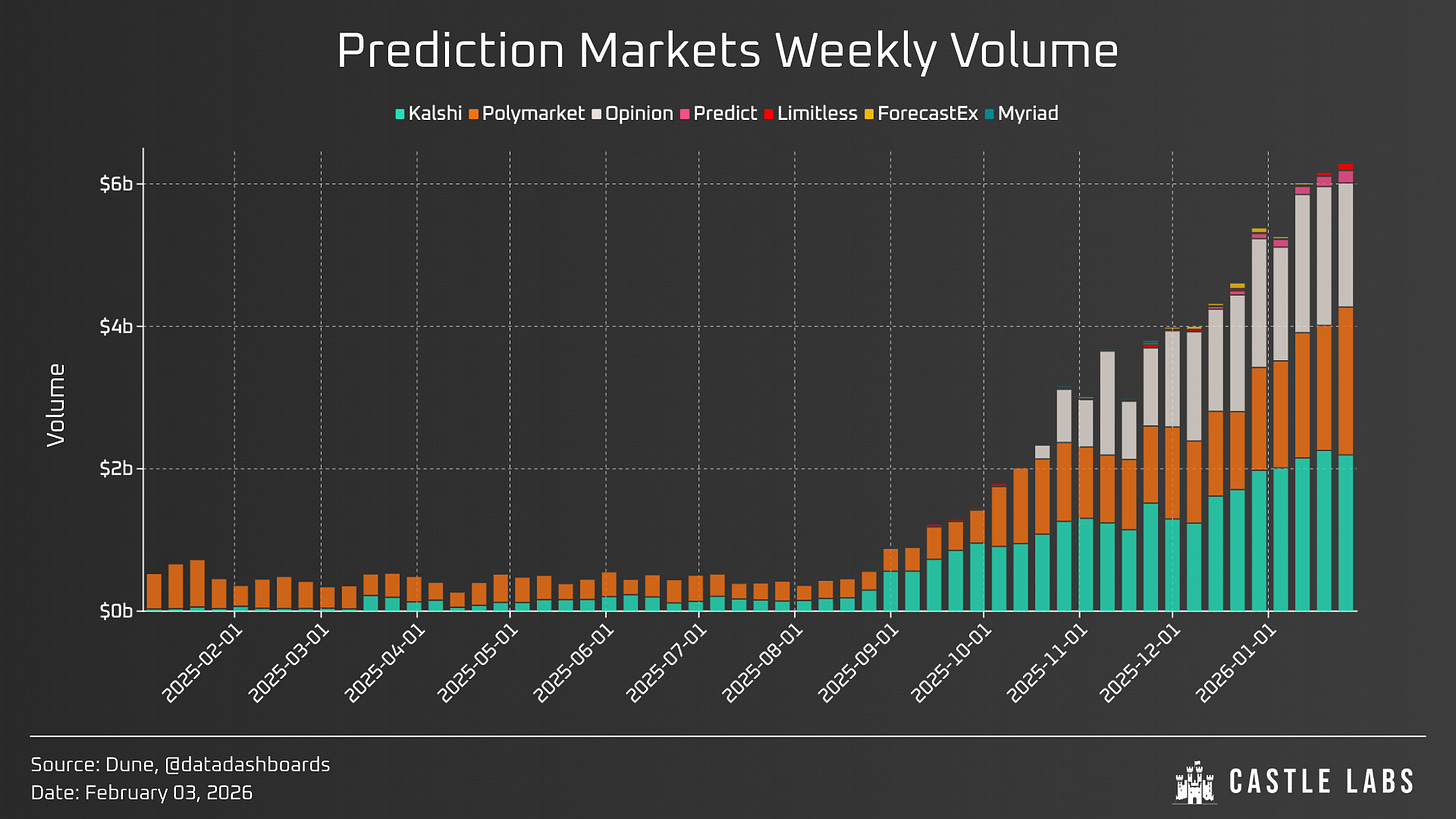

PMs’ volume speaks for itself, regularly reaching over $6b weekly in the past month.

Kalshi and Polymarket have established themselves as major players and command the majority of PMs’ volume and Open Interest. Even now, the top 3 players account for >97% of the category’s volume, so HIP-4 will stimulate more competition in this landscape.

HIP-4 goes well beyond PMs only: Binary markets are entering the house of finance.

As Ericonomic points out, “HIP-4 enables not just prediction markets (that it’s a huge market) but also options at a big scale. The major unlock of HIP-4 is that everything is hosted in the same environment, enabling a lot of trading strategies that before HIP-4 were much more complex since you had to use at least 2-3 venues to do it (e.g. vote on a prediction market for a rate cut while hedging your position with a BTC short with the same collateral). Ultimately, all this will lead to more fees, more revenue and in the end, more HYPE buying pressure”.

Before HIP-4, users had to build their own strategies across multiple platforms. Following the HL vision to become the house of all finance, they can now do it all on a single platform.

Dan from Rysk helps us note how this is also extremely significant for builders: “by shipping core primitives and letting builders build on top. This infrastructure-first approach for an exchange is a first of its kind and clearly differentiates Hyperliquid from CEXs by attracting builders and enabling open finance. Outcome markets are already mainstream with predictions because they are easy to understand and powerful enough to create markets on almost anything. Launching them within the most active DeFi builder ecosystem is a strong move: shared accounts and collateral, along with full composability, unlock entirely new opportunities. It is easy to imagine users hedging binary outcomes with perps from the same account”.

Rysk is already actively exploring how to plug into this, unlock new value for our users, and be an active part of this new primitive.

This should provide a general idea of HIP-4’s overall potential beyond supporting PMs.

Now onto the fun part - can it represent a strong enough source of revenues to impact the trajectory of HL with a whole new total addressable market (TAM)?

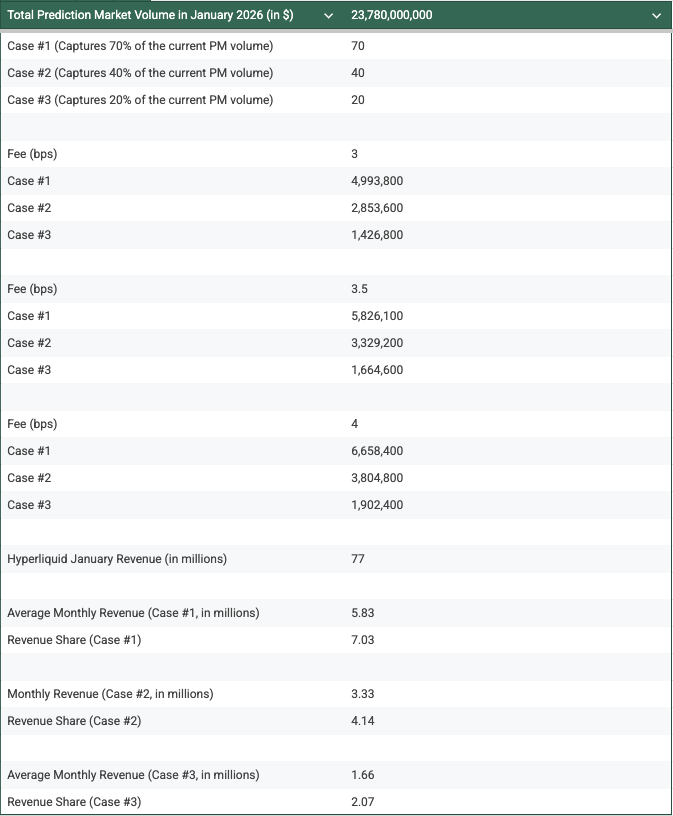

Here is a small thought exercise to determine how much HIP-4 is going to contribute to HYPE buy pressure or the protocol revenue, assuming HL is able to capture:

70% of the PM’s volume

40% of the PM’s volume

20% of the PM’s volume

Last month, PMs recorded a cumulative volume of $23.78 billion. To analyse fee generation, we are considering a 3-4 bps fee bracket.

For performing this, we have created a Google Sheet with an analysis according to the three scenarios laid out above:

If you have different assumptions for the fees and different case scenarios, you can work on them here: https://docs.google.com/spreadsheets/d/1z9AHnB2t2j73bzIEnq0x-4YQUdb1dVpIPXv0eYdDrGw/edit?usp=sharing

Here are the numbers:

In the first case, 70% of PMs volume, HL will generate ~$5.8 million in revenue

50% of PMs volume: ~$3.3 million

20% of PMs volume~$1.6 million.

These numbers represent ~2-7% of Hyperliquid’s current total revenue and could open an additional revenue stream for the protocol and HYPE buybacks.

Even if these scenarios are fairly bullish (and may not materialise), these revenues are insufficient to prompt a broader repricing or re-evaluation of HL and to exert significant buy pressure on HYPE.

Nonetheless, the analysis above considers only PMs, one of the types of binary markets supported by HIP-4.

To recap, with this implementation, HL now has access to an additional TAM that it can host on its platform.

Users can simply leverage new strategies without leaving their favourite platform.

For builders, this is a whole other primitive that could enable new protocols, developments, and composability across the entire ecosystem.

Moreover, it’s early days, and many details of HIP-4 remain to be announced.

For now, we know outcomes are still being fine-tuned on testnet, and development is ongoing.

USDH will be used as the denominator in canonical markets, with a plan to eventually make the infrastructure permissionless for anyone to deploy on.

To eventually become the house of all finance.

And bet on it.

All on HL.

Hyperliquid.

written by @noveleader and @francescoweb3 ✍️

If you are more of a Telegram guy, you can read all of our research without the noise on our TG channel: https://t.me/castlelabsreads

Interesting framework for thinking about HIP-4's revenue potential. The 2-7% additional revenue might not be huge alone, but what's intriuging is the compositional effects Dan mentions - shared colateral and cross-market strategies. I've seen similar network effects where the sum ended up way bigger than the parts. Be curious to see how much arbitrage activity this actually sparks once it's live.

Great read. HIP-4 you did the math for PMs only, love to see what would be the impact if HIP-4 includes options as well.