Ronin’s Return to Ethereum

Evaluating the L2 Proposals Shaping Its Next Chapter

1. Introduction

Ronin is coming home to Ethereum.

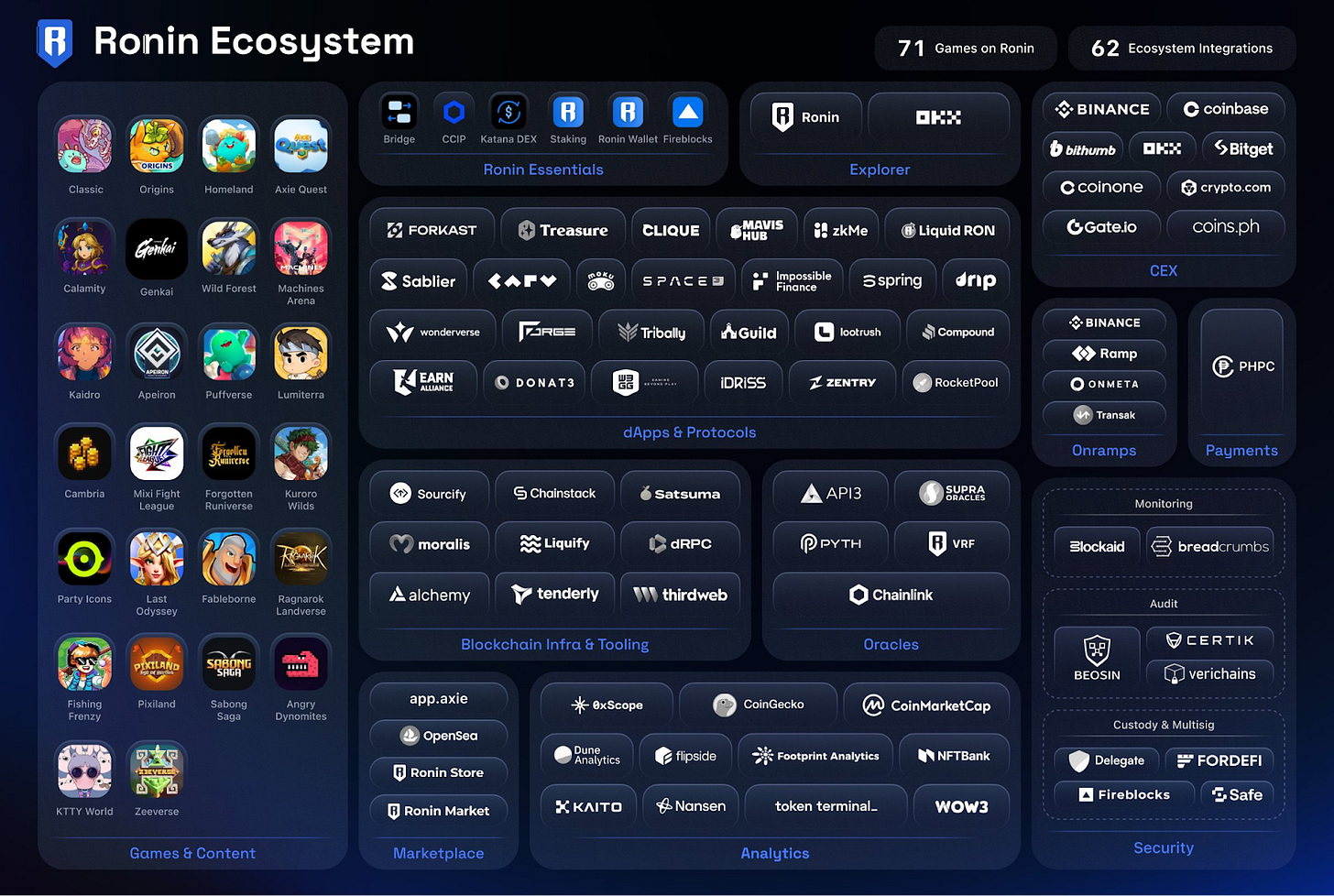

Ronin has announced its migration from a sovereign sidechain to an Ethereum-aligned Layer 2 (L2). As the home of one of the most successful onchain games, Axie Infinity, this is an opportunity for L2s to prove their stacks can deliver what gaming ecosystems demand: sub-second performance, day-one user experience (UX), sovereignty, and seamless migration.

This report outlines why migration matters, the strategic implications for Ronin, and the propositions advanced by Arbitrum, Optimism, Polygon, and ZKsync. We evaluate each bid against Ronin’s priorities, with a focus on delivery risk and long-term economic trade-offs.

We aim to demonstrate that the choice is not solely defined by headline incentive packages. The real question is which ecosystem Ronin will align with, and what that signals for the future of Ethereum’s L2 landscape.

2. The Ronin Migration

The Ronin network was built four years ago to support the growth of Axie Infinity. Back then, they needed a “faster and more efficient network”. The choice to build their own network was primarily driven by the fact that Ethereum at that time couldn’t offer these features.

Fast forward to today, and now their ecosystem is expanding beyond gaming, with a focus on:

Risk-based SocialFi

Tokenised collectibles

Gamified DeFi

Consumer AI

During this time, Ethereum has scaled through L2s, which can now, in turn, help Ronin do the same.

Some of the most immediate advantages highlighted in the migration proposal include:

The higher affordability of L2s thanks to alternative DA solutions such as EigenLayer

Improving Ronin tokenomics by leveraging Ethereum security

As part of this process, they have issued a request for proposals (RFPs), inviting Arbitrum, Polygon, Optimism, and zkSync to submit proposals, which will be voted on in the governance process. The significance of this proposal is not to be underestimated, as it is one of the first high-profile RFPs for an existing live chain with millions of users migrating to an L2.

3. Ronin’s Requirements

As part of the report, we analyse each of the L2’s proposals against the requirements of Ronin, which we highlight below:

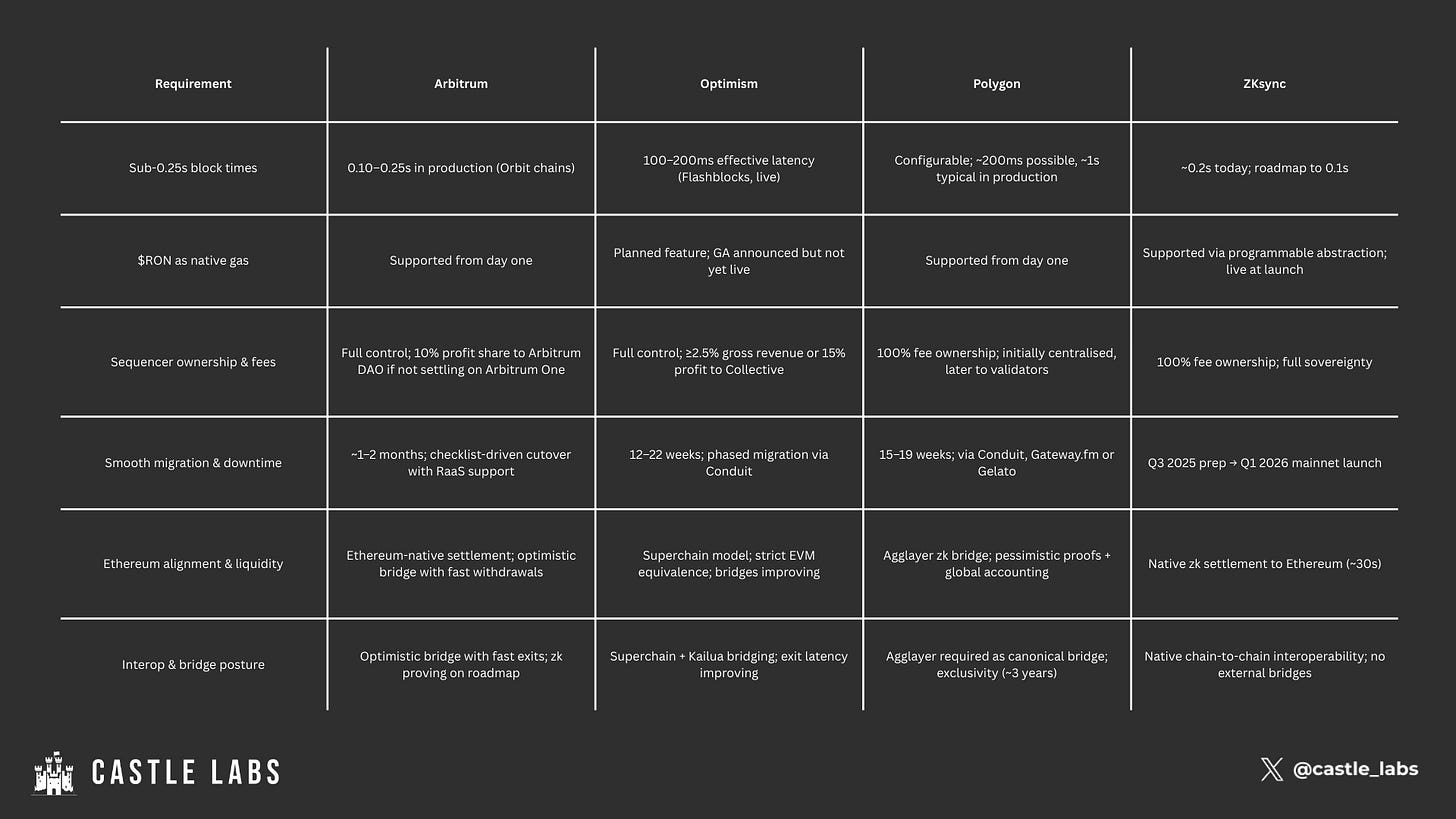

Sub-0.25s block times:

Ronin targets block times between 100 and 250ms, achieving sustained throughput under peak loads.

For games, fast block times are crucial for both providing near-instant confirmation of transactions and ensuring a smooth UX in terms of latency.

$RON as native gas:

For Ronin, being able to use $RON as gas is fundamental to ensuring continuity for the brand and alignment between token holders and validators. The $RON token plays a central utility role within the ecosystem, redistributing fees among its holders.

Full sovereignty and sequencer ownership:

Becoming an L2 will mean Ronin will have full control over its tech stack. This includes control on future upgrades, self-governance and customizability without the need to rely on third parties. Last but not least, Ronin will have full control over its sequencer, allowing it to capture fees and redistribute them within the active validators' community.

Smooth migration with minimal downtime:

The migration to the L2 must be conducted as smoothly as possible, ensuring that the existing state, balances, contracts, and validators are preserved, while also facilitating seamless integrations with existing partners, such as exchanges, wallets, and tooling providers.

Ethereum alignment & liquidity access:

Becoming an L2 is a way for Ronin to inherit Ethereum’s security, liquidity and all the developer support that comes with it. This means access to DeFi liquidity pools, stablecoin and RWA liquidity on Ethereum, and benefiting from a developer network effect (exemplified by shared tooling and easier developer onboarding).

Interop and Alt-DA preferences:

With the evolution of L2s, protocols can now choose their own alternative data availability (DA) and interoperability providers. Ronin has expressed its interest in adopting native interoperability features and safer bridges. Additionally, they have noted the low costs of operating an L2 due to DA solutions such as EigenLayer.

In the next section, we will analyse the different proposals, evaluating them against this set of non-negotiable requirements brought out by Ronin.

4. A Comparative Analysis of Proposals

This section delves into the various RPF contenders, introducing and evaluating them across four primary criteria, defined as layers of value:

Tech maturity and performance

Governance and sovereignty

Migration complexity and timeline

Commercial Terms and Ecosystem Support

The four RFP participants are:

Arbitrum (Orbit chains): An optimistic rollup, Arbitrum has established itself as one of the top L2s in terms of tech stack, liquidity, and ecosystem. Arbitrum also has a gaming-focused investment program (AGV) and can support Ronin’s asks through its Orbit stack.

Optimism (OP Stack): OP offers enterprise-grade reliability, fast migration, and robust incentive programs at a collective scale. Through this combination, it has already attracted major players to its OP Stack, including Base, Ink, and more.

Polygon (Agglayer CDK): Polygon’s Agglayer is a newer kid on the block, but from a battle-tested team. Its solution provides protocols building on it with a zk-first bridge and maximum fee sovereignty.

ZKsync (Elastic Network): Elastic is an interoperable network of ZK rollups, providing a ZK-native design, ultra-low transaction costs, and additional privacy features.

When viewed through a comparative lens, we can highlight how Ronin effectively tests the capabilities of these L2s, particularly in supporting already established games.

4.1 Tech Maturity & Performance

A choice of this matter is rarely only about the tech, but several of Ronin’s non-negotiables are related to performance and maturity. Most contenders target sub-second blocks; the key separator is maturity - e.g. which claims are production-proven versus roadmap-projected.

Arbitrum (Orbit chains)

Arbitrum positions itself as the most production-proven option in the RFP. Orbit chains already operate at 0.10–0.25s block times in live environments, with on-demand block production to eliminate empty blocks and reduce posting costs, a feature particularly useful for bursty gaming activity. Throughput benchmarks show ~50M gas/s sustained on Arbitrum One and Orbit peaks near 400M gas/s in stress tests, placing Orbit among the highest-capacity rollup frameworks.

The stack also differentiates in developer extensibility. Stylus supports contracts in C, C++, and Rust, alongside Solidity, a notable advantage for onboarding traditional game studios. Meanwhile, Timeboost introduces a MEV-management mechanism that can convert ordering priority into validator revenue. With 40+ Orbit chains live and 100+ in development, Arbitrum underscores a maturity of deployment that reduces execution risk for Ronin compared to stacks still reliant on roadmap features to reach Ronin’s requirements.

Optimism (OP Stack)

Optimism highlights its track record of running large-scale consumer chains, such as Base and World, where Flashblocks already deliver 100–200ms effective block times. The roadmap targets sub-100ms latency as the stack continues to optimise. Regarding throughput, Optimism focuses on improving reth/op-reth execution clients, which, when combined with EigenDA, are benchmarked to exceed 100M gas per second. While this is framed as a target rather than today’s default, the consistency of uptime across OP Stack chains reflects the platform’s emphasis on reliability.

A distinguishing feature is strict EVM equivalence, which ensures maximum compatibility with Ethereum tooling and developer expectations. This reduces flexibility compared to stacks that introduce new execution environments, but it provides strong predictability for projects that want to minimise migration friction. The OP Stack’s multi-client culture, along with Conduit’s experience in managing production rollouts, reinforces its positioning as a low-risk, enterprise-grade deployment path for Ronin.

Polygon (Agglayer CDK)

Polygon presents the Agglayer CDK as a highly configurable framework, with block times that can be tuned to approximately 200ms at the low end; however, current production deployments generally run closer to one second. Performance benchmarks in the proposal suggest a capacity in the range of 200–300 million gas per second, with a roadmap that combines Type-1 and Type-2 provers and EigenDA to target much higher throughput, potentially scaling up to one million transactions per second in the future.

The defining element of Polygon’s approach is its Agglayer, which serves as a unified zero-knowledge (zk) bridge. It employs pessimistic proofs and global accounting controls to enhance security and create a consistent user experience across connected chains. Interoperability ambitions are tied to this model, with a stated goal of reducing cross-chain settlement to under ten seconds by early 2026.

ZKsync (Elastic Network)

ZKsync positions the Elastic Network as a zk-native design, focusing on ultra-low costs and seamless interoperability. Current performance is around 0.2 seconds per block, with a roadmap targeting 0.1 seconds, and an internal transaction cost of roughly $0.001, the lowest among the proposals. The stack is underpinned by the Airbender prover, designed to provide efficiency gains and stronger zk finality guarantees.

A major differentiator is ZKsync’s approach to interoperability. Chains in the Elastic Network connect through native, bridge-free communication, which aims to create a unified user experience without fragmented liquidity. Transactions settle on Ethereum L1 in approximately 30 seconds, striking a balance between fast user-facing finality and mainnet security. The proposal frames ZKsync’s throughput at over 10,000 TPS per chain, with scaling achieved through sharded interoperation across the network. While these figures are forward-looking, the combination of cost efficiency and zk-first infrastructure represents a clear strategic bet on the longer-term trajectory of rollups.

Takeaway

All four proposals commit to delivering sub-second user experience, but they differ in the maturity of their deployments and the features layered on top. Arbitrum and Optimism emphasise performance that is already proven in production, supported by extensive track records across live chains. Polygon highlights configurability and a zk-first roadmap, with interoperability anchored in the Agglayer bridge and security controls. ZKsync presents the most ambitious zk-native model, coupling very low transaction costs with native interoperability, though much of this remains forward-looking. For Ronin, the key consideration is not whether sub-second performance is achievable, but which stack’s approach to scalability, extensibility, and reliability aligns most closely with its immediate operational needs and longer-term strategic ambitions.

4.2 Governance & Sovereignty

This second aspect focuses on the freedom and configurability of the tech stack, as well as the governance design. This often involves fee ownership and profit sharing as requested by these L2s. Being able to use $RON as a gas is also a non-negotiable requirement, with some networks being able to accommodate this from day one, while others are still working on this.

As always, the relationship between sovereignty and governance is not binary, and it mostly comes up to a tradeoff between independence and being able to benefit from ecosystem perks, while facing other constraints.

Arbitrum (Orbit chains)

Arbitrum offers Ronin a high degree of sovereignty in both governance and upgrade control. Orbit chains are self-managed, meaning Ronin would retain full authority over protocol upgrades without requiring approval from the Arbitrum DAO. At the same time, sequencer ownership would rest with Ronin, allowing it to capture transaction fees directly. The key trade-off lies in economics: Orbit chains that do not settle to Arbitrum One commit to sharing 10% of net sequencing profit with the Arbitrum DAO. This aligns Ronin with the broader ecosystem but reduces long-term fee retention compared with alternatives that impose no revenue share. Interoperability would rely on Arbitrum’s established optimistic bridge, supplemented by fast withdrawal mechanisms already deployed on other Orbit chains, with zk-proving on the roadmap as a future enhancement.

Optimism (OP Stack)

The OP Stack situates Ronin within the Optimism Collective, which imposes specific economic and governance arrangements. Chains operating in the Superchain agree to contribute the greater of 2.5% of gross sequencing revenue or 15% of net profit to the Collective. This structure provides funding for shared ecosystem development but represents an ongoing cost for Ronin. Gas token flexibility is promised in the near term, with the ability to designate $RON as the native gas token; however, this feature is not yet live. Optimism also distinguishes itself through strict EVM equivalence, which ensures seamless compatibility with Ethereum clients and tooling. While this design reduces extensibility compared to stacks that add new execution environments, it prioritises reliability and standardisation. For interoperability, Optimism points to its Superchain model, with Kailua bridging to shorten withdrawal times and provide a pathway to zk finality.

Polygon (Agglayer CDK)

Polygon provides Ronin with 100% of the sequencer fees, with no revenue share to the parent ecosystem. Fees would initially accrue to a central sequencer, with plans to distribute them to validators as the network decentralises. $RON would be the gas token from day one, ensuring continuity of Ronin’s economic model. The main sovereignty trade-off comes from interoperability. Ronin would be required to use Agglayer as its canonical bridge for an exclusivity period of around three years. Agglayer employs zk proofs and global accounting controls to secure cross-chain flows, but this condition limits flexibility in choosing alternative bridge infrastructure. Vault Bridge, sometimes confused with this requirement, is in fact an optional liquidity layer that can be applied to specific assets, such as USDC. It does not replace the canonical bridge and is not a precondition of Polygon’s incentives.

ZKsync (Elastic Network)

ZKsync’s Elastic Network offers full sovereignty with minimal external constraints. Ronin would retain 100% of sequencer fees, enjoy full control over upgrades, and face no mandatory revenue sharing. In addition to supporting custom gas tokens, ZKsync natively implements account abstraction, enabling developers to design flexible user experiences such as meta-transactions or sponsored gas. Interoperability is framed as a core differentiator: instead of relying on bridges, ZKsync chains communicate through native, trust-minimised interop, giving users the appearance of a single unified network. From a sovereignty perspective, this approach minimises external dependencies, but it places Ronin within a still-nascent ecosystem where many features remain under active development.

Takeaway

Governance and sovereignty across the proposals present different trade-offs rather than absolutes. Arbitrum and Optimism both grant Ronin control over upgrades and sequencing, but tie this to ongoing revenue-share models with their parent ecosystems. Polygon offers maximum fee capture and immediate $RON gas support, though it requires exclusivity to Agglayer as the canonical bridge. ZKsync combines full fee retention with features such as native account abstraction and trust-minimised interop, but its ecosystem remains less mature. The decision, therefore, centres on how Ronin balances independence and optionality against the benefits of ecosystem alignment and shared infrastructure.

4.3 Migration Complexity & Timeline

For projects that are already live and with many users, downtime tolerance is near zero. For this reason, scheduling a smooth migration is pivotal. This often comes to a tradeoff between speed and the quality of the migration path itself. Most of these L2 support both Rollup as a Service (RaaS) providers and other infrastructure and tools, which offer different migration experiences.

Arbitrum (Orbit chains)

Arbitrum frames migration as a low-friction process, supported by a detailed cutover checklist and broad adoption of Orbit among rollup-as-a-service providers. The process spans around 4 to 8 weeks, covering planning, testnet rehearsal, state preparation and final cutover. Because the codebase already supports Ronin’s requirements (custom gas token, sovereignty, and features like Timeboost), the configuration burden is reduced. The wide adoption of Orbit by bridges, oracles and explorers further limits integration risk, making the migration less about new engineering and more about disciplined project management.

Optimism (OP Stack)

Optimism proposes a structured migration plan led by Conduit, with an estimated window of 12 to 22 weeks. The process moves from design through private and public testnets to a mainnet launch, with Conduit providing sequencing and operational support. The OP Stack’s emphasis on high-availability sequencing and a multi-client culture is designed to mitigate downtime risk. For Ronin, this represents a longer path than Arbitrum, but one framed around predictability and resilience at scale.

Polygon (Agglayer CDK)

Polygon outlines a migration timeline of 15 to 19 weeks, depending on the chosen partner, including Conduit, Gateway.fm, or Gelato. The programme includes technical integration alongside ecosystem and go-to-market support. A condition of the migration is adopting Agglayer as the canonical bridge, which ensures secure interoperability through zk proofs and accounting, but reduces flexibility in bridge design. The approach strikes a balance between migration certainty and a form of ecosystem lock-in that other stacks do not require.

ZKsync (Elastic Network)

ZKsync outlines the longest transition, with preparations in Q3 2025, testing in Q4 2025 and a mainnet cutover in Q1 2026. Dedicated engineering resources and phased rehearsals would support the staged rollout. While the timeline is extended compared with other stacks, it reflects the network’s relative immaturity and its zk-native architecture. For Ronin, this represents a bet on the long-term zk roadmap rather than an immediate migration to Ethereum alignment.

Takeaway

Migration timelines reveal a clear divide. Arbitrum positions itself as the quickest route, with a one- to two-month checklist-driven cutover. Optimism and Polygon propose more predictable three- to five-month schedules, supported by experienced implementation partners but requiring greater time investment. ZKsync requires the longest runway, with full migration not expected to be complete until early 2026. Ronin must weigh the value of speed and certainty against the strategic benefits of committing to slower but potentially more differentiated architectures.

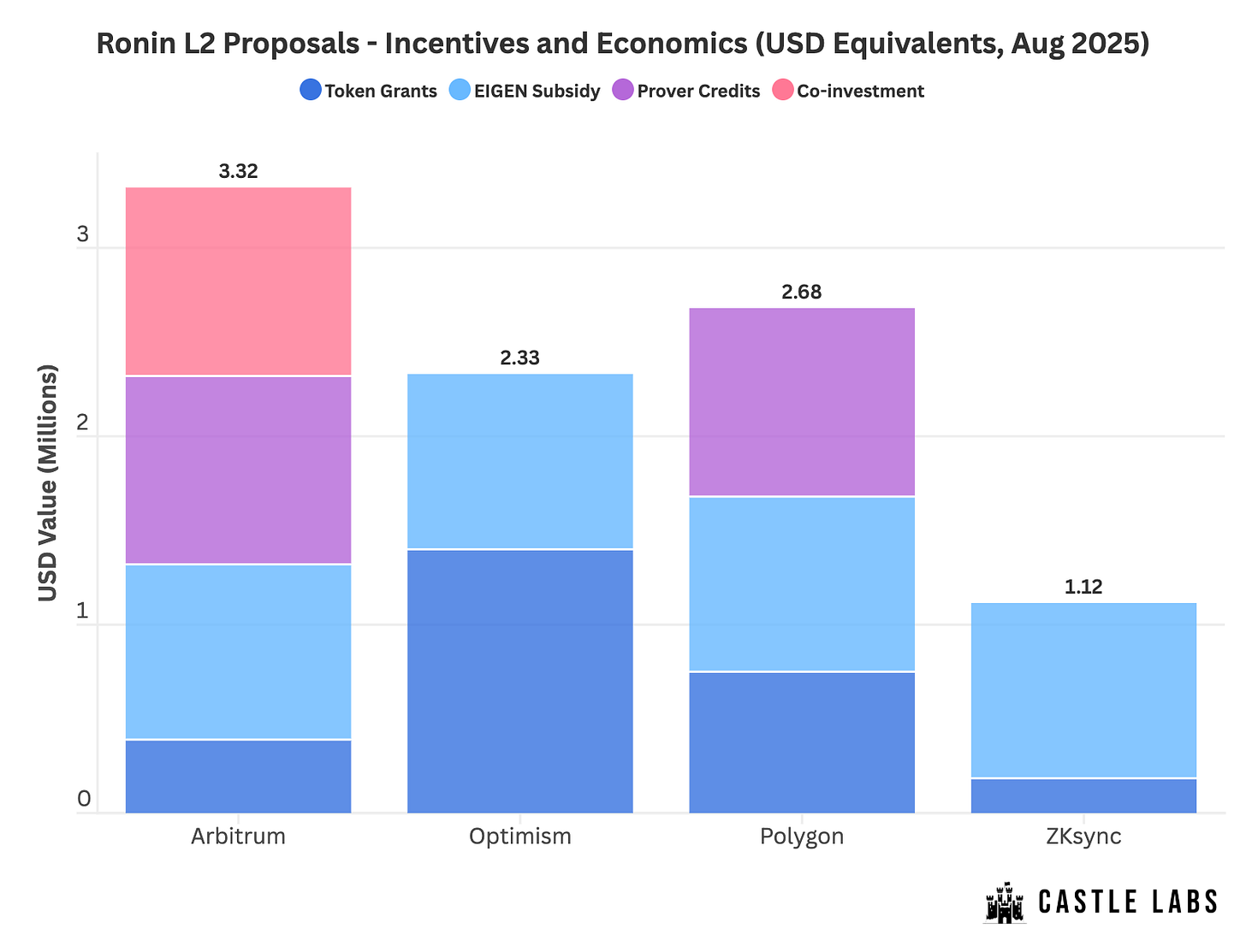

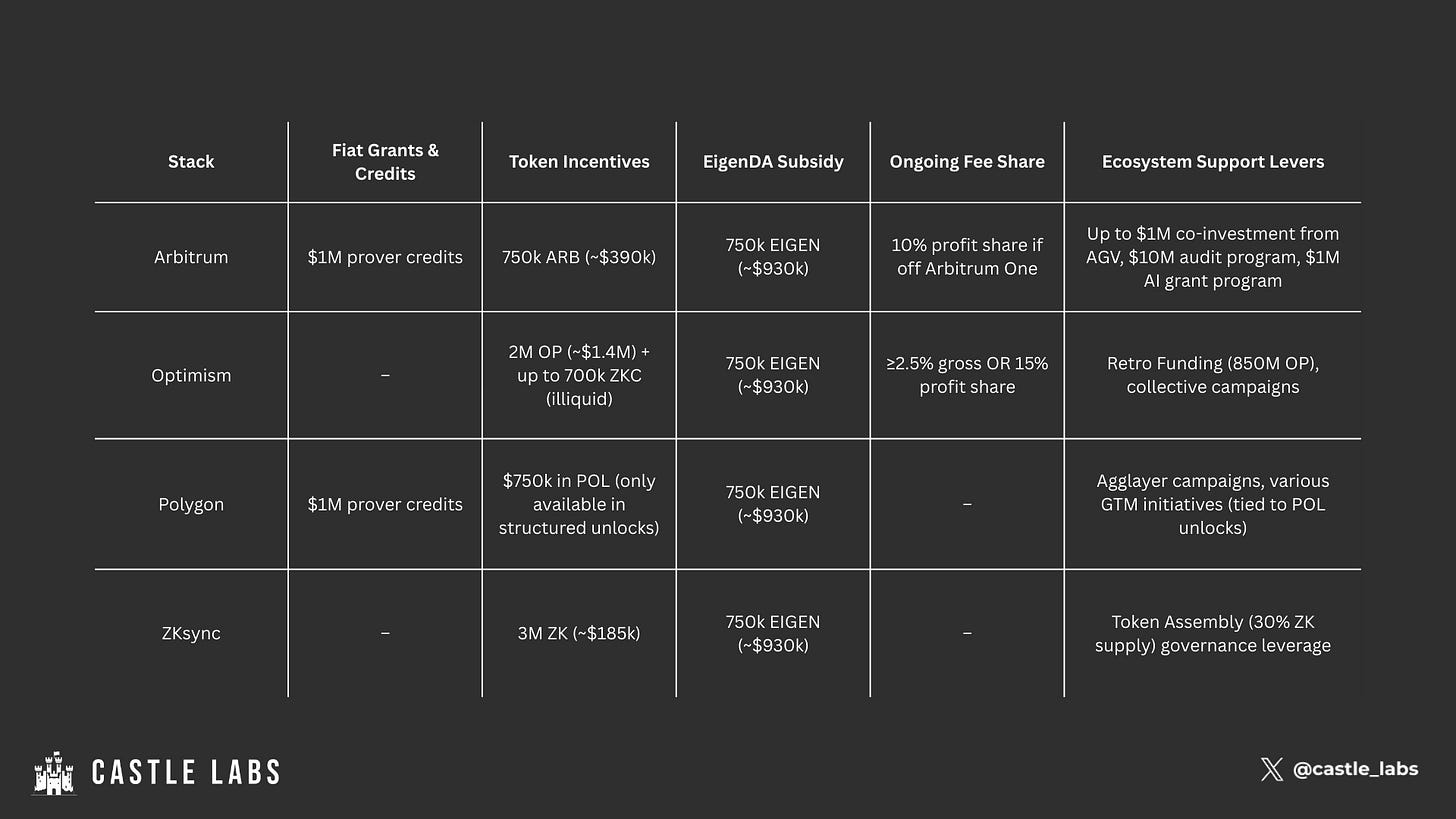

4.4 Commercial Terms & Ecosystem Support

While money (in the form of incentives or grants) is often leveraged as the main element of discussion, the final choice comes to much more than that. Nonetheless, all of the RFPs contained an economic aspect, whether through direct grants or different incentives, such as milestone-dependent economics. All of them were eligible, and ultimately, the $750,000 in EIGEN tokens was included as a subsidy for deploying with EigenDA. Here’s how they compare:

Arbitrum (Orbit chains)

Arbitrum’s revised proposal increases the total package to ≈$2.3M USD at today’s prices. This includes 750k ARB (~$390k) distributed over 3 years, 750k EIGEN (~$930k) for DA costs, and up to $1M from Succinct to cover ZK prover costs (SP1) over 2 years.

Additionally, Arbitrum Gaming Ventures (AGV) has committed up to $1 million in co-investment alongside Ronin into games and ecosystem projects. While not a direct grant, this represents aligned capital deployment.

Arbitrum also maintains access to ecosystem-wide programmes, including the Gaming Content Creator Program (~$750k), a $10M audit programme, the AI Trailblazer ($1M initiative), and future IRL marketing activations.

Optimism (OP Stack)

Optimism’s package remains largely unchanged, worth ≈$2.3M+ USD (excluding illiquid ZKC). It includes 2M OP (~$1.4M), 750k EIGEN (~$930k), and up to 700k ZKC (Boundless token; not yet liquid). Ronin would also gain access to the Retro Funding pool (850M OP) and collective-wide incentive campaigns. Obligations remain the greater of 2.5% gross revenue or 15% net profit to the Collective, embedding Ronin in the wider Superchain model.

Polygon (Agglayer CDK)

Polygon’s revised proposal totals ≈$2.68M USD, structured as $750k POL tokens, $1M Succinct prover credits over 2 years, and 750k EIGEN (~$930k). Importantly, Vault Bridge milestones and requirements have been removed. Instead, Polygon introduces targeted GTM initiatives, including launching a Ronin stablecoin (RUSD), deploying stablecoin pools (e.g. PHP:USD) to drive Katana DEX volume, rolling out a Ronin-branded wallet card, and enabling yield products through RWA partners. Ronin retains 100% of the sequencer fees and $RON as native gas, but remains subject to a 36-month Agglayer exclusivity agreement as a canonical bridge. This positions Polygon less as the highest-value package, and more as a strategic DeFi and stablecoin growth partner.

ZKsync (Elastic Network)

ZKsync’s package remains the smallest in direct USD value at ≈$1.1M USD, comprising 3M ZK (~$185k) and 750k EIGEN (~$930k). Unlike Arbitrum and Optimism, no profit share applies, ensuring Ronin retains 100% of sequencer fees. Ecosystem leverage is achieved through the Token Assembly, which governs 30% of the ZK supply and could grant Ronin influence over future incentive allocations.

Takeaway

At today’s prices, Arbitrum offers ≈$2.3M in direct subsidies and grants, excluding AGV co-investment. Optimism sits at ≈$2.3M+ (excluding illiquid ZKC), Polygon at ≈$2.68M, and ZKsync at ≈$1.1M. The choice is less about headline totals and more about ecosystem alignment: Arbitrum as the gaming-first partner, Optimism as the Collective-aligned scaling route, Polygon as the DeFi and stablecoin ally, and ZKsync as the zk-native, governance-led option.

4.5 Visualising Comparisons

Ronin’s Requirements At a Glance

Incentives & Economics

5. On the Maturity of the Layer 2 Landscape

By analysing and evaluating the different RFP bids, we can highlight a series of broader trends across the L2 landscape.

Latency convergence, delivery divergence

All four proposals commit to sub-second block times, making this a baseline rather than a differentiator. The real divide lies in delivery maturity: Arbitrum and Optimism can point to chains running at these speeds in production, while Polygon and ZKsync frame their targets around zk roadmaps that are still in development. For Ronin, the question is not whether latency can be achieved, but whether it prefers to rely on proven infrastructure or future-oriented zk pipelines.

Sovereignty economics as margin drivers

Sequencer fee ownership emerges as a central axis of differentiation. Polygon and ZKsync propose 100% fee capture, maximising Ronin’s sovereignty. Arbitrum requires a 10% profit share, and Optimism mandates the greater of 2.5% gross revenue or 15% profit. These models will materially affect Ronin’s long-term revenue profile. The trade-off is whether the value of ecosystem-scale incentives and integration justifies a smaller share of sequencer economics.

Rising ecosystem lock-ins

The proposals illustrate a trend towards deeper ecosystem entanglement. Polygon requires Agglayer canonical bridge exclusivity for three years, ensuring secure zk-based interoperability but limiting flexibility. Optimism enforces economic alignment through Superchain profit-sharing. Arbitrum requires ongoing contributions to its DAO for non-Arbitrum settlements. ZKsync avoids explicit lock-ins; however, its adoption places Ronin within a still-maturing ecosystem. This reflects a shift in the rollup market: ecosystem neutrality is increasingly scarce.

Migration readiness

The ability to deliver a migration safely is linked to the maturity of rollup-as-a-service providers. Optimism and Polygon rely on Conduit, Gateway.fm and Gelato, which provide predictable schedules of 12–22 weeks and 15–19 weeks, respectively. Arbitrum offers a checklist-driven cutover of roughly one to two months, with broad third-party support already in place. ZKsync outlines the most extensive path, targeting Q1 2026, reflecting both engineering ambition and higher execution risk. For Ronin, the migration decision is therefore as much about risk appetite and tolerance for downtime as it is about technical design.

Data availability is commoditising

A notable convergence across all four proposals is the inclusion of EigenDA support and 750,000 EIGEN subsidies (~$930,000). With DA no longer serving as a differentiator, the focus shifts to how each stack positions its interoperability model and economic terms. For Ronin, this means evaluating Alt-DA less as a technical question and more as an economic one, since DA has effectively become standardised and subsidised.

Takeaway

The Ronin RFP reflects a maturing rollup market where headline performance claims are no longer enough. Latency has converged, DA is commoditised, and the differentiators now lie in economic alignment, interoperability posture, and delivery risk. Arbitrum and Optimism provide tested infrastructure with ongoing revenue obligations, Polygon maximises sovereignty but binds Ronin to Agglayer, and ZKsync offers a zk-native future on a slower schedule. The broader lesson is that protocols migrating to Ethereum L2s must now weigh not only technical fit but also the strategic implications of ecosystem entanglement.

6. Food For Thought and Considerations

Beyond the headline numbers

Token grants and subsidies can fluctuate in value, but the deeper decision lies in how each proposal positions Ronin for the next phase of its growth. The critical factors are sovereignty economics, migration certainty, interoperability constraints, and alignment with Ronin’s identity as a gaming-first chain.

6.1 Ronin’s non-negotiables as the baseline

All four proposals have been evaluated against the same set of day-one requirements: sub-second block times, $RON as gas, sequencer ownership, smooth migration, Ethereum alignment, and interop safety. These criteria cut through the noise of incentive packages and focus on what is essential to Ronin’s success.

6.2 The strategic choice

Arbitrum

Quickest migration (≈1–2 months) via RaaS checklist.

$RON gas supported from day one.

Full sequencer control, but 10% profit share owed to the DAO if settling outside Arbitrum One.

Interop via optimistic bridge + fast withdrawals, with zk proving on the roadmap.

Incentives: ≈$2.3M USD total.

750k ARB (~$390k).

750k EIGEN (~$930k).

Up to $1M Succinct prover subsidy (SP1).

Additional ecosystem leverage:

Up to $1M AGV co-investment into Ronin games/projects.

Gaming Creator Program (~$750k), $10M audit programme, AI Trailblazer ($1M), IRL activations.

Positioning: Fastest migration path and the most gaming-aligned package.

Optimism

Predictable migration timeline (12–22 weeks) with Conduit.

Incentives: ≈$2.3M+ USD (excluding illiquid ZKC).

2M OP (~$1.4M).

750k EIGEN (~$930k).

Up to 700k ZKC (illiquid).

Ongoing obligations: ≥2.5% gross revenue or 15% profit share to the Collective.

Custom gas tokens (for $RON) due shortly, not live at present.

Interop via the Superchain model, with Kailua bridging for faster exits and zk roadmap.

Ecosystem leverage: Retro Funding (850M OP) and collective-wide campaigns for ongoing support.

Positioning: Largest liquid token package today, but comes with structural revenue-sharing obligations.

Polygon

Migration timeline: 15–19 weeks via Conduit, Gateway.fm, or Gelato.

100% sequencer fee ownership, no profit share.

$RON gas supported from day one.

Interop requirement: Agglayer exclusivity (~3 years), using pessimistic proofs + global accounting.

Incentives: ≈$2.68M USD total.

$750k POL direct grant (structured unlocks).

$1M Succinct prover credits (2 years).

750k EIGEN (~$930k).

GTM initiatives:

Launch of Ronin stablecoin (RUSD) with Polygon’s liquidity/marketing support.

Stablecoin pools (e.g., PHP:USD) to boost Katana DEX TVL.

Ronin-branded wallet card for real-world spending.

Yield opportunities (AAA-rated RWA products).

Positioning: A smaller package than Arbitrum, but highly targeted at DeFi and stablecoin ecosystem growth.

ZKsync

Longest migration timeline (Q3 2025 prep → Q1 2026 launch).

100% fee retention, no revenue share.

$RON gas supported with programmable abstraction.

Interop via native chain-to-chain communication, no bridge UX, ~30s settlement to Ethereum L1.

Incentives: ≈$1.1M USD total.

3M ZK (~$185k).

750k EIGEN (~$930k).

Ecosystem leverage: Token Assembly (30% of ZK supply), giving Ronin influence over incentive allocation in the zkSync ecosystem.

Positioning: Smallest immediate package, but offers a zk-native and governance-driven future.

6.3 The decision ahead

Ronin’s choice is not only about financial terms but also about which ecosystem to anchor itself within. The options crystallise into:

Arbitrum: speed, operational certainty, largest package (~$3.25M), and gaming-aligned ecosystem fund and audit subsidies

Optimism: predictable migration, large liquid token package (~$2.3M+), and ecosystem support through Retro funding and incentives.

Polygon: fee sovereignty, stablecoin + DeFi GTM initiatives, and Agglayer exclusivity (~3 years).

ZKsync: fee sovereignty, zk-native futureproofing, smallest package (~$1.1M), and governance influence via Token Assembly.

6.4 Next steps

The DAO vote on Ronin’s migration has been extended and will now close at 03:00 UTC on 5 September 2025. Ahead of that decision, the evaluation should prioritise:

$RON gas guarantees: Arbitrum and Polygon support day one; Optimism is planned but not yet live; ZKsync supports via programmable abstraction.

Sequencer economics: Arbitrum (10% profit share if not settling to Arbitrum One); Optimism (≥2.5% gross revenue or 15% profit share); Polygon (100% fee ownership); ZKsync (100% fee ownership).

Interoperability trade-offs: Agglayer exclusivity (~3 years, Polygon); Superchain commitments (Optimism); optimistic bridge + fast exits (Arbitrum); native zk interop (~30s settlement, ZKsync).

Commercial terms:

Arbitrum ($2.3M: 750k ARB, 750k EIGEN, $1M Succinct subsidy) - but with additional $1M AGV co-investment opportunity

Optimism ($2.3M+: 2M OP, 750k EIGEN, 700k ZKC illiquid)

Polygon ($2.68M: $750k POL, $1M prover credits, 750k EIGEN, with GTM unlocks)

ZKsync ($1.1M: 3M ZK, 750k EIGEN).

Ecosystem leverage: AGV co-investment + audits + grants (Arbitrum), stablecoin/Katana GTM initiatives (Polygon), Retro Funding + incentives (Optimism), Token Assembly governance (ZKsync).

The proposals can all meet Ronin’s baseline technical requirements, with additional work required for some of them. The decision now rests on which ecosystem Ronin chooses to anchor itself within, and whether it prioritises speed, sovereignty, capital, and which partnership best supports its evolution from a gaming-first chain to a cornerstone of Ethereum’s broader consumer landscape.