Stablecoin Adoption and Regional Usage in 2024 and 2025: What Changed?

Over the past 12 months, stablecoins moved from the sidelines of crypto into broader financial relevance. The numbers alone tell part of the story: supply more than doubled, usage climbed past traditional networks and institutional players, showing an increasing appetite for these assets. But under the surface, the shift was more structural. What used to be a place to park profits for crypto traders is now becoming a transactional layer in emerging economies, a settlement tool in fintech stacks and a strategic currency extension for U.S. monetary policy.

This report compares mid-2024 to mid-2025, tracing the growth of adoption, changes across regions and the current standing of stablecoins as both a product and an idea.

Global Trends: From Liquidity Tool to Functional Infrastructure

Market Cap and Usage Growth

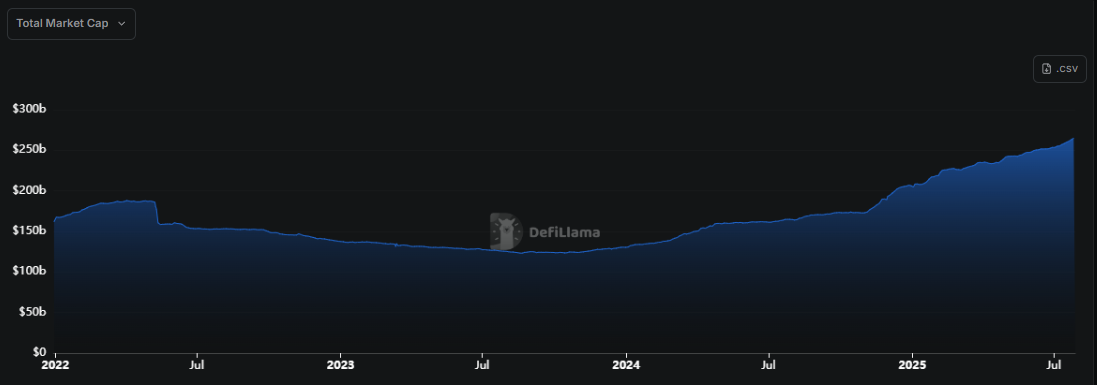

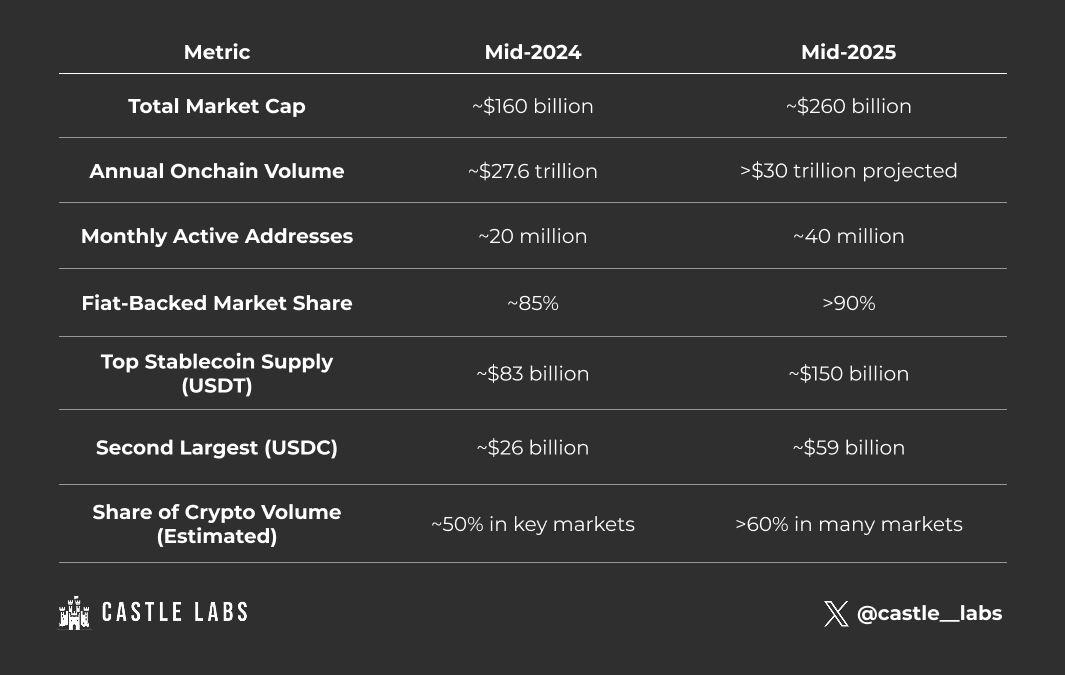

Stablecoin market cap rebounded from ~$160 billion in mid-2024 to over $260 billion by July 2025. That’s more than a 60% increase in a single year, and it pushed total circulating stablecoins past their 2022 highs. Liquidity, too, hit new records.

Onchain volume tells a clearer story. In 2024, stablecoins settled $27.6 trillion more than @Visa and @Mastercard combined. Monthly volumes doubled year-over-year, rising from $1.9 trillion in February 2024 to $4.1 trillion by February 2025.

December 2024 saw a peak of $5.1 trillion, indicating that these are no longer just crypto-native flows. In some ecosystems, stablecoins account for over half of all transaction value.

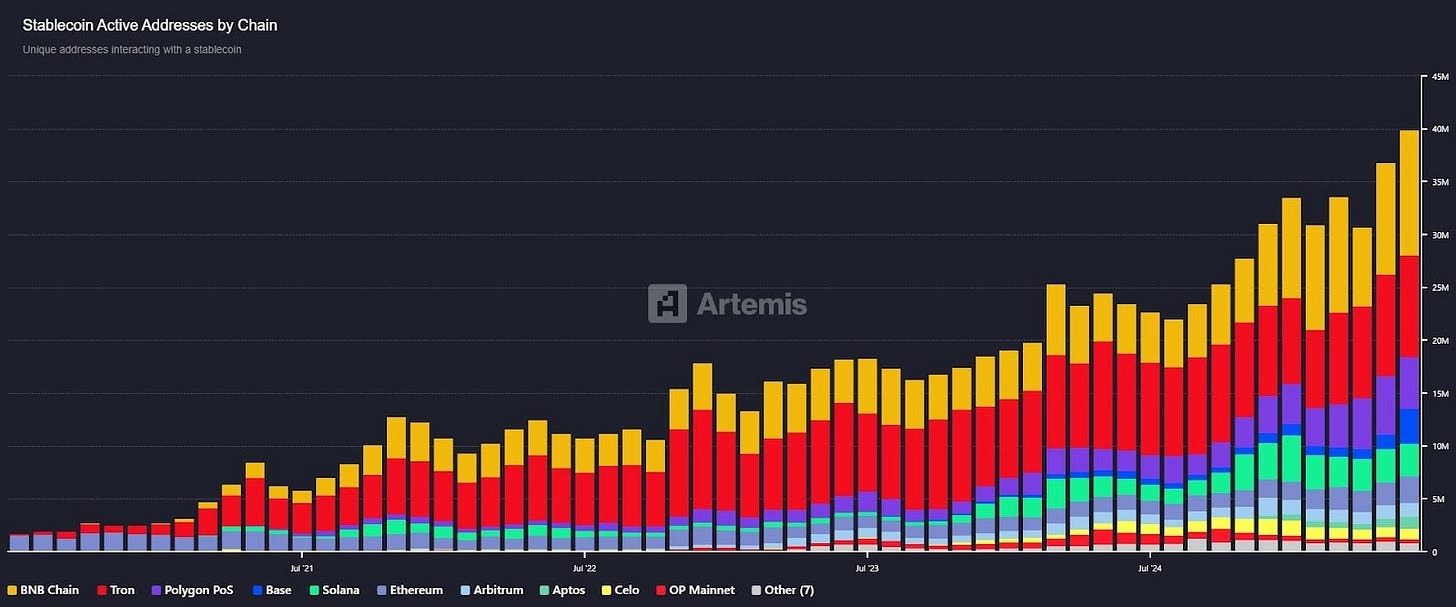

User Base Expansion

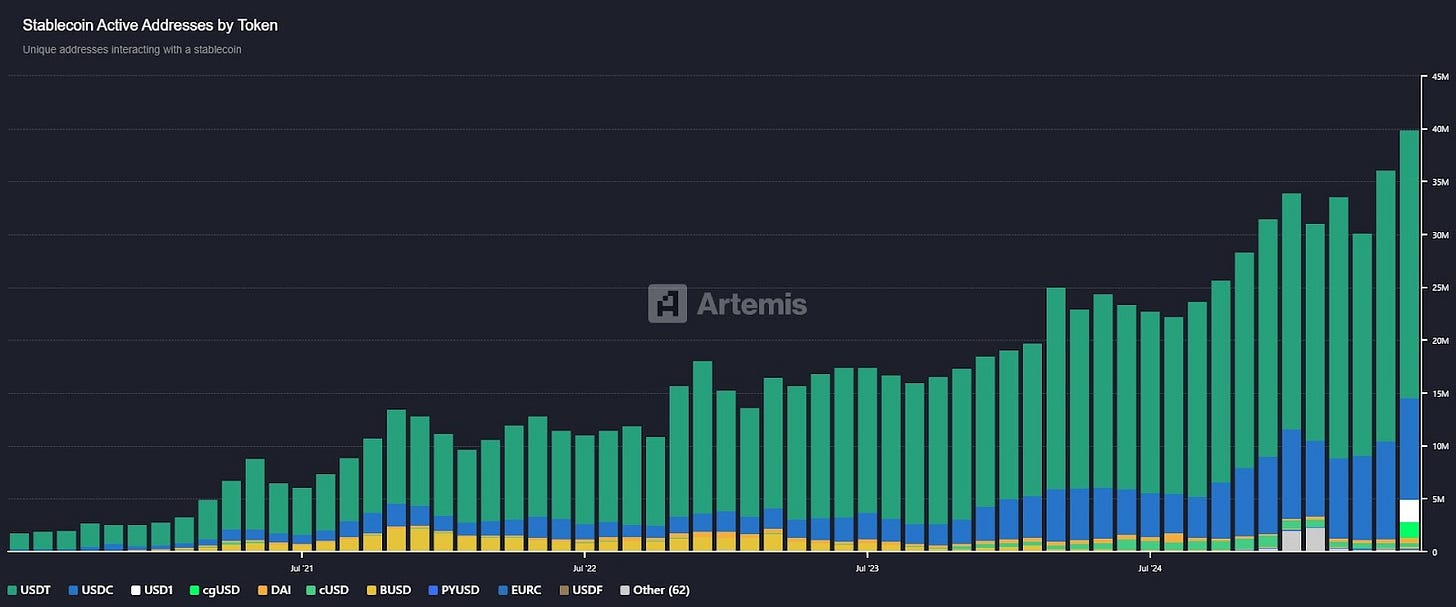

The number of active wallets jumped from ~20 million to ~40 million between mid-2024 and mid-2025. The total number of addresses holding any stablecoin balance has crossed 120 million. Growth here isn’t just about quantity but also reflects diversification. More small businesses, freelancers and remittance users are moving funds via stablecoins, often without interacting with broader crypto markets.

Institutional Integration

2024 was the year stablecoins became a treasury tool, not just for crypto firms, but increasingly for fintechs, asset managers, and some corporates. The rationale was simple: they offered a fast, programmable, dollar-denominated asset that could move across platforms 24/7 without relying on traditional banking rails. For companies operating across borders or in multiple time zones, this meant improved liquidity management, faster internal transfers, and fewer delays in settlement.

Seeing how interest rates remained elevated throughout much of 2024, holding idle cash in stablecoins like USDC also became more attractive. Many of these coins are backed by short-term Treasuries, and while users don't directly earn that yield, the reserve structure gives confidence that the underlying assets are high-quality and interest-bearing. For firms looking for a digital proxy to USD with reliable backing, stablecoins became a viable option.

This year, they’ve become more embedded in fintech architecture. Visa expanded USDC settlement to @Ethereum and @Solana. @Stripe and @PayPal brought stablecoins to consumer rails. Even banks began testing local-currency stablecoins, like Standard Chartered’s HKD coin, to explore faster cross-border settlements.

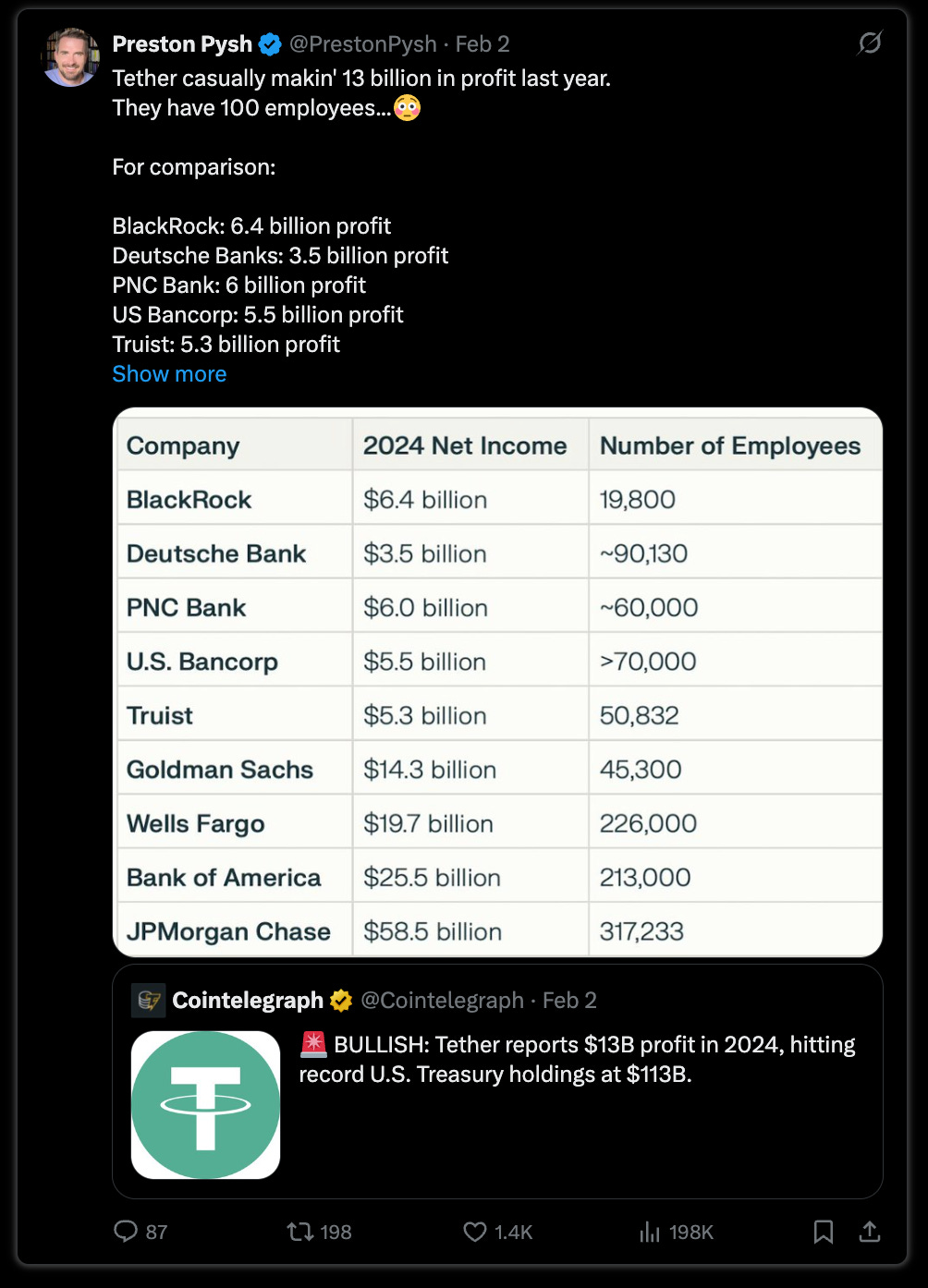

@Tether_to’s $13 billion in profit in 2024, which is more than double that of @BlackRock’s, underlined the financial significance of the reserve model. It proved that stablecoin issuers weren’t just supporting infrastructure; they were operating extremely profitable businesses. That profitability also translated into sustainability, reinforcing user trust and accelerating adoption across the broader financial sector.

Evolution of Stablecoin Types

Fiat-Backed Dominance

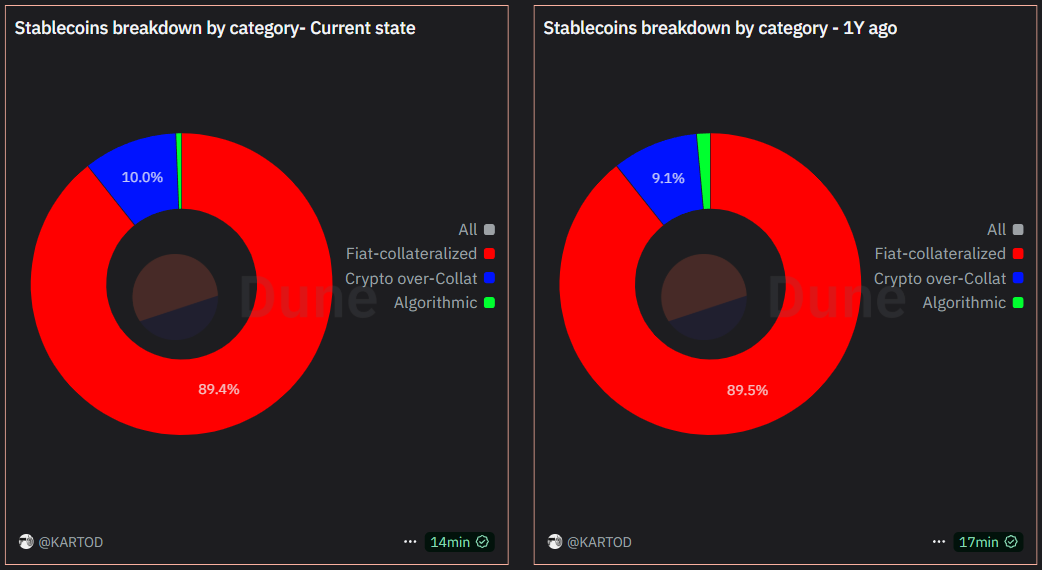

Fiat-backed stablecoins, those fully reserved with cash or short-term Treasuries, have grown from ~85% of the market in 2024 to over 90% currently. Tether ($USDT) increased its supply from ~$83 billion to ~$150 billion.

$USDC recovered from its 2023 dip to ~59 billion, reclaiming relevance among institutions. $PYUSD (PayPal), $USDP (Paxos) and others experienced modest adoption, but the real gains were concentrated among the top users. The preference for fully backed, transparent reserves is now ingrained in user expectations, although it comes with the tradeoff of centralised custody and regulatory exposure.

Crypto-Collateralised and Algorithmic Decline

Crypto-backed stablecoins, such as DAI, held steady, growing modestly in absolute terms (~$5 billion) but declining in market share. Protocols like @Aave (GHO) and @Curve_finance (crvUSD) added a few hundred million in circulation, but the real story here is that crypto-backed stables didn’t break out, nor did they break.

Algorithmic models, on the other hand, have basically disappeared. Following Terra’s collapse, designs that weren’t overcollateralized lost trust, with many, including @Fraxfinance, moving to a fully backed model in 2023. No new algorithmic entrant has gained any meaningful traction since.

Now, fiat-backed stablecoins dominate both usage and confidence. Crypto-backed coins are a small but functional niche. Algorithmic approaches, once seen as inevitable, have mostly exited the conversation.

The Rise of Yield-Generating Stablecoins

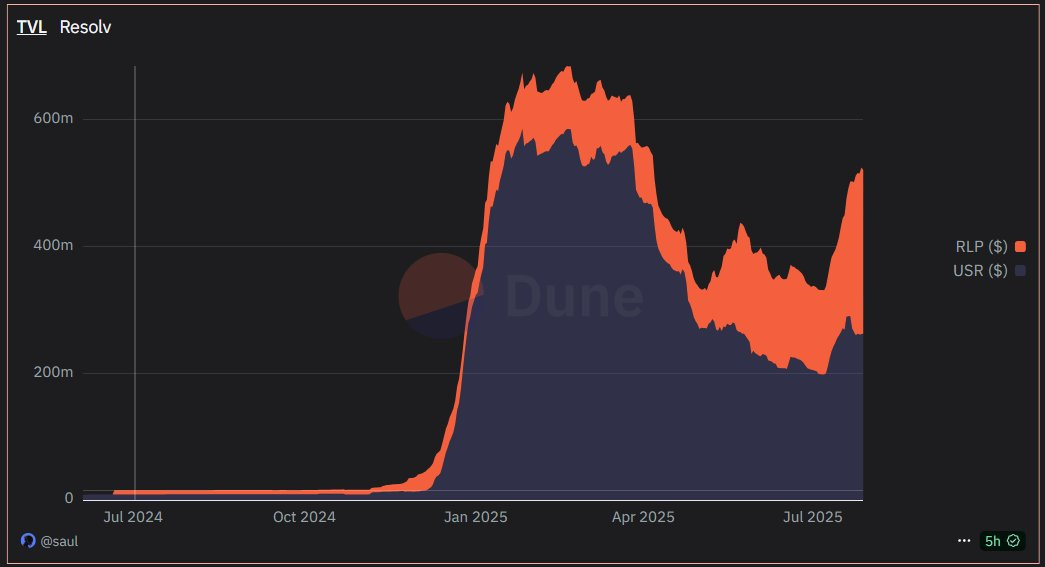

An emerging category worth watching in 2025 is yield-generating stablecoins, assets designed not just to hold value but to accrue it. Unlike traditional fiat-backed coins or overcollateralized models, these tokens explicitly integrate yield from real-world or on-chain strategies into their structure. Two notable examples are Ethena’s USDe and ResolvE’s USR.

’s USDe uses a delta-neutral strategy, pairing staked ETH collateral with perpetual short positions to maintain a peg while generating synthetic yield. That yield is passed on to holders through an additional token, sUSDe. The model attracted early attention for its composability, transparent yield mechanics, and ability to generate income without relying on centralised reserves. As of mid-2025, USDe’s supply is still small relative to the majors, but it's one of the few post-Terra experiments to gain meaningful adoption and maintain stability under stress.

@Resolvlabs, by contrast, ties yield to real-world yield-bearing assets, creating a structure closer to tokenised Treasuries but within a stablecoin wrapper.

$USR aims to maintain its peg while providing a stable yield through partnerships with off-chain credit and structured products. It’s a more institutional approach, and its adoption is concentrated in DeFi protocols and early-stage lending platforms.

These models are still experimental, and adoption is limited compared to fiat-backed incumbents. But they represent a clear trend: users don’t just want stability, they want passive yield, too. The challenge, as always, is maintaining transparency, peg stability, and regulatory clarity at the same time. If any of these elements waver, confidence erodes quickly.

Currently, yield-bearing stablecoins have carved out a niche. They aren’t replacing USDT or USDC, but they are expanding the design space, offering a more capital-efficient alternative for users who are willing to accept a different risk profile. Whether they can scale without inheriting the fragility of prior algo-stable attempts remains to be seen. But for now, they’re being taken more seriously than anything that’s come since the collapse of UST.

Regional Behaviour Shifts

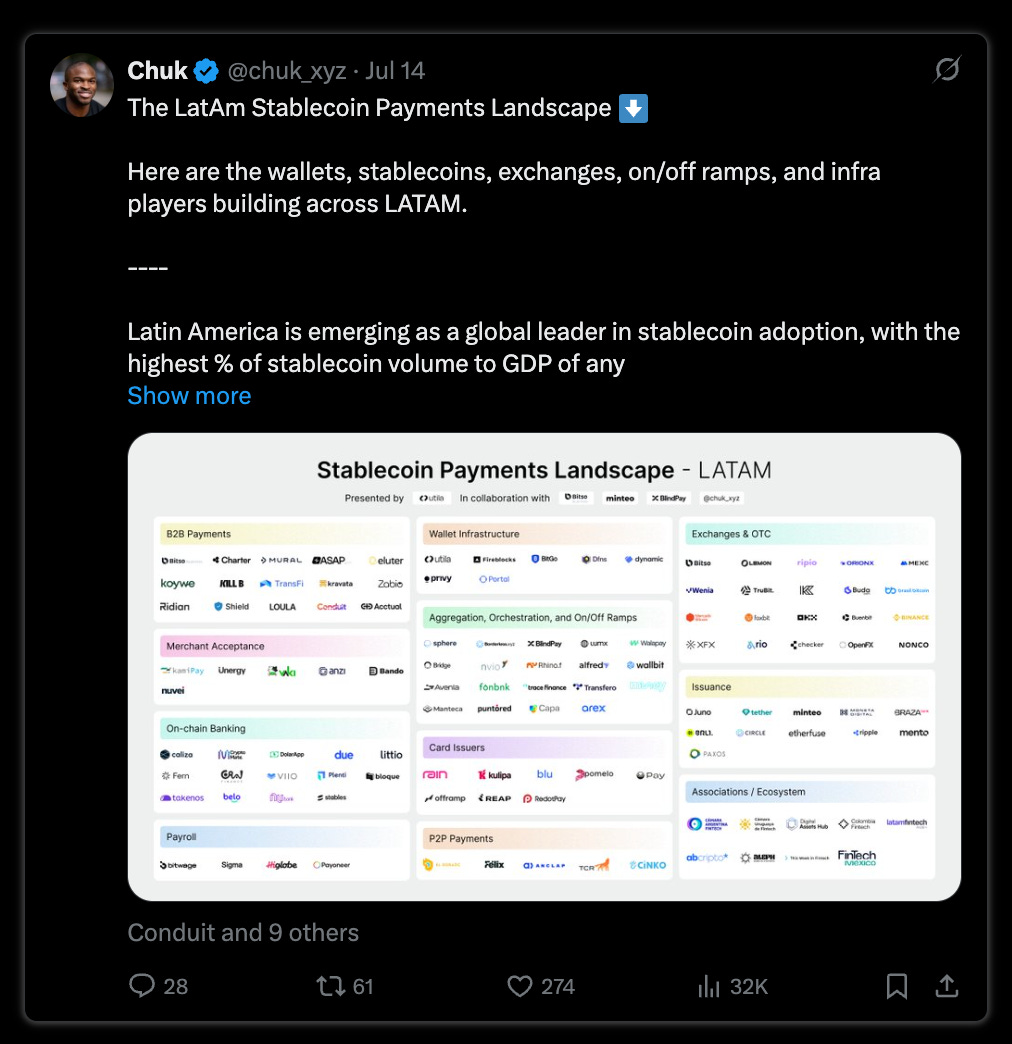

Emerging Markets: Latin America, Africa

Motivations: Stability and Dollar Access

In countries facing inflation and currency volatility, stablecoins increasingly serve as a digital dollar alternative. Argentina, Venezuela and Nigeria are examples. When local currencies dropped in 2024, demand for USDT surged. By 2025, holding digital dollars will be normalised behaviour for both individuals and merchants.

In Africa, where FX shortages affect over 70% of countries, stablecoins now bridge local economies to global capital. Nigerian exchanges commonly quote prices in USDT. Businesses pay overseas suppliers in stablecoins when banks can’t provide USD.

Remittances and Payments

Remittance corridors saw meaningful migration to stablecoins. In Latin America, crypto-based cross-border transfers rose over 40% in 2024. By 2025, apps like @Binance P2P and Airtm are the primary remittance tools for entire communities.

Sub-Saharan Africa saw a cost reduction of ~60% on average when sending $200 via stablecoins compared to traditional remittance rails. That’s not a marginal improvement; it’s a transformative impact and product-market fit

Preferred Platforms and Tokens

@Trondao remains the dominant chain for EM stablecoin activity due to low fees. Most informal and P2P markets use USDT on Tron. Binance Smart Chain and Solana have also gained market share, but Tron remains the default in many regions.

USDC is making inroads through fintech integrations, especially where regulatory scrutiny or institutional ties are a concern. Still, for grassroots adoption, USDT leads by far.

Regulatory Attitudes

Governments remain cautious. Brazil introduced digital asset regulations and is exploring a CBDC. South Africa is developing guidance specific to stablecoins. Most other EMs are still watching. There’s recognition of the utility, but also concern about dollarisation and capital flight. For now, usage is largely tolerated, especially when no alternative exists.

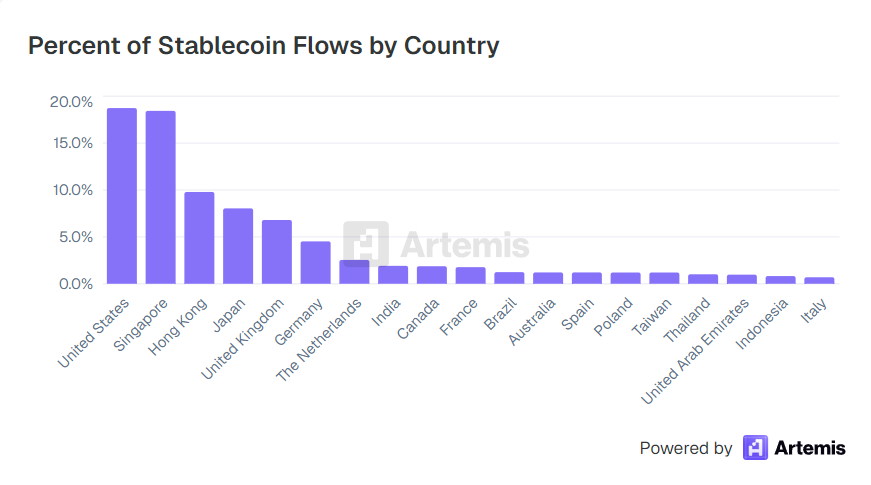

Asia: Mixed Trajectories by Region

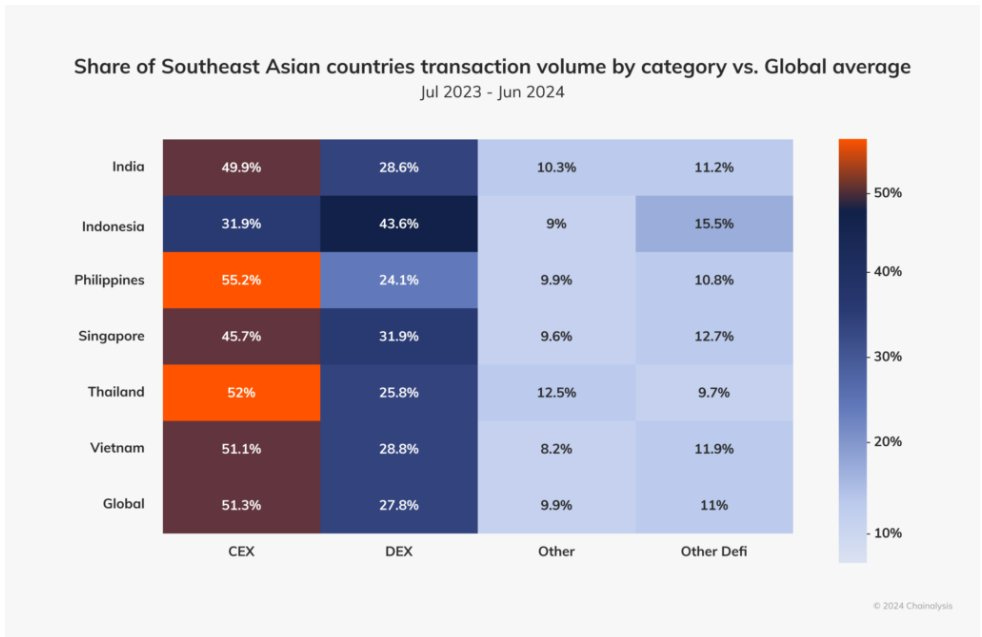

Southeast and South Asia

Stablecoin usage in Southeast Asia is less about inflation and more about access. In countries like the Philippines and Vietnam, remittances are a key driver. Workers abroad send home USDT or USDC via apps like Coins.ph or BloomX. In India, traders and freelancers utilise stablecoins to transfer funds between platforms or mitigate rupee slippage.

Vietnam continues to punch above its weight in retail crypto adoption. Singapore, meanwhile, is taking a more institutional route, granting stablecoin licenses and encouraging formalised issuance.

East Asia and Financial Hubs

Hong Kong and Singapore positioned themselves as regulated stablecoin hubs. MAS in Singapore implemented clear guidelines (reserve backing, redemption terms) by late 2024. By 2025, USDC and regional stablecoin issuers are seeking licenses there.

Japan allows banks to issue stablecoins under a legal framework established in 2023. A few Yen-pegged stablecoins are now live but remain niche. In South Korea, usage remains focused on trading due to strict regulations.

Mainland China remains officially closed to crypto, but USDT is widely used through OTC channels. Reports suggest massive off-the-books volume via Tether on Tron for capital flight and trade. It’s a persistent, though unofficial, dynamic.

Developed Markets: Integration, Not Replacement

Usage Patterns

In the US and Europe, stablecoins are rarely used for everyday purchases. Instead, they’re embedded behind the scenes in fintech stacks, corporate treasuries and cross-border settlements.

Companies use stablecoins to move funds between subsidiaries. Freelancers accept USDC for international work. Following the 2023 banking collapses, crypto firms now rely on stablecoins instead of ACH or SWIFT for fiat transactions.

Franklin Templeton’s onchain money market fund settles in USDC. Mastercard and MoneyGram have stablecoin-based services in production. These integrations hint at a complementary expansion of stablecoins within fintech, without complete replacement.

Regulatory Momentum

The EU’s MiCA framework took effect in mid-2024. By mid-2025, implementation is underway: non-euro stablecoins face daily cap rules and issuers are applying for licenses. The UK also passed legislation recognising stablecoins as digital settlement assets.

In the U.S., the GENIUS Act has passed recently, but its impact has yet to materialise. Previously, enforcement actions (e.g. BUSD’s decline) and market behaviour (concentration in USDC/USDT) show regulators are shaping the space indirectly, and that is changing. Stablecoins now account for over 1% of the M2 money supply, something Fed officials have started publicly acknowledging.

Key Comparisons: Mid-2024 vs Mid-2025

Conclusion: From Parallel Asset to Embedded Layer

Between July 2024 and July 2025, stablecoins crossed a line from being primarily a crypto-native utility to becoming a parallel financial system in their own right. In emerging markets, they’ve become a workaround to broken currencies and expensive banking. In developed ones, they’re being integrated into regulated, compliant workflows.

The structure of the market reflects that evolution. Fiat-backed stablecoins are dominant, with over 90% of market share. Algorithmic and unbacked models, once central to the “decentralisation” pitch, have mostly vanished. The use of stablecoins today is shaped more by utility and trust than by ideology.

The regulatory landscape hasn’t fully caught up, but it’s moving. And the institutions, banks, fintechs and payment giants are circling closer. Stablecoins, at this stage, are no longer a question of whether they will be regulated, but rather how they will be regulated and integrated by existing organisations, as well as how much value they’ll hold and where that value will flow.

It’s unlikely that stablecoins will replace fiat currencies outright, but in the sectors where traditional money fails after hours, across borders, or in economies with weak infrastructure, they’re already filling the gap.

What happens next will depend less on hype and more on continued utility, clear rules and whether the benefits can scale without compromising stability or transparency. But looking at the past year, the momentum is clear. Stablecoins have found their role. And it’s bigger than most expected.