It is an incredibly bullish week for this AI dispatch!

This week, Bitcoin has reached a new all-time high almost every day, sparking a wave of excitement across the entire ecosystem.

Notoriously, when BTC goes up, it sucks all of the liquidity for the market. However, this time the drivers for this increase might be attributed to a more structured institutional demand and a growing number of public companies (and countries) seeking to own BTC as part of their treasury.

So, this time might be different?

Can we expect BTC dominance to cool off for a bit and let the alts take over?

With legacy tokens such as Stellar and Cardano pumping, AI tokens are lagging behind.

While we have reclaimed our $10 billion resistance, tokens have bumped much less compared to, for instance, DeFi protocols or Layer 1s.

This also happens at a time when AI is still dominating in terms of mindshare.

This might be attributed to a couple reasons:

As a narrative, AI has come to rescue the sector at its deepest times, when trust was at an all time low. Back in December 2024, there was not much to do, and AI captured the industry’s mindshare.

After gathering initial traction, a myriad of AI projects has launched, flooding the market with often very underwhelming applications. This initial wave of AI projects is still live, some struggling to find PMF, some reinventing themselves, some finally going beyond the initial applications to focus on offering real value, through a seamless UI. This has diluted attention, liquidity and often resulted in many copycats and GPT wrappers. Nature is now slowly healing and the AI sector has to step up from hype to substance.

One of the projects that has been affected the most negatively is @Virtuals_io. Its Virgin flywheel seem to be struggling, as most tokens, even the most promising ones, have failed to gain tractions and their charts look down only.

ACP also has shown limited utility for the everyday users, with most agents being… underwhelming.

If you want to learn more about ACP, you should refer to this report by @fourpillarsfp:

How will these changes be taken into account?

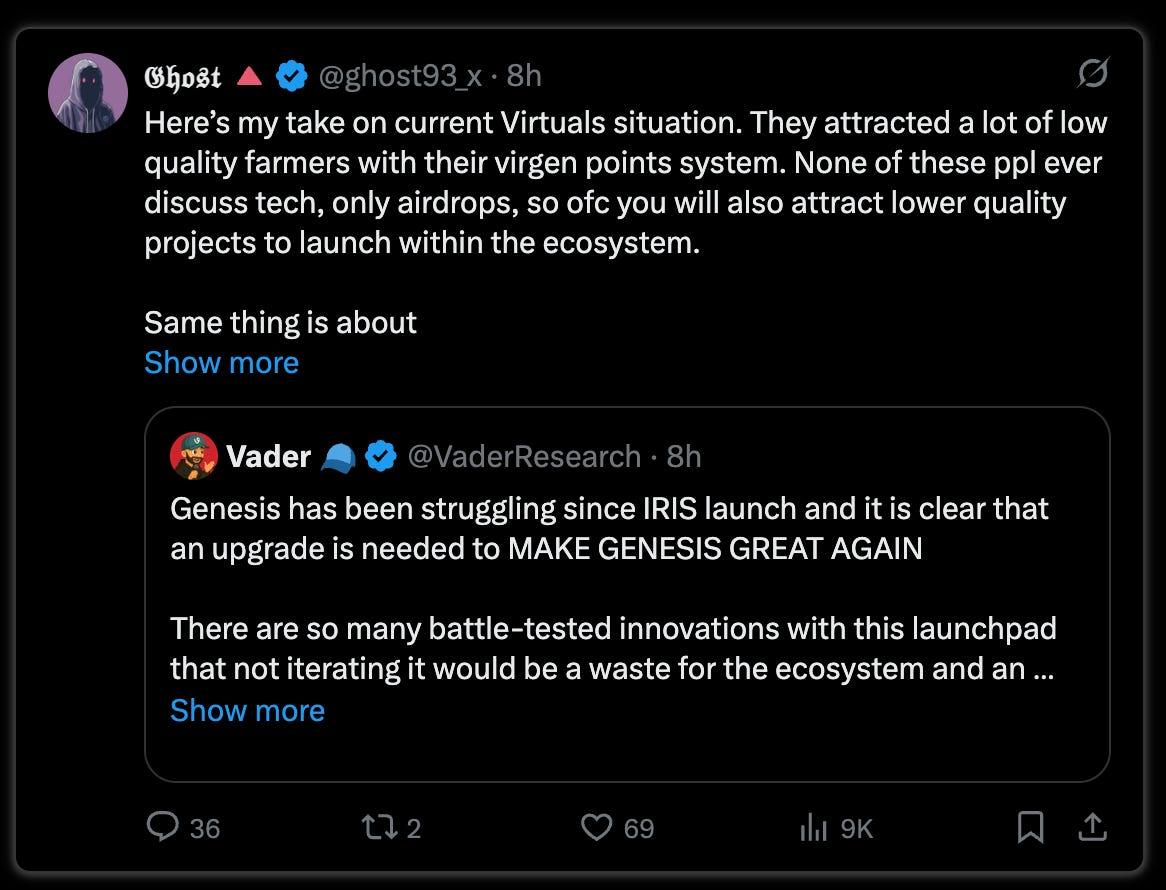

Many have shared their concerns with regard to Virtuals:

We’ll continue to observe how things evolve and whether any changes will be implemented in the upcoming weeks.

Virtuals needs to focus on quality and make sure to leverage the current trends, just as much as building a strong ecosystem. A couple good protocols can make the difference between a flourishing ecosystem and a short term spark.

Vader itself is not immune to criticism, with many suggesting refocusing the point program on quality, rather than post quantity.

Last but not least, Virtual is also facing increasing competition with CreatorBid Launchpad V2 just going live:

The first agents have already launched.

For today’s AI dispatch we have the pleasure to welcome @francxbt with an introduction to @Gizatechxyz, one of the best performers in the past couple months.

On @gizatechxyz: Autonomous AI Revolutionizing DeFi and Beyond

Giza platform has achieved extraordinary milestones in autonomous artificial intelligence (AI), demonstrating revolutionary potential across multiple verticals. With over 320 million in agentic volume generated (total volume generated on-chain by the swarm of agents, in the specific case of ARMA, refers to the sum of all deposit and withdrawal transaction volumes across all agents) and more than 33,000 active agents managing over $11.5 million in Assets under Agent (AUA), Giza is fundamentally reshaping how we interact with decentralized systems.

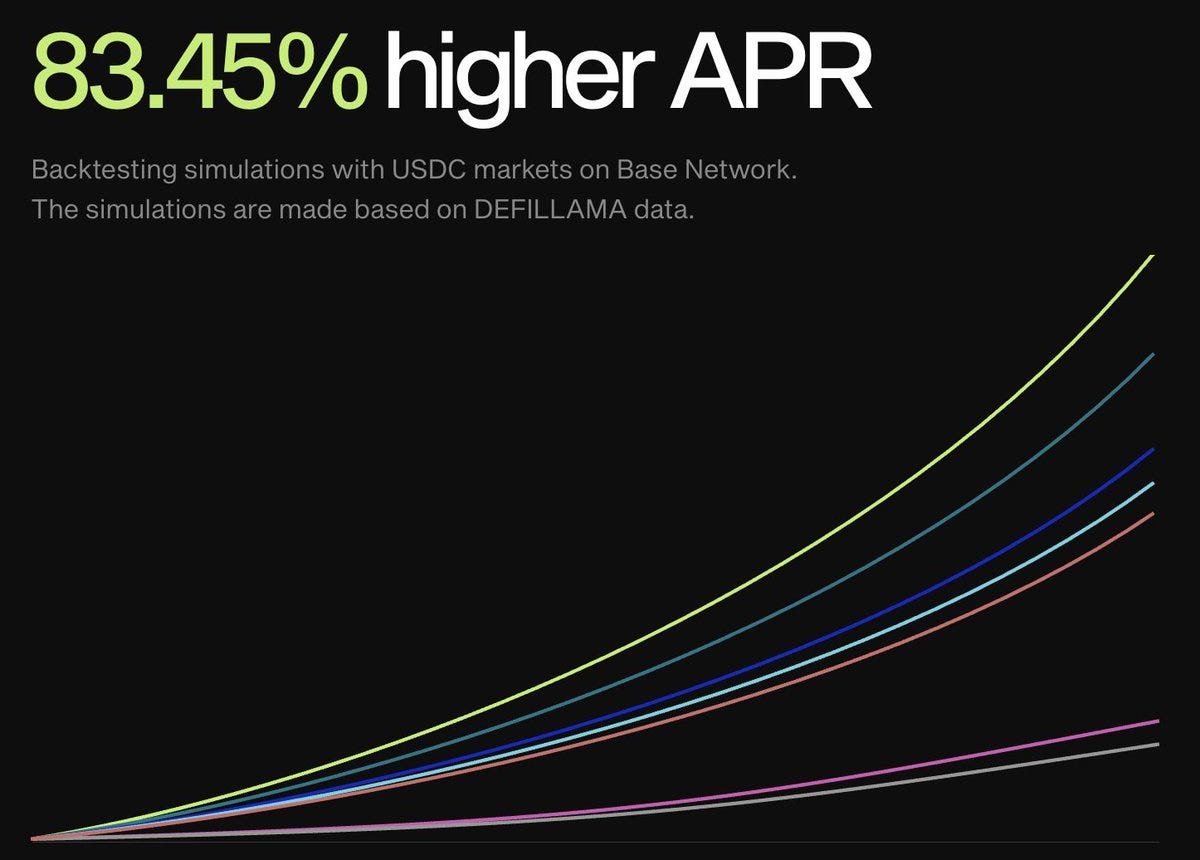

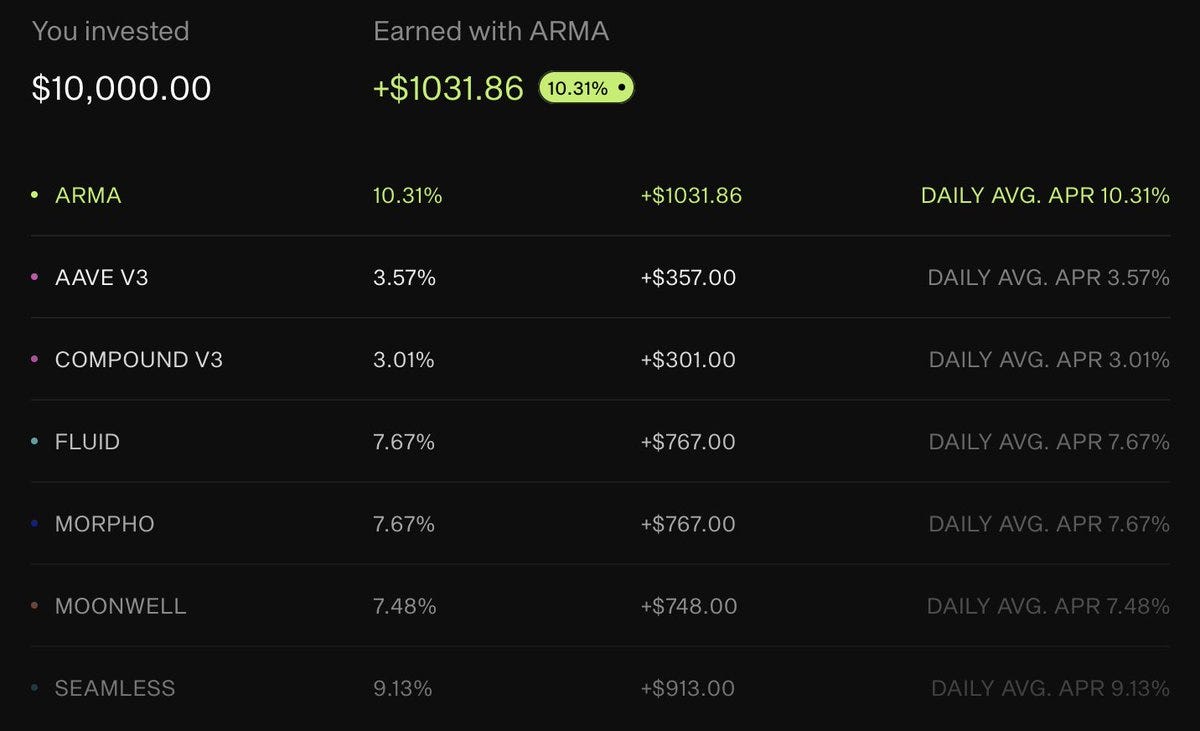

The platform has processed more than 200,000 autonomous transactions, with Giza agents delivering 83% higher yields than static positions through continuous market optimization across AAVE, Compound, Morpho, Fluid, Moonwell, Seamless, and Euler pools.

How are Giza agents able to outperform?

Intelligent automation that treats each protocol as a curve

Unique liquidity, fee, and utilization dynamics, moving beyond simple APR comparisons to incorporate modern portfolio theory.

With increased regulatory clarity, the growing institutional adoption represents a pivotal trend for the industry.

Re7 Capital, with over $550 million in assets under management, has chosen Giza agents for autonomous liquidity management, validating the effectiveness of self-driving capital in high-volume professional contexts.

Furthermore, the applications of these agents expand beyond finance: Giza has shipped Verifiable AI through zkML and the LuminAIR framework, integrating cryptographic proofs to ensure transparency and security. This innovation represents a fundamental step toward trustless and verifiable AI systems.

LuminAIR enables provers to cryptographically demonstrate that a computational graph has been executed correctly, while verifiers can validate these proofs with significantly fewer resources than re-executing the graph. This makes it ideal for applications where trustlessness and integrity are paramount, such as healthcare, finance, decentralized protocols, and verifiable agents.

In collaboration with Rekt News, Giza has pioneered cryptographically verifiable content recommendations, enabling users to independently verify that recommendations are authentically produced according to open-source algorithms.

The technical architecture combines @Succinctlabs zero-knowledge proofs with intuitive user interfaces, allowing real-time verification directly within browsers without compromising performance.

Active participation in ETHcc Cannes summits, focused on stablecoins, AI, and agents, confirms Giza's leadership role in the blockchain ecosystem. The integration of AI and DeFi promises to redefine the future of autonomous systems, with Giza spearheading transparent, accountable artificial intelligence that puts control back in users' hands. And this is just the beginning: more agents, more protocols, more chains, and more innovation are on the horizon. Join Giza in building a more transparent internet where algorithms serve users rather than hidden agendas, and where trust is earned through verifiable proof rather than corporate promises.

Weekly News Roundup

@cryptopunk7213 on China open sourcing AI before other countries:

@Messaricrypto on @Wardenprotocol:

How to find the best prompt? Easy, ask the AI:

Philosophy in the age of AI:

On Tether’s QVAC SDK:

On @TheoriqAI:

@AIOZnetwork AI image blending:

Everyone on CT is into $CODEC and robotics you should probably look up at least:

How to find alpha using @Nansen_ai:

Weekly Mode Updates:

Virtual agents spotlight:

Market dynamics of AI tokens:

Web2 AI:

on Google DeepMind:

Generative AI tech stack:

NVIDIA CEO on future role of AI:

Top AI papers:

Unique voices and AI content:

We hope you enjoyed this edition! Super insightful and full of things to go deep into.

See you next week bros