The AI Dispatch: Merry Virtuals, Robotics and a General Vibe Check

Welcome, welcome to another edition of the AI dispatch!

The year is almost coming to an end, giving us a good occasion to reflect on it.

For this reason, our last AI dispatch of the year (next week) will take the form of a yearly recap.

In the meantime, enjoy a roundup of everything happening in the last week.

Vibe Check

The vibes are…. gone! Man, 2025 was a tough year for everyone.

We started with such high promises for AI as an upcoming vertical, only to eventually end the year with the majority of projects either failing or close to an all-time low.

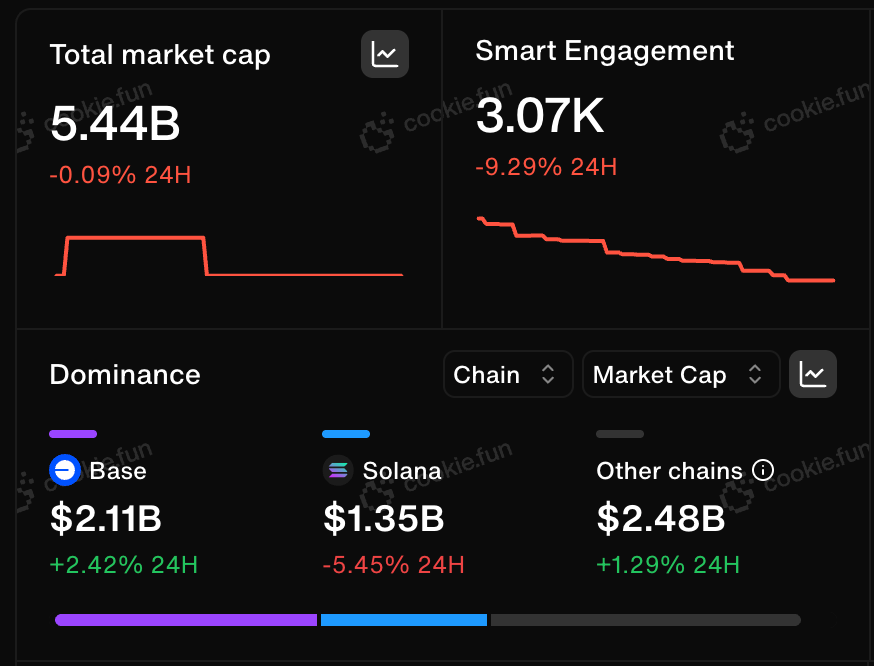

The whole AI agent sector is now worth $5.44b, for comparison, on January 3rd 2025 Virtuals was worth $4.61b.

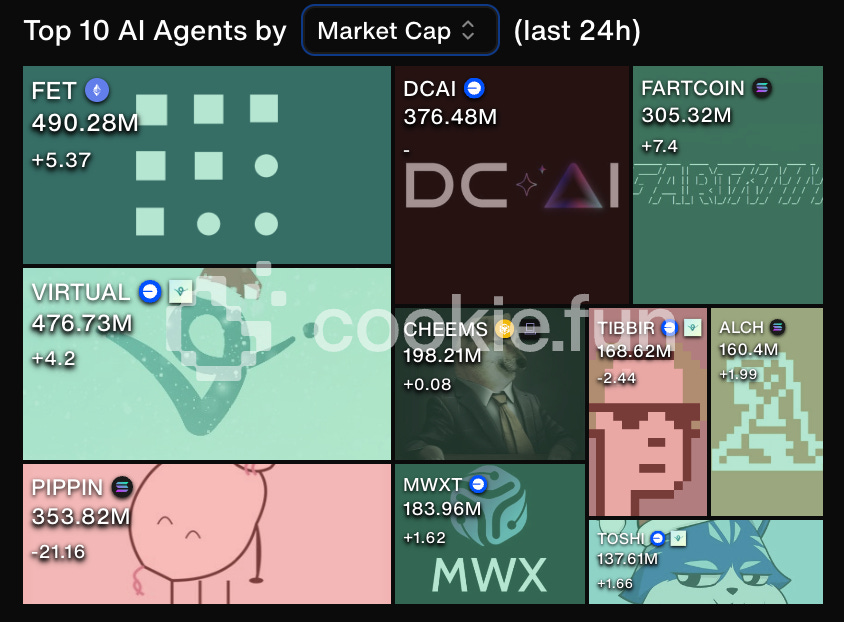

So who’s left? Here are the top 10 AI agents by marketcap:

Eventually, during the year, we’ve also slightly reframed AI as a whole. First, as the much-sought-after ally to give crypto reasoning and push their capacities to the extreme. However, it is increasingly becoming a competitor, both in terms of talent and liquidity.

Merry Virtuals!

This was quite the year for Virtuals, arguably one of the few names able to position at the frontier of AI while still very.. being alive at the end of this troubled year.

Virtuals found a dynamic home on Base. Since then, Virtuals and its ecosystems of tokens represent almost 10% of trading volume on the base chain (excluding stable and blue chips), and they are estimated to have brought over 53,554 unique users throughout 2025.

Quite the impact, considering Base’s immense volume of transactions.

One of the last events which further pushed these numbers is the launch of the x402 standard for agentic commerce. Since its launch, Virtuals has scored consistently among the top servers for x402 transfers, with over $1m in the last 2 weeks.

While Base seems to have momentarily established itself as the agentic chain, competition is intensifying.

For instance, Solana just purchased the x402 X handle.

Is something brewing?

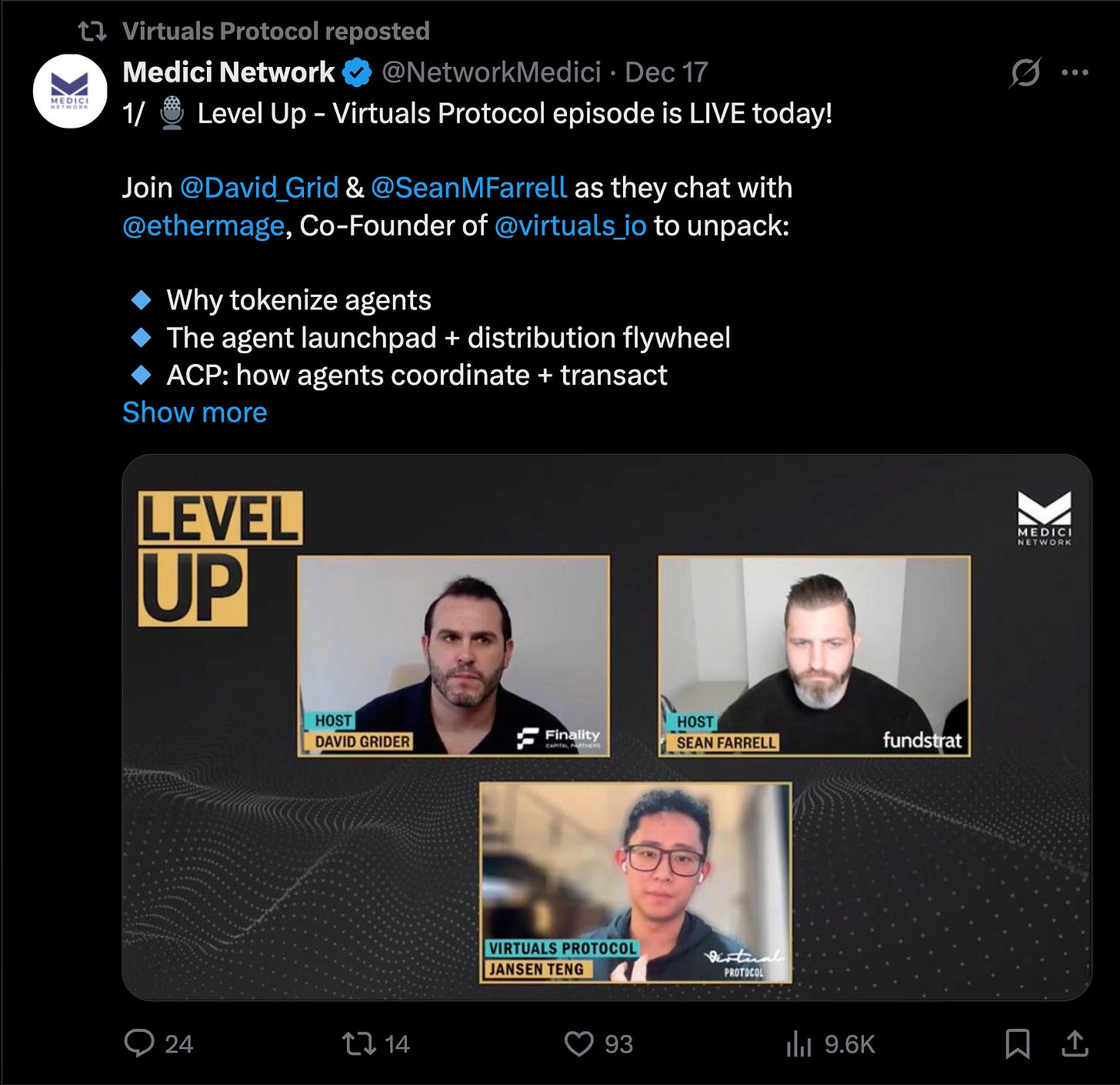

If you are interested in diving deeper into this and more, here’s a great podcast with one of Virtuals co co-founders:

One of the aspects of Virtual’s success is its fast pace to market and adaptability. Say any upcoming narrative, and Virtuals got it covered.

Last but not least, users can now access Prediction Markets directly on X through Butler, Virtuals AI agent living on X.

But we are not over yet with the Virtuals updates… one last one.

Most of you should already be familiar with xMaquina, as we have already written a couple of articles on them. The partnership gives Virtuals ecosystem participants a chance to participate in the xMaquina launch and its investments.

The concept of xMaquina is fairly interesting. Whether it is already too late to invest in robotics and crypto, people are just getting the last scraps of the table, or not, is probably another conversation, one which we will only answer in a couple of days.

For the moment, robotics stands as one of the most hyper verticals and one to watch.

Talking about robotics….

Codec Coded

Codec keeps shipping updates - and has also been more active on their X channel, sharing insights into their work and long-term vision.

For many, these robotics companies seem fairly abstract in what they are trying to achieve, closing this gap even for the laziest users is incredibly important to build a foundation for the narrative.

For those who have missed the update, here’s a great recap:

Read the full article:

Here is quite an interesting conversation between VaderResearch and the cofounder of Coded on his vision:

Now onto other news all around!

Weekly AI-lights

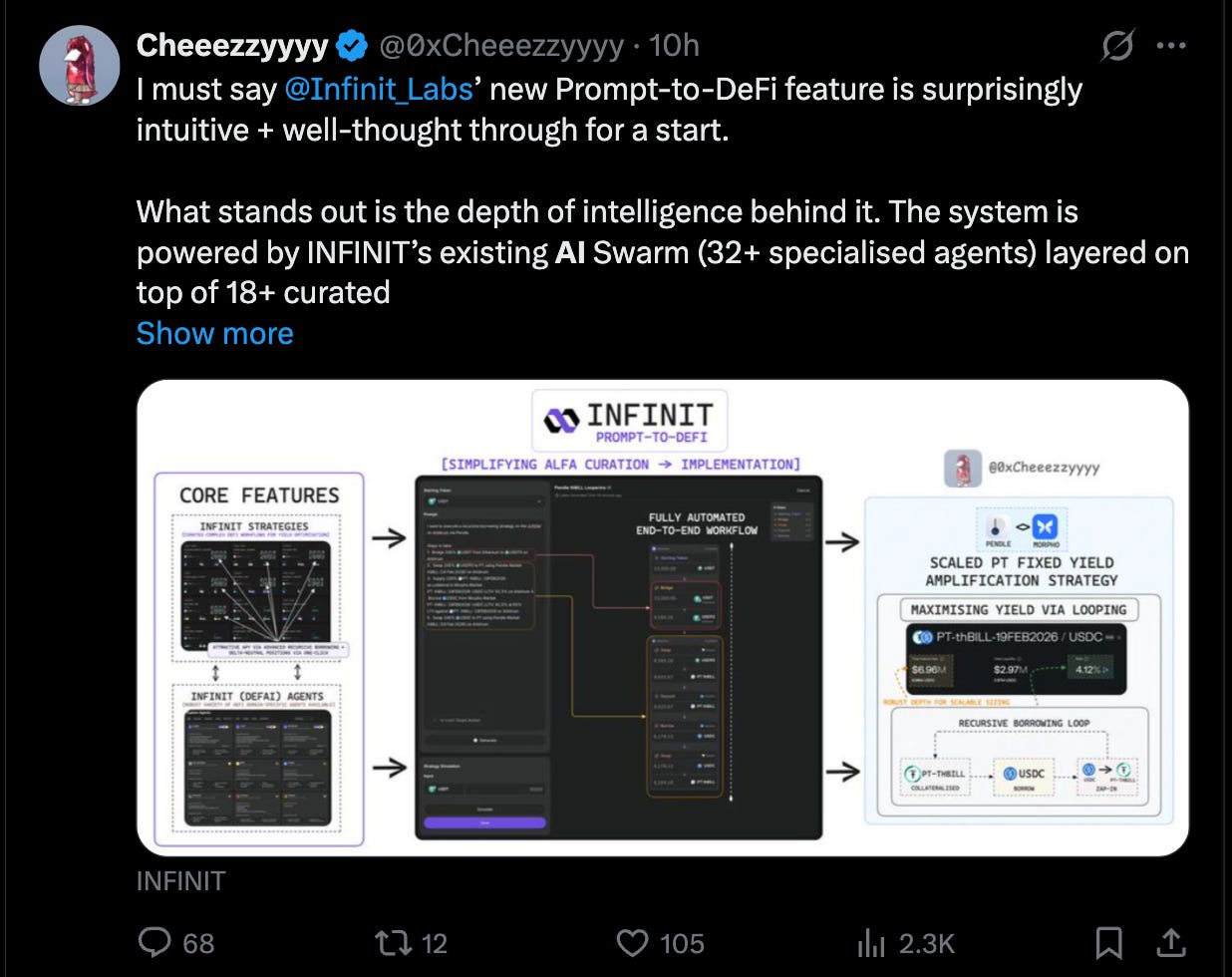

On Infinit Labs’ new Prompt-to-DeFi feature

Are AI chips getting commoditised? And how is this going to affect giants such as NVDA? Within all this talk about the AI bubble, it’s incredibly important to keep in touch with everything happening in the market beyond crypto.

FetchAI end-of-year recap:

Looks like Open AI is going to raise again - this time one of our favourites, Jim Cramer, puts down the hypothesis of a $200b raise at a… Trillion dollar valuation.

You know what time it is…

Short edition this week!

Stay tuned for next week’s recap, and bring your tissues.

byebye