The Castle Chronicle: Analysing the Strongest Narratives, is Morpho V2 the next Big Thing for DeFi?

PLUS: Filling you in on the latest AI Agents Drama on Arbitrum

Welcome to Edition 125 of The Castle Chronicle!

CT is always entertaining, even when summer arrives and most people are posting less than usual.

Here’s what we have for you today:

🔍 Market Watch - Price action & Relevant metrics across sectors and assets

🍐 CL’s Corner - The latest Arbitrum AI Agents Drama

🧙♂️ Matt’s Corner - What’s Morpho V2’s Value for DeFi

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads - The best reads from the best researchers on CT

ETHMilan announced IRL prizes for top voices on their CookieDAO dashboard. Snap about the conference and meet builders and degens in Milan on June 24th, you have only one week left!

Castle Labs is an official Media Partner of ETHMilan 2025, and we secured an exclusive 25% discount on tickets for the event for the Castle community.

Don’t lose the opportunity to meet Arbitrum builders and degens in Milan, see you there!

🔍 Market Watch

Gm frens! It’s been quite an uneventful few weeks. BTC started showing some promise and then ended up consolidating for 4 weeks. The expectation is still very bullish, though.

Price Action

After BTC reached new ATHs at around 110,000$ price distributed and failed its momentum cycle. The instant expectation was to see an accumulation schematic form, confirmed by a bullish breakout forming a new bullish momentum cycle.

Currently, we see BTC re-accumulating above the rising 10/20 EMA, and the expectation is bullish continuation towards new ATHs.

Top Performers

During periods of consolidation, I like to zoom out as far as I can to see the overall picture. CoinMarketCap allows me to look at 24h, 7d, 30d, and 90d charts. So let’s sort by the strongest 90d % performance and see what’s going on.

I’m always looking for impulsivity as one of the main indicators of strength. Strong moves in the trend direction and shallow pullbacks - that’s the stuff! Such charts give me confidence that whatever demand is buying these assets up will likely continue to do so.

In the TOP 5, we can see an interesting mix.

3 out of 5 are memecoins - clearly, this category is a heavily demanded one.

Then we got $HYPE - a spot/perp DEX

And lastly, $VIRTUALS - an AI Agent protocol

This is useful information because it tells us more than just which individual coins are in demand. It provides a clearer picture of the types of assets or narratives that have been the strongest in the past quarter. We can then use this knowledge to identify possible beta plays related to the strongest performers.

Narrative Performance

Since we took a look at the 90d top performance this time, let’s do the same for the narratives.

Social-Fi and InfoFi - This is still a very small narrative led by a few coins like $KAITO, $COOKIE, and $ARENA.

ICM - Also a small narrative with just a couple of bigger coins like $VINE, and $JELLYJELLY

Sweet spot - This is a weird mix of all kinds of coins and doesn’t give us any relevant information at all; therefore, I’m not paying attention to it.

Lending - Has been performing surprisingly well. Especially $SYRUP, $MAKER, and $AAVE

Memecoins - Have been killing it with strong performers like $MOODENG, $SPX etc.

By analyzing the 90d best performers and 90d narrative performance, we can draw a few conclusions

Memecoins - These crypto-exclusive assets have proven to be extremely in demand and capable of reaching astronomical market caps.

AI-Agents - A consistently strong narrative that hits an interesting intersection of crypto x AI

DeFi - Some DeFi is still high in demand, especially lending protocols

This information allows us to understand what the most demanded assets are and where it makes sense to look for investment/trading opportunities. I hope you’ll find it useful.

Remember to always risk responsibly, and I’ll see y’all next time!

Courtesy of 0x_Vlad - trend-based trader and MentFX student

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

🍐 CL’s Corner: On the Arbitrum AI Agents Drama

Not sure if you’ve heard about what I call the “Arbitrum AI Agent drama”, but let me explain it briefly to you an0n, you’ll enjoy this.

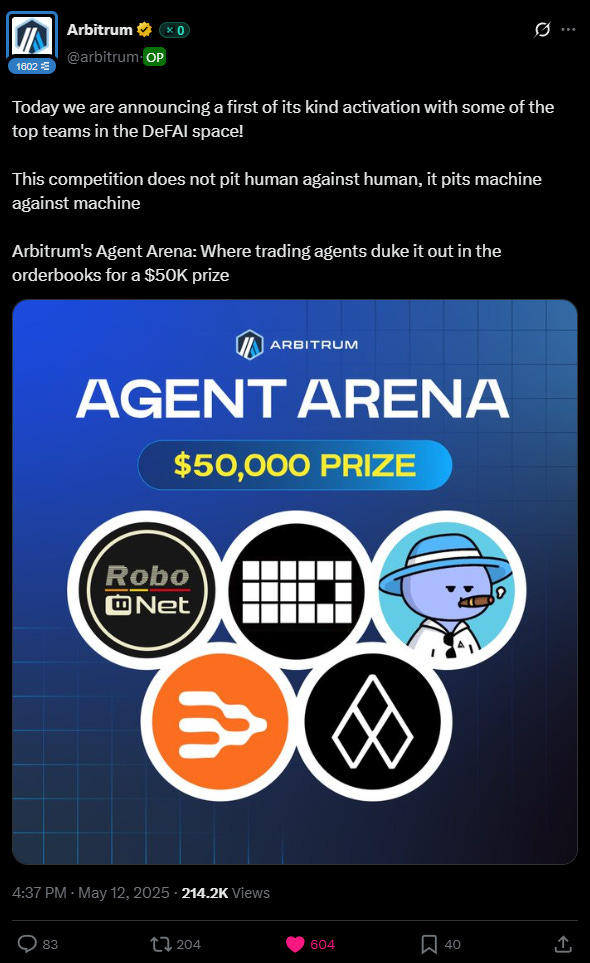

This competition was launched on May 12th and ran until June 11th, with the goal of showcasing different AI Agents trading on Arbitrum and having them compete to see which one would yield the highest ROI (Return on Investment).

Agent Arena Documentation

The rules were simple & relatively straightforward:

The five different teams participating in this competition were:

Each AI agent started with 10k USD and had the possibility to execute trades on ANY DEX as long as it was producing TX on Arbitrum One.

On the 11th of June, this was the outcome:

As we can see, only Kudai & BigTony agents were actually profitable. Then something a lil strange happened.

Basically, the least profitable AI Agent won the 50k usd prize.

In my book, if you lose the most money among all, you should not be winning….

I tried to find an explanation for this but I did not yet. Think the only logical one is that they would be considering fees paid in the PNL, which could cause discrepancy.

In conclusion

1) AI agents are not there YET to replace our everyday trad00r.

2) Some people giving AI grants need to check on how they calculate closed PNL.

Have a good one!

Courtesy of CL

🧙♂️ Matt’s Corner: What is Morpho V2’s Value for DeFi?

In the article “The Price of Trust,” the Morpho team explained that every type of loan can be priced, and that over/under-collateralisation should not determine whether a loan should be issued, but rather adjust the trust assumptions to modify the loan conditions.

While I completely agree with their arguments, trust becomes valuable only when there are measures to quantify it and enforce repayments in the event of liquidation.

Based on the aforementioned premise, Morpho launched its V2, enabling flexible loan agreements, cross-chain and exotic token collateral, and market-driven rates.

But before diving into V2, let’s recap what Morpho is and how we got here.

History of Successes and Big Figures

Morpho was initially launched as an Aave and Compound optimizer. By matching lenders and borrowers peer-to-peer, Morpho Optimizer improved capital efficiency and offered users better rates.

Despite its success (ATH of $1.5B TVL), the growth limitations of being only a percentage of the protocols it optimized, along with the dependency on third-party protocols for its future, led the team to realize this was not the right path. As a result, they decided to pivot.

They launched Morpho V1 (Blue), a new lending protocol based on lending vaults, which allow for the deposit of a single asset into a diversified market. Curators could run strategies within these vaults, offering higher yields and unique opportunities.

This version was the real breakthrough:

Morpho V1 reached $6B in total deposits in just over a year.

More than 15 active curators were involved.

Tens of markets were deployed across over 18 chains.

It became the first protocol directly integrated by a major enterprise like Coinbase, which now issues over $300M in Bitcoin-backed loans. Multiple other leading distributors, including Trust Wallet, Binance Wallet, Safe, and Ledger, use Morpho to power their earn products.

However, this wasn’t enough to fulfill the Morpho team’s mission to price every loan, which is why they launched Morpho V2.

Introducing Morpho V2

Morpho V2 is an intent-based lending platform designed to realize this vision. It consists of two core components: Morpho Markets V2 and Morpho Vaults V2.

Initially, the system is intended to facilitate fixed-rate, fixed-term loans with customizable parameters, but it can be extended to support other loan types.

Morpho V2 should follow these precise guidelines:

Creating an open and competitive market, ensuring competitiveness and incentive alignment.

Enabling lenders' and borrowers' intent without fragmenting liquidity.

Minimizing trust assumptions among users.

Acting as a piggybank for existing liquidity, allowing users to enjoy the benefits of V1 or other protocols while waiting for a loan offer to be matched on Markets V2.

This is meant to be a step further for Morpho to achieve its mission, and the announcement sounded very bullish to me, but let’s now dive into V2's features.

Design and Features

Morpho V2 has been designed to be compatible with its V1, providing instant liquidity for withdrawals and variable yields, with different strategies and flexibility across chains and assets.

The new version introduces a wide range of key features and changes:

Offered liquidity becomes more flexible: Lenders will no longer have their liquidity locked into a specific market or condition. They can offer the same liquidity simultaneously across multiple conditions, enabling lending against unlimited collateral assets, multiple oracles, and optional whitelists without liquidity fragmentation or the need to bootstrap a market.

Market-driven pricing: There are no more formulas to determine rates. Lenders and borrowers can make offers with a specific price and rate they expect from the loan. This approach is somewhat similar to Liquity V2, a protocol where users can mint the overcollateralized stablecoin BOLD on their own terms.

Wide range of collaterals for loans: Users can use entire portfolios and niche assets as collateral for their loans. They will also be able to specify multiple oracles, LLTVs, and other terms.

Fixed and variable rates: Morpho V2 unlocks loans with fixed rates in addition to variable ones.

On-chain compliance: Depositing in compliant pools on Morpho V2 does not fragment liquidity. KYC and non-KYC lenders can coexist within the same market. This is very important for institutions, which prefer deep and liquid markets over fragmented or isolated ones.

Cross-chain compatibility: Liquidity is no longer fragmented across different chains. Lenders can choose which chains to offer their loans on, and borrowers can decide where to settle.

Morpho V2 is designed to complement, not replace, Morpho V1. Together, they create an ecosystem where users can choose their preferred approach without compromise.

What This Means for DeFi

What we all want from DeFi is programmability. We need an ecosystem that is flexible and can accommodate everyone’s requests without relying on middlemen, only on trustless systems and contracts.

Morpho V2 aims to be that programmable layer in DeFi that unlocks fixed rates at scale, compliance without liquidity constraints, cross-chain functionality without fragmentation, and multi-asset collateralization.

This is a major step for institutional adoption as well, since every fund or company has its own needs, and one-size-fits-all solutions like Aave might not be suitable for most of them, unless they want to diversify and build more complex strategies involving multiple protocols. Having full control over rates, loan conditions, and risk parameters is a significant advantage for funds, and I say this based on multiple discussions and involvement in various deals. Their focus is on risk mitigation and flexibility, and Morpho V2 might be a very appealing tool for them.

While this product is still being audited, I am genuinely curious to see the traction it will gain in the community and whether we will finally witness these steps forward in action.

See you next week, fellas. defi.

Courtesy of Matt

🏰 Castle Reads

“Revenue: The Missing Piece for Crypto PMF”, by @0xmars_:

“Maple Finance: The Future of Institutional Asset Management is Onchain”, by @defi_gaz:

“My First Quarter Managing a $1.5M Grant Program on Arbitrum”, by @chilla_ct:

📖 Recommended Reads

A valuation framework for $PUMP, by @defi_monk:

Full breakdown of the Stripe’s acquisition of Privy, by @chuck_xyz:

“Tokenising Thin Air: The Stablecoin Yield Flywheel”, by @mugglesect:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.