The Castle Chronicle: Bitcoin is Heading towards a New ATH, Ethena's Master Plan Explained

PLUS: Why you Must Pay Attention to Hyperliquid Tickers

Welcome to Edition 124 of The Castle Chronicle!

This was a busy week in crypto and we are ready to condense it in a new issue.

Here’s what we have for you today:

🔍 Market Watch - Price action & Relevant metrics across sectors and assets

🔬 Research Corner - Why you must pay attention to Hyperliquid Tickers

🏛️ Fundamentals Corner - Diving into Ethena’s Master Plan

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads - The best reads from the best researchers on CT

ETHMilan announced IRL prizes for top voices on their CookieDAO dashboard. Snap about the conference and meet builders and degens in Milan on June 24th!

Castle Labs is an official Media Partner of ETHMilan 2025, and we secured an exclusive 25% discount on tickets for the event for the Castle community.

Don’t lose the opportunity to meet Arbitrum builders and degens in Milan, see you there!

🔍 Market Watch

Gm frens! Last week, BTC lost its momentum cycle, at which point I expected a period of sideways price action followed by a strong breakout. Well, that’s exactly what happened, and we are so back!

Price Action

Whenever a momentum cycle in a good context fails, the instant assumption should be re-accumulation.

Here we can see a very strong trend that failed on the 3rd anticipated re-accumulation and flushed towards to 50 EMA, where it went sideways for a while. At that point, we wait for new demand to enter the market, and with that, a fresh new momentum cycle starts.

So far, BTC is doing exactly what every textbook continuation does, which is why I’m expecting new ATHs.

Top Performers

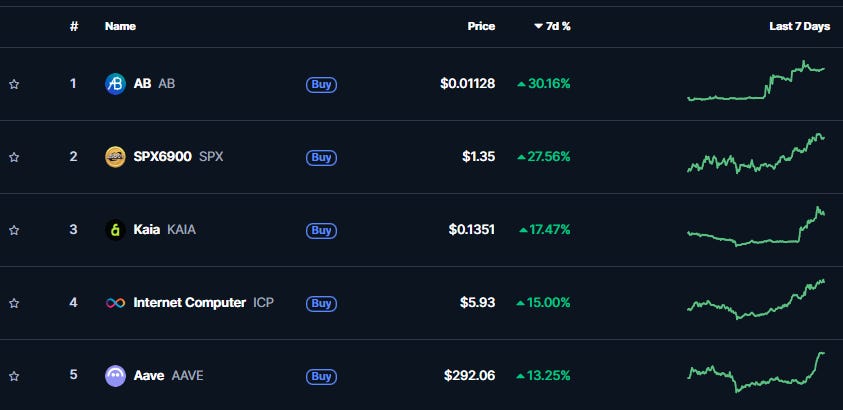

BTC is now in a prime context for continuation, therefore, it makes sense to look for relatively stronger performers. Looking at the top performers this week, we can see a weird mix of many newcomers, but amongst them is one that we’ve seen many times before - SPX6900.

Taking a look at the chart, we can see a very clear accumulation schematic that broke out into a strong ongoing momentum cycle. So as long as this momentum cycle holds, SPX6900 is ready to be followed on the lower timeframes.

Once price breaks down, we can once again assume re-accumulation and wait for new demand to show up and trade long with it.

It’s good to pay attention to the best performers to slowly curate a watchlist of assets that are most in demand, both during periods of bullishness and bearishness. Because chances are, they will continue to be demanded.

Narrative Performance

Overall, I don’t see any crazy narratives forming right now. Social-Fi is leading the charge with a close to 20% overall gain, mainly being carried by $ARENA. It’s important to keep in mind that this is still a very small narrative with only a few other legit contenders - $KAITO, $COOKIE, and $LOUD.

But perhaps that’s exactly where we should pay attention, as narratives these days are over before you even notice them lol.

No matter the context and no matter the asset, remember to always risk responsibly, and I’ll see y’all next time!

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

Courtesy of 0x_Vlad - trend-based trader and MentFX student

🔬 Research Corner: Why you must pay attention to Hyperliquid Tickers

If most of the fame about Hyperliquid is around its perpetuals products, I believe that its spot orderbook component will soon become of the hottest exchange for project to list their tokens.

Protocols interested in having a ticker on the Hypercore spot orderbook need to bid the desired ticker with HYPE token via a Dutch Auction and each ticker is unique.

Instead of having shady CEXs asking for undisclosed USDT amounts + treasury tokens to list a ticker, everything is now 100% transparent and brings value to HYPE holders.

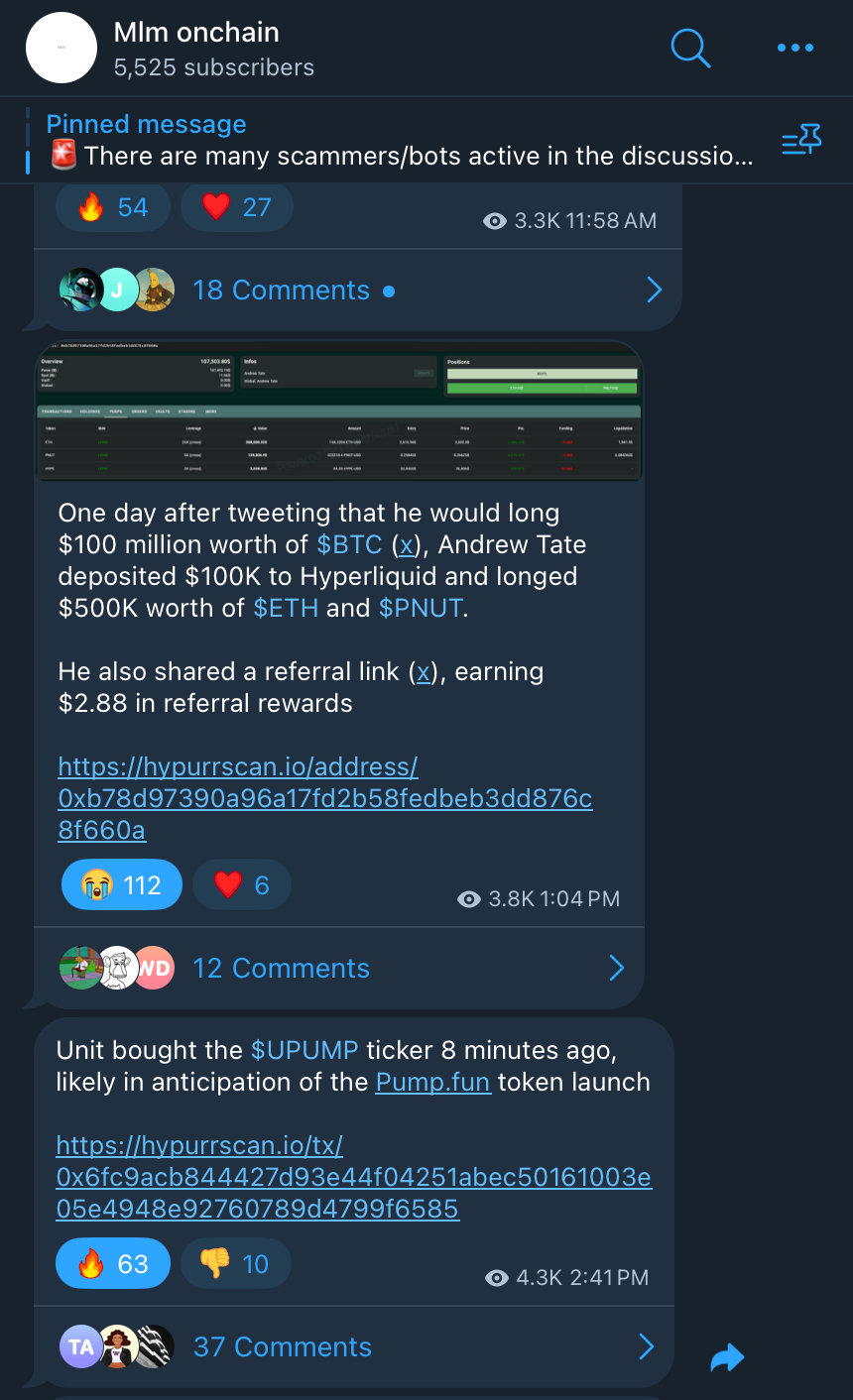

More and more projects from different ecosystems have been acquiring their own ticker on the Orderbook. Tickers don’t have to start trading immediately once projects buy them, they can wait for the timing they desire.

And with its native bridge, Hyperunit, securing close to $335M in crypto assets, there is now serious liquidity on the HL spot orderbook for $BTC, $ETH & $SOL.

Another reason im very bullish on everything HL spot? Simply because it’s one of the cheapest venue to trade on.

A fairer and cheaper spot market, that puts the users and the community first before the big CEX and their market markers.

We Like this Story but…

Be sure that Binance and other big CEXs won’t let this market slip out of their centralized hands so easily. We can expect some pushback and some rebates programs that will try to lure in the traders and liquid funds to keep their volume on CEXs.

In the meantime, It will be fun to keep an eye on the bidding wars for tickers on the Hypercore spot orderbook. Different projects could be tempted to scoop tickers of others protocols to gain some form of leverage over them. An interesting Game Theory to be watched.

On this, have a great week y’all.

Courtesy of CL

🏛️ Fundamentals Corner: Ethena’s Domain Expansion

Every anime fan here has surely caught the reference to Jujutsu Kaisen’s Domain Expansion, a technique used by characters in this Japanese animated series to extend their reach and increase their power by dragging their foe into a magical zone.

This is essentially what Ethena is doing with the crypto market and beyond: siphoning liquidity into its instruments by attracting chains, asset managers, and protocols within its reach. They are adopting an approach similar to that of major stablecoin players, but in a different manner.

In this piece, I will analyse Ethena’s latest moves and contextualise them within their master plan: Convergence.

Ethena’s Reach is Wild

@gdog97_, in its “Convergence” article posted at the beginning of 2025, outlined the insane opportunity and master plan Ethena has to take over the entire crypto space and beyond.

Since then, things started moving faster:

USDe landed on Aptos, BNB Chain, TON, and HyperEVM.

Ethena launched its DEX, Ethereal, which is powered by USDe and accumulated over $1.1B in pre-deposits in just three months, with current deposits still above $700M.

The lending protocol Spark welcomed $1.1B in USDe and sUSDe on its platform to bootstrap its liquidity layer.

Securitize, one of the largest institutional RWA issuers, partnered with Ethena, Arbitrum, and Celestia to launch Converge, a chain designed to onboard institutional capital into RWAs and stablecoins, powered by sENA, USDe, USDtb, and other assets.

Major exchanges such as ByBit and Deribit onboarded USDe as collateral for derivatives.

Plasma, the stablecoin payments chain that recently raised capital from the community at a $500M valuation, will natively integrate USDe.

What’s Going On Under the Hood

These are just the major integrations and headlines around Ethena, while much more can be observed through on-chain data.

For example, although USDe struggled to maintain rapid growth after the first ENA airdrop, USDtb, its institutional counterpart backed by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), has grown from under $100M in March 2025 to the current $1.45B.

USDe has also strongly rebounded since May 2025, rising from $4.7B to $5.9B, indicating renewed demand for Ethena’s flagship product. The staking ratio and sUSDe’s APY also increased from their May lows.

The Master Plan

Ethena’s plan is to expand its reach to institutions as well as to ordinary users through different strategies:

Embedding into the liquidity layers of centralized exchanges, new chains and decentralized protocols such as DEXes and lending markets.

Creating an ecosystem that penetrates deeper into DeFi by building a proprietary decentralized exchange.

Using Plasma to infiltrate the payments system.

Accessing institutional markets through iUSDe, USDtb and Converge, which are tailored for them.

Ethena is achieving milestones no other stablecoin has ever attempted, and all of the team’s efforts appear to be successful.

Their master plan is proceeding smoothly, and we will definitely hear much more about this project in the future, as it is now among the largest and most important in the space.

Courtesy of Matt

🏰 Castle Reads

Lessons from Arbitrum’s Largest Incentive Program:

Coverage of a misterious project on MegaETH, by @cryptondee:

A deep dive into Sophon, by @francescoweb3:

📖 Recommended Reads

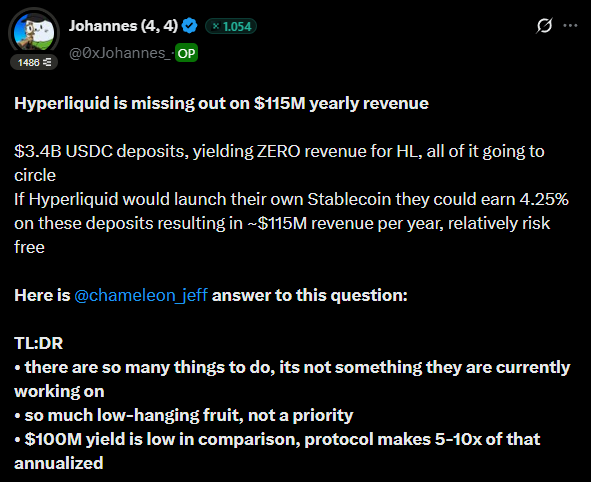

Hyperliquid is missing out on $115M yearly revenue, or maybe not, by @0xJohannes_:

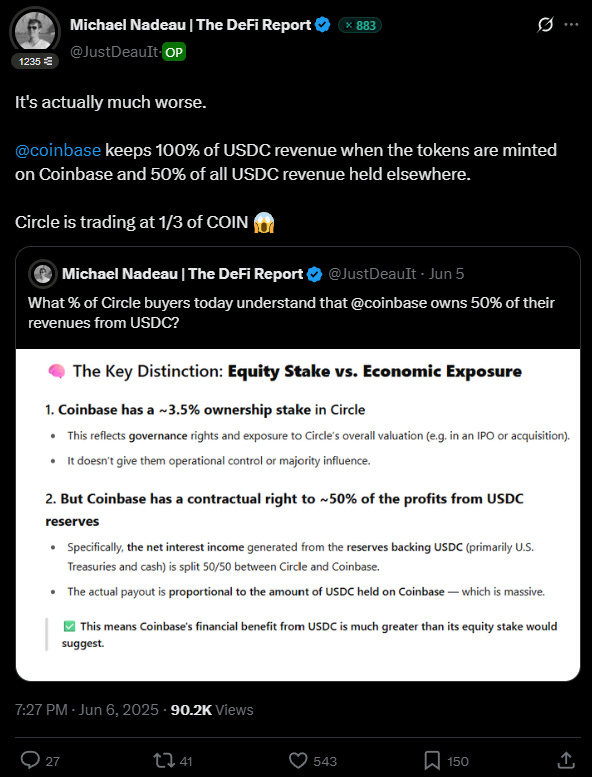

Circle USDC revenue split with Coinbase is raising concerns on its current market valuation, by @JustDeauIt:

Key differences between Plasma and Stable, by @0xDiplomat:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.