The Castle Chronicle: Bitcoin is in War Mode, How to Leverage Farm Points on Pendle

PLUS: On-chain Sleuthing into the HyperEVM Ecosystem

Welcome to Edition 121 of The Castle Chronicle!

The market presents many new opportunities every week, and as usual, Castle is here to keep you updated on what’s happening.

Here’s what we have for you today:

🔍 Market Watch - Price action & Relevant metrics across sectors and assets

🔬 Research Corner - On-chain Sleuthing into the HyperEVM Ecosystem

🏛️ Fundamentals Corner - How to Leverage Farm Points on Pendle

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads - The best reads from the best researchers on CT

Great news! Castle Labs is an official Media Partner of ETHMilan 2025, the largest EVM-focused conference in Italy, taking place on June 24 in the city of Milan.

As partners, we have secured an exclusive 25% discount on tickets for the event for the Castle community. Get yours here!

I bet you want to explore one of the best cities in Italy and talk crypto with us, as well as with top degens and builders in the space, coming from many countries, including those outside Europe. See you there!

🔍 Market Watch

Gm frens! It’s been another beautiful bullish week for crypto, so let’s not waste any time and jump right into the analysis!

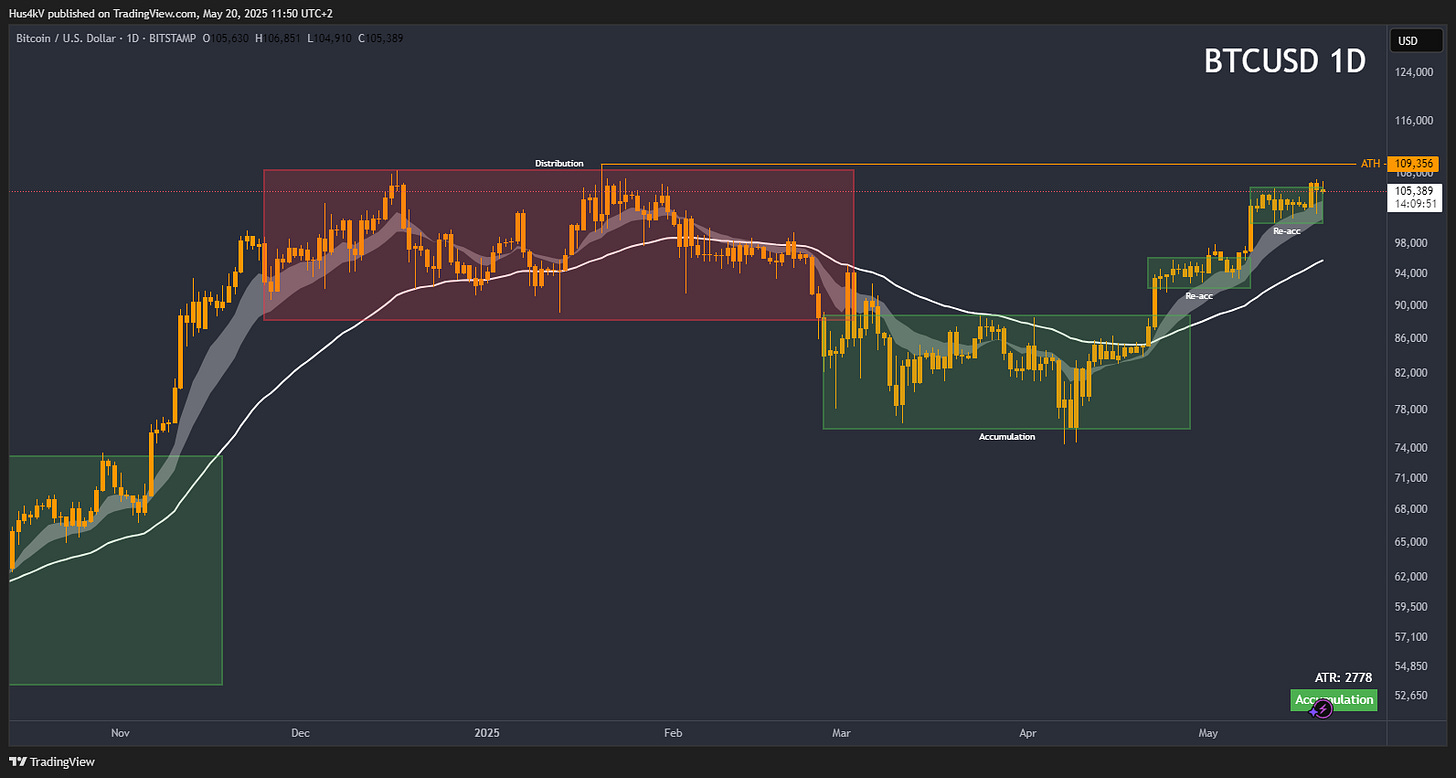

Price Action

Demand continues pushing BTC higher and the chart looks amazing. On the daily chart we can see a beautiful accumulation schematic that broke out higher and started a momentum cycle (strong trend above rising EMA 10&20). Currently we are sitting in the 2nd re-accumulation and things are looking great.

We are now in a momentum cycle, experiencing a re-accumulation.

I fully expect BTC to reach new ATHs. It can either continue printing new re-accumulations above the rising EMAs, or break down, accumulate lower, and then start a new run to ATH. Either way, this is a very bullish market right now, which sets the rest of the crypto market up for strong trends.

Top Performers

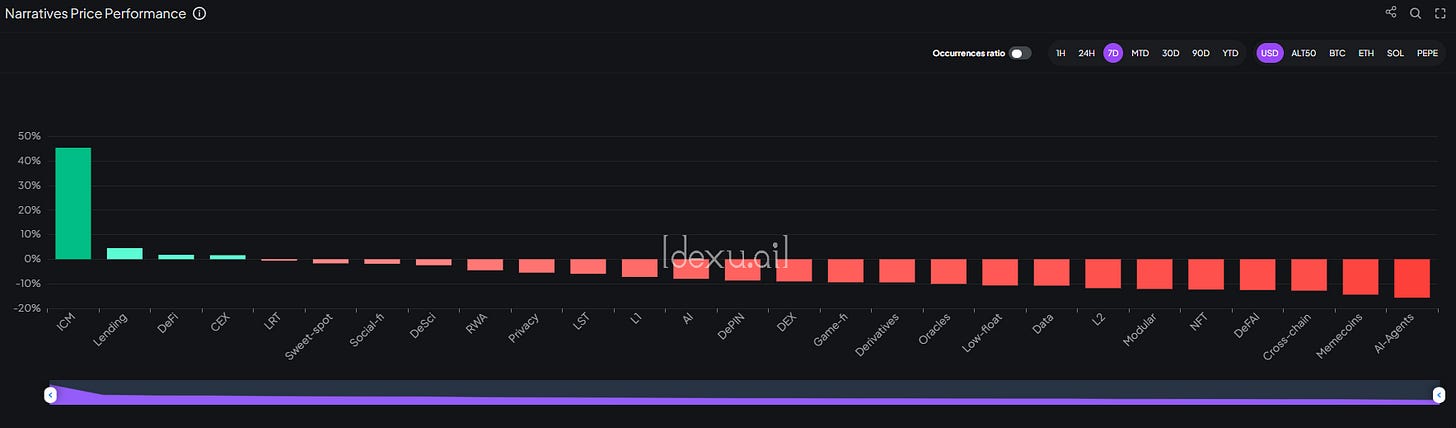

With BTC being in a very bullish context, I expect there to be many strong relative outperformers. Week after week, I’ve been looking at the 7d change, so let’s take a look at the 30d for once to get a more zoomed-out perspective.

To nobody’s surprise, $VIRTUALS has been absolutely killing it. I’ve been talking about $VIRTUALS and the AI-Agent sector for a while now, as these assets have had the most demand come in. The other huge crypto asset class seeing a lot of demand is memecoins. So if BTC continues pushing higher, definitely keep an eye on these two narratives!

Narrative Performance

Even though BTC has been pushing higher, altcoins seem to be taking a bit of a breather still. Most narratives are pulling back anywhere from -1% to -15%. This isn’t anything alarming, as just a few weeks ago, everything pumped like crazy. If anything, this is a great opportunity to get positioned.

(NFA) I would say this is a great time to scoop some long-term bags, especially in AI-Agents and Memecoins. Just make sure to always have your risk properly defined not to end up becoming a diamond hand community member. The markets can do anything they want, we’re just playing the probability game.

Risk responsibly, and I’ll see y’all next time!

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

Courtesy of 0x_Vlad - trend-based trader and MentFX student

🔬 Research Corner: The Best On-chain Sleuth into the HyperEVM Ecosystem

At the moment, I am mostly only focused on the Hyperliquid ecosystem. I have been setting up a couple of farms on different addys, trying the new protocol on the HyperEvm and just overall looking to learn MOAR about the community.

As some know, I started crypto mostly by looking at wallet & sleuthing around to find some edge. So I recently decided to look for more focused on-chain info on this eco & I found the best ANON to follow :

MLM Onchain and his telegram channel

This channel literally is a GOLD MINE to find some edge & to identify the wallet of the big players slowly coming into this ecosystem.

After some analysis and research leveraging this TG chat, I made a small list of wallets of known crypto anon/institutions on the Hypercore/HyperEVM (you can click on images to be redirected to the addy on Hypurrscan):

Galaxy Digital (Galaxy Research) - 785,000 HYPE spot.

Anon - 820,109 HYPE staked.

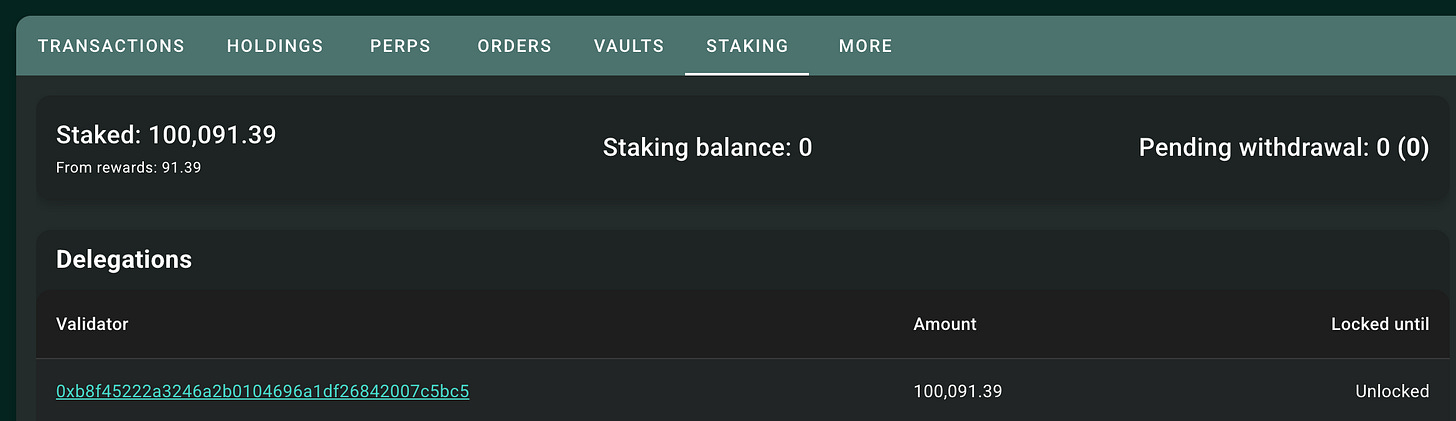

Our favorite french DEFI farmeuuurr CBB (@Cbb0fe) - A bit more than 100k $Hype staked and a basket of differents asset. This addy has been ARBING price difference between the HyperCore and the EVM.

Machibigbrother - 74,761 HYPE staked.

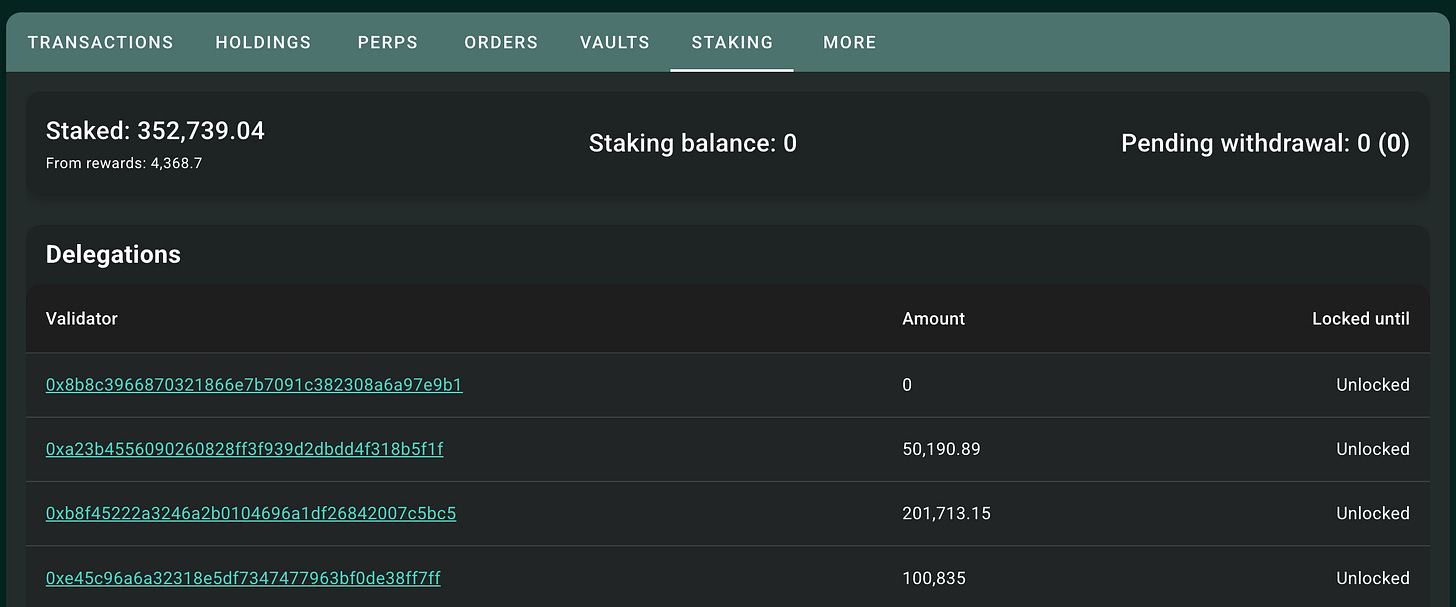

Based16z - 352,739 HYPE staked.

Arca - 993,895 HYPE spot.

Nikitabier - not holding any HYPE but just using the addy to execute trade on the orderbook.

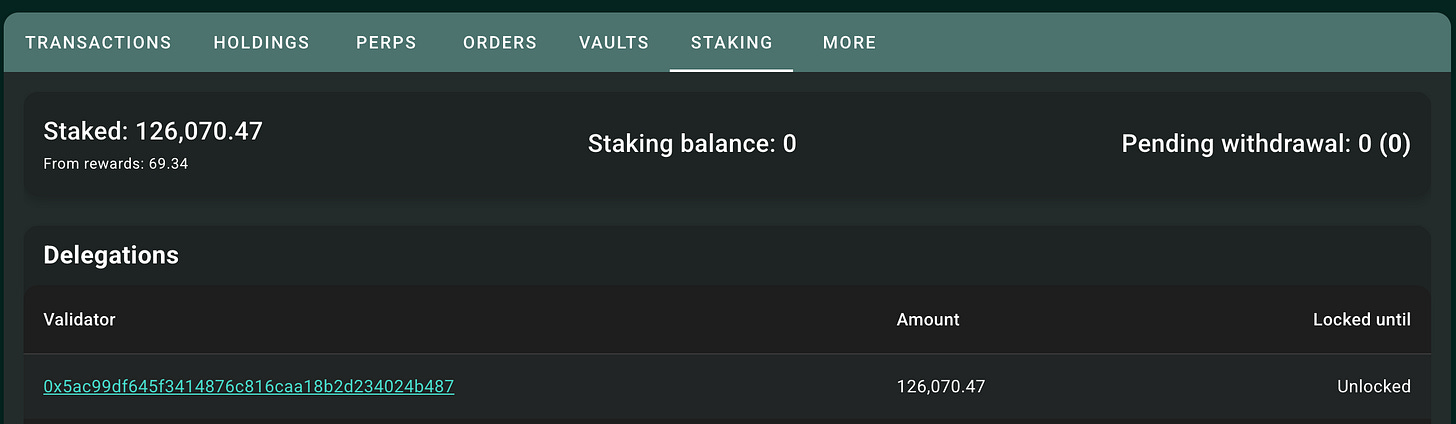

JamesWynnReal (#1 trader by PNL on Hyperliquid) - 126,070 HYPE staked and using the wallet to execute lots of trade.

Flowdesk (Market maker in the Crypto space) - 28,445 HYPE spot.

Kucoincom (The only Tier 1 CEX that listed HYPE) - around 307,658 HYPE spot and some other asset from the ecosystem

There is much MORE alfa in this TG chat but I made a list of the most important players, easier for our readers to digest and leverage those alpha.

See you next week chicos!

Courtesy of CL

🏛️ Fundamentals Corner: Points Leverage Farming with Pendle YTs

During the last week, I’ve been doing some research on YTs, mainly regarding point farming activity on tokens like lvlUSD, and I came across an interesting mechanic that I believe is either misunderstood or overlooked by many: Leveraged Points Farming. But first, let’s quickly cover the basics.

What is a YT

Yield Tokens (YTs) are a component of yield-bearing tokens that represent the interest accrued over time, while the capital deposited to earn that yield on the platforms issuing them is called the Principal Token (PT).

The price of a YT starts from the amount of yield expected to be earned by those who buy them, with a discount or premium determined by the market, depending on whether they earn points on top or not.

It is important to highlight that even non-yield-bearing tokens can have YTs and PTs. Some of these tokens accrue points, making it possible to assign a value to the YT. Without the points, holding the yield portion of a non-yield-bearing asset would be meaningless.

Leveraged Points Farming

The price of YTs is designed to linearly decay until reaching zero at maturity. This means that, theoretically, as maturity approaches, you are able to buy more YTs per dollar spent.

Since you are buying more tokens, your exposure to the generated yield increases (including point rewards) but the value of the capital you put in will logically devalue more quickly compared to a longer-dated YT.

This raises an important question: What is the goal of your strategy? Are you more focused on farming points quickly, or are you pursuing a different approach?

This tactic may be more useful for those who have calculated the potential value of points at TGE and estimate that the points, along with any yield the asset itself may generate, will be worth more than the capital they are sacrificing in the short term.

Example: YT lvlUSD – 29 May

Level Money is a platform that provides access to restaking and DeFi yield through its lvlUSD stablecoin, which becomes a yield-bearing asset when staked (slvlUSD).

Here, it can be observed that for every dollar (or lvlUSD) you deposit, you receive approximately 479 YTs. This number is significant because it defines your leverage.

Each lvlUSD accrues 40x XPs per time period on Pendle (because of a special multiplier), so 479 YTs, that represent the yield part of 479 lvlUSD, would earn 19,160x XPs. This, as a consequence, results in a 479x leverage on point accumulation.

At this point, you should (digitally) take out pen and paper and make assumptions on the following:

Points accrued daily by the YT.

TVL/FDV ratio of Level’s token at TGE.

TVL growth until the points snapshot.

Percentage of the token supply allocated to point holders.

Total number of points accumulated by the end of the campaign.

From this, you can estimate a reasonable dollar value per billion points you expect to receive at maturity (or at your chosen exit point) and determine whether that value exceeds your actual capital outlay.

I followed this strategy myself and found it worthwhile, but my assumptions and estimates may differ from yours. Always do your own research, and if you want to share your thesis on X, you know where to find me. I’d be happy to discuss it.

See you in the next one!

Courtesy of Matt

🏰 Castle Reads

An Introduction to Defi App and its XP Campaign:

Mantle Roadmap and Ecosystem Overview:

“How will SocialFi manage to Survive?”, by @mattdotfi and @0x_davi:

📖 Recommended Reads

How to Master Kaito Mindshare, by @YashasEdu:

Rev Sharing is Dead. Long Live (HYPE) Buyback & Burns, by @13300RPM:

Caldera Mindshare has been growing significantly since they launched their Kaito Yapper campaign, an interesting piece by @belizardd:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.

So deep in Pendle rn🤒👀