The Castle Chronicle: Bitcoin is in (another) accumulation phase, How to farm MegaETH’s ecosystem

PLUS: How USDhl is about to eat DeFi

Welcome to Edition 126 of The Castle Chronicle!

Even though the entire team is around ETHMilan, we still managed to work on a banger edition full of alpha and insights. Enjoy!

Here’s what we have for you today:

🔍 Market Watch - Price action & Relevant metrics across sectors and assets

🍐 CL’s Corner - USDhl is going to eat DeFi

🧙♂️ Matt’s Corner - How to prepare for MegaETH Mainnet Launch

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads - The best reads from the best researchers on CT

Castle has brought fresh vibes to ETHMilan: something is brewing, and we can’t wait to announce it.

Stay tuned. For now, here’s a sneak peek:

🔍 Market Watch

Gm frens!

BTC has been going sideways for a while, and the market has been overall quite calm. Nothing crazy is going on.

Price Action

BTC has been in the same spot for several weeks now, but hasn’t lost its new momentum cycle yet - therefore, I remain very bullish, as I expect this sideways price action to result in a re-accumulation.

Now it’s all about waiting for big demand to show up again and riding the next wave.

Top Performers

When it comes to top performer analysis, I love using CMC as it allows me to see multiple charts next to each other, and I can see the behaviour of each coin from multiple perspectives.

When sorting by 7d %, I can see that $SEI has been doing very well. But when I look at the 90d chart, I can see it’s overall going sideways and isn’t too impulsive.

Compare that to $KAIA. While the weekly gains aren’t as strong, the 90d chart tells a very different and more convincing story - a story of continuous demand coming in.

Taking a look at the $KAIA chart, we can see a long period of accumulation that eventually started a new momentum cycle (A strong trend above the rising 10/20 EMA). This is a beautiful chart that shows a clear direction.

My expectation here is for the momentum cycle to continue playing out until it fails. And once it does, I’ll assume re-accumulation and I’ll wait for new demand to show up.

It’s the same thing on repeat, as markets are cyclical in nature. Our goal is always to ride demand when it’s there and to sit on the side-lines when it’s not.

Narrative Performance

It’s a sideways week not just for BTC, but for most coins out there. All narratives are pulling back anywhere from -1% to -22%. This time, Social-Fi took the biggest hit, as $LOUD got absolutely hammered with a -54% loss.

So while this might be an uneventful week, I don’t mind. As a trader, more than 90% of the time, it’s about waiting for the right context.

Until then, risk responsibly, and I’ll see y’all next time!

Courtesy of 0x_Vlad - trend-based trader and MentFX student

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

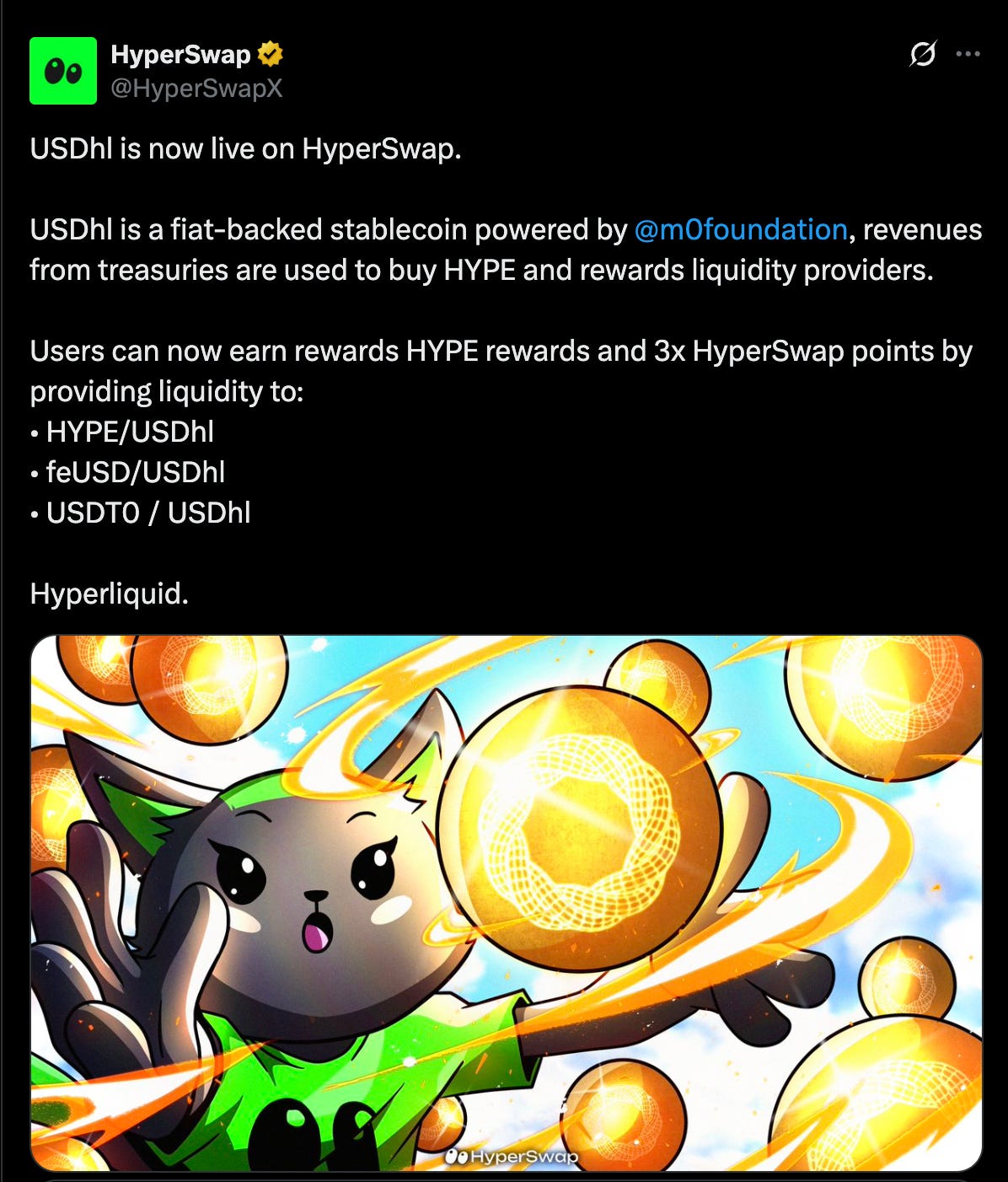

🍐 CL’s Corner: USDhl is going to eat DeFi

USDhl (Hyperliquid Dollar) is a new type of fiat-backed stablecoin meticulously crafted by Felix Labs in collaboration with M0, exclusively created for the Hyperliquid ecosystem.

Similarly to centralized stablecoins like USDC and USDT, USDhl serves as a purpose-built digital dollar designed to maintain a 1:1 peg with the U.S. dollar, leveraging a reserve of short-term U.S. Treasuries. But unlike Circle and Tether, which keep all the yield for themselves, Felix intends to redistribute over 100% of the 4%+ annualized yield generated from its treasury collateral back into the ecosystem as rewards for users, enhancing DeFi yields and incentivizing participation in the HL ecosystem.

The core idea is simple: there are hundreds of millions of USDC sitting idle in the Hyperliquid bridge, so why not replace a significant percentage of that USDC with USDHL and use the treasury yield generated by the bonds to buy back the $HYPE token and distribute it to the community?

Built to integrate seamlessly with Hyperliquid’s decentralized trading environment, including both HyperCore (spot and perpetual futures order books) and HyperEVM, USDHL supports advanced use cases such as lending, liquidity provision, and future applications as a collateral and quote asset. It includes all the functionality needed to replace USDC as the pristine collateral for trading and DeFi within the Hyperliquid ecosystem. Given the absence of native USDC support on HyperEVM (unlike USDT0 and USDE from Ethena), USDHL has a real opportunity to capture a significant market share, in my opinion.

The concept behind USDHL is particularly compelling, as it aims to leverage treasury yield in an innovative way. For example, $HYPE rebates could be given to market makers using USDHL as a collateral asset, or airdrops could be distributed to USDHL holders based on their equivalent share of the treasury yield on a bi-weekly or monthly basis.

The idea is a small revolution in the world of the treasury-backed stablecoin, imo, and may create ripples affecting the giants Circle and Tether. But as usual, you're asking: how can we monetize all of this? Easy! You can see all the different opportunities for USDhl to be put at use on Felix.

My favorite strat is providing liq on the USDT0/USDhl and feUSD/USDhl pairs on Hyperswap because it gives you exposure to both Hyperswap points szn and Felix points szn. Win win. I have personally created many feUSD/USDhl pools on different wallets in order to increase my chances of getting FELIX points, which I consider will be very valuable.

Have fun on the HyperEVM an0n.

X0X0

Courtesy of CL

🧙♂️ Matt’s Corner: How to prepare for MegaETH Mainnet Launch

As you already know, the earlier you are, the more chances you have to successfully leverage new ecosystems, and that’s exactly what we’re talking about today.

MegaETH’s Mainnet has not been announced yet, but in order to position yourself for one of the most anticipated launches of the year (hopefully of this one), it is really important to get ready for:

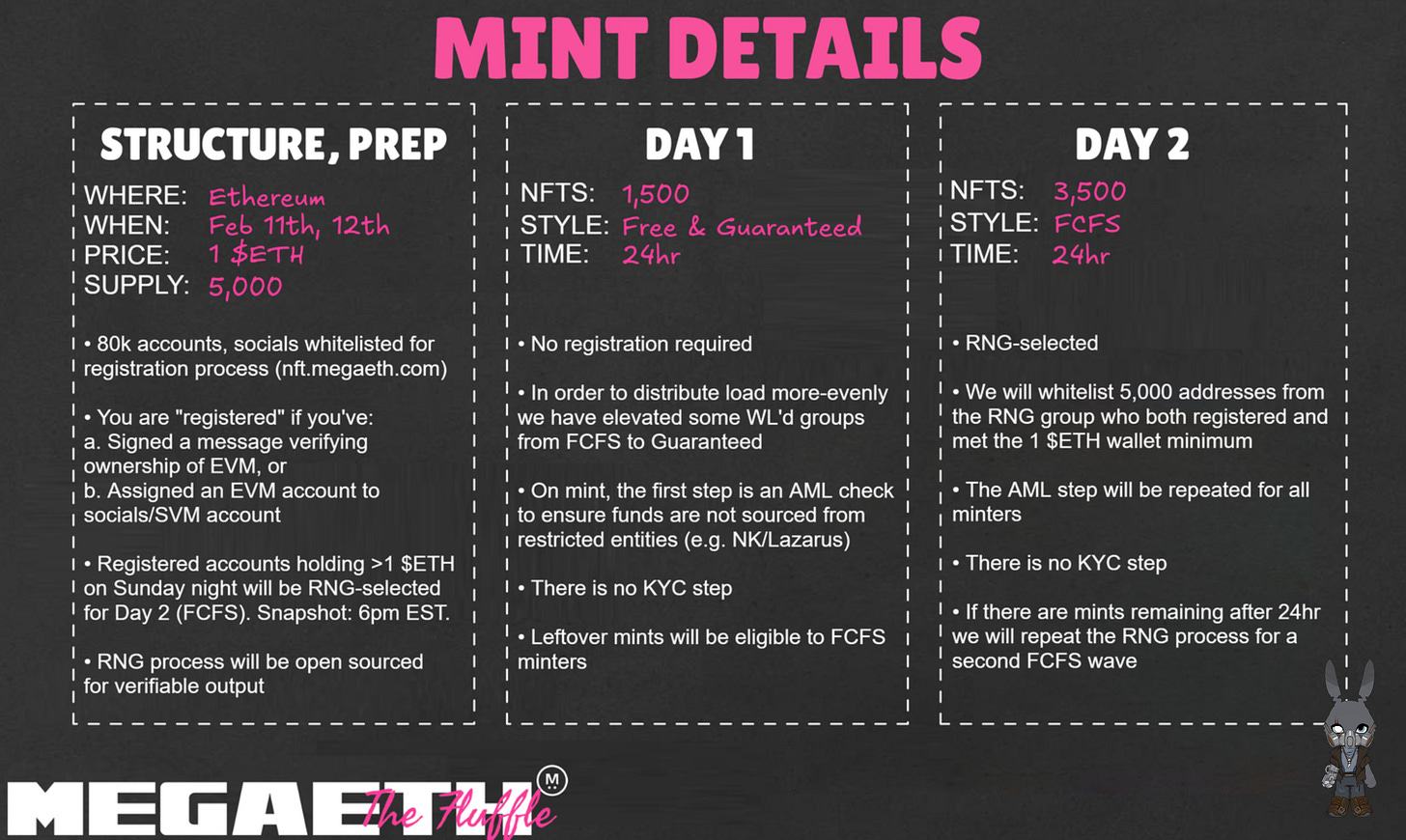

The second wave of “The Fluffle” soulbound NFTs drop (5,000 units still to be minted), a collection that will grant holders access to over 5% of the MEGA token supply.

Any possible airdrop coming from ecosystem projects.

Whitelists for upcoming NFT mints.

Let’s start with the second Fluffle drop.

How to be Eligible for the 2nd “The Fluffle” Drop

The first Fluffle drop was distributed retroactively, selected from a few thousand whitelisted addresses.

But for the second drop, things are changing. Interacting with longstanding DeFi protocols is no longer enough. The address whitelist selection for the second batch will be proactive, and users will have to:

Provide value on X, which will likely be based on Kaito mindshare metrics.

Interact with the MegaMafia testnet ecosystem by trying out the various dapps already deployed (which will be covered later in this piece).

Protocols to interact with

Many dapps are already deployed on MegaETH’s testnet, and it's certain that several of them will offer benefits or airdrop allocations to early users.

Here is a quick list of those already live (taken from @0xUltra’s Fluffle.Tools):

@Valhalla_defi — Spot and perp DEX (already hinted at its own points program).

@noise_xyz — Mindshare trading platform (I still need an invite, I wanna cry).

@GTE_XYZ — CLOB perp and spot DEX.

@cap_money — A novel platform for decentralised stablecoins.

@trysweep — A prediction market for streamers.

@bronto_finance — A ve(3,3)-based DEX.

@avon_xyz — A CLOB DEX that leverages lending.

@showdown_tcg — An exciting card game inspired by poker (not on testnet but currently in an invite-only beta).

While the list is not extensive, I strongly recommend trying them out consistently, in order to secure a Fluffle whitelist spot as well.

Others I am waiting for to launch their testnets are @euphoria_fi and @wcm_inc.

Upcoming NFT mints

I already talked about “The Fluffle,” so there’s no need to cover that again. Also, shoutout to @badbunnz_, one of the collections that has already launched, with a cool graphic style and a strong community behind it. This collection now sits at a 0.4ETH floor and could be a play for the ecosystem (in case you’re lazy and don’t want to grind for a Fluffle or a whitelist).

As for other collections, I think only two are really worth grinding for.

Megalio

@MegalioETH, a Milady derivative in MegaETH fashion. Since Hypio on Hyperliquid was a strong performer, this one might follow a similar path. Many whitelists have already been distributed, but there is still some hope, as they expanded the GTD list by a few more spots.

Here are the roles you want to secure on their Discord in order to secure a whitelist (you might want to interact with them, participate in raffles and giveaways, as well as contribute in order to get them):

Meganacci

@meganacci is another cool PFP collection featuring distinctive artworks and a solid amount of hype behind it.

This collection will be a free mint, and to get a WL spot, it is necessary to participate in challenges like the one they recently launched with FantasyTop, or through riddles, tasks, etc.

A good signal that you might be eligible for the whitelist is said to be being followed by @fimmonaci, the founder of the project.

That said, MegaETH will be an exciting launch to participate in, and as you might have seen from this piece, there are lots of things to do in order to be early.

gMega and good luck.

See you next week, fellas. defi.

Courtesy of Matt

🏰 Castle Reads

A deep dive into Hyli, a new L1 based on cheap and fast zk proofs:

Is Opensea ready for a comeback? By @0xdominus:

Top 5 Content Mistakes by Protocols, by @francescoweb3:

📖 Recommended Reads

An interesting piece on Circle’s valuation and the stablecoin game, by @cryptohayes:

How to manager risk in crypto, by @crypthoem:

@0xfoobar investigates a casino that is rumored to be offering six-figure monthly payouts to KOLs to stream it live:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.