The Castle Chronicle: HYPE Ripping, Real Stocks On-chain with Dinari, Ostium and RWAs

PLUS: Challenges Faced by New Perp DEXs and the Best Reads from CT

Welcome to Edition 119 of The Castle Chronicle!

If you see this issue on Tuesday, don’t worry, there’s no problem with the publication date! We simply decided to shift our release day from Thursday to Tuesday to give you a better outlook at the beginning of the week.

Here’s what we have for you today:

🔍 Market Watch - Price action & Relevant metrics across sectors and assets

🔬 Research Corner - Discovering Dinari, tokenizing stocks

🏛️ Fundamentals Corner - A deep dive into Ostium, a RWA perp DEX

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads - The best reads from the best researchers on CT

🔍 Market Watch

PRICE ACTION

BTC recently broke out of its accumulation range in a strong, impulsive move and is now taking a breather.

I expect this to develop into a re-accumulation phase; therefore, I am happy to follow any strong momentum in my direction that takes us to new highs from here.

HTF uptrend;

Breakout out of accumulation;

Rising EMAs.

As long as the price stays above the rising EMAs, the momentum cycle remains intact, and strong bullish setups are worth considering.

TOP PERFORMERS

With BTC in a favorable context, this is a prime time to look for relatively stronger performers. In recent weeks, we’ve seen $VIRTUALS and the broader AI-Agents narrative perform very well, so it’s no surprise to see it in the top 5 again this week.

But we already know that; let’s take a look at another strong performer: $HYPE.

After the TGE, $HYPE went pretty bonkers, creating new millionaires. Eventually, it found a top and began moving sideways, followed by a slow bleed downward. Now, we can observe a clear accumulation schematic, indicating the downtrend has stopped and potentially signaling a bullish reversal.

Breakout out of accumulation;

Rising EMAs.

While there is certainly an argument that this is already a bullish trend, I personally am not the biggest fan. When assessing a trend, impulsivity is a crucial factor—I want to see strong candles that leave behind valid demand zones and imbalance. So, while this may qualify as an uptrend in terms of higher highs and higher lows, the way it prints them is not very impressive, and I’m certain there are other cryptos out there showing much greater demand.

To illustrate my point, let’s take a look at the strongest performer this week: $FORM. This chart mostly shows a period of sideways chop that isn’t interesting at all, but then, all of a sudden, huge momentum comes in. This is the type of strength I’m looking for when trying to follow a trend. It shows money entering the market in a significant way. And as long as the price stays above the rising 10/20 EMA, I’m happy to step down to lower timeframes and bet on continuation.

Prolonged sideways chop;

Strong move showcasing demand.

That being said, I will keep an eye on $HYPE in case serious momentum starts to build.

NARRATIVE PERFORMANCE

After every sprint, a brief pause is necessary. Last week, we saw a strong green wave, with many coins posting triple-digit percentage gains, so it’s only natural to witness some pullbacks. Overall, most narratives have given up around 10–20% of their gains, with DeFAI and LRT experiencing the largest losses.

Overall, it’s been a rather calm week, but if demand continues to push prices higher, now is a good time to start getting positioned.

Always remember: Risk responsibly, and I’ll see y’all next time!

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

Courtesy of 0x_Vlad - trend-based trader and MentFX student

🔬 Research Corner: Tokenising Stocks through Dinari

I recently saw news about Dinari raising $12.7M in a round led by Hack VC and Blockchange VC. Even though Dinari has been making a lot of noise in recent weeks, I felt it hasn’t received enough attention on Crypto Twitter and our circles.

This is why I decided to write a small piece on it for our dear readers.

So let’s get into it!

WHAT IS DINARI

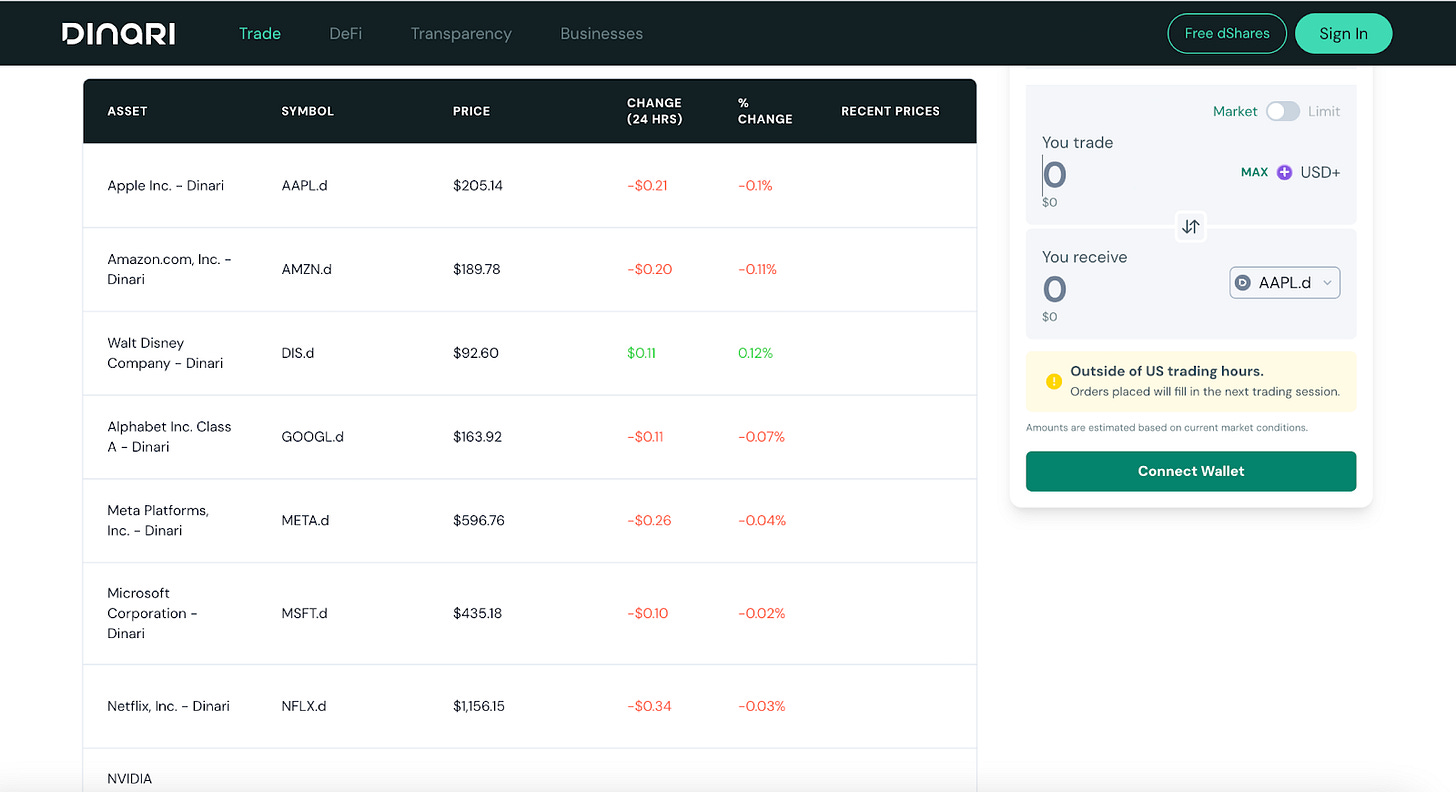

Dinari transforms U.S. equities into dShares, digital tokens each fully collateralized 1:1 with actual shares of prominent companies such as $Apple, $Tesla, $Nvidia, and $Google. This backing guarantees that each token signifies direct ownership of the corresponding underlying stock.

Unlike other protocols that have offered synthetic exposure (RIP Mirror Protocol on LUNA), all dShares are backed by actual stocks owned by Dinari and held in custody with a regulatory-compliant stockbroker. The dShare represents a claim on the underlying stock, but the ownership remains with Dinari.

Built on the Base L2, the platform provides an API-first solution enabling neobanks, fintechs, and wealthtech companies to integrate U.S. stock exposure directly into their apps, allowing seamless embedding of tokenized equities into existing financial products for their users. This opens the door for traditional Web2 businesses to integrate blockchain-based products without their users even noticing.

The end goal of Dinari is simple: enabling ANYONE with an internet connection to access the US financial system. This can be done either directly through their UI or via various businesses integrating their API.

UNLOCKING NEW POSSIBILITIES THROUGH dSHARES

What’s most fascinating about this use case is the possibilities unlocked by tokenized dShares as a composable primitive.

They could be integrated as collateral into Aave or other lending protocols, allowing users to access permissionless loans against their stock holdings to purchase real-world assets. This could open the door to making the on-chain credit market mainstream.

Alternatively, dShares could be added as tradable assets on popular perpetual protocols, enabling LONG/SHORT strategies that combine crypto and stocks in a single trade. Imagine going LONG on $APPLE and SHORT on $FARTCOIN.

We could easily see tokenized equities traded spot on Uniswap or other 24/7 AMMs, offering traditional finance traders uninterrupted access to their assets.

In simple terms, this protocol could open the floodgates for blockchain-based settlement. Unlike traditional stocks and bonds, which can take days to settle, Dinari’s blockchain-based system enables instant settlement, reducing delays and counterparty risks while improving liquidity for global investors.

Very bullish on Dinari — and this is just the beginning, in my opinion.

Courtesy of CL

🏛️ Fundamentals Corner: A deep dive into Ostium

NOT A TRADITIONAL PERP DEX

While CL spoke about the ability to tokenize stocks for on-chain trading and ownership, a project that is both similar and yet fundamentally different has recently gained significant attention: Ostium.

Ostium is a perpetual decentralized exchange (DEX) on Arbitrum that enables trading of crypto, indexes, commodities, and forex in a synthetic manner.

HOW DOES IT WORK?

Ostium allows traders to operate on-chain through synthetic perpetuals on various RWAs, even with leverage.

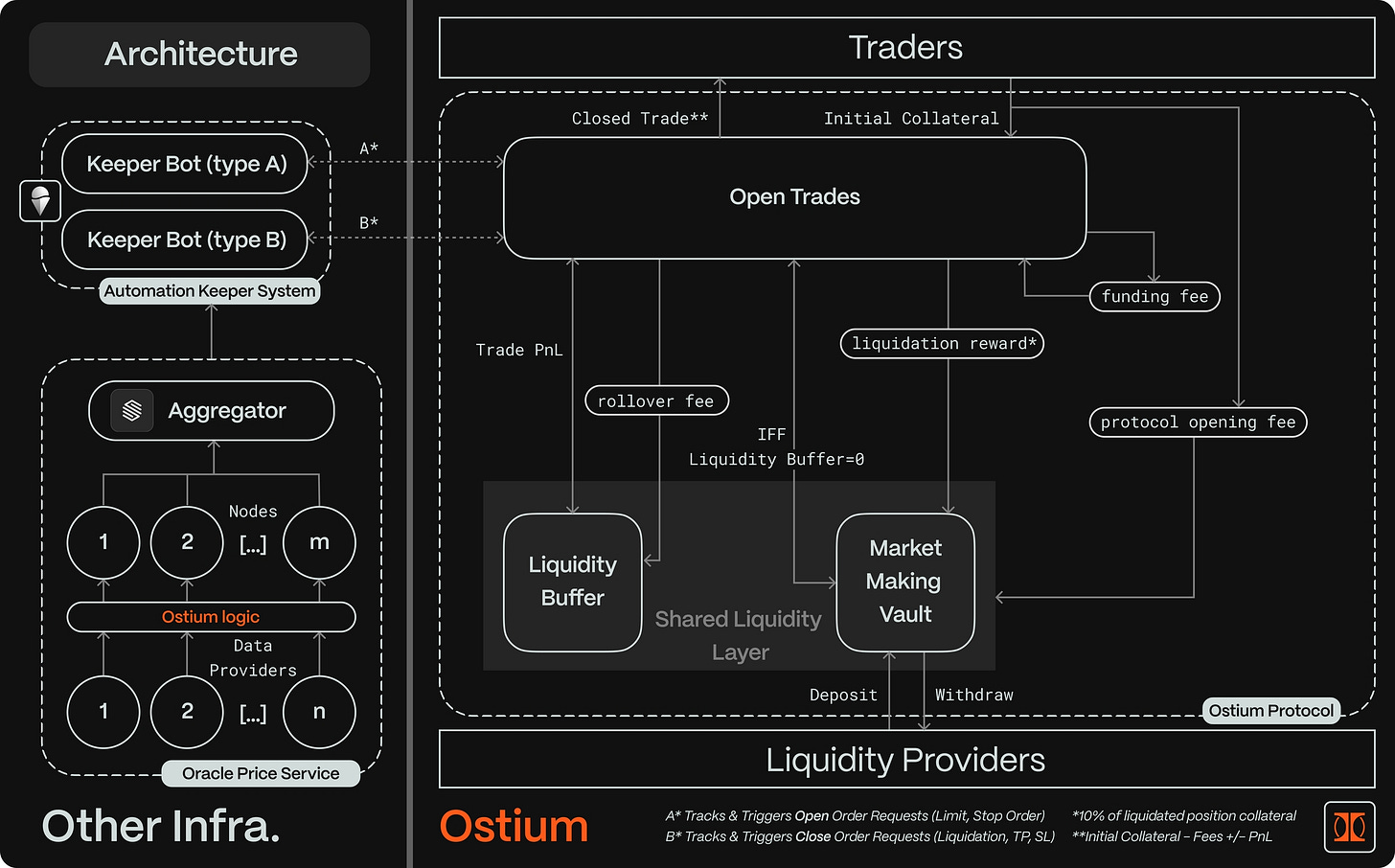

This is made possible through an architecture composed of:

Stork and Chainlink oracles, which respectively provide on-demand price feeds for RWAs and crypto assets;

Gelato Automations, used to execute different types of orders;

Ostium contracts, which simulate price changes in the underlying markets to prevent manipulation and manage liquidity provision and fees.

Speaking of Ostium contracts, there are a few key differences compared to those of known perp DEXs like Hyperliquid:

The backing liquidity for settling positions is divided into two segments, forming the so-called “Shared Liquidity”:

The Liquidity Buffer, which serves as the primary settlement layer for trader PnL, accrues value through rollover fees (in the case of non-crypto assets) paid by the trader;

The Market Making Vault, composed of LP deposits, acts as the secondary settlement layer and is used only if the Liquidity Buffer is depleted.

The liquidity in the vault is held in USDC, similar to peers like Gains Network.

End users can either trade or provide liquidity on the platform, in line with the “Ostium Points” campaign, which is expected to lead to an airdrop of the protocol’s token.

Let’s look at some data:

Ostium has generated over $5.8B in volume since inception, with $5.5B recorded in the last two months alone;

The TVL of its Market Making Vault rose from $2M to nearly $62M year-to-date (YTD);

The platform has between 600 and 1,200 traders operating daily.

Numbers don’t lie: Ostium is growing, and people are interested in this DEX.

PROS AND CONS

There’s a lot to be said about Ostium’s model—something we’ve already seen to some extent in action with GMX, Gains Network, and other similar synthetic perp DEXes—but let’s start with the pros:

On Ostium, you can trade indexes, commodities, and major forex pairs with a reliable peg to their conventional counterparts in traditional markets. Just yesterday, they even introduced all MAG7 stocks. This growing range of non-crypto assets is an underrated feature for a DeFi protocol, especially for users who don’t want to off-ramp their stablecoins just to trade, for example, EUR/USD;

Vaults like the Market Making Vault (represented by OLP) offer a convenient way to deposit stablecoins and earn yield from them;

The dashboard is simple and well-designed. Additionally, the quality of order execution is solid (I tested it myself);

The Ostium team is actively working on new asset integrations, major bug fixes, fee reductions, revamping features like "Strategies," and much more.

However, nothing is perfect, and the model chosen by Ostium comes with some drawbacks:

Due to the synthetic nature of its non-crypto pairs, rollover fees are higher than average, and traders are not incentivized to arbitrage rate discrepancies, as they incur charges whether they go long or short;

The GLP/OLP model is inherently difficult to scale, as it operates in a zero-sum framework where LPs earn only from (a portion of) trading fees and trader losses. This challenge is well-explained in an insightful article by @DiogenesCesares;

Fees and liquidity are still not competitive compared to players like Hyperliquid.

Overall, Ostium is a solid product that I personally enjoy trading on, especially when I can farm some points in the process. However, its model and approach still face significant challenges that need to be addressed for it to become a serious competitor to Hyperliquid.

Courtesy of Matt

🏰 Castle Reads

Read our Weekly AI Dispatch:

Big things are happening in the Mantle ecosystem, by @AmirOrmu:

Kaito gave us more than just a few airdrops, by @insomniac_ac:

📖 Recommended Reads

Thoughts on the role of RWAs in the crypto ecosystem from Token2049, by @Moomsxxx:

A Letter to Private Market Token Participants, by @TraderNoah:

Web3: Crypto’s Biggest Mistake, by @ohmzeus:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.

Banger!