The Castle Chronicle: Is Bitcoin going to face a new re-accumulation? What you need to know about Aave V4

PLUS: Exploring the tokenization layer of Hyperliquid

Welcome to Edition 127 of The Castle Chronicle!

Greetings from the team, which is now at ETHCC, ready and eager to chat with chads.

Here’s what we have for you today:

🔍 Market Watch - Price action & Relevant metrics across sectors and assets

🍐 CL’s Corner - Exploring the decentralized asset tokenization layer of Hyperliquid

🧙♂️ Matt’s Corner - What you need to know about Aave V4

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads - The best reads from the best researchers on CT

Robinhood, the largest social trading app in the world, announced the launch of their own chain using the Arbitrum stack, solidifying our conviction in this ecosystem and the people who have been building it over the past years. As Arbinauts, we’re proud of this achievement and will continue to support Arbitrum.

🔍 Market Watch

Gm frens! BTC has been chopping around for the past couple of weeks, so there isn’t really anything interesting going on.

Price Action

Price is still stuck in this range that I anticipate becoming another re-accumulation. Everything here is pointing to bullishness - an ongoing healthy uptrend and price trending above the rising 10/20 EMA. My expectation, therefore, is new ATHs eventually.

We might first break down for a bigger re-accumulation of course, but if that should happen, we can just sit on the side-lines and wait for demand to show up again.

Top Performers

Sorted by 7d% gain, we can see $PENGU having quite a nice pump of +44%. Even looking at the more zoomed out charts, we see decently impulsive price action on the 30d and 90d. Let’s take a look at the chart!

The daily chart tells a clear story. After finding a bottom and accumulating for a while, price broke out and reached ATH’s (All-time-highs). Since then price started going sideways and bleeding out a bit for what I would anticipate to be a re-accumulation. At that point, we want to see demand entering the market again, which is exactly what happened in the past few days.

This is a very bullish-looking chart, and my expectation is continuation towards new ATHs. $PENGU is definitely a good one to keep on our watchlist.

Narrative Performance

Most narratives continue to underperform during this period of sideways chop. Biggest losses can be seen in AI-Agents (-9.18%), DeFAI (-12.67%), and Social-Fi (-13.89%).

My expectation is for this to continue happening until BTC makes a decisive move. If we see big demand come in, those narratives that outperformed in the past and have shown resilience during periods of sideways or slow-bleed, will once again see big inflows.

Times like these are great to sit on the side-lines and let the market show its hand. Our goal should always be to join the ride when demand comes in.

Until that happens - risk responsibly, and I’ll see y’all next time!

Courtesy of 0x_Vlad - trend-based trader and MentFX student

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

🍐 CL’s Corner: Exploring the decentralized asset tokenization layer of Hyperliquid

I have been quite vocal about my bullishness on everything Hyperliquid. A couple of weeks ago, I wrote a piece in the Chronicle about the spot side of the HL orderbook, where I presented several reasons why I believed it would continue to grow from here.

However, for the Hyperliquid spot orderbook to be a real success, it needs a layer that tokenizes assets from different ecosystems and makes those tokens tradable on the orderbook as native spot assets.

The solution for this : Hyperunit

For the moment, only four assets can be deposited in the Hyperunit bridge and become native tradable assets on the HL orderbook: $BTC, $ETH, $SOL, and $FARTCOIN.

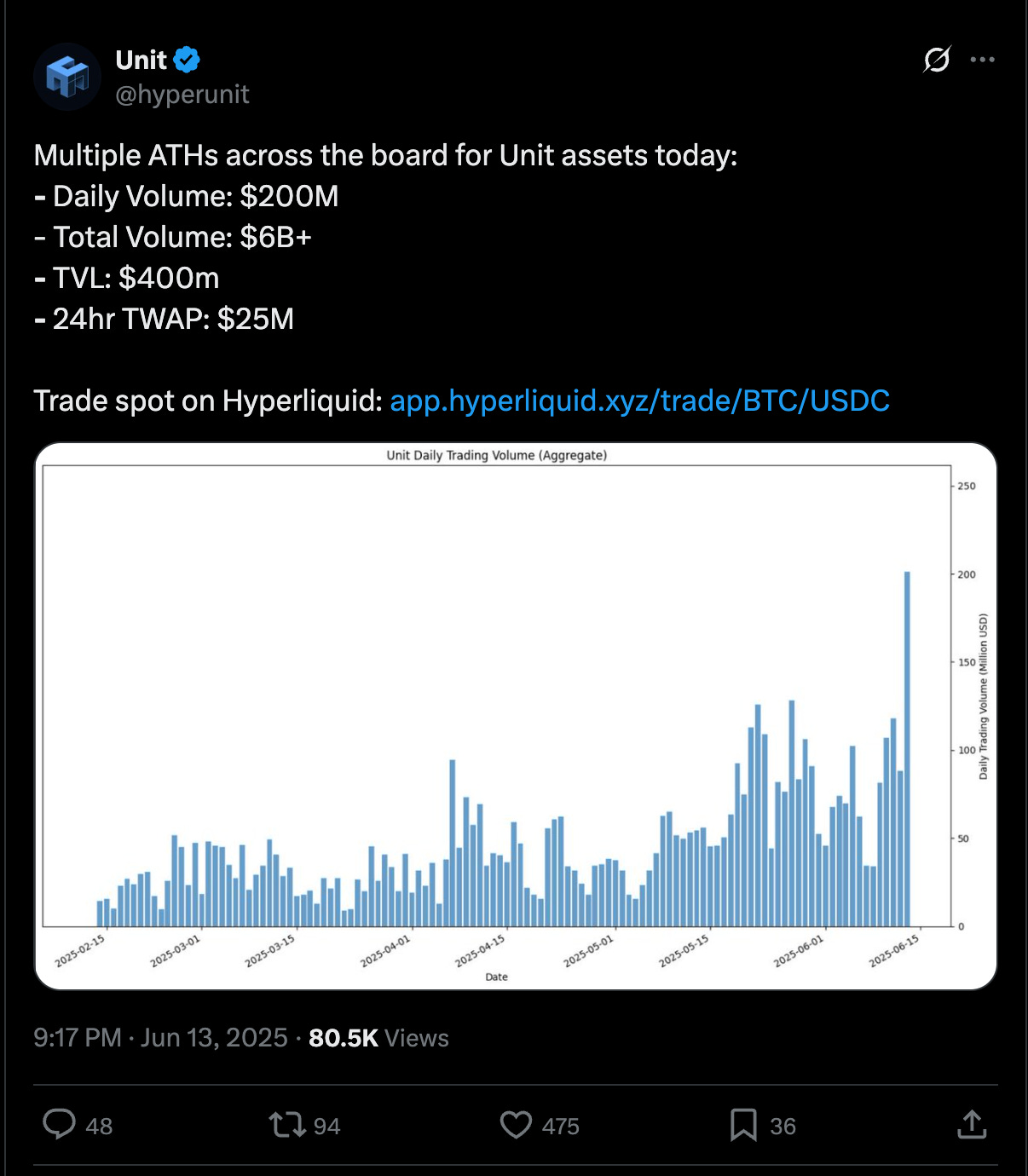

The metrics are pretty good: an average of 200 million USD in daily volume for those assets, around $6B in total volume, and more than $400M in TVL. (B00lish))

In the last few weeks, we have seen a couple of big whales using the Hyperunit tech to tokenize their assets on the orderbook. Some are even using it as a way to bridge their token, selling on the orderbook and accumulating $HYPE with the proceeds.

As we can see, the success is REAL. Another example of this: Hyperunit is now the biggest single holder of $FARTCOIN.

I’m expecting Hyperunit to add more and more assets in the coming months to increase the choice for traders. I could easily see tokens like AVAX, SUI, or SEI being integrated into UNIT, which would further increase the attractiveness of the HL spot orderbook. Another interesting strategy that the Hyperunit team may follow in the future is securing a ticker on the HL orderbook for new, high-potential tokens that will be launching soon and integrating those assets into their bridge.

The most recent example is PUMP. It will be possible to send the Pump token through the Unit bridge at TGE, enabling traders to buy and trade it natively on the HL orderbook.

How to monetize all those informations? IMO, very simple.

Deposit asset on : https://hyperunit.xyz/

Hold or trade them on the orderbook,

Can even bridge them on HyperEVM & leverage them in some protocol like FELIX.

We don’t know yet what the airdrop related to HyperUnit will look like, but I’m pretty confident that it’s going to be one of the best in the HL ecosystem.

On this, I wish you a great July.

CIAO

Courtesy of CL

🧙♂️ Matt’s Corner: What you need to know about Aave V4

At ETHCC, the founder of Aave, Stani, announced the imminent launch of Aave V4, the new iteration of the largest lending protocol in DeFi.

Today, my piece will focus on the new implementations of Aave V4 and how they could potentially reshape the protocol, especially regarding the new rate parameters and GHO upgrades.

What’s Aave V4

Aave recently surpassed $25B in TVL for the first time, a milestone no other protocol has achieved. The team is actively working to ship new features that can adjust risk and further fuel its growth.

Here are the new features announced last year that will soon be implemented:

Unified Liquidity Layer: Introduces a set of modules that remove previous constraints related to liquidity migration, while adding new capabilities such as crosschain lending.

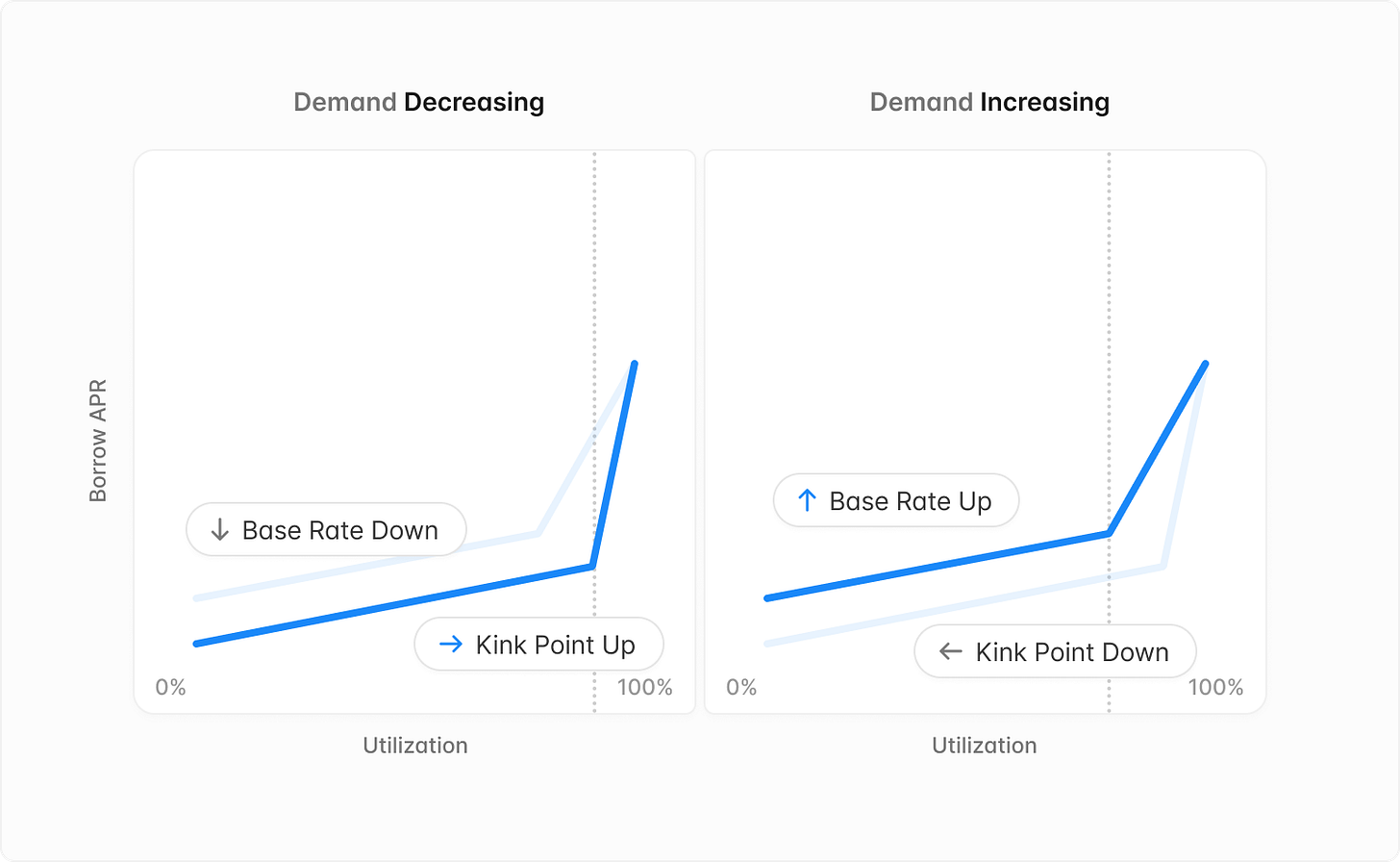

Fuzzy-controlled Interest Rates: A new mechanism to automate interest rate curves and kink points based on market conditions, rather than relying on governance votes.

Liquidity Premiums: Borrowing costs become more dependent on the liquidity conditions of each token. While assets like ETH remain premium-free and serve as benchmarks, others such as WBTC and wstETH will be subject to premiums based on their liquidity.

Aave V4 Borrow Module: Smart Accounts are being explored to introduce features like Aave Vaults, which can lock liquidity, disable collateral usage, and more.

Dynamic Risk Configuration: Collateral rates are tied to the moment a position is created and are not affected by subsequent market changes, offering users greater position stability.

Automated Asset Offboarding

Automated Treasury Management.

Liquidation Engine V4: Aave’s liquidation engine is undergoing significant upgrades, including variable liquidation factors and bonuses, as well as batched liquidations.

Stronger GHO Integration: GHO is being integrated more natively into Aave V4, with enhancements such as soft liquidations, stablecoin interest paid out in GHO, and a new emergency redemption mechanism.

Additional changes include gas optimizations and the deprecation of features like tokenized positions and stable rates.

Let’s now dive deeper into two major changes: the Unified Liquidity Layer and GHO upgrades.

Unified Liquidity Layer

The unified liquidity layer introduces a new chain-agnostic, independent, and abstracted infrastructure for liquidity provision.

A major improvement in this modular system is the ability to onboard new borrow modules and offboard old ones without requiring liquidity migration.

This architecture enables the addition or enhancement of borrowing features, such as isolation pools, RWA modules, and CDPs, without altering the overall system or the liquidation module. It also addresses the issue of fragmented liquidity seen in earlier versions of the protocol.

The liquidity layer supports both supplied and natively minted assets, improving integration with GHO and other collateralized Aave-native assets.

Crosschain lending is likely one of the most impactful modules, allowing users to deposit on one chain and borrow on another. This significantly enhances the platform’s liquidity capabilities across chains and provides new opportunities for market growth.

GHO Upgrades

GHO is Aave’s overcollateralized stablecoin, currently holding a market cap of over $220M, with a 53% increase since the beginning of 2025.

Beyond minor changes such as more efficient native minting, the standout upgrade is the introduction of soft liquidations. This mechanism draws inspiration from the model introduced by crvUSD (Curve USD), using a Lending-Liquidating AMM (LLAMM) to streamline the liquidation process.

Liquidations are managed in customizable ranges that guide the conversion to GHO during downturns and the repurchase of collateral during upturns. Compared to crvUSD, Aave V4 offers three main advantages: users can choose which collaterals to use for liquidating a position from a basket, select which collateral to repurchase from the entire set of assets available on Aave (even those not initially supplied), and benefit from GHO automatically earning interest.

Another notable change is the ability for users in stablecoin markets to receive interest payments in GHO, which could expand GHO’s supply through direct interest conversion into the token.

Aave V4 also introduces an Emergency Redemption Mechanism to address situations involving severe and prolonged depegging of GHO. When triggered, the collaterals of positions with the lowest health factor are gradually redeemed to GHO, and their debt is repaid, leveraging the new LLAMM design.

Conclusions

For a protocol of Aave’s size and importance, minimizing risk is essential, particularly when launching major features like crosschain lending.

Automating processes such as asset offboarding and interest rate model adjustments helps reduce reliance on slower DAO processes, especially in response to market-driven changes.

Aave remains confident in the growth of its stablecoin, GHO, which now benefits from significant improvements and deeper integration into the protocol.

Aave is poised to remain a cornerstone of DeFi for the foreseeable future. The success of the broader ecosystem heavily depends on its continued leadership, as no other project has amassed this level of TVL while maintaining the same level of security.

Just use Aave.

Courtesy of Matt

🏰 Castle Reads

New AI Dispatch out now, covering Kaito, EigenCloud and more:

The Castle team was at ETHMilan last week, and we were pleased to meet those who joined us for the Arbitrum Day event, where many ecosystem and DAO representatives held engaging panels and speeches. Here is a quick recap of the event:

Plasma Vs Stable: Exploring Stablecoin-Specific Chains (And Whether We Need Them), by @chilla_ct:

📖 Recommended Reads

Why pmf is usually founder-investor fit, by @therosieum:

Comments about Katana’s model, by @0xCheeezzyyyy:

Very interesting exchange of opinions about Coinbase perps, by @troyharris__:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.