The Castle Chronicle: $PENGU is Ripping, How a HyperEVM NFT Collection Created a New Primitive

PLUS: Would you like some free money? The Curious Case of PUMP

Welcome to Edition 129 of The Castle Chronicle!

New ATH for $BTC and everyone is sidelined, but don’t worry: enjoy Castle’s alphas from the past week and get ready for the next one.

Here’s what we have for you today:

🔍 Market Watch - Price action and relevant metrics across sectors and assets

🍐 CL’s Corner - How a HyperEVM NFT Collection Created a New Primitive

🧙♂️ Matt’s Corner - Would you like some free money? The Curious Case of PUMP

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads - The best reads from the best researchers on CT

🔍 Market Watch

Gm frens! Looks like demand is overpowering supply once again and prices are moving higher. Exciting times! Let’s take a look at the charts.

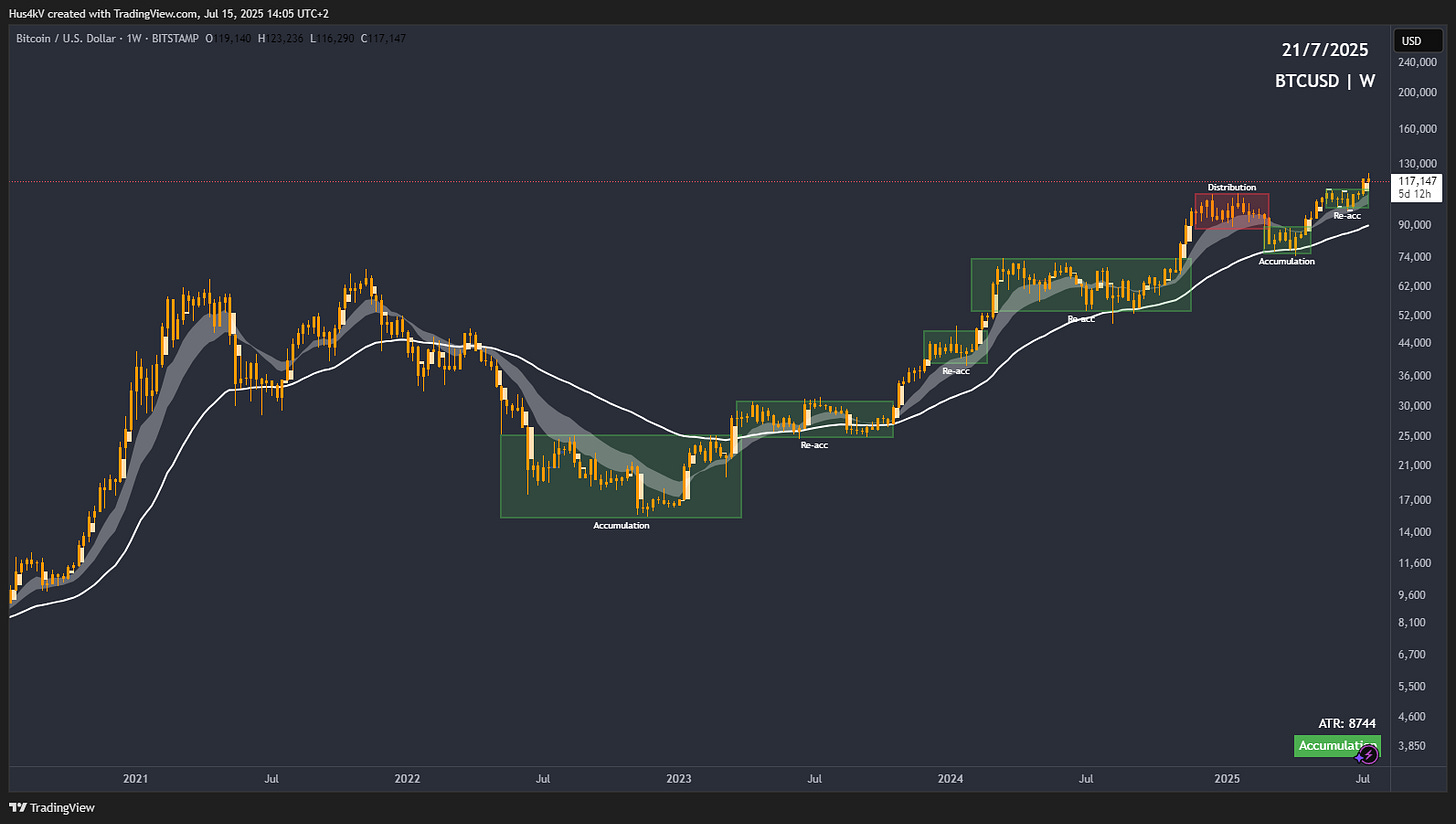

Price Action

The analysis has been playing out perfectly. The most recent sideways price action has once again resulted in a re-accumulation, as price broke out higher to new ATHs (All Time Highs). The trend is very much ongoing, and I expect it to continue.

Top Performers

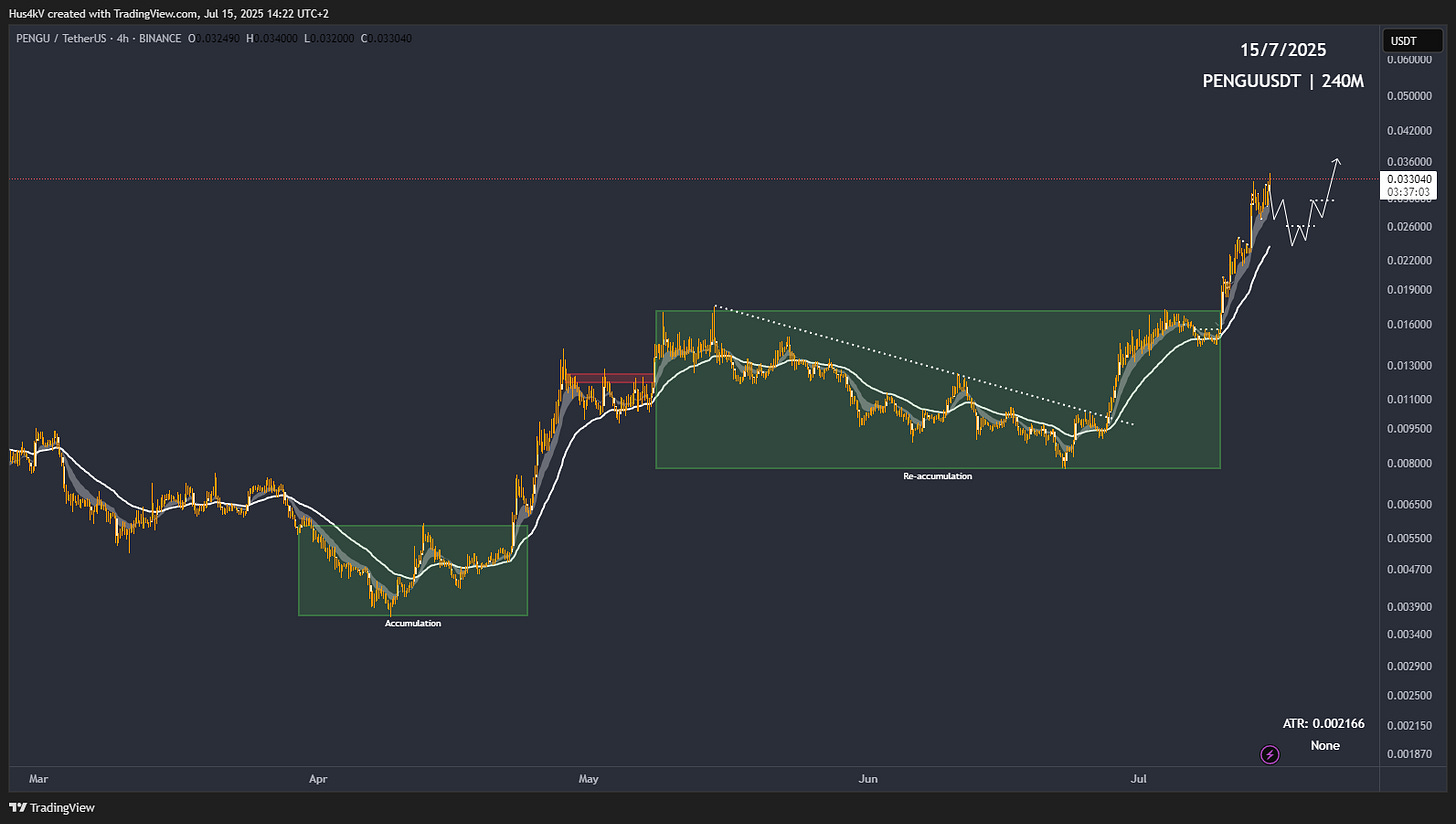

Looking at the past week performance, $PENGU has been going crazy! +117% is no joke.

Over the past couple of weeks and months, we’ve seen numerous different coins appear in the TOP 5. It’s worth paying attention to those that show up multiple times during periods of both strength and weakness. These can then be added to a watchlist. Here is mine, sorted by 90d % change.

These are coins that have time after time shown strength and outperformed the rest of the market. Therefore it’s reasonable to expect that to continue.

Let’s take a look at the overall winner again, $PENGU!

From its ATLs (All-Time Lows), we can see the price pushed higher and started moving sideways. At that point, the expectation is always the same: re-accumulation and re-ignition. Once demand shows up again, that’s the best time to put on risk, especially when the overall context of the market (BTC) is favorable.

Now we can see PENGU breaking out into new highs through a strong momentum cycle. Once the 10/20 EMA breaks down, we can once again assume re-accumulation and look to get involved on re-ignition within that range.

Narrative Performance

Taking a look at the narratives, we can see a green wave across the board, as is usually the case when BTC starts moving. The overall winners this week are:

DeSci, with a +62% increase carried by $YNE

Cross-Chain, with a +53% increase carried by $HYPER

Every time BTC breaches into new ATHs, it’s an exciting time, as we can expect others to follow. And while there is an overall tide that carries the whole market, it’s not the same as it used to be in the past during alt season. The outperformers are few, so we have to allocate our risk well.

So as always, risk responsibly, and I’ll see y’all next time!

Courtesy of 0x_Vlad - trend-based trader and MentFX student

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

🍐 CL’s Corner: How a HyperEVM NFT Collection Created a New Primitive

The NFT platform Drip Trade on HyperEVM, in partnership with the recently minted Bald Bröthers collection, has launched a new type of primitive that could really add an interesting dynamic to the NFT world. Let's try to make sense of it.

Token Vaults

Let’s call this new primitive: Tokens Vault. It will allow any NFTs to act as secure containers for locking underlying tokens, such as ERC20 tokens or $HYPE tokens. Think of it like a digital safe deposit box embedded in the NFT itself. The NFT isn’t just a piece of art or a collectible anymore; it becomes a hybrid asset with both artistic and financial value tied to the tokens locked inside.

How does this work?

When an NFT is "vaulted," a specific amount of tokens is deposited into a smart contract associated with that NFT. This process is irreversible until the next step is triggered.

The smart contract ensures that anyone can initiate this token deposit into the vault, and the tokens are tied to the NFT’s unique identifier (e.g., its token ID on the blockchain).

The value of the NFT now includes the market value of the locked tokens, in addition to its intrinsic or collectible value. For example, if a bald bröthers NFT has $100 worth of $HYPE locked in its vault, the NFT’s total "net asset value" (NAV) increases by that amount.

This creates a tangible, on-chain value floor for the NFT, which can be verified by anyone, enhancing its appeal and utility.

The only way to retrieve the locked tokens is to "burn" the NFT, permanently destroying it on the blockchain. This is a deliberate design choice to maintain scarcity and align the interests of token holders and NFT owners.

When burned, the smart contract releases the tokens to the burner’s wallet, but the NFT is gone forever, making this a high-stakes decision. After the NFT is burned, the vaulted tokens are withdrawable only by the address that burned the NFT, which prevents possible attack vectors.

This opens interesting opportunities for creators and NFT artists:

The vaults can be applied to specific sub-collections (like the Baldio Niqab). This allows communities or projects to tailor the mechanic to their ecosystem, locking relevant tokens to boost that sub-group’s value and align it with the token’s purpose. Creators could give special perks to only a few of their NFTs based on a unique trait, reinforcing their value.

Token founders can use vaults to distribute tokens to specific sub-communities with precision. For instance, distributing a new token airdrop only to the rarest NFTs of a collection. This could increase loyalty among certain sub-groups and help create new narratives based on unique artistic traits.

In conclusion

This mechanic pushes NFTs beyond art into financial instruments. It addresses liquidity issues by giving NFTs a clear, collateralized value.

This new vault tech is yet to be released.

The official rollout of this new crypto tech will involve the $RUB token and a yet-to-be-minted NFT collection: Ramen_HL, where 79 unique NFTs of this collection will be vaulted at launch with a certain amount of $RUB tokens.

Alpha:

KEEP AN EYE ON THE BALDIO BRO AND WILL BE MAX MINTING THIS RAMEN_HL COLLECTION ONCE IT LAUNCHES.

CIAO

Courtesy of CL

🧙♂️ Matt’s Corner: Would you like some free money? The Curious Case of $PUMP

I’d bet everything I got that you fumbled the $PUMP presale. Don’t worry, I don’t want to mog you.

Rather than that, I would like to cover this week why, in these cases, our mind becomes so overwhelmed by the conviction that something is going to perform badly, even if it is an asymmetric bet that could largely outperform the overall market by 50% in just a few days. And those who are now celebrating the price correction are just coping with not having been able or not having wanted to participate, fumbling an instant 1.5x with size.

How to Miss an Asymmetric Bet

The PUMP example is perfect:

Pumpdotfun is the largest and most used token launchpad that has ever existed.

It can be deemed the memecoins/virality index token, with a strong brand and recognizability on any social network and platform.

It generates huge revenues and volumes, which is important for the narrative.

Its valuation ($4B) is relatively low for a project of this scale.

PUMP open interest (OI) is nearing $600M on Hyperliquid and Binance combined, just a few days after listing. Also, the estimated FDV extrapolated from these futures contracts is now above $6.2B.

So why were we not bidding this?

Well, many of us tried, and with size, but there were a few major problems:

Any site, even CEXs, was giving users a hard time accessing the sale due to the huge traffic.

Those who bid on centralized exchanges got rekt by the low allocation they received.

People who had been waiting for that moment bid an insane amount of money because of the conviction they had in the trade, so much so that the $500M sale, considered one of the largest ICOs of all time, lasted only 12 minutes.

And then comes the “Why?”

Another issue I noticed from people’s tweets was a mix of the “free money paradox” and “anchoring bias.”

Let me explain:

The "free money paradox" occurs when an opportunity seems so easy or low-risk that it’s perceived as “free money,” but the paradox is that people often fail to take advantage of it due to cognitive biases, lack of action, or a distorted perception of the required effort. These barriers can include procrastination, underestimating the effort needed, or overthinking potential risks.

The “anchoring bias” is a cognitive bias where people rely too heavily on the first piece of information they encounter (the "anchor") when making decisions. This initial reference point influences subsequent judgments and estimations, often leading to biased conclusions. We encounter it in many areas of life, and it can fool our brain and lead us to poor decision-making. Most of us were anchored to the idea that Pumpdotfun wasn’t good for the space, even though the token later started performing well in derivatives.

People like me, probably you, and others were affected by this, which led many of us to not participate in the sale.

On improving

In my journey, I’ve always strived to improve, and the best way to avoid these kinds of biases is to keep your mind trained to be flexible and not subject to external opinions.

This, coupled with consistent journaling and less procrastination, will definitely improve your overall approach to asymmetric opportunities.

The last thing I want you to know is that this is not the last train, and this is not the end. In the last bear market, we saw huge opportunities like farming Hyperliquid, betting on GMX, and others arise, so why would you feel doomed with BTC at its all-time highs?

See you soon, fellas.

milady

Courtesy of Matt

🏰 Castle Reads

An Overview of the Arbitrum Gaming ecosystem:

Why should protocols think small in terms of growth, by @francescoweb3:

@mattdotfi on "why using revenue multiples makes no sense in token valuation”:

📖 Recommended Reads

@thiccyth0t explains the math and rationale behind the jackpot mindset in life, investments and crypto:

@degentradingLSD dives into the implications of excessive shorting of illiquid assets, comparing the supposedly imminent alt season to Jane Street’s practices:

How important is to farm “aura”, by @kashviETH:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.