The Castle Chronicle: Studying BONK's latest price action, Pumpdotfun's Leadership is in Danger

PLUS: Is it a Suit or not?

Welcome to Edition 128 of The Castle Chronicle!

Summer is a beautiful season because most people are missing out on alpha and leaving the edge to chads like you, who are reading this while it’s (probably) 35 degrees Celsius outside.

Here’s what we have for you today:

🔍 Market Watch - Price action & Relevant metrics across sectors and assets

🍐 CL’s Corner - Polymarket and the Issue with Zelenskyy’s suit

🧙♂️ Matt’s Corner - Will Pumpdotfun be replaced anytime soon?

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads - The best reads from the best researchers on CT

🔍 Market Watch

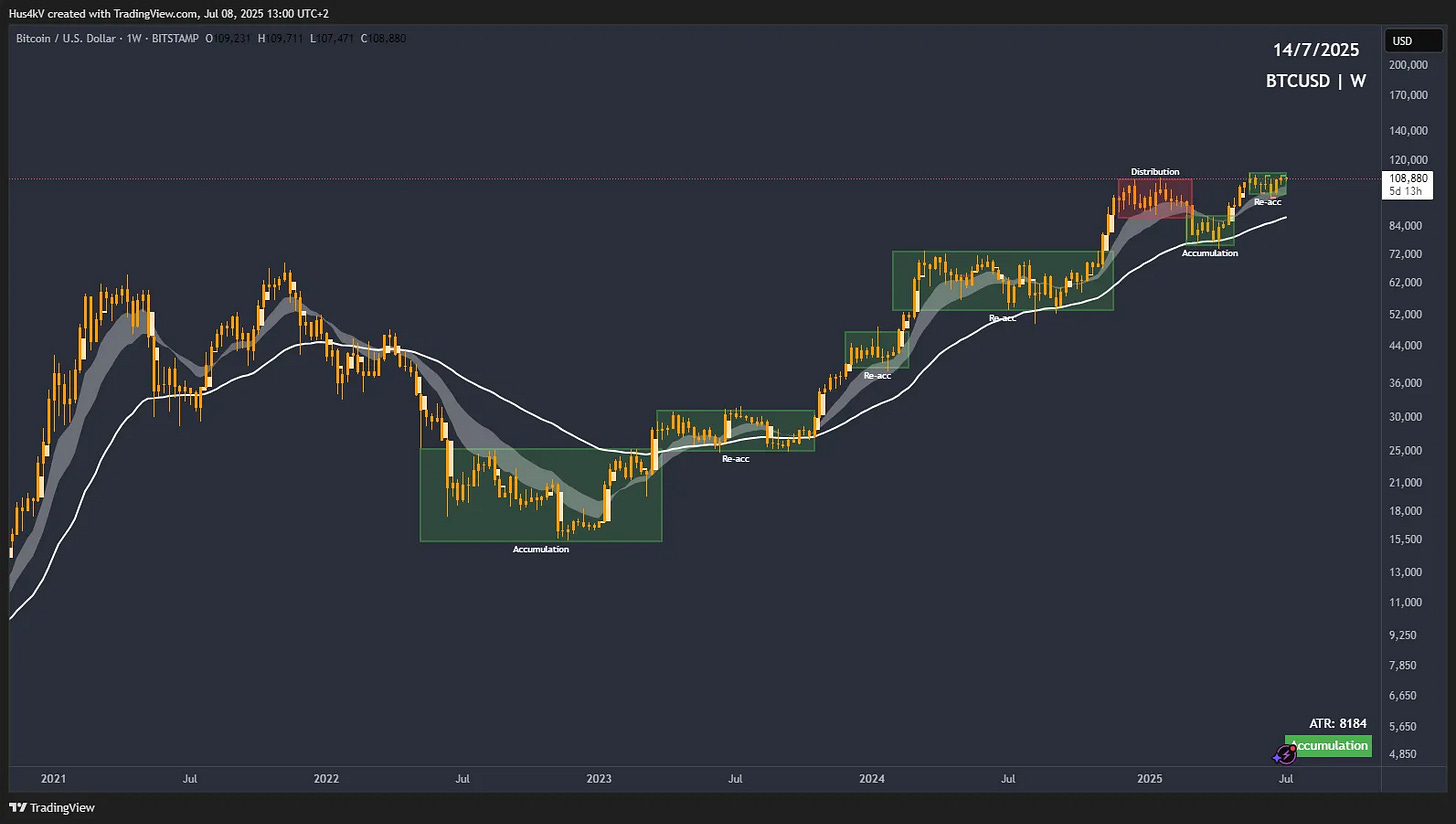

Gm frens! The chop continues for yet another week, so don’t expect anything too interesting. During calm periods like these, we can occasionally see a coin pop, but most of the time it’s about waiting for demand to come back into BTC and then following relatively stronger performers.

Price Action

Nothing is new on the BTC chart. We’re still very bullish overall, but we’re taking a breather. My expectation here is for the most recent sideways price action to result in a re-accumulation and subsequent continuation higher towards new ATHs (All-time-highs)

Top Performers

Except for $BONK, this week’s best gains are not too impressive. One thing to note though, is that 3 out of 5 top performers are memecoins. Time and time again, this sector is showing strength and resilience - something to keep in mind.

Yes, some demand has shown up buying up $BONK, but is it significant? Let’s take a look at the chart.

I’m a trend follower at heart, and this chart does not scream trend to me whatsoever. Yes, there might be a trend on the lower timeframes, but I want to see money come into a market on a day-by-day basis. And from that perspective, this chart screams sideways and boring. So the 63% pop to me is nothing but a random occurrence that I simply cannot capitalize on - and that’s okay.

Narrative Performance

It’s another one of those calm, boring weeks where nothing much is happening. Most narratives are fairly flat or bleeding out a little bit.

Weeks like these are normal in the market. It’s important to remain patient and not over-trade. Let the market show its hand first. Until then - risk responsibly and I’ll see y’all next time!

Courtesy of 0x_Vlad - trend-based trader and MentFX student

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

🍐 CL’s Corner: Is that a Suit or not?

I don’t know if you’re aware, but there is a big drama happening on Polymarket at the moment. Let me explain it to you.

Everything started with this bet, based on a simple question:

“Will Zelenskyy wear a suit before July?”

Then on June 24th, Zelenskyy arrived in The Hague for a NATO summit with Mark Rutte and Donald Trump, where he was wearing something very similar to a suit.

The real drama started from this NATO summit.

For many, it was a really a suit. The Kiev Post & the Associated Press called it a Suit. The Kiev’s tailor that made the piece claimed it was a Suit too. And many others said it was a Suit because both the jacket and the pants were meant to be worn together.

(I had to ask clarification to ITALIAN DEFI MAFIA, they know fashion well, they Italian)

The thing with Polymarket is that it is UMA Protocol acting as the Oracle, deciding the ultimate truth on which every bet is resolved. UMA Protocol itself is controlled by its largest stakers, who can influence all contentious bets on Polymarket.

And those big UMA whales simply used their concentrated governance power to influence different outcomes over the course of Polymarket history.

Whales can place big bets on Polymarket and coordinate with a few other large UMA stakers to win some gambles that would normally be resolved differently.

One of the X accounts that covered the most this Polymarket drama is @Atlantislq. As he noted during one of his many posts on the situation, there seems to be very close coordination between the few big UMA stakers.

So can we still consider Polymarket, which calls itself the World’s Largest Prediction Market, as fully neutral and independent from vested interests when the time comes to settle a problematic bet?

For now, the official ruling has been postponed many times, and we do not know yet (as of Tuesday 8th July) on which side the bet will resolve. However, seeing the price action, we may think it shall resolve as no.

But for the moment, the question still remains: is that a suit or not?

CIAO

Courtesy of CL

🧙♂️ Matt’s Corner: Will Pumpdotfun be replaced anytime soon?

Pump’s sentiment is Worsening

@Pumpdotfun is definitely one of the most pivotal dapps of this cycle: it enabled faster and easier token creation for anyone on Solana. But as the trend matured, more people began to realize that it’s a rigged casino: bundled tokens, snipers, and fees on every single transaction made it nearly impossible for the average degen to turn a profit in the long run.

Even if the sample is not that large, Pump’s Ethos score clearly reflected the worsening sentiment toward the largest memecoin launchpad in the game.

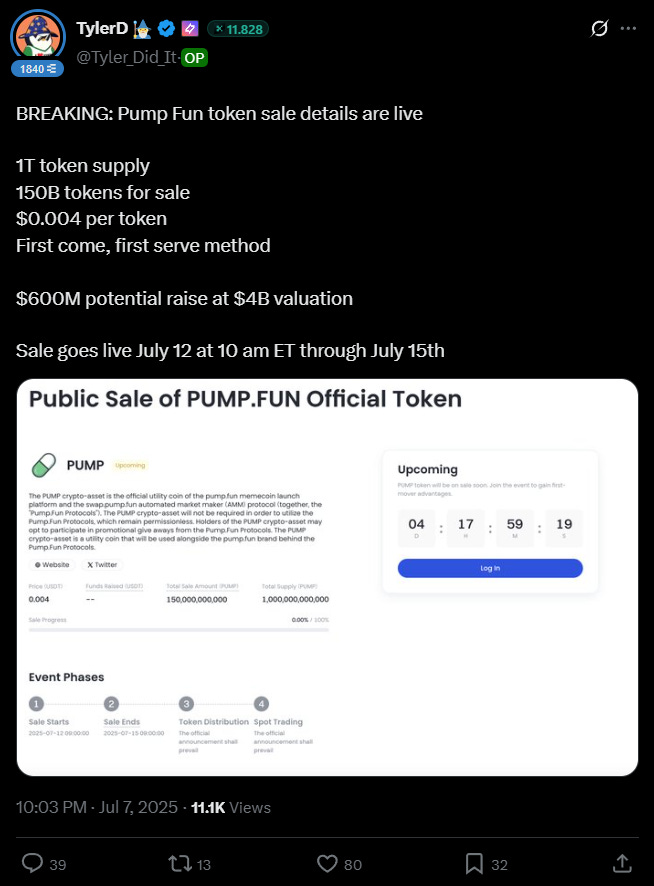

This sentiment further declined when the Pump team indirectly announced they were raising $1B at a $4B valuation from investors for the PUMP token.

LETSBONK is the Solana community’s latest Uprising

Now, for most of the community, Pump seems like an extraction app that doesn’t contribute to the space, especially to “stakeholders,” so new alternative launchpads have started to surface once again to dethrone the king.

One that has been gaining attention lately is Bonk_fun, a project built by members of the BONK community, one of the most solid in the Solana ecosystem, aimed at flipping the script and making these launches fairer.

Something that upset the community was the amount of revenue flow Pump intended to retain through:

Buy/sell and bonding fees.

The launch of Pumpswap, an AMM built for Pump coins that bond. This cut out Raydium’s value accrual from new launches, despite Raydium being the AMM that supported Pump’s success from the beginning.

These are the two main points addressed by LETSBONK and other launchpads, which aim to redirect revenue to token holders (such as BONK holders) through buybacks and burns, and to Raydium stakeholders.

A metric that reflects both the growing dissatisfaction with Pump’s decisions and the support for new launchpads is the recent overtaking by LETSBONK in daily graduates: 56% compared to Pumpdotfun’s 43%.

This narrative strongly appealed to traders, fueling a +70% upward move in BONK within just one week.

The Roots of the Problem

In my opinion, the “Pump issue” goes deeper than just the internal retention of revenues by the company. Projects like LETSBONK are taking a positive step by redistributing revenue to the ecosystem, but at the same time, problems such as supply bundling and sniping remain unsolved and continue to worsen the broader challenge faced by memecoin traders.

While the agentic launchpad @virtuals_io introduced mechanisms like Virgen Points and limitations such as a maximum cap on deposits before bonding to mitigate these issues, memecoin launchpads remain more reliant on swap fees prior to bonding, which creates a conflict of interest with traders' goals to push tokens to graduation.

Pump is still the “king of the hill” for now, with branding that remains strong and appealing to normies, regular traders, and meme devs. However, LETSBONK has strong roots within the Solana community and appears to be the only real competitor to Pumpdotfun at this stage.

Remember: No crying in the casino.

See you soon fellas.

Courtesy of Matt

🏰 Castle Reads

Castle’s new AI weekly issue is out now:

@francescoweb3 dives into the new vision for the Ethereum protocol presented by the new leader of the Ethereum Foundation, Tomasz Stanczak:

The Chad @jojo17568 talks about their experience with crypto jobs, conferences, life, and value extraction, also mentioning Castle:

📖 Recommended Reads

Understanding the unique infra approach of Hyperliquid, by @arndxt_xo:

@Moomsxxx wrote an insightful post that highlights the potential growth for Arbitrum once Robinhood will deploy an Orbit chain:

The Sunk Cost Cage explained by @evan_ss6:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.