The Castle Chronicle: VIRTUAL is Back, Stronger than Ever!

PLUS: How Sonic Cracked the Liquidity Game and Why KAITO is Loved by Users

Welcome to Edition 118 of The Castle Chronicle.

Lots of new changes in this edition! First of all, this is our first issue on Substack.

Secondly, for those who don’t know me yet, I’m Matt, and I'll be hosting this and the upcoming Chronicles alongside the other researchers at Castle.

Here’s what we have for you today:

🔍 Market Watch – Price action & Relevant metrics across sectors and assets

🏛️ Fundamentals Corner - Native USDC on Sonic and its relevance

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads – The best reads from the best researchers on CT

🔍 Market Watch

PRICE ACTION

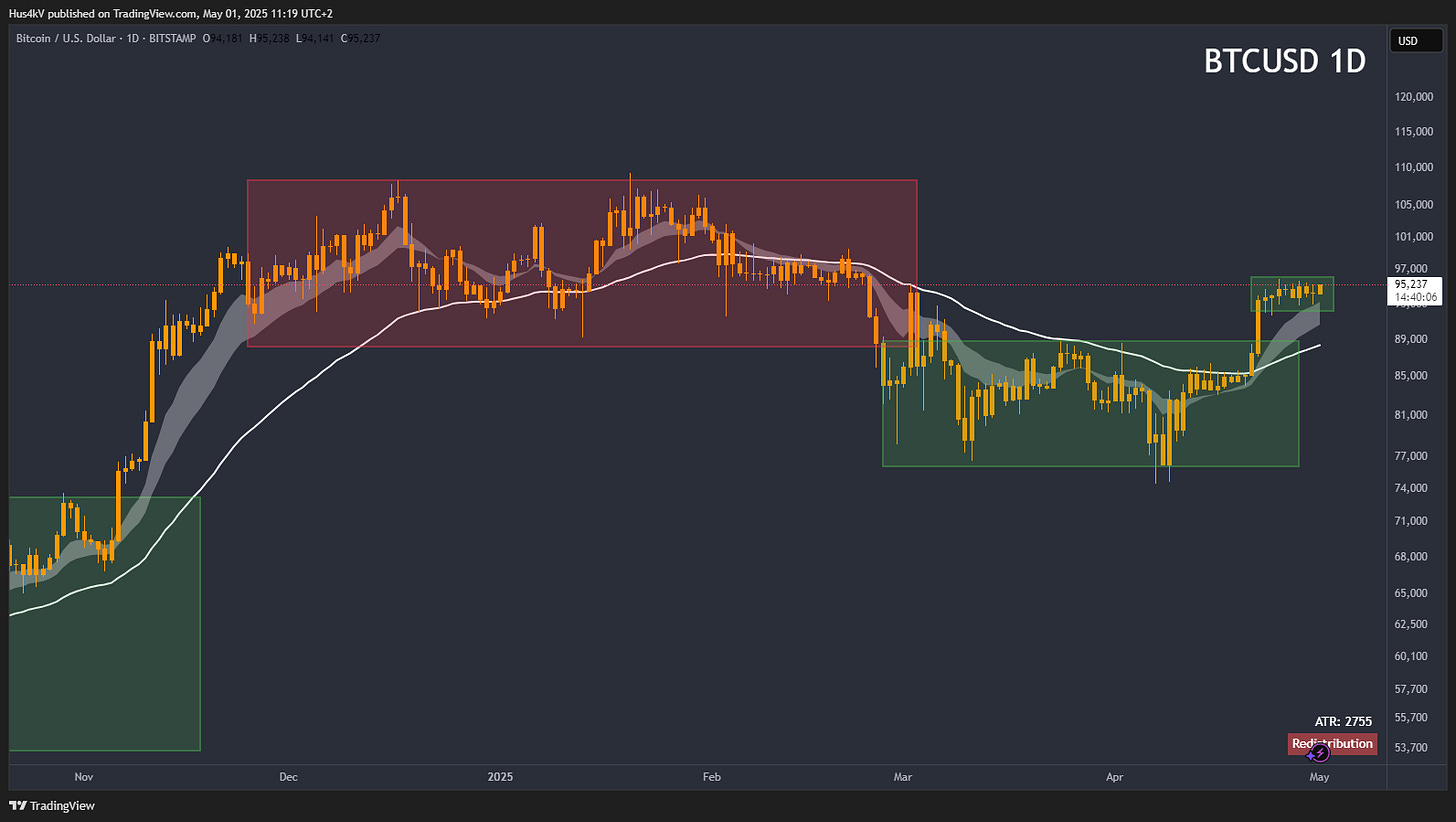

Last week, BTC showed some strength by breaking out of its accumulation range. The price is now above all the rising EMAs, and I’m waiting for the final bits of confirmation. Currently, the price is somewhat congested, and I want to see it break out of this range (small green box) to confirm a re-accumulation.

Breaking out of accumulation range;

Above all EMAs;

Waiting for re-accumulation confirmation.

Once we see a big chonky candle that breaks out of this current range I’ll be happy to go to lower timeframes and follow the trend. Until then it’s still side-line time.

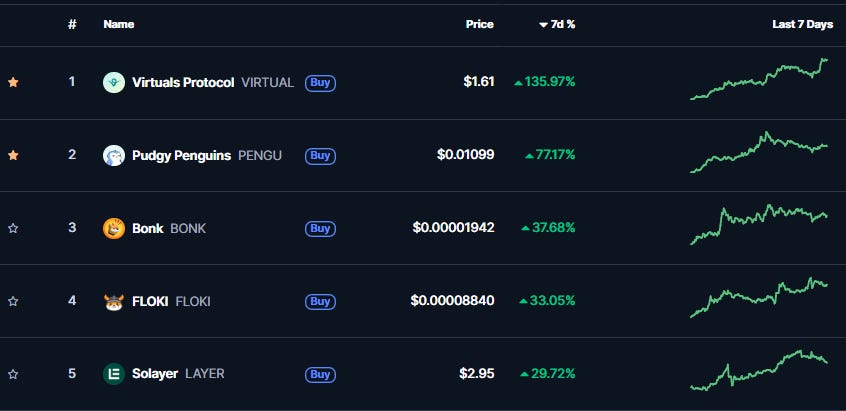

TOP PERFORMERS

With BTC showing the first signs of strength, it is always a good idea to observe what is being demanded most across the entire market. Last week, we saw significant demand emerge in the AI Agents narrative, so it should come as no surprise to see $VIRTUAL performing well.

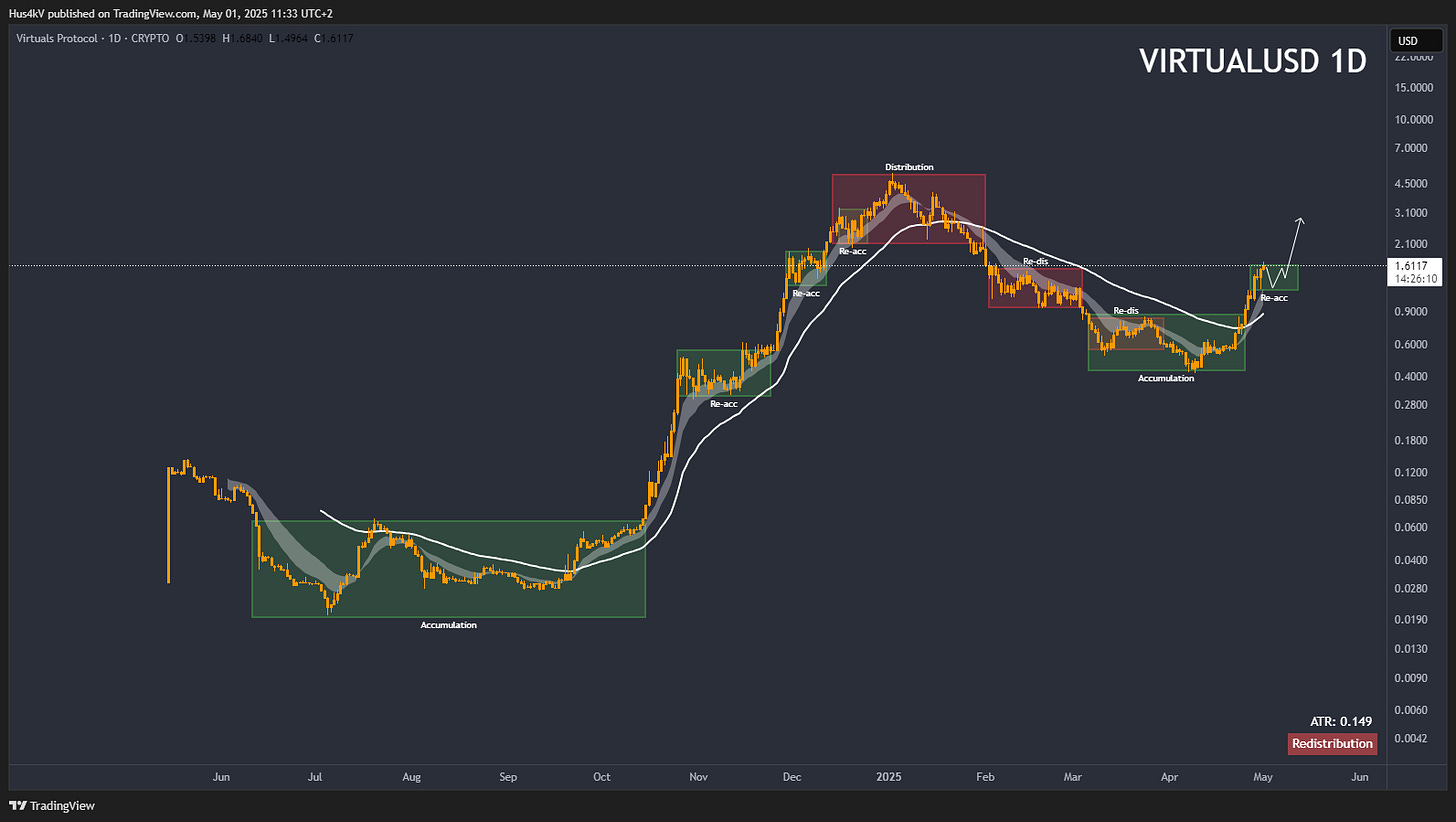

The daily chart tells a clear story. Starting from the initial accumulation (the large green box all the way on the left), we saw a strong breakout that resulted in a picture-perfect momentum cycle. Price continued to rise above all the ascending EMAs, printing re-accumulation after re-accumulation whenever it pulled back. Eventually, it reached its peak and distributed, followed by a multi-month bear market. Now, price is showing immense strength, which leads me to believe that we might see a continuation to new highs.

If BTC continues to display strength, $VIRTUAL (and many small-cap AI Agents) will remain hot on my watchlist. Keep an eye on it!

NARRATIVE PERFORMANCE

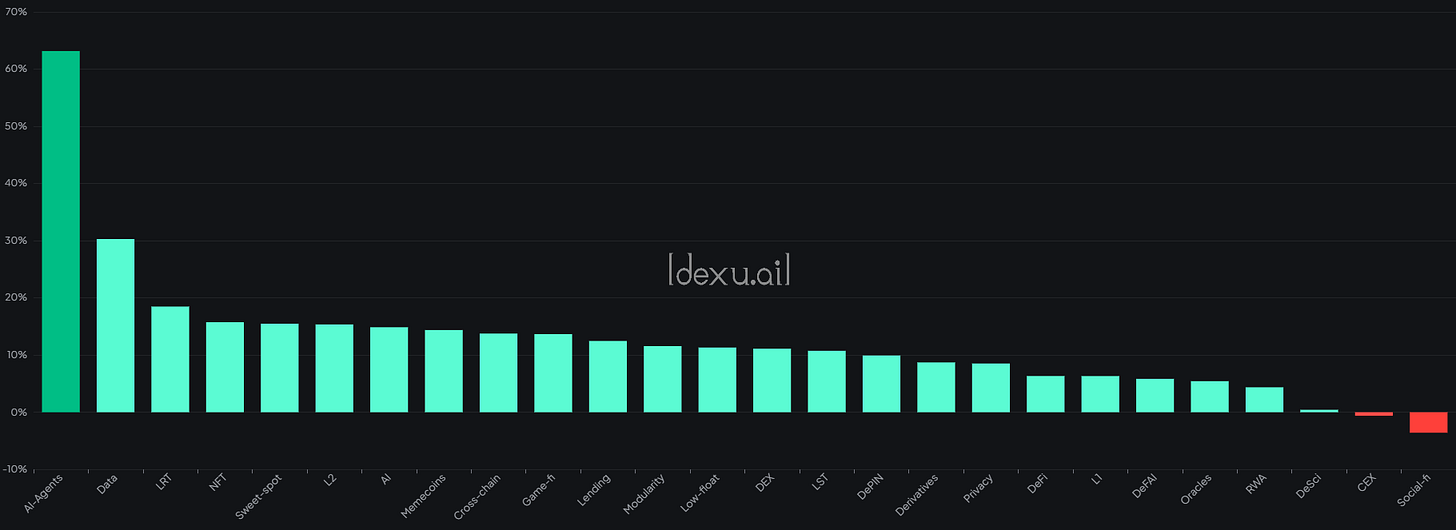

The AI-Agents category is showing sustained positive momentum, building on last week's average gains of 35% to become the current top-performing narrative at +63%. The strength demonstrated by $VIRTUAL further underscores this trend. Such significant performance indicates strong market appetite for these types of assets. Therefore, continued strength in BTC could signal further potential for AI-Agents, making them a key area to watch.

Just take a look at the best-performing coins within the AI Agents narrative: all by Virtuals.

Isn’t that something?

Trade responsibly and I’ll see y’all next time!

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

Courtesy of 0x_Vlad - trend-based trader and MentFX student

🏛️ Fundamentals Corner: Understanding Why Native USDC on Sonic Matters

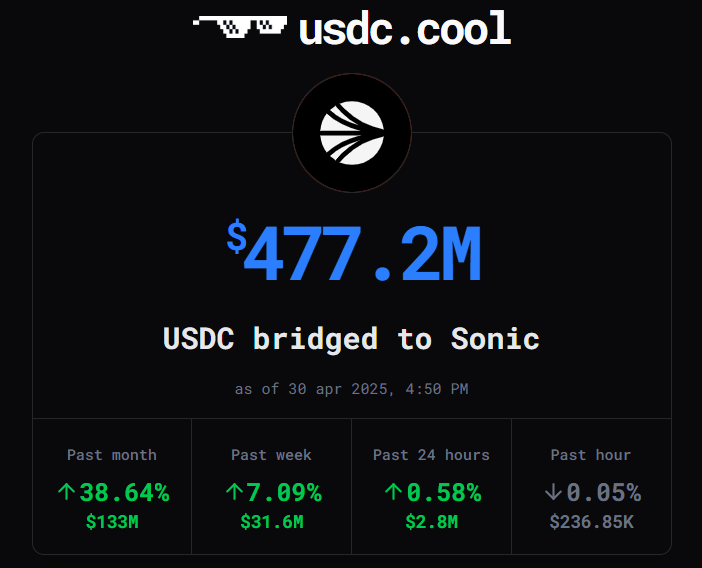

Circle enables Native USDC on Sonic

Even before the official launch of the Sonic blockchain, Sonic Labs integrated USDC.e on Fantom, enabling users to utilize the stablecoin on the network by leveraging Wormhole’s Native Token Transfer standard.

This provided reliable liquidity for the chain, crucial for its growth, but came at the cost of relying once again on a third-party bridging standard.

Circle was already in contact with the Sonic team and required certain milestones to be met to integrate native USDC. A key condition among them was that the total USDC.e supply on the chain had to surpass the $250 million mark.

Needless to say, Sonic met this and all other thresholds in less than three months after launch. In fact, USDC.e on Sonic is now close to doubling that figure.

That’s why, a month later, Circle and Sonic jointly announced the deployment of native USDC on the Layer 1.

Lesson Learned

The ex-Fantom team learned a key lesson from the primary cause of its downfall during the last bear market: excessive reliance on third-party liquidity.

The 2023 Multichain exploit served as both a precedent and a warning for any chain that did not own its liquidity. In response, Sonic decided to:

Opt for a different partner.

Set terms and milestones with asset issuers (in this case, Circle) to rapidly transition to native stablecoins;

Define and execute a strategy that enabled them to attract nearly $500M in liquidity within four months.

We covered Sonic’s rise extensively in a recent article.

It's safe to say their strategy of building deep liquidity on-chain from the start proved successful, as no other chain managed to reach $1B in Total Value Locked (TVL) within just a few months of launch.

The Importance of Deep On-Chain Liquidity

When considering financial markets in general, we often assume that growth can be limitless. However, there are critical factors that, if not scaled properly, will inevitably constrain further expansion.

Liquidity is the foundation for steady market growth and plays the most crucial role in DeFi:

You need liquidity to exchange assets;

Farmers and users want stablecoins to settle trades and rotate positions;

Funds require liquidity to operate, and so on.

This is the most overlooked condition that determines the breadth and growth potential of any DeFi ecosystem. Sonic understood this better than most, especially after learning from past mistakes, and centered its strategy on increasing the circulation of stablecoins within its ecosystem through partnerships, integrations, and active ecosystem engagement.

Sonic’s rise should be studied by other Layer 1s; they essentially cracked the code for rapid growth.

Courtesy of Matt

🏰 Castle Reads

$DOLO TGE Analysis:

Is the AI trend back? Dive into it with our weekly AI Dispatch:

Why people love Kaito, by @francescoweb3:

📖 Recommended Reads

Boros, the new protocol by Pendle that enables funding rates trading, is closer than we think, by @xparadigms:

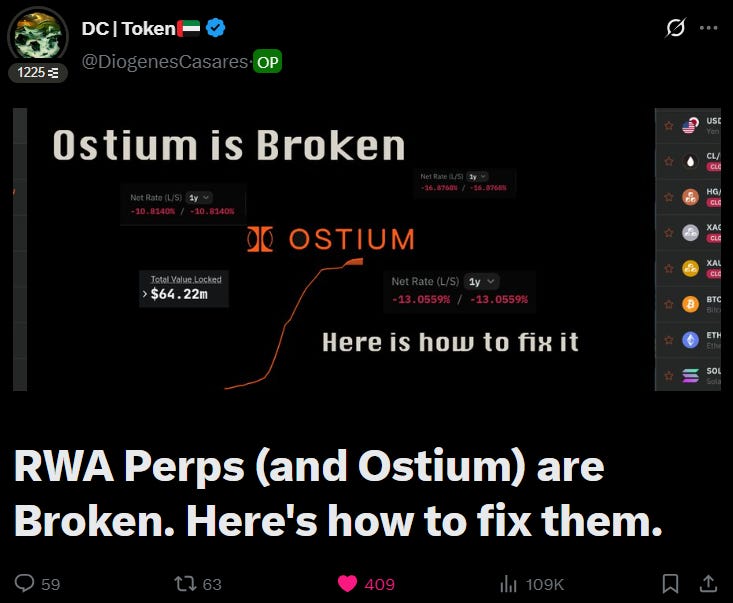

RWA Perps (and Ostium) are Broken, by @DiogenesCesares:

What contributes to mindshare within a Project Leaderboard (on Kaito), by @0xfs7:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.