The Castle Chronicle: What Bitcoin’s Pullback Signals, Why EulerSwap is a Game-Changer for DEXs

PLUS: The Top3 Trending NFT Collections on HyperEVM

Welcome to Edition 123 of The Castle Chronicle!

Today we are covering this week’s hot topics with deep insights you don’t want to miss out on.

Here’s what we have for you today:

🔍 Market Watch - Price action & Relevant metrics across sectors and assets

🔬 Research Corner - Trending NFT collections on HyperEVM

🏛️ Fundamentals Corner - How EulerSwap is set to make Liquidity Smarter

🏰 Castle Reads - All of Castle’s research you might have missed

📖 Recommended Reads - The best reads from the best researchers on CT

ETHMilan just announced the first Arbitrum Day in Italy, which will take place in Milan on June 24th during the conference.

Castle Labs is an official Media Partner of ETHMilan 2025, and we secured an exclusive 25% discount on tickets for the event for the Castle community.

Don’t lose the opportunity to meet Arbitrum builders and degens in Milan, see you there!

🔍 Market Watch

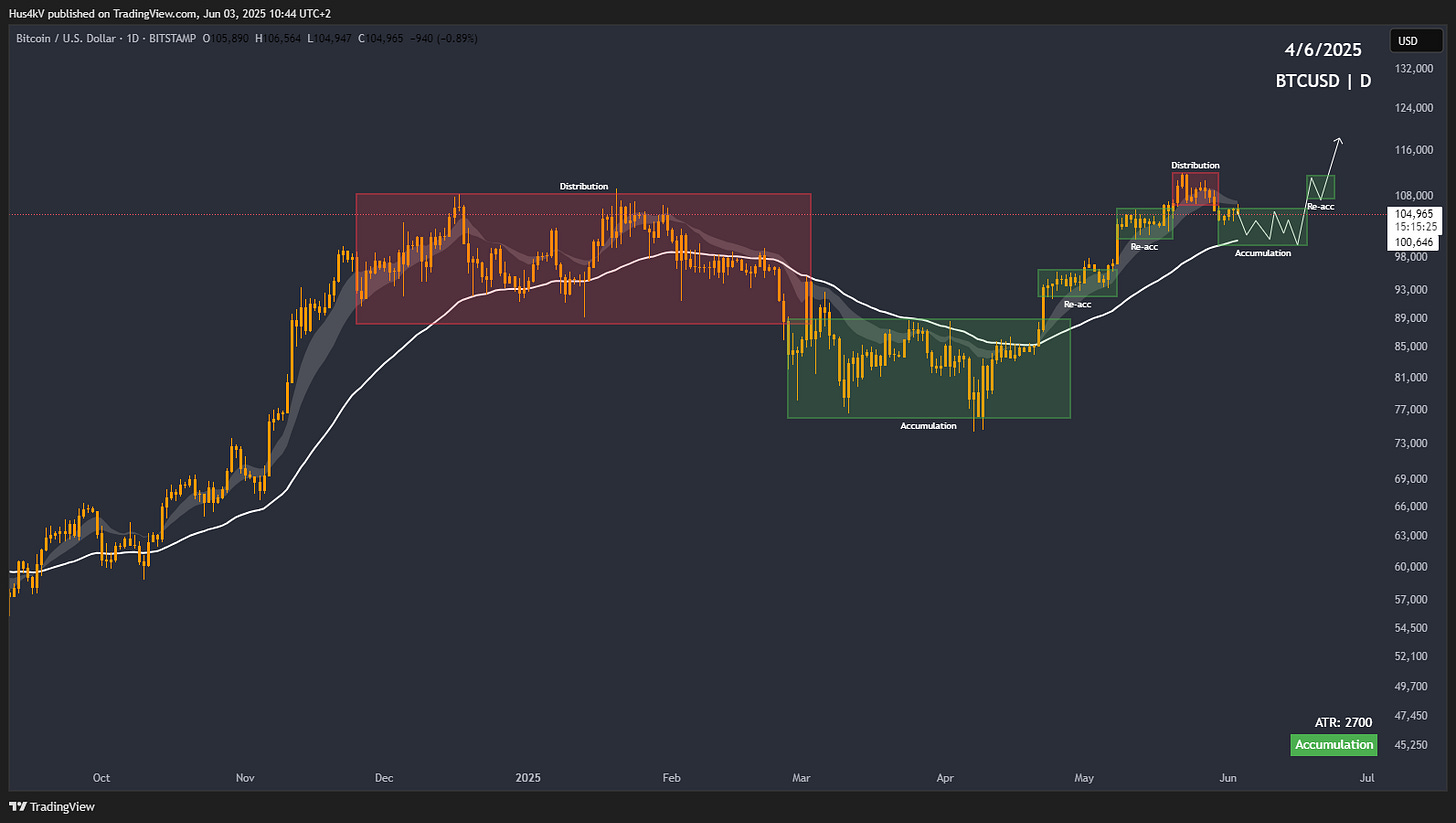

Gm frens! After several bullish weeks in a row, it looks like we are finally seeing a bit of a pullback. This is a completely natural occurrence in a bullish market, so there is no reason to panic at all. Let’s check the charts!

Price Action

The momentum cycle (price trending above the rising 10/20 EMA) has finally broken down. This indicates potential short-term bearishness, but the overall expectation remains bullish.

The ideal scenario would be for the price to move sideways for a period of accumulation before breaking higher. At that point, we would once again be in a strong position to put some risk behind the market (NFA).

Top Performers

As BTC pulls back, it is a good idea to zoom out and review the 30d performance. One asset that has been performing exceptionally well lately is $HYPE.

I wrote about $HYPE back in early May, and I remember not being particularly impressed by it. At the time, it was not showing much strength, and other assets were in significantly higher demand. Well, times change, and so do market contexts.

Right now, we can see a very strong momentum cycle that might potentially be overextended. After strong moves like this, the expectation is always the same: distribution for the purpose of overall re-accumulation.

Therefore, once price starts going sideways for some time and eventually breaks out higher, I will be very interested in following this market, as my overall expectation here is new ATHs.

Narrative Performance

As BTC is pulling back, it’s no surprise to see overall weakness in the market. All narratives lost anywhere from 2% to 30%. It is generally a good idea to pay attention to these metrics to gauge relative strength.

Narratives that show the most resilience during BTC pullbacks are often those that end up showing the most demand once we continue going higher.

Keep in mind that while we are overall bullish and expect new ATHs, the market can do anything it wants to. I’m personally not a big proponent of buying with limit orders into weakness, expecting strength. I’d much rather wait for strength to show up again and only then jump on board.

So, while there might be opportunities to grab “cheap coins” in the upcoming weeks, they might continue getting cheaper for a long time, and before you know it, we’re bearish again. It certainly wouldn’t be the first time.

Risk responsibly, and I’ll see y’all next time!

Not following what I’m talking about? Check out my quick cheatsheet to understand how I approach a chart.

Courtesy of 0x_Vlad - trend-based trader and MentFX student

🔬 Research Corner: Which are the NFT Collections Trending on HyperEVM?

A lot of mindshare is on the Hyperliquid ecosystem at the moment, and as usual, it's always interesting to look at the NFT side of an ecosystem to see what's popular.

The main NFT platform on HyperEvm is Drip Trade.

Here are the most popular ones on the platform.

1) Wealthy Hypio Babies

Originally launched on Base L2 because back then (the mint was in January 2025) there was no HyperEVM yet, this collection has a deep lore among the early community.

Hypios’ floor (around 5k USD right now) has been rising significantly from the mint price of 0.0055ETH, and they have received numerous airdrops from various projects within the HL ecosystem, which has increased the ROI from mint. They could be compared to the Miladys of the HL ecosystem.

2) Hypers

Launched in February 2025, this is the official NFT collection of the DRIP platform.

This is a more classic pixeled type of PFP, with a possible connection to the yet-to-be-released utility token $JPEG, which is expected to power the DRIP Trade platform in the future.

Considering that DRIP Trade is running its own points campaign and a leaderboard based on it, it would make sense if the ownership of a Hypers yielded more than just their pixelated art to their holders.

3) Pip & Friends

Pip & Friends is by far my favorite among the top 3, nicest art. (I hold some PIP NFT) .

There is no rarity in the collection and it's on the community to decide which trait shall be the most valuable.

Mint happened in mid-May and was priced in the $PIP token.

The token $PIP is on the Hypercore Orderbook & has LPs on Hyperswap on the EVM.

9% of the supply was burnt through the mint process, and there has been good volume for both the collection and the tokens in the past few days.

Hope you liked this one. Have fun on the HyperEVM.

Courtesy of CL

🏛️ Fundamentals Corner: How EulerSwap is set to make Liquidity Smarter

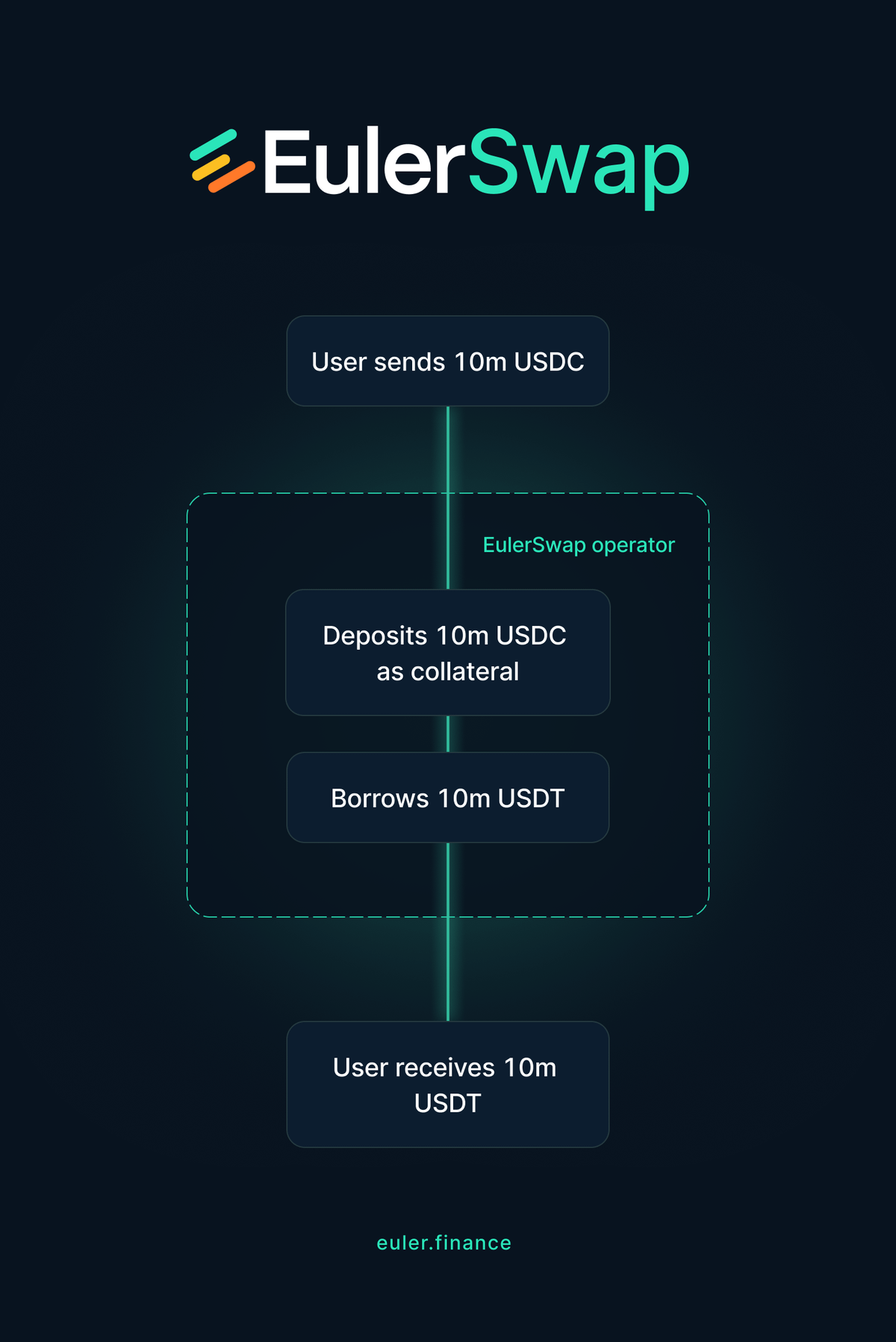

Euler, one of the largest lending protocols, just launched a new feature called “EulerSwap”: a DEX that can potentially increase Vaults' APYs by enabling swaps through borrowing Just-in-Time (JIT) liquidity. Let’s take a closer look.

How it Works

With EulerSwap, Euler Finance aims to make the liquidity inside its Vaults productive.

This is achieved by using these Vaults to fill swaps, avoiding idle liquidity in the pools.

The operator contract in EulerSwap is a specialized smart contract that manages an LP’s Euler account. It plays a central role in enabling the protocol’s unique mechanics by acting as a programmable agent that can control collateral, debt, and swap execution on behalf of the LP.

Key Features of the Operator Contract in EulerSwap:

Account Delegation via EVC

EulerSwap uses Euler’s Ethereum Vault Connector (EVC) to delegate control of an LP’s account to the operator contract. This delegation allows the operator to act with full authority over the LP’s balances and vault positions.Just-in-Time (JIT) Liquidity Execution

The operator facilitates JIT swaps by:Receiving the input token from a swapper.

Depositing it as collateral.

Borrowing the output token against that collateral.

Delivering the borrowed output token to the user. This enables real-time borrowing and swap execution without requiring the LP to pre-fund both sides of the pool.

Example:

Suppose that Euler supports borrowing USDT with USDC as collateral at a loan-to-value (LTV) ratio of 0.95, and vice versa. This means that for every $1 of USDC or USDT collateral, a user can borrow up to $0.95 of the other asset.

Now suppose an LP has an Euler account with $1 million of USDC deposited as initial margin liquidity. Using maximum leverage, the account could hypothetically support deposits of $20 million in USDC and debts of $19 million in USDT.

Conversely, if the LP swaps the initial $1 million USDC into USDT, it could support $20 million in USDT deposits and $19 million in USDC debt. EulerSwap converts this $40 million swing in notional liquidity between two leveraged positions into usable, virtual liquidity available for swaps.

Custom AMM Curve Enforcement

The operator enforces the custom AMM curve defined by the LP, which dictates pricing, slippage, and liquidity distribution across different price ranges. The curve also adjusts swap pricing based on the LP’s current collateral and debt exposure.Dynamic Rebalancing Support

The operator can be uninstalled and reinstalled by the LP to reset parameters or change the curve. This allows LPs to rebalance their positions or update hedging strategies without disrupting the account structure.Collateral and Debt Management

The operator dynamically adjusts the LP’s collateral and debt balances during trades, ensuring compliance with loan-to-value (LTV) constraints and enabling risk-managed liquidity provision.

In short, the operator contract is the automation layer that ties together lending, borrowing, and market making, making EulerSwap capital-efficient, flexible, and programmable.

The result is a more efficient use of the liquidity and higher APYs for LPs.

Benefits and Drawbacks

After a trade like the one mentioned before, the trader will receive the full amount requested, minus operator fees, swap fees, and slippage. The trade results in a more efficient route compared to other AMMs if these costs are lower than theirs.

The introduction of custom curves definitely improves the overall design of the DEX, as different assets like stablecoins require a different liquidity distribution than volatile tokens.

EulerSwap should provide:

LPs with higher APYs on the capital deposited in Vaults.

Traders with competitive swaps enabled by deeper liquidity through an artificial reserves principle similar to UniV3 and compatibility with UniV4.

Projects with less capital needed to bootstrap liquidity for their pairs, since EulerSwap can provide counterparty liquidity to multiple pairs through its Vaults.

This new design introduces a few complexities that are worth highlighting:

The impermanent loss risk is still present, as rebalancing is necessary to avoid depleting the reserves of Vaults or pools.

Higher APYs come with slightly more risk, since the capital is actively used for borrowing and looping to fill orders (liquidation risk), and some impermanent loss could occur for LPs.

Conclusions

EulerSwap is a clever implementation of the Fluid DEX model, which unifies lending and swaps under a single liquidity layer, along with the core mechanics used by PMM DEXes such as Native, including reliance on an operator contract that manages the liquidity journey, single-sided liquidity provision mechanisms, and the involvement of external market makers in the process.

While this DEX still needs to prove whether the model is competitive in terms of yields and swap rates, I believe we are moving toward a new DEX paradigm that involves rehypothecation, composability, and flexibility of the liquidity layer across multiple protocols and use cases.

Courtesy of Matt

🏰 Castle Reads

This week we covered Noise, a new app on MegaETH that enables mindshare trading:

All you need to know about Laudio and how it incentivizes alignment in the attention economy within Kaito:

How USDT₀ Is Quietly Taking Over the Stablecoin game, by @chilla_ct:

📖 Recommended Reads

A comprehensive look into how “American Exceptionalism” distorts reality from the markets’ perspective, by @TraderNoah:

Good list of airdrops to farm and strategies to do so, by @rektdiomedes:

A unique view into the whole Loudio situation and the compromises involved for creators/KOLs, by @FIP_Crypto:

That’s it for today’s issue, we hope you enjoyed it.

You can check out our X for new research reports and weekly gigabrain content.

See you in the next issue,

The Castle Team

In our newsletter, we may discuss projects or tokens in which we hold positions. While we aim to provide informative content, our views are not financial advice. Please conduct your research and consult professionals before making investment decisions. Crypto markets are volatile, and past performance doesn't guarantee future results. Invest responsibly, and be aware of the risks. Your capital is at risk, and we do not accept liability for any losses.